An LLC operating agreement (or LLC agreement for short) is a legal document that establishes the rules, regulations, and provisions for structuring and running your business.

The operating agreement controls the relationship among LLC owners.

It covers matters such as:

- Decision-making powers

- Member capital contributions

- Ownership interest percentage

- Distribution of profits and losses

- Members’ voting rights

- Dispute resolution process

- LLC dissolution procedures

LLC members sign operating agreements to declare that they will abide by the agreement's terms.

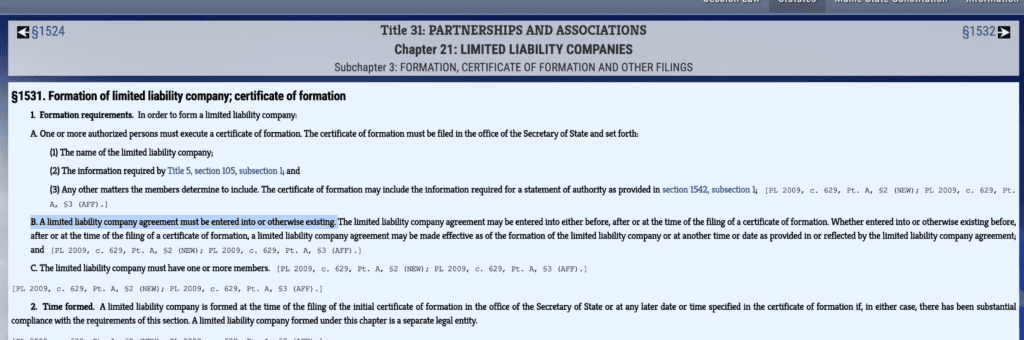

Is an LLC required to have an operating agreement?

Legally, only 5 states – California, Delaware, Maine, Missouri, and New York – require LLCs to have a written operating agreement.

It doesn’t have to be filed with the state authorities but stored internally. Other states leave this to your judgment. You can have an oral or implied agreement (e.g., members of an LLC accept to be governed by the default LLC state laws).

But without a written and signed operating agreement, you’ll have to adhere to state statutes, which may be vague, subject to change, and not in favor of your issue.

Unlike your Articles of Organization, which you must file with the Secretary of State when forming your LLC, you don’t need to submit an operating agreement with any state governing body.

We recommend checking the requirements with your state’s business registration division so you can stay compliant.

Overall, business owners should create a written LLC operating agreement when:

- The LLC has two or more members: The operating agreement details how decisions will be made in case of disputes, plus lists the rights and obligations of each member.

- You’re a single-member LLC seeking funding: Without an operating agreement, it may be harder to articulate your stake/role in the business to potential investors or creditors.

What should be included in an LLC operating agreement?

An operating agreement is tailored to your type of business and industry. So no two documents are entirely alike.

But, there are several standard points your operating agreement must cover:

- Company details

- Member information

- Accounting practices

- Operational procedures

- Additional provisions, e.g., amendments and governing law

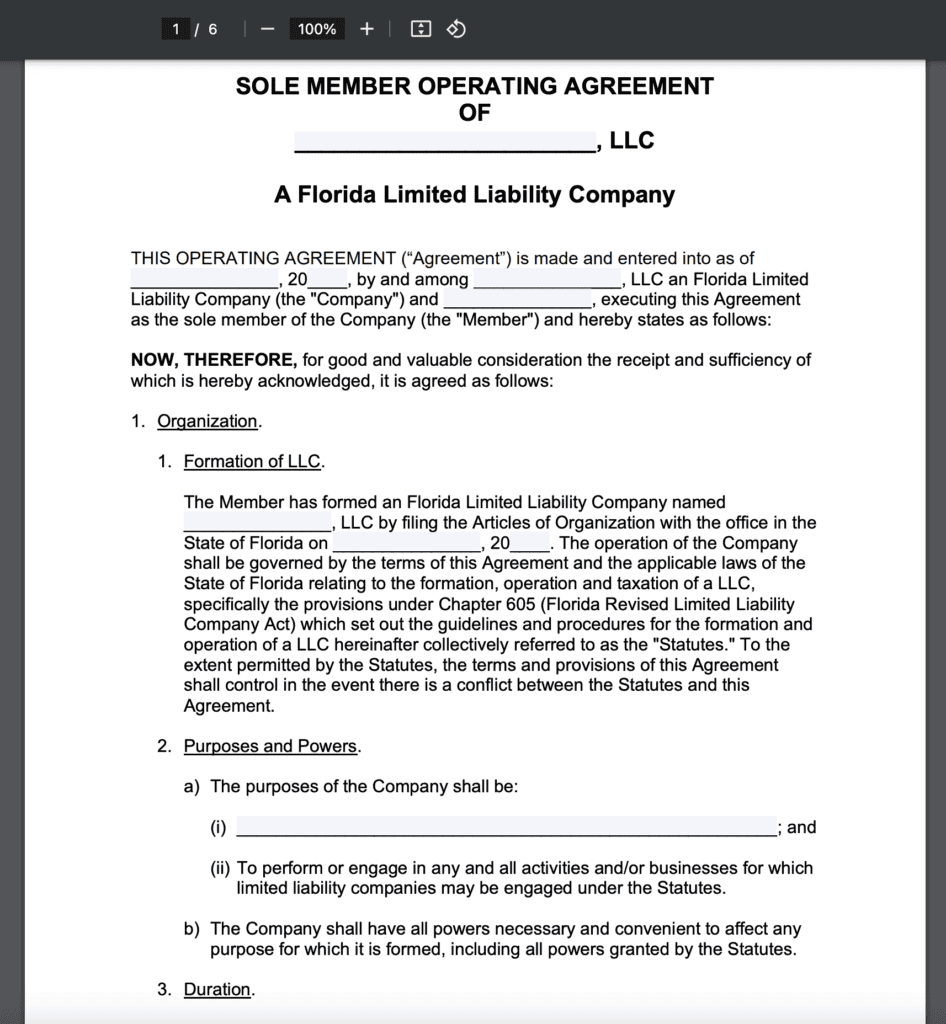

1. Company details

An operating agreement has to open with a general snapshot of your company.

Basic company details

Describe your company's essential characteristics in your operating agreement:

- Legal name

- Doing Business As (DBA) or fictitious names

- Company address

- Registered agent's name and address

You can also add a line or two about your business’s purpose, industry, and nature (e.g., primary product or service and any other lawful business purpose).

Statement of intent

This section states that the operating agreement should comply with the state LLC laws. It also specifies that your business comes into existence once the owner files all proper legal documents with the state.

Management structure

Your LLC operating agreement needs to list each member and manager’s name, address, title, job responsibilities, and ownership percentages proportionate to their capital contributions.

Specify whether the LLC is a member-managed or manager-managed company. If manager-managed, include the manager’s responsibilities, salary, and employment tenure.

Tax treatment

This section defines whether the LLC will be taxed as a sole proprietorship, partnership, or corporation (S-corp or C-corp).

2. Member information

Along with the general information about each member and manager, the operating agreement also has to detail:

- Member rights, obligations, and duties: List each member’s rights related to the business, their duties, and responsibilities.

- Member contributions and ownership allocations: Specify the stake of each owner, proportional to their capital. Members can contribute cash or in-kind (e.g., skills, property, labor, intellectual property, or other resources).

- Voting and approval rights: Outline procedures (e.g., time, place, and manner) for making decisions through periodic meetings, the purpose of each session, and each member's voting rights.

- Compensation: Specify how individual members will be compensated depending on their roles and how your LLC is taxed.

Accounting practices

Your LLC operating agreement should also define:

- Fiscal year: Specify the fiscal year your business will use. Most LLCs use a calendar year.

- Accounting method: The two common types are cash-basis and accrual accounting. The former is easier to do but only allowed for businesses with $5 million or less in gross annual receipt.

- Profit distribution: Provide general guidelines for profit distribution. This can be merit- or contribution-based. Or backed by a formula.

3. Operational procedures

Other common types of provisions you should cover in your operating agreement include rules for LLC dissolution, voting rights, and procedures for adding new LLC members.

LLC dissolution

At some point, you may decide to close your LLC.

Your operating agreement should address this possibility and its implications for other members of the LLC. It should include a plan for the end of your LLC to avoid being forced to adhere to the state’s default rules when dissolving your business. The operating agreement should specify the vote needed to trigger dissolution proceedings, how members will split the LLC’s assets and losses prior to closure, and the wind-down procedures.

Adding/removing members

At the same time, you may want to add a new member to your LLC or fire someone. Again, your operating agreement must put down the provisions for that.

- What happens if a member joins: Define the onboarding process, incentives they'll get, and the required initial contribution.

- What happens when a member withdraws: Detail what the member is entitled to when they leave the LLC. You must also notify the Secretary of State when you have a change in ownership.

Meeting and voting procedures

Procedures like adding/removing members, closing an LLC, or selling it off require a member vote. As do many other operating decisions. Therefore, your operating agreement must explain how members cast votes. Mention:

- Meeting schedules: Summarize the place, time, and manner of meetings (e.g., video call or in-person).

- Voting rights: An LLC member can vote their membership percentages or get one vote no matter the size of their ownership shares.

- Voting procedures: Unlike corporations, which hold annual meetings for their shareholders and directors, LLCs can schedule periodic meetings at any time.

4. Additional provisions

There are a handful of other provisions you can add to your LLC operating agreement, such as:

- Dispute resolution process. Outline the next step if there’s a tie in voting or some confrontations between members.

- Provisions in case of a member’s death. Detail what will happen to the member’s interest in the company in such a case.

- Any special arrangements. You may include conflict of interest policies, non-compete clauses, or other custom rules for operation.

FAQs about LLC operating agreements

Here are answers to several frequently asked questions about LLC operating agreements.