One of the first things you’ll want to determine is whether you want to set your business up as a sole proprietorship or a limited liability company (LLC).

You’ve heard of LLCs and may even understand the advantages.

But you may not have realized that you, as an individual, can set up a single-member LLC.

What is a single-member limited liability company (SMLLC)?

A limited liability company is an incorporated business structure, diminishing the members’ personal liability over business actions. While there may be many LLC owners in a multi-member LLC, single-member LLCs have a single owner who is typically in complete control of the company.

Who can form a single-member LLC?

Any person or legal entity can form a single-member LLC. Most states allow the following subjects to create a single-member LLC:

- A citizen of the United States

- A non-U.S. citizen

- A non-U.S. resident

- Another limited liability company

- A corporation

To form a single-member LLC, you have to complete several steps, including choosing a business name, selecting your state of incorporation, deciding how the company will be managed, appointing a registered agent, and filing the required paperwork with the Secretary of State in a location where you’re setting up your LLC, and register with authorities for tax purposes.

Paperwork and regulations vary from one state to another, so you must always double-check with a local authority.

What’s the point of a single-member LLC?

An SMLLC, compared to a sole proprietorship, offers greater liability protection.

In case of any financial or legal issue arising with your business, your personal assets will remain intact.

Also, single-member LLCs have greater tax flexibility and can elect to pay taxes as a sole proprietorship or S-corporation.

So if you’re seeking better personal asset protection and an incorporated status without the hassle of double-taxation, a single-member LLC may work for you.

Single-member LLC: key characteristics

Limited liability companies were first formalized in the 1970s, based on respective state laws.

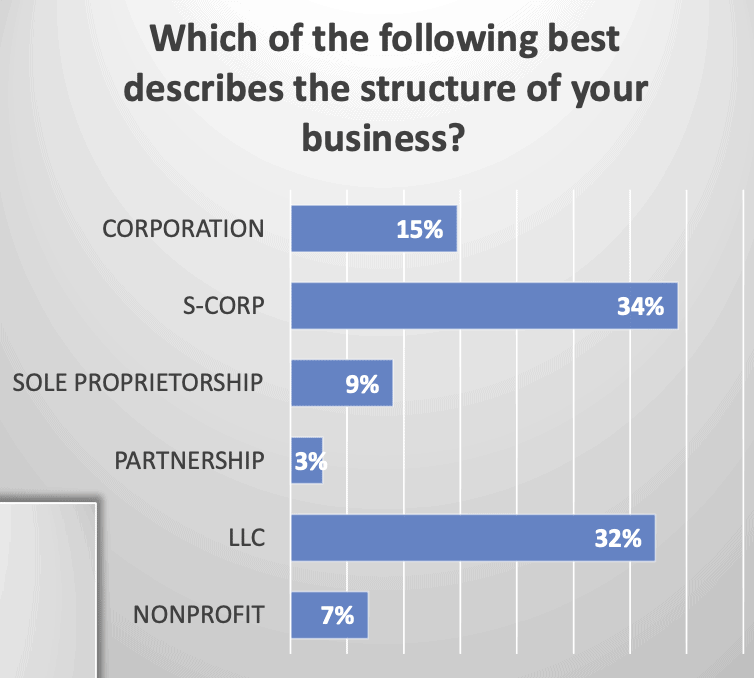

Today, well over a third of all small businesses operate as LLCs, according to the National Association of Small Businesses.

Here’s what makes single-member LLCs such an attractive business structure for entrepreneurs.

1. Personal liability and asset protection

A single-member LLC is a separate entity from its owner(s). Meaning your assets are shielded from any debts and liabilities of the company.

However, your personal bank account, business bank account, and other assets must be kept isolated to retain limited liability. This is called maintaining a “corporate veil.” Consequently, if someone sues a single-member LLC, or the business can’t pay its debts or obligations, the owner doesn’t have to worry about having personal assets on the line.

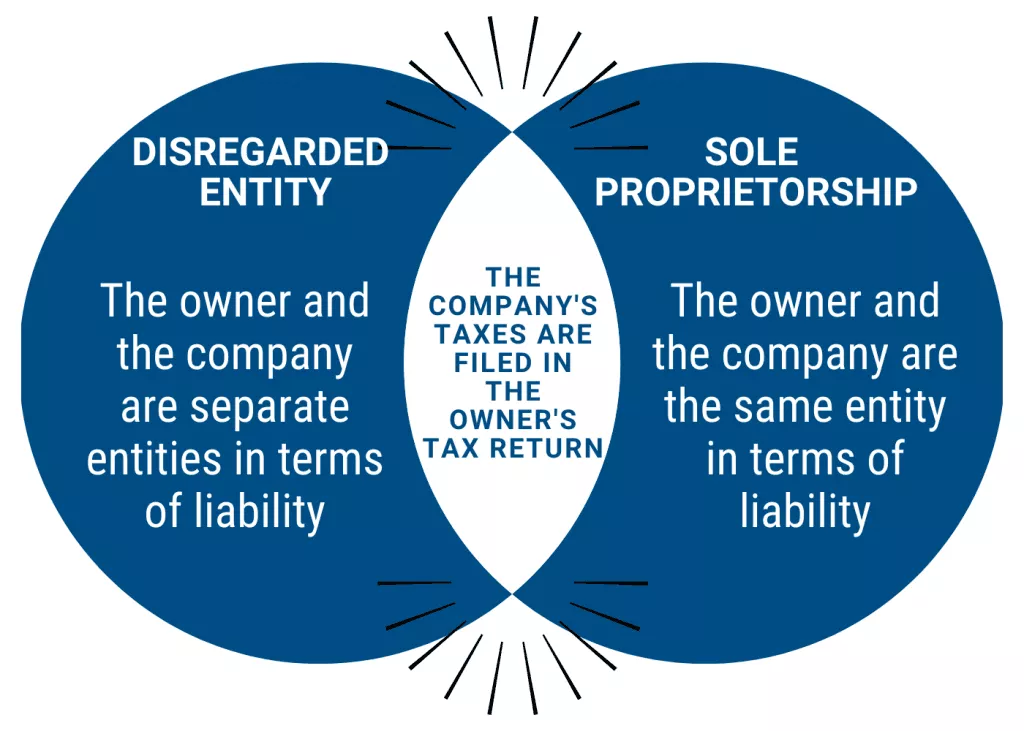

On the other hand, a sole proprietorship leaves the business owner completely exposed to accumulated debts and obligations. A sole proprietorship and the business owner are the same, so you’d be personally held responsible.

2. Management structure

While a sole proprietorship is the easiest of all business entities, creating and maintaining a single-member LLC is far less complicated than other business entities.

Because a single-member LLC only has one member, that member is usually considered the manager in complete control of the company.

But in some cases, the owner may give management duties to a third-party outside manager. Thus, two LLC management scenarios are possible:

- Member-managed LLCs are entirely operated by the owner making all corporate decisions.

- Manager-managed LLCs are managed by an outside party (professional manager) who runs day-to-day operations, leaving more high-level decisions to the owner. In some cases, an owner may just take the role of a passive investor and leave the complete decision-making to the manager.

The LLC’s articles of organization and operating agreement spell this all out, using state statutorily provisions as guidelines.

3. Taxation

Different business tax treatment scenarios are possible because an LLC is considered a “disregarded entity” by the IRS.

Tax classification selection is one of the primary decisions that members of an LLC must make. By default, a single-member LLC is taxed as a sole proprietorship. But members can elect to be taxed as an S-corporation or C-corporation instead.

If you’re staying with the default classification, your single-member LLC will report business income and pay federal income tax under your social security number on your personal tax return.

You should include business profits and losses on Schedule C of your federal income tax return.

If you choose to pay taxes as a corporation or S Corp, you must file an election of tax status with the IRS. The S-corp status allows you to pay tax-free profit distributions without paying federal and state corporate taxes.

Single-member LLCs and sole proprietors must also pay self-employment taxes and Medicaid contributions. You’ll also need to have an employer identification number (EIN) before hiring employees to report payroll taxes.

Depending on your state of incorporation, you may also be required to pay personal income taxes based on your new status.

Additionally, LLCs may be subject to other types of state and local taxes for doing business in that state, such as:

- Minimum annual franchise taxes

- State sales taxes

- State employer taxes

Do LLCs pay more taxes than sole proprietorships?

Generally, no. The federal government taxes your LLCs in the same way as a sole proprietorship by default.

On the state level, however, you may be subject to extra LLC taxation. But the asset and liability protection you get as a single-member LLC can far outweigh any incidental fees you may be subject to for filing your LLC with the state.

4. Business compliance

As a single-member LLC, you’re required to maintain good standing with the state that you’re incorporated in. This will require that you:

- Establish an operating agreement and keep it on record where it’s necessary, such as the states of California, Delaware, Missouri, and New York.

- Depending on your state of incorporation, file an annual report with the associated Secretary of State and pay a filing fee.

- Obtain a general business license where required in that state and county where you’re operating. About 15 states require a general business license.

Last, but not least – while the simplicity of a sole proprietorship is unmatched, you should only use it for businesses that have little profit or risk.

Because a sole proprietorship doesn’t protect your personal assets, you may be held personally liable for any legal issues or debts your business accumulates.

A single-member LLC can offer you:

- Personal liability protection, ensuring that your personal assets will be protected if the company can’t pay its debts or gets sued.

- Tax benefits, resulting from flexible taxation options, that allow you to work out the optional taxation scenario based on your type of business.

- Credibility and brand recognition, earning trust from both your financial relationships as well as your customers.

- The ability to grow and become profitable with the peace of mind that you’re protected.

While creating and maintaining a single-member LLC can be slightly more costly and labor-intensive, it can be well worth the trouble and cost for the benefits it offers.