A limited liability company (LLC) is one of the most popular business structures in the US. That’s a well-known fact.

What you might not know is that there are other sub-types of LLCs.

Based on the member count, there are single-member LLCs — with only one owner (member) — and multi-member LLCs. Also, depending on the management structure, an LLC can be member-managed or manager-managed.

Depending on the relation to the formation state, LLCs can be domestic or foreign. Foreign LLCs are legal entities incorporated in one state (e.g., Delaware) and authorized to do business in another one (e.g., Georgia).

Finally, there are also several legal sub-designations for LLCs.

These include:

- Restricted LLC

- Professional limited liability company (PLLC)

- Series limited liability company (series LLC)

Most business owners form an LLC to benefit from personal asset protection and limited liability.A series LLC offers more than that. This type of LLC may not be as popular but is beneficial to certain businesses.

What is a series LLC?

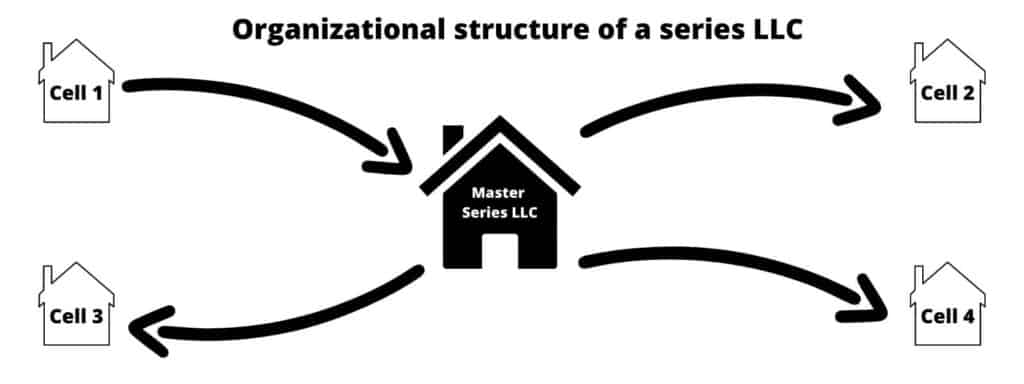

A series LLC is an LLC with a master LLC and individual series that serve as branches, also known as cells or series. This type of business structure allows you to create unlimited subsidiaries from the master LLC.

What is the difference between an LLC and a series LLC?

A regular LLC and a series LLC protect the owners from liabilities. However, these two LLCs also have some significant differences. A series LLC provides additional protection for company assets and is more cost-effective and tax-efficient than a traditional LLC.

Benefits of series LLC

Some of the key benefits of a series LLC include:

- Separation and protection of assets for each child series from liabilities of others.

- Lower administrative costs, compared to forming multiple LLCs.

- Less complex to form and maintain than a corporation.

- Greater protection to individual assets, held by series companies.

- Faster business growth achieved by subdividing the company units.

- Tax savings in states that don’t charge sales tax for the rent paid by one series to another.

- Lower state filing fees and ongoing LLC maintenance costs.

- Single federal income tax return due for the master LLC, which also serves as the tax returns for other series in the LLC.

States allowing series LLCs

Not all state laws recognize series LLCs as a legal entity. States that allow series LLC:

- Illinois

- Indiana

- Iowa

- Kansas

- Tennessee

- Texas

- Utah

- Virginia

- Wyoming

- Missouri

- Montana

- Nebraska

- Nevada

- North Dakota

- Oklahoma

- Ohio

- Puerto Rico

- Alabama

- Arkansas

- Delaware

- District of Columbia

- Wisconsin

How to form a series LLC step-by-step

Most states have similar procedures to form an LLC. Though there are some specific nuances.

For example, several states, including Arizona, Nebraska, New York, have a publication requirement for LLCs. Others like California, Delaware and Missouri require a mandatory operating agreement.

Therefore, you must always confirm the company incorporation requirements with your local Secretary of State.

Steps for forming a series LLC:

- Confirm state laws around series LLC

- Designate a registered agent

- Prepare and file articles of organization

- Create an operating agreement

- Complete other LLC registrations

1. Confirm state laws around series LLC

Each state has unique series LLC laws.

In Illinois, series LLCs owners must file annual reports for each cell. In contrast, you don’t need to file a yearly report for the series LLC in Delaware.

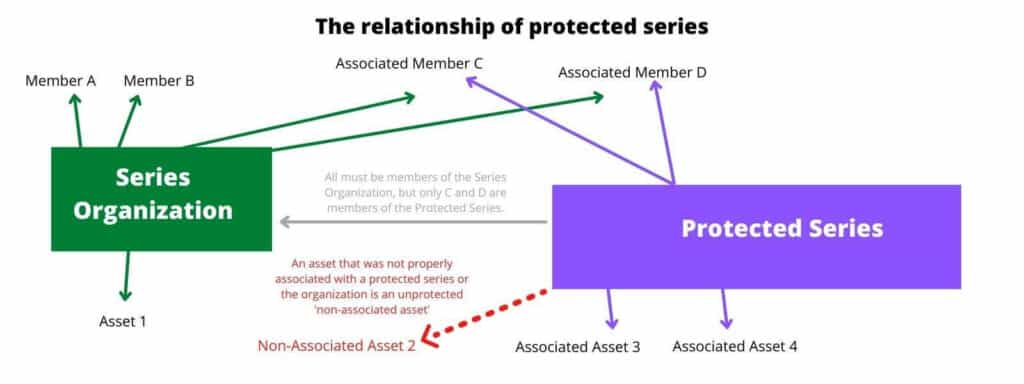

Some states also recognize Protected Series LLC. This kind of protection separates each cell from the other, allowing them to operate independently.

However, this protection also comes with some risks.

For example, some LLC operators can misuse the protection to commit fraud. As a result, the Uniform Protected Series Act provides guidelines for record-keeping, asset ownership, and more to block such loopholes.

Series LLC is still a new concept in many states. For this reason, the rules governing these business structures can be confusing at times.

Taxation

For instance, in some states, series LLCs are considered one taxable entity. Yet, in other states, they operate as multiple taxable entities.

At the federal level, the Internal Revenue Service (IRS) hasn’t yet issued its final verdict either. They do, however, have some guidelines for series LLC, where they leave tax decisions to each state.

Bankruptcy

The US Bankruptcy code also doesn’t recognize the series LLCs structure.

There are no guidelines on whether a series LLC should file bankruptcy as a single business entity or as an independent series. This issue puzzles even experienced bankruptcy attorneys.

Foreign LLC registrations

Finally, if you decide to register a series LLC as a foreign entity in a state that doesn’t authorize this kind of business model, you’d be in legal limbo once again. Because of this, most series LLC owners tend to conduct businesses only within the formation state.

It’s still unclear whether courts in foreign states should recognize and respect the formation state’s liability protection given to series LLCs.

Additionally, there are no federal guidelines explaining what to do in such a scenario.

Limited liability

Many legal professionals also observe that the liability shield offered by series LLCs is untested in court since this business model is still new in most parts of the country.

Liability protection is often discussed in theory, but there’s little evidence that LLC operators have successfully avoided liability arising from lawsuits targeting separate series. Again, many business owners restrict their LLC series operations to the formation state. This tactic is beneficial when avoiding lawsuits, but it can also limit growth and expansion opportunities.

For instance, a hospitality company may wish to operate nationwide using the series LLC model for liability protection. But since it’s problematic to operate a series LLC in states that don’t recognize this structure, the cheaper option is to restrict their operations within the formation states or states of jurisdictions.

For example, California doesn’t recognize series LLCs. But they don’t explicitly prohibit such entities from conducting business in the state either.In this case, the only disadvantage is that California requires that each cell that conducts business in the state pay an annual franchise tax of $800.

Can a series LLC do business in another state?

It all depends on the policies of the other state. California lets foreign series LLCs do business in the state.

To do so, you’ll have to register the series LLC as a foreign entity. This requirement applies whether you want to register the series LLC individually or one of the cells.

However, since you can’t register a single cell on its own in California, you’ll need to register the entire series LLC. You should best consult with a corporate attorney before moving a series LLC to another state.

2. Prepare and file Articles of Organization

Articles of Organization (also called Certificate of Formation in some states) is the main document establishing your new company registration.

You’ll need to prepare and file the same state-supplied articles of organization form as you would when forming a traditional LLC. But you’ll have to select “series LLC” among the proposed options. In most cases, the cost to incorporate an LLC and a series LLC is the same.

3. Create an operating agreement

An operating agreement outlines the rules and regulations governing the operations of the series LLC. In particular, this legal document:

- Establishes the master company’s intent to establish and authorize series LLCs

- Identifies the management obligations of each cell (if different from the master)

- Identities the managers of each cell (if different from the master)

- Establishes that each series LLC operates as a separate entity

- Separates certain aspects of the series LLCs, such as bank accounts

The LLC operating agreement should also cover the duties and responsibilities of all series LLC members, specify their contributions to the business, and profit/loss allocations.

4. Complete other LLC registrations

You’ll also need to complete other registrations required to establish the LLC.

These include:

- State tax registrations to obtain a local tax ID

- Business license(s) applications

- Trade name registration

- Separate business bank account registrations for each cell

Do series LLC file separate tax returns?

Since the IRS treats series LLCs structure as one entity, each cell doesn’t have to file separate federal tax returns. Instead, every LLC member must file their personal tax return, disclosing income gained from their series LLCs.

Although you don’t need to file taxes for cells in a series LLC, you still need to keep separate financial records for tax purposes. It’s especially important if you get audited by federal or state tax agencies. It also helps simplify the tax filing process.

Series LLC notes

- Montana requires a separate operating agreement and Articles of Organization for each cell.

- Texas requires an annual Certificate of Assumed Name for each cell.

- In Missouri, Articles of Organization must contain information on every Protected Series and be amended if a series is added or removed.

- In the District of Columbia, Illinois, and Kansas, rules of the Secretary of State require Articles of Organization or similar paperwork as part of the formation of each cell (as opposed to allowing the creation of cells in the LLC’s operating agreement).

- In Minnesota, North Dakota, and Wisconsin, the cells are not bankruptcy-remote (liabilities of one cell may become liabilities of others), and cells cannot individually contract, only the top-level LLC.

- In Delaware, a cell can enter into contracts, hold title to assets, grant liens and security interests and sue or be sued.

Is a series LLC worth it?

Separate LLCs work best for companies with multiple streams of income.

For example, a property management company or real estate investors can register multiple series LLCs to protect individual property from liability.

But this business model might not work for entrepreneurs or startups that have one source of income, lack significant assets, or have little or no experience operating series LLCs.

If you’re considering creating a series LLC, it’s best to seek legal advice first.