Starting a business is a big decision, requiring some operational knowledge.

It's essential first to determine your business’s optimal structure, especially if you plan to get a business partner instead of operating as a sole proprietor.

When two or more people enter into a business agreement, a general partnership is the default business structure.

However, if you’d like to get your business incorporated, you have more options:

- A limited liability company (LLC)

- A limited partnership (LP) with a general partner and limited partners

- A limited liability partnership (LLP)

Read on to learn more about a partnership versus LLC, plus when an LLP or LP is a good idea for your business entity.

Partnership vs. LLC: the main differences

Think of an LLC as a hybrid partnership-corporation business structure. There are many similarities to a traditional partnership, but some underlying differences too.

The easiest way to understand the difference between a partnership and an LLC is by comparing the following factors:

- Formation requirements: LLCs require state filings, GPs don’t

- Operational requirements and annual costs

- Taxation on federal and state levels

Overall, the operational requirements are similar on an internal level. But with LLCs, business owners should expect annual reports or bi-annual reports (usually, depending on state rules).

Taxation can also be about the same, except that LLCs can instead elect to be treated as an S corporation or C corporation for tax purposes.

Business owners must understand when partnerships and LLCs differ to choose the proper business structure.

1. Business registration requirements: LLC vs. partnership

To register an LLC, you will need to file for articles of incorporation with your secretary of state (and, in some cases, provide additional documents such as an operating agreement, affidavit of publication, etc.).

LLC formation costs vary by state. Filing fees range from $40 — the lowest in Arkansas — to $500 — the highest in Massachusetts. But keep in mind that there may also be fees to file for a name reservation and designate a registered agent.

How does the registration process differ for partnerships?

A general partnership (GP) doesn’t need to file incorporation documents with the state. There’s no formal incorporation process involved.

Partnerships will be cheaper than LLCs in terms of filing fees. Since general partnerships can be formed with a simple agreement that is not filed with the secretary of state, it is not a costly business structure to form.

If you want to form an LLP or LP, the company formation process is similar to a traditional LLC. The state filing fees are often the same or somewhat higher.

For example, in Texas prepare to pay:

- $300 for obtaining a certificate of formation for a multi-member LLC

- $750 for obtaining a certificate of formation for a limited partnership (LP)

- $200/partner for registering a limited liability partnership (LLP)

What documents do you need to start a partnership?

General partnerships do not have formal filing requirements, unlike limited liability companies. It is good practice to have a partnership agreement, which is like an LLC's operating agreement.

Suppose you want to establish a legal entity such as an LLP or LP. In that case, you’ll need to prepare a set of government forms, mainly articles of organization/formation, operating agreement, etc. Check what documents are required with the local secretary of state's office.

2. Operational requirements for partnerships vs. LLC

When it comes to running a general partnership vs. having an LLC, stay in the loop regarding the following requirements:

Liability

When it comes to the day-to-day of running your business as a general partnership, factor in that you (and your partners) can be held liable for any wrongdoings and mishaps. Including those done by another party.

Since LLC is a separate legal entity, it lends better asset protection against individual actions. If there are any legal issues, these will be attributed to the LLC (not you personally).

LLPs and LPs also offer liability protection to other partners for the actions of one partner (in the case of an LLP) or the limited partners (with an LP). However, LLPs are not available in every state or may be limited only to certain professions.

Securities regulations

LLCs may sell interests in the business entity — a security offering subject to security laws. LPs may also raise capital by selling interests in the LP and be subject to security laws in raising money from “silent” business owners.

General partnerships and LLCs typically can’t sell securities to raise capital, but other actions they engage in can still be governed by securities laws and regulations.

Annual reports and filing fees

A general partnership doesn’t have to file any annual reports with the secretary of state. But all incorporated entities have to.

Annual or biannual reports are mandatory in all states, except for Alabama, Arizona, Missouri, New Mexico, Ohio, Pennsylvania, South Carolina, and Texas.

Annual filings also assume paying a state fee. That’s the case in all states, except for Idaho and Mississippi, where annual reports for LLCs are free to file. Filing fees and requirements, like annual reports, depending on the state – also, the business structure. So, always check local rules!

3. Taxation of partnerships vs. limited liability companies

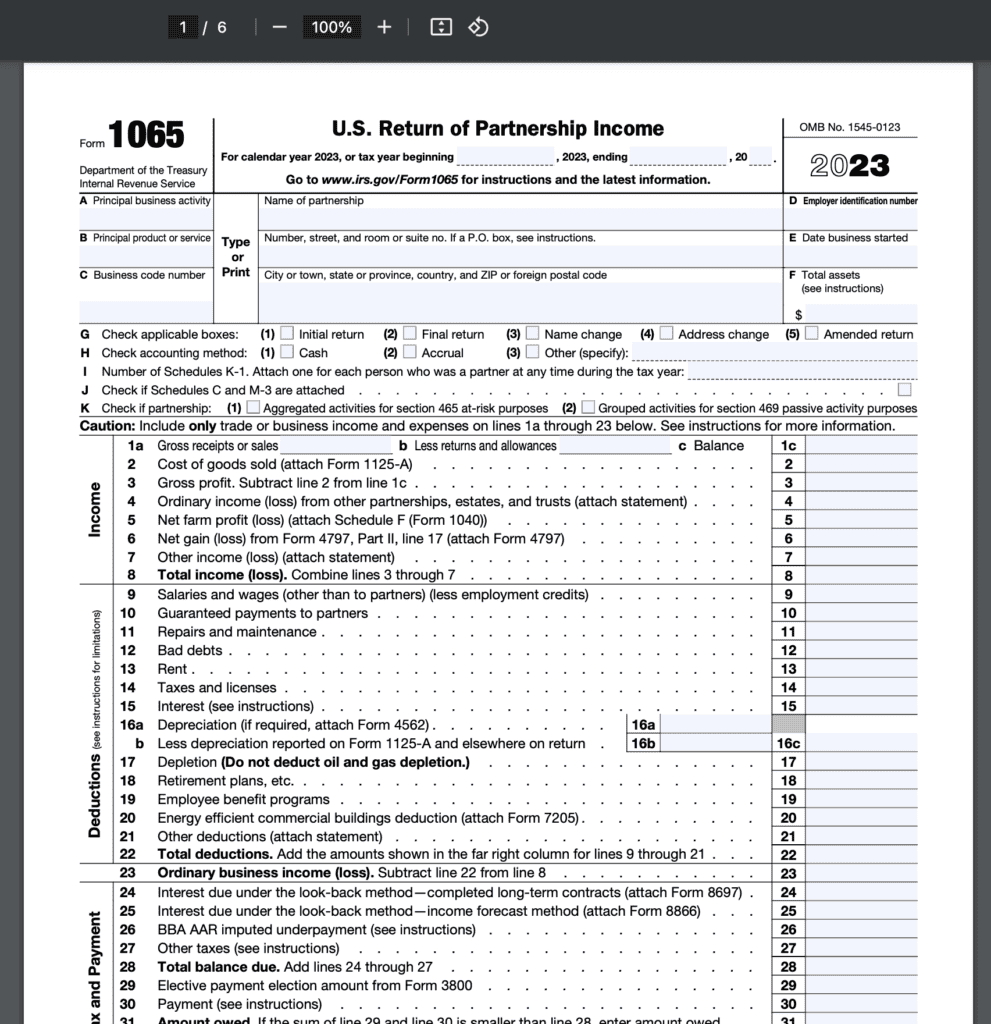

Partnerships (including LPs and LLPs) and LLCs need to file annual tax returns, Form 1065, with the IRS for taxation at the federal level.

Partnerships do not pay income taxes as a separate entity. This type of business entity is a pass-through structure. Income, losses, deductions, etc., are reported on the partners' (or business owners') personal income tax returns.

LLCs, by default, don’t pay income tax and are seen as disregarded entities. As such, LLCs with two or more business owners are taxed similar to a partnership by default.

However, LLCs can elect to be taxed as an S corporation or a C corporation instead (but mind the double-taxation if you select the latter). To do so, they need to file a form with the IRS. This election will then impact the personal tax returns of the business owners (or LLC members).

Are limited partnerships taxable entities?

No. While all partnerships must file an annual report with the IRS with their income, deductions, gains, and losses, they do not pay income tax as a separate entity. Instead, the income and losses pass through to the personal income tax returns of the partners.

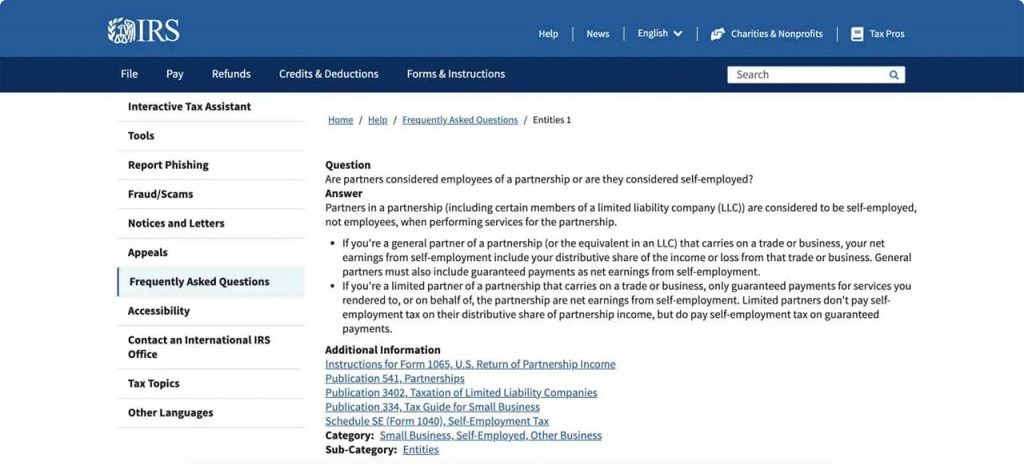

Do limited partners pay self-employment tax?

Sometimes. Limited partners may pay self-employment taxes if they receive regular income. Or if the state they are in requires it. But otherwise, limited partners do not owe self-employment taxes at the federal level on business profits.

The IRS explains:

Do I file my LLC and personal taxes together?

Yes, if taxed as a partnership.

In this case, the partners will report the earnings from the LLC on their personal tax returns. Single-member LLCs are treated as sole proprietorships with the default tax classification, while multi-member LLCs are treated as partnerships.

In both cases, the income and losses flow through and are reported on the personal income tax return.

Different taxation requirements will apply when the LLC elects to be taxed as an S corporation or a C corporation.

Conclusion: Partnership vs. LLC pros and cons

General partnerships are easier to form than LLCs. However, they do not come with the same liability protection. LPs and LLPs can offer better liability protection to the other partners or the limited partners, but the LLP structure is not available in every state for every business type.

LLCs are treated as separate entities from business owners and, as such, grant personal liability protection to the business owners.

Day-to-day management and taxation can be very similar for a partnership versus an LLC in many cases. But not always. So business owners should know the nuances to pick the best business structure.

FAQs about partnerships and LLC differences

Here are the most frequently asked questions concerning partnership vs. LLC.