How to choose the optimal business structure? — this question never gets old. Small business owners want the easiest, fastest, and least expensive option for incorporation.

How to choose the optimal business structure? — this question never gets old. Small business owners want the easiest, fastest, and least expensive option for incorporation.

Many settle for a sole proprietorship or Limited Liability Company (LLC). Others form a corporation, either an S-corporation or C-corporation. Still, many small business owners wonder if they made the right choice, especially when it comes to LLC vs. Inc.

Each business structure has its pros and cons. There are also different tax implications involved. At any rate, making an informed decision is key when starting a business.

Comparing LLC with Inc.

- Limited liability company vs. corporation: the differences

- LLC vs. Inc: comparison

- When to use an LLC?

- When to use an Inc?

- Conclusion: Should I create an LLC or an Inc?

- FAQ section about LLC vs. Inc

Limited liability company vs. corporation: the differences

Unfortunately, there’s no right or wrong answer when choosing between an LLC and a corporation entity for your new business. The decision boils down to your company’s growth plans, operational structure, and a number of owners.

Limited liability companies are cost-effective to establish for a single owner, whereas an Inc. is more suitable for multi-members. Corporations, however, have more tax obligations and more complex reporting requirements, whereas LLCs are treated as “disregarded entities” for federal tax purposes.

Other than that, the business formation process for each is similar. Both structured are formed by filing Articles of Organization with your Secretary of State’s (SOS) office. Neither legally requires an operating agreement in most states (though it's highly recommended).

When making your choice, you must consider the number of owners and how ownership changes impact the business. You must also think about taxation, company management, and reporting requirements.

Below is a detailed lowdown to help you make your choice.

What is an LLC?

For the protection of personal assets, many entrepreneurs choose a Limited Liability Company (LLC). This entity has a flexible management structure. You can form a single-member or multi-member LLC. LLC owners are called members. Each member has an ownership percentage in the company, called a membership interest.

Compared to a corporation, LLC requires less record-keeping. Also, for tax purposes, an LLC is seen as a disregarded business entity by the IRS. So LLC members pay income tax on their share of profits on their personal income tax returns. But don’t have to foot a corporate tax bill.

Advantages of an LLC

- Easy and fast formation

- Minimal cost to maintain

- Liability protection for members

- Can have unlimited members

- Pass-through taxation

What is a corporation (Inc)?

In some cases, a corporate structure is a better fit for your company. For example, if you have ambitious plans for growth and plan to seek external investments, attract shareholders, and perhaps even go public someday.

But running an Inc company requires additional steps such as holding annual meetings, creating bylaws, and filing annual reports. Although it's a separate legal entity like an LLC, corporations make it easier to change ownership. It’s helpful for startups who want to be acquired. In addition, the business continues after the death or withdrawal of other owners.

There are two types of corporations: an S-corporation and a C-corporation.

- An S-corp or Subchapter S corporation provides added tax benefits for its owners. For example, you can reduce self-employment taxes by paying taxes on only salaries and not on total profits. However, there are limitations on the number and type of shareholders accepted. Similar to an LLC, business profits and losses are passed through to S-corp owners’ personal tax returns.

- C-corp profits are taxed at the corporate tax rate and again at the personal tax rate when dividends are paid to shareholders. It’s known as double taxation and a significant drawback for small business owners.

Advantages of a corporation

- Well-suited for multi-ownership

- The business continues despite ownership changes

- Owners don't share personal liability for business debts

- Conductive with going public (IPO)

LLC vs. Inc: comparison

The following comparison will help you decide on an LLC vs. a corporation based on costs, taxes, and paperwork.

Company formation

To form an LLC, you must file an Articles of Organization with required business information to a local secretary of state and pay applicable fees. Also, states such as Arizona, Nebraska, and New York require you to make a newspaper publication announcing your LLC formation. It can cost another couple hundred dollars. Aside from state-required annual reporting (mandatory or skippable in some states), little other work is needed to maintain the LLC.

To create a corporation, you must file an Articles of Organization and pay state fees too. The costs of incorporation are comparable to LLC and vary from state to state. The corporate articles require more information than an LLC, however. Corporations are public companies, so more detailed business information is required about the owners and ownership structure. Also, the corporation must create bylaws and have a board of directors. The board will appoint officers to run the business.

Both an LLC and a corporation can have unlimited owners. Also, when forming an LLC or corporation, both require selecting a registered agent. This individual or entity will receive legal documents on behalf of your business.

Taxation

Both LLCs and corporations are business entities separate from their owners.

On a federal level, LLC members pay taxes on their profits and distributions at their personal tax rates. The LLC itself doesn't pay taxes since an LLC is not recognized as a business entity by the IRS.

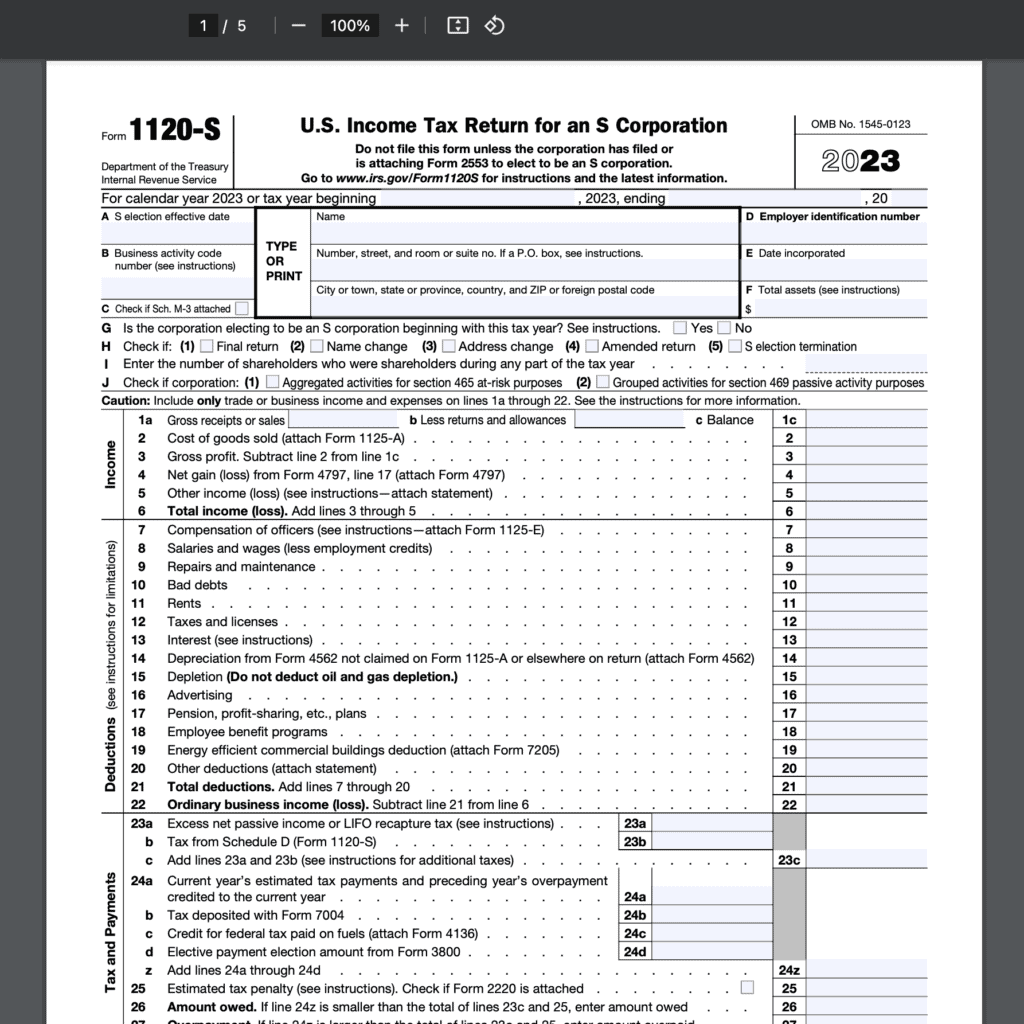

S-corp owners must pay self-employment taxes on profits and distributions received. Corporations must also file Form 1120S to report earnings to the IRS.

Moreover, S-corp owners must also file a Schedule K-1 to report their share of corporate earnings. These are taxed at the owners' personal income tax rates.

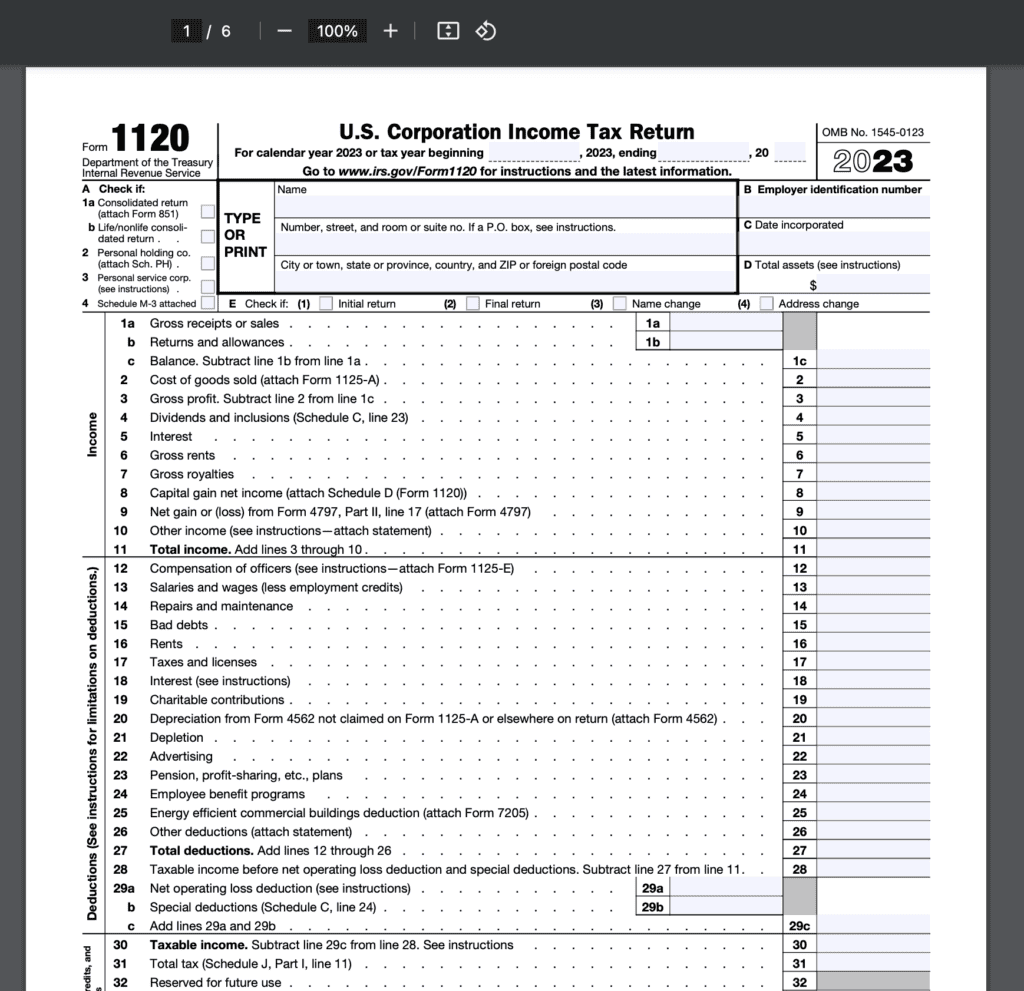

C-corps must file Form 1120 to report earnings and taxes due.

It’s a separate return, and tax due is based on the corporate tax rate. Dividends paid to stockholders are taxed again at the individual tax rate. This rate is lower than the corporate rate but still a double tax on the same profits.

Which is better for taxes LLC or S Corp?

For income tax purposes, an S-corp is more beneficial for multi-ownership. Stockholders are taxed only on the salary paid and not total business income, which could significantly increase. With an LLC, members are taxed on their portion of total profits from the business.

Here’s a sample tax calculation to provide more context:

Suppose that a taxpayer made $100,000 in business income. As an LLC, the member would pay self-employment tax of 15.3% on the $100,000 of income, or $14,130 (self-employment tax applies only to the first $147,000 for 2022, but for simplicity, we calculate on $100,000). As an S-corp, the stockholder received $40,000 of the $100,000 as a salary and the remaining $60,000 as a distribution.

The stockholder will still pay self-employment tax at 15.3% but only on the $40,000 salary, which is $6,120. The owner saves over $8,010 by simply selecting the proper business structure. In both cases, the income is reported on the personal tax returns of the owners.

Ongoing costs

Forming an LLC can cost hundreds of dollars. All states, except Alabama, Arizona, Missouri, New Mexico, Ohio, Pennsylvania, South Carolina, and Texas, require LLC members to file annual registrations and pay renewal fees. Annual registrations ensure companies maintain current information with the state. The annual LLC fees are often minimal (except for Massachusetts, where an annual report costs $500).

Corporations require annual registration renewals and also have to pay state fees to obtain a current certificate of existence. Both LLCs and corporations can be subject to annual franchise taxes.

These are paid on top of federal taxes as a form of “privilege” for doing business in a certain state. Failure to pay franchise taxes or renew annual registrations can result in companies being dissolved by the state.

Ownership

Both LLCs and corporations can have multiple owners. LLC members have membership interests while corporation owners are issued shares of stock.

For the above reason, multi-member LLC should have an operating agreement. The document will outline membership interests and specify how ownership changes can happen. If an LLC member dies or exits the business, the LLC can be dissolved if no special provisions are placed in the operating agreement.

Ownership changes don’t impact the corporation’s existence. If a stockholder dies or transfers ownership, the corporation continues to operate. This structure is ideal for businesses that plan to go public or have external investors.

Liability protection

Both an LLC and a corporation provide added asset protection for its owners.

LLC members are liable for their investment in the business. If your LLC is sued, your personal assets are protected from litigation. There are instances where you can lose this personal protection.

It’s called “piercing the corporate veil” and can occur in the following situations if you:

- Mix business and personal transactions in the same bank account

- Fail to make sufficient investments the business

- Create an LLC to perpetrate fraud or other illegal activities

The liability protection is similar for corporation members. You also cannot be held liable for any business debt or legal mishaps. No matter how much the stockholders manage the business, they are only liable to the extent of their investment.

When to use an LLC?

Select an LLC structure when you want a low-cost and straightforward way to manage your business.

Forming an LLC makes sense when you:

- Look for a fast way to incorporate

- Want simple compliance for operating your business

- Want to be privately held and don’t plan to seek investors

When to use an Inc?

A C-corporation or S-corporation makes sense when you plan to seek outside investors. Corporations make it easy to transfer ownership, and the business continues when owners die or transfer.

Forming a corporation makes sense when:

- You're seeking to attract other stakeholders

- You want the business to continue indefinitely

- You want stockholders to have limited liability

Conclusion: Should I create an LLC or an Inc?

The decision depends on your long-term business goals and tax strategy. Both an LLC and a corporation provide added limited liability protection of the owners’ assets. LLCs require less paperwork to form and provide more flexibility in managing the business.

LLC owners can also select a corporation status for tax purposes should they wish to. In that case, the LLC members will pay taxes on their share of profits and distributions on their personal tax returns.

However, if you plan to seek outside investors or issue stock, a corporation may be a better option. But there’s an added compliance factor with annual filings, board meetings, and filing a separate tax return for the corporation. C-corporation stockholders will pay personal income taxes on dividends received from the corporation, in addition to the corporate taxes paid on business profits.

FAQ section about LLC vs. Inc

Here are some frequently asked questions regarding LLC vs. Inc.