Many real estate owners and investors agree that using an LLC for a rental property is a wise decision.

Incorporating a formal business structure offers numerous benefits, including liability protection and potential tax advantages. However, it also comes with some disadvantages, such as increased paperwork and potential costs.

In this guide, we’ll delve into the pros and cons of forming an LLC for your rental property.

Additionally, we'll address some frequently asked questions to help you make an informed decision about whether this business structure is right for you.

Pros of an LLC for a rental property

Much like starting an LLC for any other company, there are financial and legal benefits to running your rental property under an LLC.

1. Keeping your business and personal expenses separate

When you invest in a rental property, there will be many expenses to take on, like closing costs, tenant screening charges, and maintenance incidentals. Separating your rental property into its own LLC will require a separate bank account and credit cards, allowing you to organize your finances better and avoid muddling your personal statements with your business expenses.

Likewise, when you file your tax return, your personal tax returns and business returns will be calculated and adjusted separately.

2. Avoiding corporate taxation

United States tax laws require corporate income tax at the entity level and the shareholder level. Shareholders cannot be distributed any profit as income until entity-level taxes are paid. Using the LLC structure helps avoid corporate double taxation on business profit and personal income.

3. Limiting your personal liability

If you choose to operate without a formal business structure, you risk becoming personally liable for any business matters. When you operate under an LLC, you and any relevant members have legal protection against any possible company wrongdoing.

For example, if your property requires any repairs, but the contractors go unpaid and eventually sue, your personal assets will be protected.

Cons of an LLC for a rental property

There are also disadvantages to consider if you’ve recently asked yourself, “Should I put my rental property in an LLC?”

1. Paying initial setup fees and recurring annual fees

Forming an LLC and acquiring a business license come with many setup fees and recurring annual fees. There’ll be an initial state filing fee which ranges from $40 to $500 depending on the state. Likewise, there's an annual fee, which also varies by state, associated with filing your annual reports. If you submit your report late, you’ll also be charged a late fee.

2. Filling out forms and an annual report

When transferring your property to an LLC, you’ll be required to submit your Articles of Organization, Operating Agreement, and IRS form SS-4 for your Employer Identification Number. In addition to these upfront documents, you’ll be required to submit an annual report. The annual report, however, is a recurring submission you’ll need to file every year.

3. Giving ownership to a company instead of yourself

When you create an LLC to manage your property, the process technically transfers ownership to your company. You own the company, but the company owns the property. In this kind of arrangement, the property is no longer personal equity.

Having property as personal equity is important since it can help build personal wealth and net worth.

How to form an LLC for rental properties

You can form an LLC by hiring a trusted professional service or undertaking the whole process yourself. In either scenario, you’ll have to:

- Choose your location: You’ll need an incorporation state for tax purposes.

- Pick a business name: You’ll need to reserve and register a name for your LLC. Be sure to check that your desired name isn’t already taken.

- Appoint a registered agent: A registered agent is an individual or business assigned to accept any official business documents on behalf of your LLC.

- Select a management style: LLCs can be managed by either members or hired managers.

- File all necessary documents: This includes your Articles of Organization, Operating Agreement, and SS-4.

How to transfer property to an LLC

In order to start conducting business, you’ll need to transfer the property’s title to your new LLC. Be sure to research your incorporation state’s individual requirements for doing so. Transferring property to an LLC involves:

- Contact your lender: If you're still paying down a mortgage, your lender will need notice before you transfer your title. Review your mortgage's “due on sale” policy, as you may be required to pay the remaining balance in full before transferring ownership.

- Fill out necessary deed forms: Depending on whether you already own or are financing your property, you'll need to fill out forms for a quitclaim or warranty deed. Paperwork will vary by state, so do your due diligence and make sure you’re meeting your state's requirements.

- Update your lease: Any lease agreements should have the LLC as the landlord and not your own name.

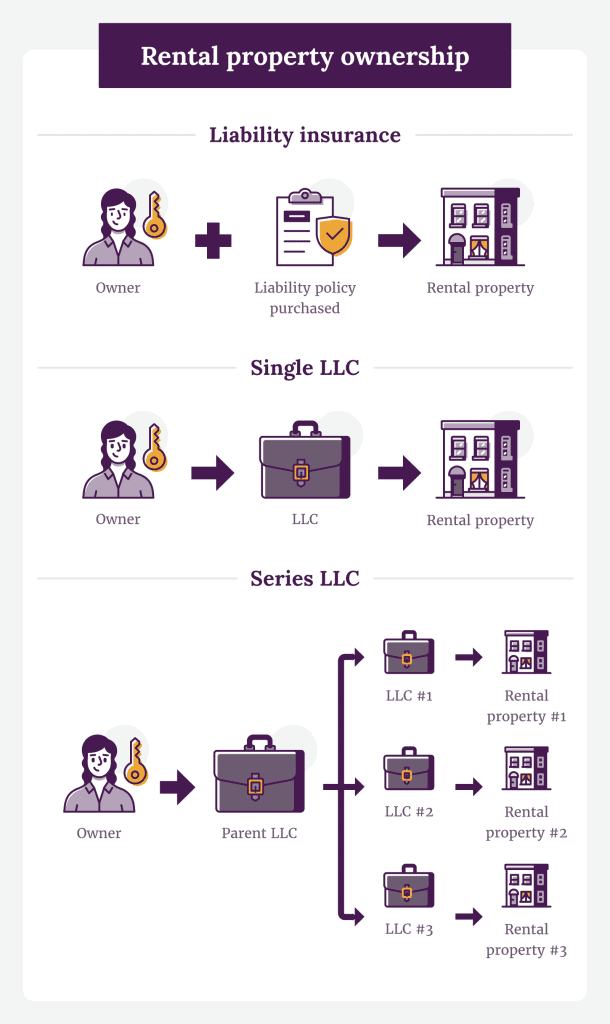

Single LLC vs. Series LLCs vs. Liability Insurance

If you have multiple properties you’d like to manage and are wondering how to start a rental property business, you might want to use a series LLC.

A series LLC involves an overarching parent LLC which oversees each LLC that branches off of it. You can often save yourself paperwork and filing costs by running your rental business as a series LLC as opposed to multiple independent LLCs.

Sometimes, rental property owners opt into buying a liability insurance policy to protect themselves against lawsuits.

While an LLC provides business owners asset protection and defense against personal liability, some may not want to go through the hassle of transferring property to an LLC.