Investing is a shortcut to building personal wealth.

But it also carries some financial risks — you can win big and lose big.

That’s why professional investors often use a limited liability company (LLC) as a means to protect personal assets and diminish liability.

LLC investing: Benefits

When your company's primary business activity is investing, this is called setting up an LLC for investing.

Like a private person, an LLC can invest in various assets — stocks, bonds, real estate, cryptocurrency, and other businesses.

There are many reasons why people choose to form investment LLCs. For one, it’s an excellent way to pool money from several informal investors — friends, family, or business partners. Also, this business structure allows parents to invest with or on behalf of their kids. Or give them percentage ownership of individual assets.

Investors also often use LLCs to fund real estate ventures. For example, Bill Gates used an LLC to strategically buy off farmland across the US for investment purposes.

Overall, there are many personal reasons why investors choose to incorporate an LLC. But in each case, they get many superb business benefits in tow.

1. Asset protection

As the name implies, LLC members face limited liability over the company’s actions. Likewise, they cannot be held personally responsible for the company’s actions. Distributing assets between your personal and business accounts creates the first layer of insulation between your investments.

Next, you can set up separate LLCs to manage different types of assets. When separate entities hold investments, they are isolated in the event of a lawsuit.

2. Limited liability

Also, every LLC member has limited liability protection. If anything goes wrong for the company, their personal assets are protected. Should there be a default on a loan or a claim made, the demanding side won’t be able to go after your private funds.

3. Pass-through taxation

LLCs have flexibility in how they report federal taxes. It lends to several tax advantages.

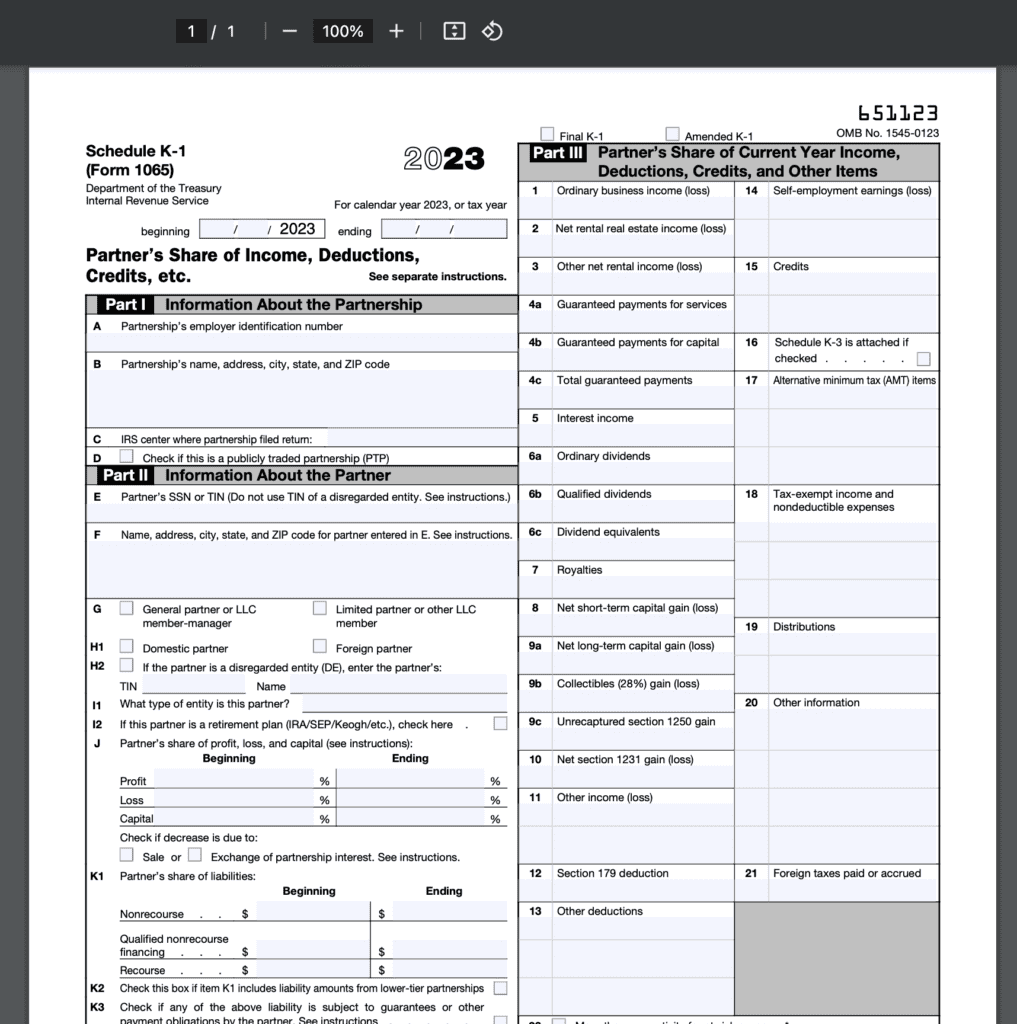

That means the company’s income and losses flow through to the members and are reported on the member's individual tax returns:

- Single-member LLCs report taxes as a sole proprietorship.

- Multi-member LLCs report taxes as a partnership.

Apart from default treatment, you can also elect another tax class for your LLC such as an S-corporation or C-corporation.

An S-corp remains a disregarded entity. But it allows members to retain more profits in the company (rather than distributing all of them) and save on taxes this way.

C-corporations, on the other hand, face two levels of taxes. The legal entity itself pays tax on the profits. Additionally, shareholders pay tax on dividends received.

4. Flexible management structure

LLCs can choose to be member-managed or manager-managed.

Investment LLCs often select a third-party management company to oversee their investment. For example, a real estate LLC can hire a property management company to handle the rentals it owns. Or have a financial advisor on board to oversee and rebalance the investment portfolio.

At the same time, you can run your small business without any external help or appointments. It’s common for family-managed investment LLCs, for example.

In this case, however, you’d want to be crystal clear about the responsibilities of each member. Document all the capital contributions, operational procedures, decision-making powers, and profit allocations in an operating agreement.

What can you invest in with an LLC?

LLCs can invest in numerous types of securities, physical and digital assets. The only difference is that you can’t invest using retirement accounts such as a 401K or Roth IRA.

Instead, you’ll have to open a separate business bank account and then a trading/investment account.

Here's what an LLC company can invest in:

- Real estate (commercial and residential)

- Land (commercial and residential)

- Stocks and bonds

- Mutual and index funds

- Certificates of deposits (CDs)

- Gold or silver bars, other precious metals

- Cryptocurrency and NFTs

- Crowdfunding campaigns

- Other businesses using cash or ownership percentages

- Other LLCs

1. Real estate

Real estate LLCs are probably the most common type of investment LLCs.

Company incorporation provides a safe method of pooling money with other investors to purchase commercial properties.

Also, the LLC structure is attractive to real estate investors because of added asset protection and limited liability. No one wants to be held personally liable upon a loan default or a lawsuit related to a rental property you’ve co-invested in. Real estate LLCs provide that extra layer of protection.

2. Stocks and bonds

Investment LLCs are commonly used to purchase stocks and bonds. That’s a good strategy if you want to build a long-term portfolio. Then pay yourself for the company as you retire.

Similarly, if you are a more active stock market investor, you can avoid paying as much capital gain and stock dividend taxes by trading as an LLC.

3. Mutual and index funds

Rather than investing directly in individual stocks or bonds, LLCs can invest in mutual funds. The benefits of a mutual and index fund are asset diversification. Rather than betting most of the money on one stock, you spread your investments over a group of companies held by the fund.

4. Cryptocurrency

Cryptocurrency investments are volatile. Using an LLC can help you protect your personal assets from market fluctuations.

Also, if you plan to mine crypto, doing so as a company allows you to claim back some of the spendings as business expenses. Business owners also would benefit from the limited personal liability related to the mining operations.

Using an LLC to invest in crypto allows multiple members to pool money to make more significant investments in the cryptocurrency industry, e.g., support an emerging startup.

5. Business investments

Your LLC can invest in other types of businesses (instead of getting started on your own).

You can purchase and flip other companies. Or acquire equity (a stake) in another business. You can act as a small venture firm by pooling money from other investors, funding interesting projects in exchange for an equity percentage.

Can an LLC invest in another LLC?

Yes, LLCs can invest directly in other LLCs. In that case, the investing LLC becomes a member of the funded LLC and obtains a certain percentage of ownership in the company. The transaction should be recorded in the LLC operating agreement.

How are LLC investments taxed?

LLCs have a choice of how to file federal taxes.

The default rule is that an LLC with multiple members is taxed as a partnership unless elected otherwise. An LLC with one member is taxed as sole-proprietorship. Both can choose to get taxed as an S-corporation or C-corporation instead.

Unless taxed as a C-corporation, the LLCs profit will “pass through” to the members of the LLC. The members will pay tax on the earnings of the LLC on their individual tax returns.

Suppose the LLC elects to be taxed as a C-Corporation. In that case, the LLC will pay tax on the profits at the corporation level and the individual shareholder level when they receive dividend payments. Because C-corporations are subject to two tax levels, most LLCs choose to be taxed as a partnership or S-corporation.

However, in rare situations, S-Corporations can be required to pay taxes directly to the IRS.

Typically, the profits, losses, and capital gains pass through to the S-Corporation shareholders. However, suppose an S-Corporation was previously taxed as a C-Corporation. In that case, the S-Corp might be required to pay taxes on built-in gains that existed at the time of the conversion.

For example, if the C-Corporation had a basis of $100k in Public Co's stock worth $300k when they converted to an S-Corporation, the built-in gain would be $200k. If the S-Corporation were to sell those shares shortly after converting, the S-Corporation would be required to pay tax on up to $200k of built-in gain.

This rule preserves the C-Corporation double tax structure that existed when the gain was created.

LLCs taxed as S-corporations or partnerships will file their annual tax return by the 15th day of the third month after year-end (typically by March 15th). LLCs taxed as C-corporations will need to file their tax return with the IRS on or before the 15th day of the fourth month after year-end (typically April 15th).

How are capital gains taxed in LLC?

Just like regular investors, LLCs have to pay capital gain taxes. On a positive note is that you can apply deductions/exceptions to lower your personal bill if you report taxes as a partnership, sole proprietor, or S-corp. On the other hand, Investment LLCs reporting taxes as C-corp will pay taxes on the net capital gain.

How to set up an investment LLC: step-by-step

Creating an investment LLC is the same as creating a regular LLC. There are no differences in company formation requirements or state laws.

To create an investment LLC, you’ll have to complete the following steps:

- Select an incorporation state

- Chose a business name

- Appoint a registered agent

- Select a management structure

- File articles of organization with the Secretary of State

- Draft an operating agreement

- Register your LLC for tax purposes

- Obtain business licenses and permits

Each state has somewhat different rules and regulations around company formation. Refer to our state-by-state guides for additional information.

FAQs about investment LLCs

Here are some frequently asked questions about setting up an LLC for investing.