Registering a limited liability company (LLC) comes with many perks. Most notably, limited personal liability and personal asset protection, hence the name.

However, you need to complete several administration formalities to gain these benefits.

Namely, obtain Articles of Organization (also known as “Certificate of Formation”) from the Secretary of State, create an operating agreement, and complete other company registration forms.

But there's more.

Your small business may need a document that proves your business is legitimate and shows that all the members have agreed on major issues concerning the LLC. That's what different LLC certificates are for.

Not heard of it before?

Here's a guide that explains what an LLC certificate is and how to get one for your company.

5 Types of LLC Certificates

An LLC certificate is an informal term that can refer to any of the following company formation documents:

- Certificate of Organization

- Member Certificates

- Certificate of Good Standing

- Certificate of Existence

- Certificate of Authority

Let’s look at each one individually.

1. Certificate of Organization

A Certificate of Organization, also known as Articles of Organization, is a document that verifies your domestic limited liability company (LLC) registration with the state and establishes it as a legal business entity in the state where you are incorporated.

A Certificate of Organization typically lists:

- The name of the LLC

- Office address/place of business address

- Registered agent name and registered office address

- Purpose of business (main business services provided)

- LLC members’ names (some states allow keeping members’ names off public records)

The document acts as proof that members undersigned to form a limited liability company (or a limited liability partnership) and comply with the company formation state laws.

Each state has different laws and filing requirements (and state fees) for obtaining the Certificate of Organization.

2. LLC Member Certificates

Once you get an approved Certificate of Organization from the state, you may want to create individual LLC members certificates.

It makes sense if you plan to raise outside capital or sell membership interests to incentivize future investors.

Like stock shares in a corporation, LLC member certificates determine each person’s stake (interest by units or percentages) in the company.

Plus, they help owners identify the LLC's structure regarding ownership interest, profits, and taxation.

The LLC itself can specify:

- Number of certificates to issue (usually at the time of LLC formation)

- State of origination

- Name of the member receiving the certificate

If the LLC ownership structure changes, the old member certificates will be revoked and new certificates issued.

To prevent any issues with your LLC’s ownership and registration, it’s essential to maintain and update all member certificates.

You don’t need to get the member certificates notarized, provided the person who signed it is authorized to admit members to the LLC.

3. Certificate of Good Standing

Once you file your LLC’s annual report and pay applicable fees, the state will give you a Certificate of Good Standing (or Certificate of Status).

This certificate declares that your company is correctly registered with the state, complies with state regulations, and is legally authorized to conduct business.

Without it, third parties like financial institutions (banks, lenders), investors, vendors, or agencies may not want to do business with you.

Also, if you plan to operate in another state, you’ll need to register there as a foreign limited liability company. To process your request, the local Secretary of State (SOS) will ask to provide a Certificate of Good Standing from your home state, along with other legal documents.

In most states, the SOS or one of its subdivisions (e.g., a Division of Corporations) issues a Certificate of Good Standing.

For example, in Florida, you can order a certificate from the SOS’s office online, by mail, or in person.

Online requests are often handled on the same day.

You’ll pay a $5 fee by check, credit card, or money order. Once your payment is processed, your Certificate of Good Standing will be emailed to you as a PDF form.

4. Certificate of Existence

Some states do not issue a Certificate of Good Standing but give a Certificate of Existence. This document shows your LLC exists and is in good standing in your home state.

A Certificate of Existence proves your business is incorporated and legally permitted to do business in a particular state.

Plus, it shows that you don’t owe any outstanding fees, taxes, or penalties to the SOS, haven’t filed for LLC dissolution and submitted the most recent annual reports.

You may be asked for a Certificate of Existence if you want to:

- Register your LLC to operate in another state

- Apply for a loan or line of credit in the name of your LLC

- Open a new business bank account or corporate credit card

- Form a contract with another business

- Transfer or sell some or all of your company

- Purchase business insurance

- Renew certain licenses or permits

- Get funding from external investors

You can obtain a Certificate of Existence from the Secretary of State’s portal for your state.

In Georgia, for example, you’ll enter your business name on the Georgia SOS website, click on your business name, and then get your LLC’s records. Once you verify the information is correct and accurate, you can generate the certificate, and the state will email it to you as a PDF.

A $10 filing fee will apply. You can pay it with any major debit or credit card. Once the payment is processed, you’ll receive your Certificate of Existence via email within the hour, and you can send it to the requesting entity.

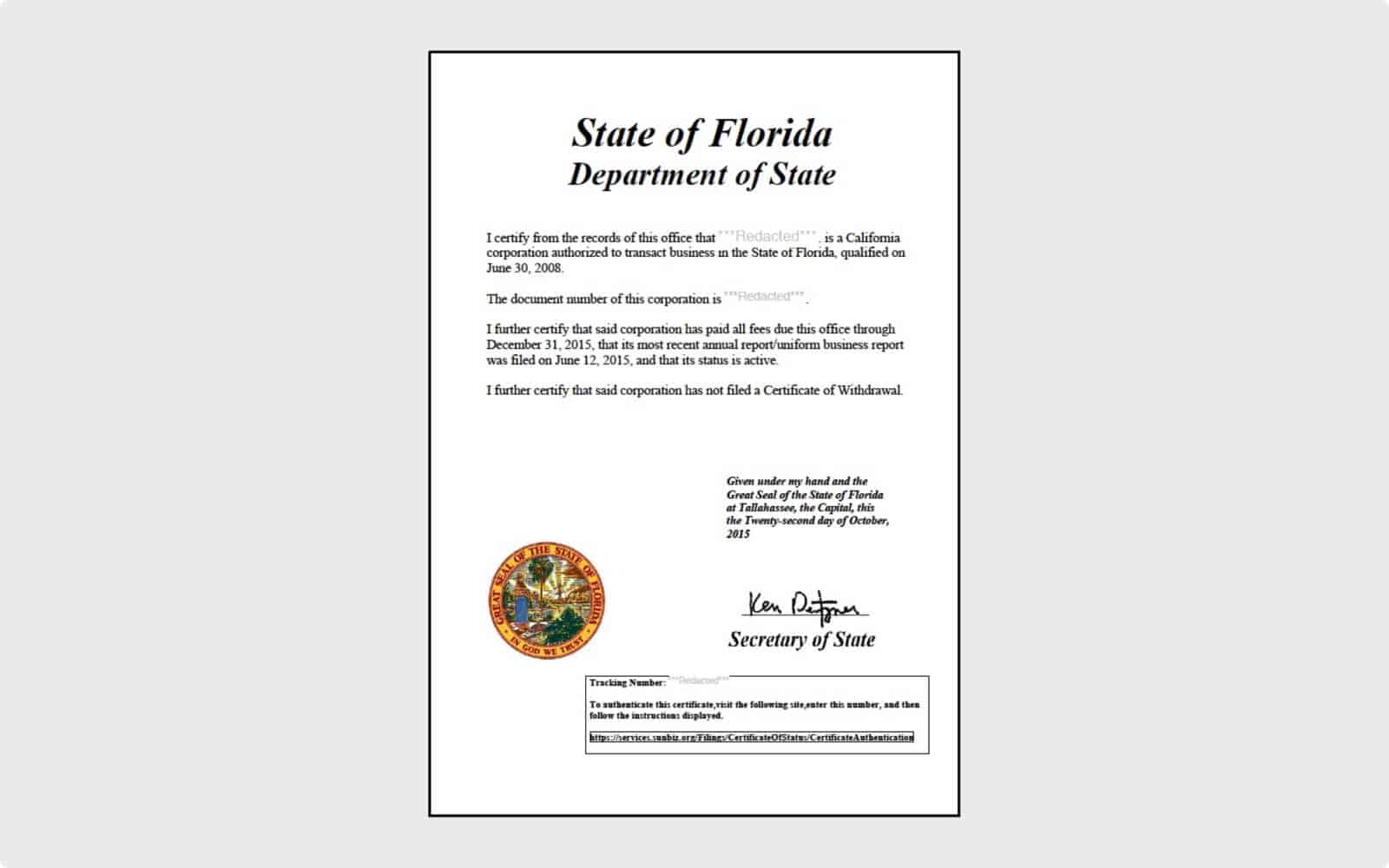

5. Certificate of Authority

If you intend to operate your LLC outside the state of registration, you’ll need to register as a foreign LLC.

That means you’ll need a Certificate of Authority (or Foreign Qualification) to legally do business in that destination.

This document provides other states with important information about your business, such as the official company name, business address, owners’ and members’ names, and the legal structure (LLC).

To obtain a Certificate of Authority, you’ll need to:

- Research the jurisdiction’s requirements for out-of-state businesses

- Apply for the Certificate of Authority form and pay the applicable fee

- Provide extra documentation to show that your LLC is in good standing in your home state

- Appoint a registered agent in the state to receive service of process on your LLC’s behalf

If everything is in order, you can file the Certificate of Authority application with the Secretary of State yourself or work with a legal document preparation service to complete the requirements.

Conclusion

Incorporating your LLC is a significant milestone that marks the start of your business. Stay on the good side of compliance by preparing the correct documentation.

LLC certificate is a colloquial term that refers to different types of legal documents. By now, you should well understand which one you need to complete future filings.