If your limited liability company (LLC) works with any business partners (which it probably does!), you may be asked to fill in and submit a W-9 form.

That’s a standard request for ensuring federal tax compliance.

But new business owners often feel trouble with understanding when they need to complete a W-9 form and how to do so. This post provides step-by-step instructions.

What is a W-9 form used for?

The W-9 is an IRS form for requesting information returns.

In other words: the company asks you to provide some details about your business so that they can properly record payments made to you as a vendor, freelancer, or independent contractor.

That’s why this form is also called “Request for taxpayer identification number.”

Essentially, form W-9 helps your partner collect all the data they need to complete “Form 1099, Miscellaneous Income” during tax season.

Similar to W-2, it tells the IRS how many payments they made to your company and helps them process their returns for the tax year.

Who needs to fill out a W-9?

Your client will ask you to fill in a W-9 if you have billed them for over $600 in the previous year as a self-employed person or business entity.

Any other following incorporated and unincorporated business structures can be asked to complete this tax form:

- Sole proprietorships (e.g., freelancers and independent contractors)

- Limited Liability Companies (LLCs)

- Disregarded entities such as general partnership

- C-Corporations

- S-Corporations

- Trusts/Estates

Can I refuse to fill out a W9?

Yes, you can refuse to fill out a W-9 tax form. That’s your right.

The contracting party may, however, refuse to do business with you. Another issue with refusing to complete a W-9 is that your customer or payer might take “backup withholding” out of your payment.

Backup withholding is applicable when the vendor fails to supply a valid tax ID number. The payer (customer) then has to charge a 24% withholding fee on your behalf and wire it to the Internal Revenue Service.

Providing the customer with a completed and accurate form W-9 before beginning work can easily prevent this.

Do you have to pay taxes on W9?

No tax is due upon W-9 submission to the customer. It’s not a tax return.

They just use this information to complete Form 1099-MISC and report the losses (payments made to you). But, since you’re a W-9/1099 contractor for that business, you’re responsible for paying applicable taxes on your income.

For LLCs, tax obligations vary depending on the elected federal tax classification. This means you either have to make self-employment tax payments or withhold employment taxes from your salary (received via the company). And pay all income taxes due on profits from your small business.

How to fill out a W-9 for an LLC step by step

Filling out a W-9 for the first time can feel overwhelming. But after several times, you’ll learn to fill it on auto-pilot.

We break things down below.

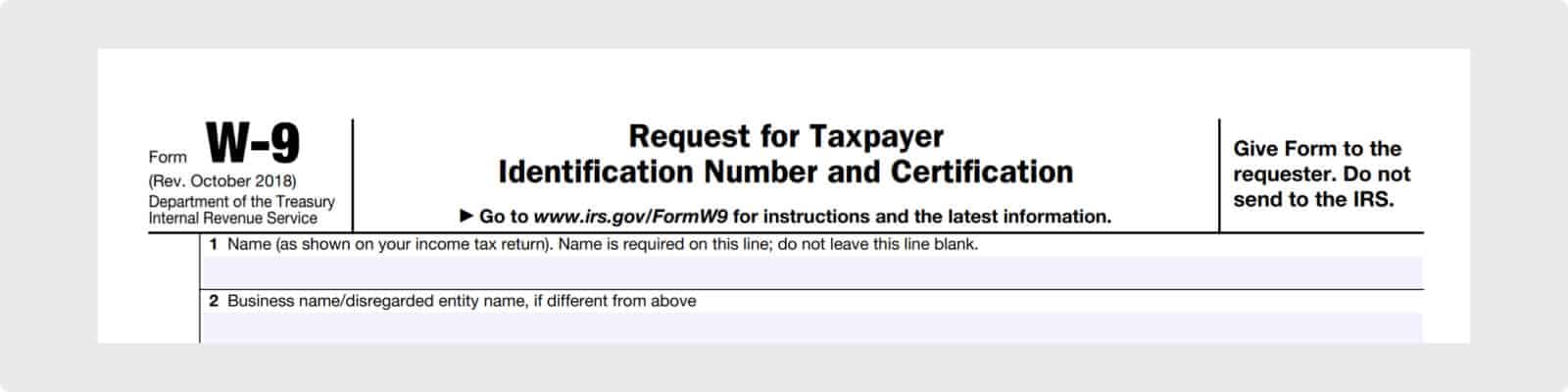

1. List your company details

A big chunk of information you need to provide on Form W-9 are basic company details.

Line 1 asks for a name.

If the business is a single-member LLC (or disregarded entity for tax purposes), you must put your name on the first line and your LLC name or DBA name on Line 2.

For example, if you’re the only owner of Tom Smith Plumbing LLC, you would write “Tom Smith Plumbing LLC” on the second line and then put your full legal name, Tom Alexander Smith, on the first line.

If you’re a multi-member LLC, reporting taxes as a partnership, S-corporation, or C-corporation, put your business name on Line 1.

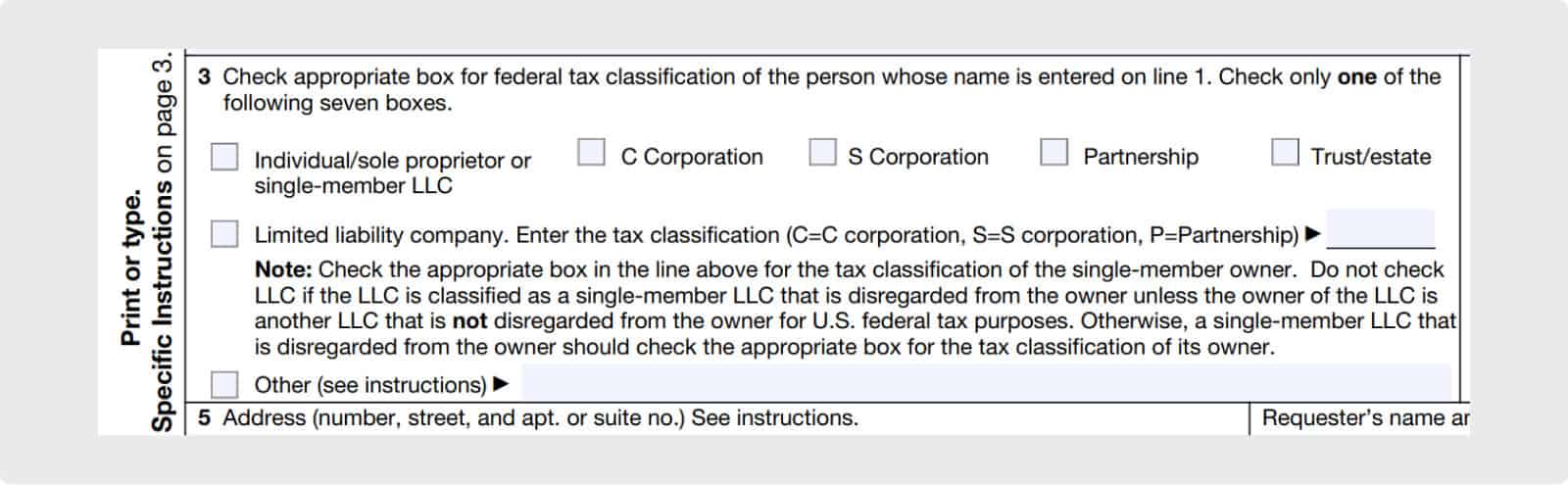

Line 3 prompts you to tick the box about your tax class.

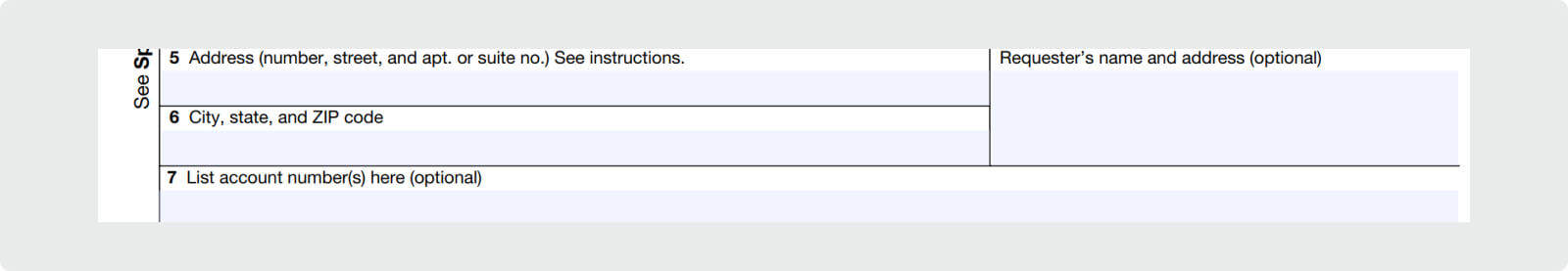

On Lines 5 & 6, list your business address, city, state, and zip code.

2. Select the correct tax classification

To ensure you check the appropriate box for Line 3, please review the different LLC tax classifications.

To recap:

- A sole proprietorship is an unincorporated business structure used by freelancers and independent contractors.

- Single-member LLCs, by default, are taxed as sole proprietors.

- Multi-member LLCs are taxed as a Partnership by default.

- But you can elect S-Corp or C-Corp status for federal tax purposes. This election doesn’t make your legal entity a corporation – it just changes how you report taxes.

To ensure line 3 is completed correctly:

- Sole proprietorships should select the “Individual/sole proprietor” or “single-member LLC” box.

- Single-Member Limited Liability Companies that have not elected to be taxed as an S-Corporation should select the “Individual/sole proprietorship or single-member LLC” box.

- Single-Member LLCs elected to be taxed as an S-Corporation should select the “Limited Liability Company” box and then write “S” in the empty line to indicate they are taxed as an S-Corporation.

- Multi-member LLCs should select the “Limited Liability Company” box and then indicate how they are taxed for tax purposes by either writing an S (S-Corporation), C (C-Corporation), or P (Partnership) in the empty line.

- C-Corporations, S-Corporations, Partnerships, and Trusts should select the appropriate box on Line 3

Line 4 should only be filled out if your business is a special type of Corporation, a Federal or State Government entity, Securities Dealer, Real Estate Investment Trust (REIT), among others. For a complete list, please see page 3 of the instructions to Form W-9.

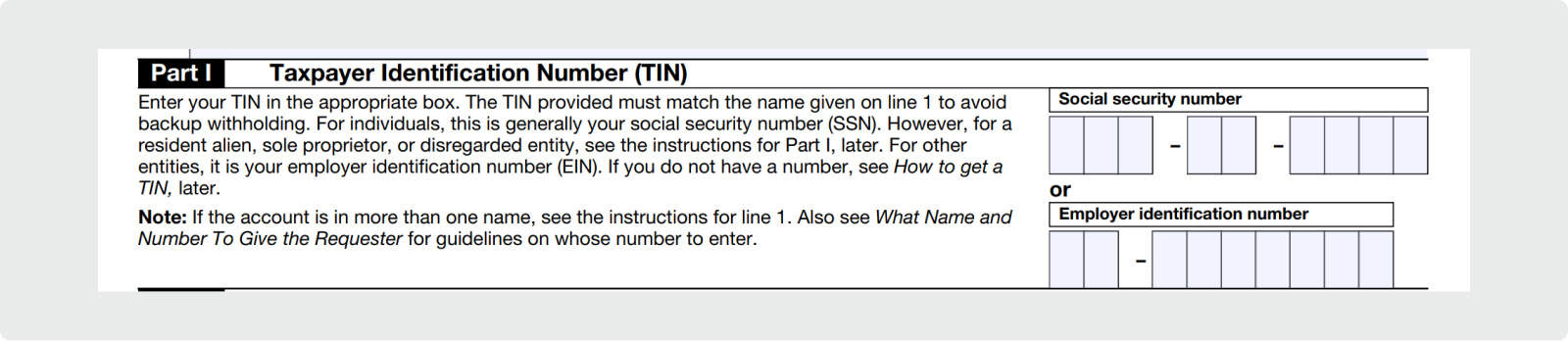

3. Add your SSN or EIN

Once you’re done with the intro, you have to complete Part 1, asking for your Taxpayer Identification Number (TIN).

Your Taxpayer Identification Number is either your:

- Social Security Number (SSN)

- Or Employer Identification Number (EIN)

If you’re a single-member LLC that has not elected S-Corp or C-Corp status, use your SSN or EIN if you have one.

If the single-member LLC has made an election to be taxed as a different business entity type, use that entity’s EIN.

If you’re a resident alien rather than a U.S. Citizen, use your Individual Taxpayer Identification Number (ITIN).

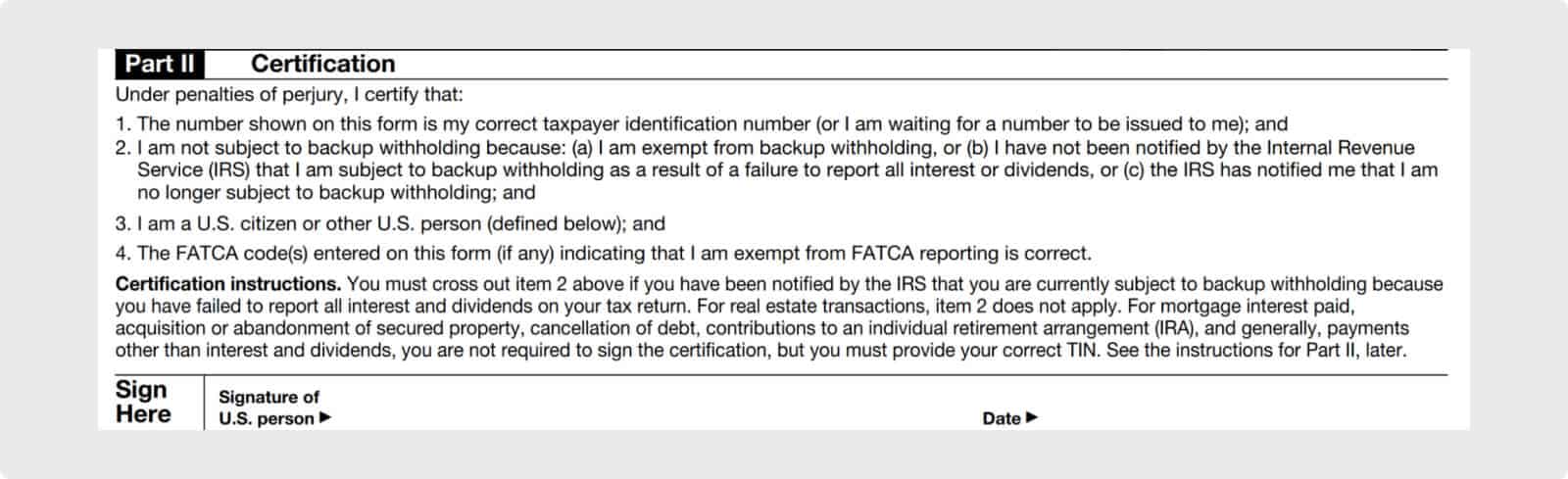

After completing Part I, the final step is to sign the W-9 in Part II as shown below:

Once Form W-9 has been completed, you should send it to your client or payor and not to the IRS.

That’s it – information returns are no biggie!