When starting a new business, most entrepreneurs choose the sole proprietorship status first.

Then as your business grows to a new level, you may consider incorporation.

Getting established as a Limited Liability Company (LLC) is a common next step. This business structure comes with the flexibility of a sole proprietorship while offering additional tax advantages and better personal liability protection.

How to change from a sole proprietorship to LLC: step-by-step

Before we dive into the details, let’s clarify some terms.

The sole proprietorship is a business structure type and a federal tax class. An LLC is a business structure that can elect several tax classifications.

All single-member LLCs continue reporting tax as a sole proprietorship by default even though your company remains a separate business entity. Multi-member LLCs report taxes as partnerships. Either can also elect to be taxed as an S-corporation.

It’s called “pass-through taxation” — your LLC is disregarded for federal tax purposes. Instead, all business profits “pass-through” to your personal tax returns.

Now to switch from an unincorporated status of a sole proprietor to an incorporated business structure (LLC), you’ll have to complete several steps.

No matter where your company is located in the United States, LLC formation is a relatively uniform process:

Table of contents

- Step 1: Select a business name for your LLC

- Step 2: Choose a registered agent

- Step 3: Prepare and file Articles of Organization

- Step 4: Open a business bank account

- Step 5: Create an Operating Agreement

- Step 6: Register your LLC for tax purposes

- Conclusion

Here's a short video explaining the process of changing the sole proprietorship to LLC.

1. Select a business name for your LLC

When converting to an LLC, the first thing you’ll have to do is select a legal business name. This process is similar to registering a DBA (doing business as) name as a sole proprietor.

You’d have to come up with a brandable business name. Then double-check its availability using your local Secretary of State's online registered business database.

If another company is already using the same or similar LLC name, you'll need to come up with another moniker to avoid copyright infringements.

Also, your LLC must have one of the following abbreviations:

- LLC

- L.L.C.

- Liability Co.

- Limited Liability Company

States also have rules around naming. For example, you can use profanity, misleading descriptors like “corporation” or “corp.” or imply an association with governmental entities.

2. Choose a registered agent

Registered agents are private individuals or service providers appointed to receive legal documents on your company's behalf. Some of the documents they receive include:

- Tax documents

- Service of process

- Legal demands

- Compliance-related paperwork

- Government correspondence

Every state requires LLCs to designate a registered agent. Their name, addresses, and contact information will be listed on the company formation documents.

You can hire a professional service provider, handle this duty yourself, or appoint an employee. But in either case, you must ensure that your agent meets all the state requirements. Typically, this includes being of legal age (18+), having a local street address, and being available during standard business hours.

3. Prepare and file Articles of Organization (or Certificate of Organization)

To form a limited liability company, you must submit an Articles of Organization (Certificate of Organization in some other states) form with a local Secretary of State. This document constitutes the legal foundation for your LLC.

The Articles of Organization form include the following information:

- Company name and address

- Purpose of the LLC formation

- Contact information of the chosen registered agent

- LLC management structure

Every state charges a fee for forming an LLC. LLC filing fees vary between states. Plus, the costs can be significantly higher for foreign LLCs — businesses operating outside of their home state — versus domestic companies with most operations located in the state where they first incorporate.

4. Open a business bank account

Unlike sole proprietors, LLCs can’t commingle personal and business funds. In fact, doing so can result in a loss of all personal liability protections this business structure offers.

So get yourself set up with a business bank account once your formation documents get approved. Most banks have competitive rates and offer no-fee current accounts for small business owners. Though, you’d probably have to pay extra for a debit or credit card.

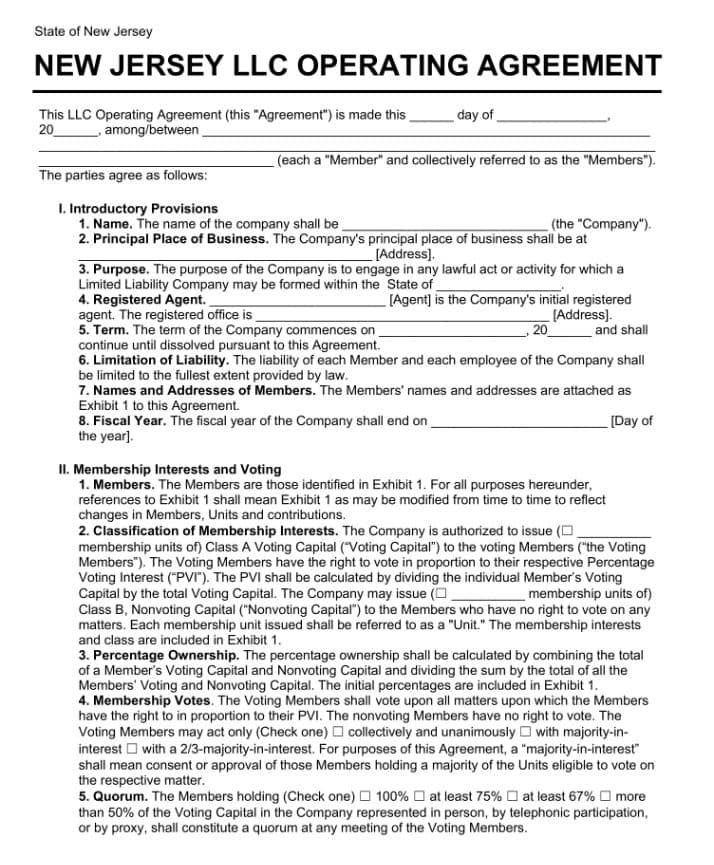

5. Create an Operating Agreement

An LLC operating agreement is a legal document that sets forth the rules and regulations all members will abide by regarding company management, financials, and organizational changes. So that in case any disputes arise, you could settle them using this document.

Creating an operating agreement optional step for most single-member LLCs formed in all states except California, Delaware, Missouri, and New York. These four states require all companies to keep a copy of an operating agreement on record.

6. Register your LLC for tax purposes

As mentioned earlier, limited liability companies are viewed as “pass-through entities” by the IRS. It means two things for you.

As a single-member LLC, you'll keep reporting as a sole proprietor on Schedule C. Though, if you intend to have employees, you will need to obtain a new employer identification number (EIN). An EIN is also mandatory for multi-member LLCs who will report federal taxes as a partnership.

But your LLC may also become subject to state taxes. Unless you've registered earlier, you’ll have to receive a state sales tax ID (when applicable). Also, in some states, LLCs must pay minimum annual franchise taxes. This triggers registration with the local authorities, such as the Department of Revenue.

Finally, companies with full-time employees must pay state and federal employment taxes. Plus, make applicable social security contributions.

Learn more about how to file taxes for an LLC.

Conclusion

In most cases, switching from a sole proprietorship to an LLC is as simple as the above six steps.

Yet, some states have additional requirements, such as the need to obtain a general business license or publish a public notice about your company formation.

At any rate, you get ample benefits by switching from a sole proprietorship to an LLC, such as extra personal assets from business-related liabilities. Company formation also provides extra capital — either contributed by new members or extended by banks.

Ready to get started? Check out our state-specific company formation guides.