When starting a business, you have two options — build operations from the ground up or buy an existing company (LLC for example).

The idea of being a startup appears to many entrepreneurs. But it’s not the easiest path to business ownership. You’d have to do a lot of prep work — from registering as a legal business structure to getting all the necessary permits and opening doors for customers.

So what if you’re eying an existing business that’s already doing what you want to do? You can make an offer to the owner. And if they accept, buy their LLC and the operation it runs.

What is an LLC? Definition for buyers

A limited liability company (LLC) is a legal entity that provides owners with personal asset protection and limited liability on the actions done by other LLC members or company employees.

Affordable to set up and easy to maintain, LLCs are a common business structure large and small business owners choose.

The added benefit of an LLC is flexible taxation. Business owners can elect to report federal taxes as:

- Sole proprietorship

- Partnership

- S-corp

- Or C-corp (rarely)

The first two tax classifications are assigned by default to single-member LLCs and multi-member LLCs accordingly. S-corp and C-corp are elected tax statuses. You can ask the IRS to tax you this way if you meet several eligibility criteria.

An LLC is a strong contender for small business owners who wish to minimize their personal liability but don’t want to carry the heavy burden of corporate income taxes.

How to get full LLC ownership post-purchase step-by-step

Let’s say you’ve found your LLC for purchase. Due diligence went smoothly, and you feel ready to close the deal. Here are three steps you have to complete to get the deed done.

1. Ask the seller to provide an operating agreement and Articles of Organization

An LLC operating agreement is an internal company document that outlines the LLC’s ownership structure and operational policies.

Typically, an operating agreement also states which procedures must be completed by the current LLC owner(s) to complete a business sale. Request a copy to review what the company rules are saying. So if there’s any clause that conflicts with a sale of the business, an operating agreement will have to be amended first. That delays the transaction while the agreement is being revised.

The LLC Articles of Organization (also called Certificate of Formation) is a state-issued document that verifies LLC registration and existence. It includes the LLC name, owners, and registered agent information.

The articles also serve as confirmation from the state of incorporation that the LLC is recognized as a compliant business entity. The seller has no good reason to refuse to provide a copy.

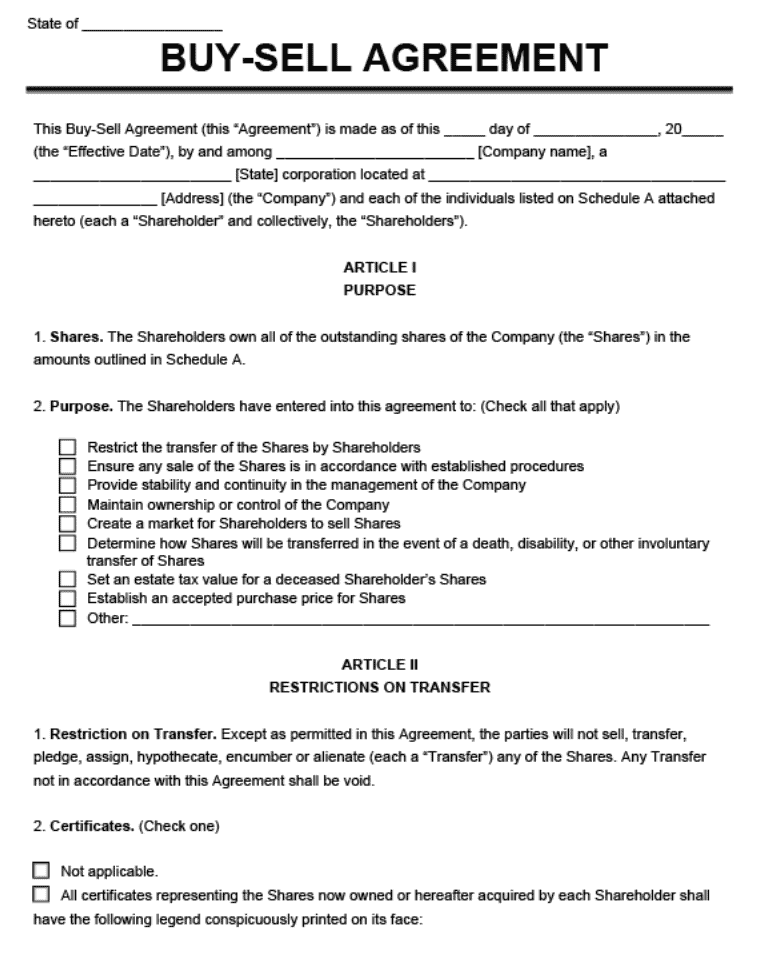

2. Create a buy-sell agreement

A buy-sell agreement, also referred to as a purchase agreement, is a legally binding document where the buyer and seller agree to sell the business (or a specific member’s interest). It outlines the terms of the sale, the purchase price, and a timeline of when the sale will be completed.

The buy-sell provisions are either outlined as part of the operating agreement or as a separate agreement. Without these provisions, a deal could be disputed, delayed, or even terminated if the LLC owners disagree.

If everyone’s on board, make sure that your buy/sell agreement includes the following:

- Whether the LLC is being sold in its entirety or in part

- Specific assets included in the sale

- Consensus of existing business owners to sell a stake in the business

- Special clauses that need to be disclosed about the sale

3. Ensure the sale is recorded with the state business registration agency

Once you’ve purchased the LLC, you’ll need to notify federal and state entities about the change of ownership. It includes the IRS, your Secretary of State for business licenses and permits, plus state tax authorities. If the seller’s registered agent is a friend or family member, you’ll need to update this information too. Also, don’t forget to update the details on the corporate bank accounts (if these were part of the purchase deal).

Why buy a limited liability company: pros and cons

Forming an LLC is pretty simple. But many business owners choose to buy an LLC instead to either skip on admin formalities or access other benefits.

Pros of buying an existing LLC

Good credit history. You can pick an LLC with a good credit history. Buying a company with a stellar credit score is excellent for entrepreneurs operating in high-dollar industries like real estate or manufacturing, for example. Since about half of new businesses fail within five years, lenders consider them higher risk. So buying a company with good history can give you access to a bigger credit line and more favorable lending terms.

Fewer administrative tasks and red tape. Buying an LLC means no run-ins with a local Secretary of State regarding extended articles of organization filings processing times or other admin formalities. Legally, you’re all set up. But to stay compliant, you’ll have to file an annual report and pay applicable filing fees. Other than that, there’s not much paperwork required to manage your new LLC.

Profitable business. You don’t have to figure out how to make money — the primary sales funnel is already in place. So you can take it from there and scale up or improve current efficiency (and profits by proxy). If you plan to grow aggressively, good business credit history will come in handy.

Tax benefits. The costs to buy an LLC can be steep. When you factor in the fees for legal advice and accountants plus the purchase price, buying an existing LLC is way more expensive than forming one. But if you can write-off your acquisition as a tax deduction to minimize your tax bill.

Brand awareness. You buy a business name some people in the community may recognize, like, and prefer over the competition. Likewise, an existing company may come with a pleasant (or not so) baggage of publicity. So be sure to verify the earlier buzz around the biz you’re about to buy.

Cons of buying an existing LLC

Need for due diligence. Purchasing an existing LLC means you accept everything about the business —the good and the bad. To negotiate the right price, you’d have to do a formal due diligence process. It’s where company receivables, debt, cash flow, and compliance are deeply analyzed. Due diligence is a step in the LLC buying process where deals often fall apart. That’s because potential buyers may review financial statements, legal documents, or public records that reveal risky things about the business that they’re not willing to deal with.

LLC ownership transfer. Finally, you’d have to ensure that all parts of the business deal are legally formalized in a buy-sell agreement. Then ask the owner to initiate ownership transfer. This process can be complex and requires the help of a corporate attorney. Meaning there are more fees involved.