When running a small business, you have to be ready for the ups and lows.

At some point, you may need assistance from other people to get your business to the next stage. This assistance may come in the form of time, money, or advisory. But what can you offer them in return if your cash flow is already tight?

An ownership stake is one common option. But before you add a business partner to your limited liability company (LLC), you must carefully consider the legal and operational implications.

But if you have already negotiated the terms of the deal and shaken hands, here’s a walkthrough of the typical steps involved in adding additional members to your LLC.

Five Steps to Add a Member to Your LLC

- Step 1: Review your operating agreement (or create one)

- Step 2: Decide on the terms of the LLC agreement

- Step 3: Vote to add an amendment to your operating agreement

- Step 4: File for an amendment to the articles of organization (if necessary)

- Step 5: Review if you need to update your tax documents

1. Review your operating agreement (or create one)

An LLC operating agreement is a contractual document that governs the internal operation and management of the company.

In most cases, it covers:

- Operational decision making

- Expansion

- Allocation of profit and loss

- Changes in ownership

Many single-member LLCs don’t have a written operating agreement (unless they operate in a state where authorities legally require an operating agreement).

If that’s your case, don’t fret. Adding a new member is an excellent opportunity to draft an operating agreement for governing your business relationship.

An LLC with multiple members will almost always have a written operating agreement. If you already have multiple members, the first task is to review the terms of the agreement related to adding new members.

These terms will dictate the procedures for adding a new member, including who among the current LLC owners is entitled to vote and what percentage of the vote of existing members is needed to add a member. Some operating agreements may require an unanimous vote. Others may require a 2/3 majority vote.

Can a married couple own an LLC?

Yes. A married couple can own an LLC. For obvious reasons, a husband and wife LLC should have a detailed operating agreement governing the rights of each member concerning the LLC.

Remember, the divorce rate in the USA is still about 50%. So it’s best to plan ahead. An LLC owned by a husband and wife is generally treated as a partnership by default.

However, where the husband and wife owners of an LLC live in a community property state and treat the LLC as a single-member LLC, the IRS will respect that treatment.

2. Decide on the terms of the LLC agreement

Adding a new member to your LLC means sharing the benefits and burdens of your business with them.

Together the members of the LLC will:

- Influence the direction of the business

- Vote on important decisions

- Receive income/profits from your company

- Share responsibility for the business obligations

An operating agreement documents the allocation of the above factors between parties.

Specifically, your document should spell out:

- Capital Contributions to the LLC

- Service contributions to the LLC

- Membership interest in the LLC

- Allocation of profit and losses

- Distributions

- Tax provisions

- Reporting responsibilities

- Identification of managers

- Access to records of the LLC

- Voting rights

- Management structure

- Admission of New Members

- Withdrawal of existing members

- Transfers of interest

- Remedies for failing to follow the operating agreement

- Procedures for how to resolve disputes between members

- Dissolution of the LLC

When you add a new LLC member, you’ll have to reach an agreement on all of the above terms and put them into writing.

How do you split ownership of an LLC?

You can change the ownership of an LLC by admitting new members or by selling part of an existing LLC member’s interest.

You can also change the ownership structure when the LLC liquidates a current member’s interest. The decision is up to you and other members.

3. Vote to add an amendment to your operating agreement

To add new members, official voting must be held both by single-member LLC and multi-member LLCs. Then the voting outcome must be recorded and kept on file.

After the voting procedure is completed, you can amend the operating agreement and file the state paperwork for adding the new member.

How does voting work in an LLC?

Voting by LLC members can be very informal — like saying who is in favor or against.

However, when important decisions are made, you should make a written resolution and have it signed by all members in favor. For example, your operating agreement may include a special procedure for authorizing specific actions such as signing a big contract, making distributions, or adding new members.

You should keep a record of the amendment and vote resolution with all LLC formation documents. In some states, it’s required. In some, it’s optional. However, it’s recommended.

Can LLC members have no voting rights?

Yes. Voting rights can be restricted to certain members of an LLC, called managers.

It’s known as a manager-managed LLC. The manager(s) can be members or third parties. They would be responsible for making the day-to-day decisions of running your business entity.

Voting rights can also be reserved to only certain members for critical decisions such as whether to wind down the business. Again, your operating agreement should have all of the above details spelled out.

4. File for an amendment to the articles of organization (if necessary)

Depending on the LLC formation state, you may be required to file an amendment to the LLC’s articles of organization with local authorities. Check the state law requirements with a local authority.

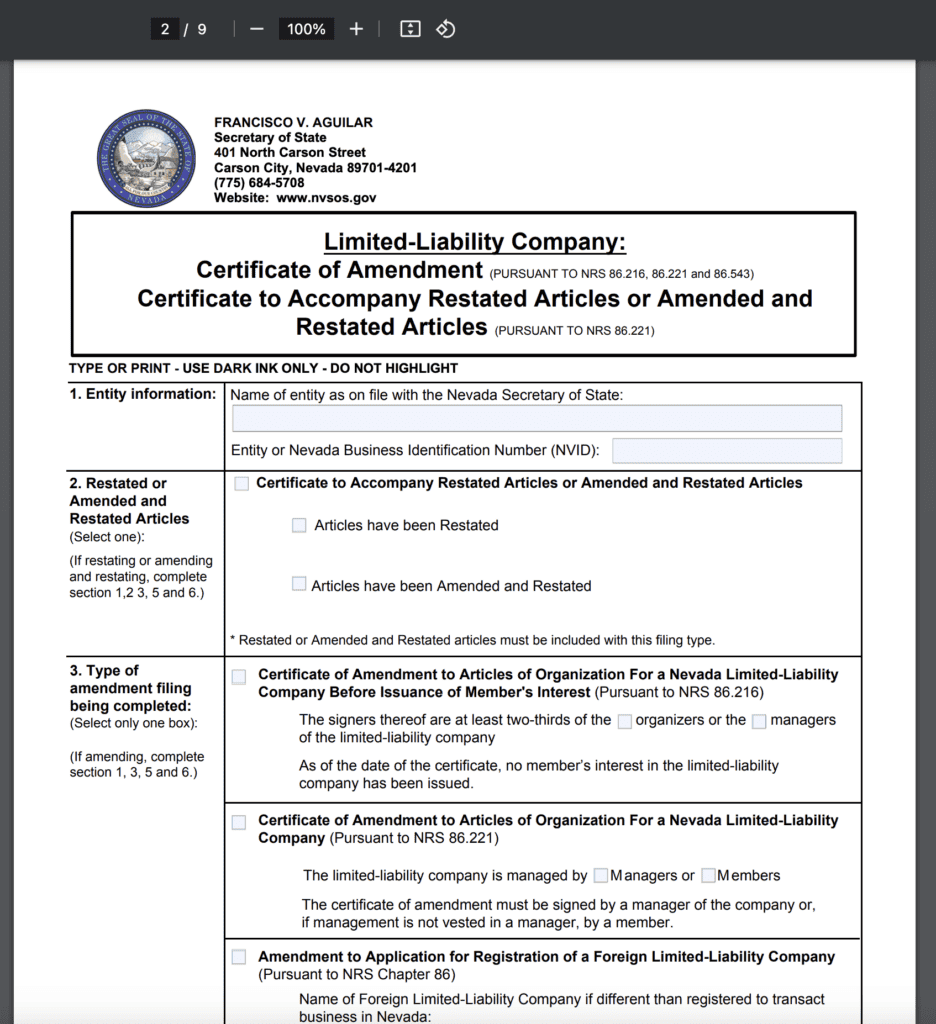

For example, in Nevada, you’re required to file a form called Amendment to Articles of Organization.

You only need to file this document if there were any changes to the information contained in the original articles of the organization.

You don’t have to file this document for all amendments to the LLC operating agreement.

For example, you may file this document if:

- For a name change to the LLC

- The new member(s) will also be the manager(s) of the LLC

- The public contact information has changed

- Your registered agent has changed

In Nevada, you don’t have to file the amendment if you’re only adding a new member.

If you use the amendment form, the filing fee is $175. It takes approximately one week to process the amendment. You can request an expedited service with fees ranging from $125 for 24-hour service to $1,000 for one-hour service.

You may also report the changes to the Secretary of State on the annual report.

5. Review if you need to update your tax documents

Adding a member to your LLC has several tax implications.

Tax status changes

If you were a single-member LLC, your tax classification would change after adding a new member. For federal tax purposes, your LLC will now be treated as a partnership (not a sole proprietorship).

As a sole proprietor, the business income up to the time you add a new member will be reported on your personal tax return on Schedule C. After that, you’ll report the income on a partnership tax return on Schedule E.

Alternatively, you may elect to be treated as a C-Corporation or an S-Corporation. Whether to make that election will depend heavily on the type of business you operate and how you wish to distribute profits. Read more about tax classification elections for LLCs.

Transaction reporting

If you’re adding a new member by selling a portion of your LLC interest, you’ll need to report this transaction on your individual tax return. Further, suppose the new member receives an “equity” interest in the LLC. In that case, they may also have to report this fact as a taxable transaction for the value of the interest received.

You can check the IRS bulletin for more information or consult with a tax specialist or CPA.

Does a single-member LLC need a new EIN when becoming a multi-member LLC?

It depends.

Suppose your single-member LLC has already been assigned an employer identification number (EIN). In that case, you don’t need to request a new number. If the EIN was given to you individually, the LLC does need a new EIN.

FAQs about adding LLC members

Here are some frequently asked questions regarding adding new members to an LLC.

Disclaimer: This material is provided for informational purposes only. The provision of this material does not create an attorney-client relationship between Paul Donovan and/or Donovan Legal PLLC and the reader, and does not constitute legal advice. Legal advice must be tailored to the specific circumstances of each case, and the contents of this article are not a substitute for legal counsel. Do not take action in reliance on the contents of this material without seeking the advice of counsel.