Flexible taxation is one of the main reasons for creating a limited liability company (LLC).

By default, the Internal Revenue Service (IRS) classifies an LLC as a “disregarded entity.” LLC owners are not subject to corporate income tax.

Instead, they report business profits on their personal tax returns and pay respective personal income and self-employment taxes. That makes tax compliance easier. On the other side, you have the freedom to choose an alternative tax classification such as S-corporation on C-corporation. It can give you some tax advantages too.

But first, you must get the tax ID number of your LLC.

(Or, as you’ll learn in this post — several types of IDs).

When does your LLC need a tax ID number?

Your LLC will need to apply for a federal tax ID — federal employer identification number (EIN) — if you have several members and/or plan to hire employees.

If you run a single-member LLC without employees, you can use your social security number (aka your Taxpayer Identification Number – TIN for tax identification purposes.

On a state level, you may be required to get a local tax ID number (different from EIN/TIN) if your company needs to collect sales tax and/or pay minimal annual franchise taxes. Read more about filing federal and state taxes for an LLC.

What is a federal employer identification number (EIN)?

Employer identification number (EIN), also called Federal Tax Identification Number (FEIN), is a unique nine-digit number issued by the Internal Revenue Service to identify your business for tax purposes. Think of it as a corporate alternative to your personal SSN.

Even though many people use these terms interchangeably, there is a technical difference between an EIN and a tax ID number. Both federal and state governments can issue a tax ID number. But only the IRS (a federal body) can issue an EIN.

You can apply for an Employer Identification Number online. Below is a step-by-step walkthrough.

How to Apply for a Tax ID Number for an LLC

The tax ID application process varies at federal and state levels.

LLCs may be required to file the following taxes at the state level:

- Corporate and income taxes: Corporate tax is levied on business profits if your LLC files federal taxes as a C-corporation. State personal income tax rates apply to business profits you claim as personal income.

- Sales tax applies to certain groups of products and services sold in the state. The sales tax rate can be either the same across the state. Or consists of state-wide rate + city/county level surcharges.

- Excise tax is levied on certain goods at the manufacturing stage rather than during the sales. So if you want to run a manufacturing business, it's advisable to check with your state to find out whether you'll need to file excise tax.

- State unemployment tax: SUT taxes are taxes levied on certain businesses to pay benefits to eligible unemployed workers.

- Gross receipts tax: Refers to the tax levied on a business's gross income regardless of its source, without deducting any operational costs or expenses.

On a federal level, LLCs owners report taxes either on:

- Schedule C as sole proprietors

- Schedule K-1 as partnerships

- Other schedules as S-corp or C-corp

For both types of reporting, you’ll need a separate set of tax IDs.

Federal tax ID application for an LLC

To apply for a federal tax ID number (EIN), follow these steps:

- Head over to the IRS.gov website

- Read the requirements for submitting your application

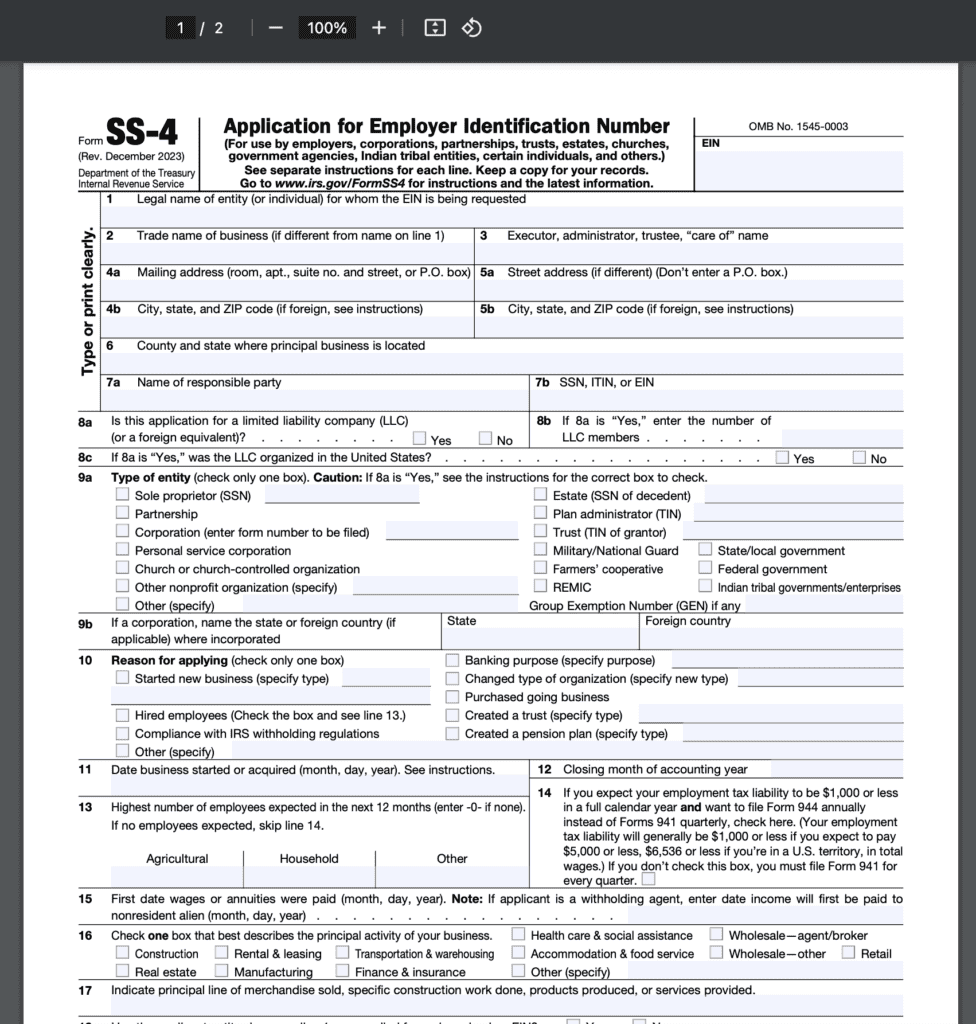

- Fill out IRS Form SS-4 (online)

If your application is approved, the IRS will email you a new EIN in several minutes. Or they will send it to the provided fax number within four business days. You can also send the Form SS-4 by mail, but processing times are 4-5 weeks.

State tax ID application for an LLC

At the state level, the local revenue department usually handles tax ID registrations.

Similar to the IRS, most departments ask you to complete a basic form online to get a local ID number. Registrations are mostly free.

For instance, to get a state tax ID in Ohio, you need to:

- Go to the Ohio Business Gateway portal, operated by local tax service

- Read the application instructions

- Complete and submit your registration

Many states have a similar state tax ID registration process with some exceptions.

States like Washington or Delaware pair state tax ID applications with general business license applications. So you need to provide a bit more information.

Also, the need to register for a state tax ID (and your subsequent tax obligations) depends on your business location.

Using Washington as an example, Steilacoom, a city in Pierce County, doesn't charge Local Business and Occupation Tax, also known as B&O taxes.

In contrast, if your business is located in Seattle, King County, you'll need to pay B&O taxes. Usually, you can apply for a state tax ID via a state-wide business portal or the Department of Revenue website. But some cities may require you to apply through a local website.

It doesn't necessarily mean the state won't process your application, but it can be confusing. For instance, if your small business is based in Everett, Seattle, Bellevue, or Tacoma, Washington, you can apply via the FileLocal website or the WA Department of Revenue website.

Regardless of the filing process, it might take up to 3 business days to process your application.

Takeaways

- A Tax ID is your unique identifier for federal and state tax purposes.

- An EIN is only issued by the federal government, while a tax ID can be issued by the federal and state governments.

- You can apply for an EIN through the IRS website for federal taxes and a state tax ID number through the state government website.