Starting a limited liability company (LLC) in Texas for your business is one of the fastest and easiest ways to get your operations off the ground.

An LLC is a cost-effective structure for small to medium-sized companies. It provides the advantages and protections of corporations with less hassle. And LLCs avoid double taxation through a concept called pass-through taxation.

Whether you’re starting a new business or already running a side-business, opening a Texas LLC is simple.

We’ll walk you through the process from start to finish.

Ready? Let's get started!

Steps to Create an LLC in Texas:

- Step 1: Choose a name for your new LLC

- Step 2: Appoint a registered agent

- Step 3: File the Texas LLC Certificate of Formation

- Step 4: Get certified copies of your LLC formation documents

- Step 5: Create an LLC operating agreement

- Step 6: Get an EIN (Employer Identification Number) from the IRS

- Costs to start an LLC in Texas

- Further steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Choose a name for your new LLC

Choosing a name for your LLC is the first step of registering a business.

The name you choose should be recognizable by your clients, distinguishable from other businesses, and compatible with Texas’s state laws for business naming.

When choosing your LLC’s name, keep the following official requirements in mind:

- Must contain the phrase “limited liability company” or “limited company” or any abbreviation of these phrases like LLC, L.L.C., LC, Limited, Ltd.

- Avoid choosing a name that can be confused with a governmental entity (e.g., Secret Service, IRS, Homeland Security, etc.)

- Obtain permission to use certain restricted words (e.g., Olympic requires approval from the U.S. Olympic Committee and using college or university requires approval from the Texas Higher Education Coordinating Board)

- Foreign words won’t be translated (e.g., Casa Blanca Productions won’t be translated to White House Productions)

- Avoid words that can be deemed grossly offensive

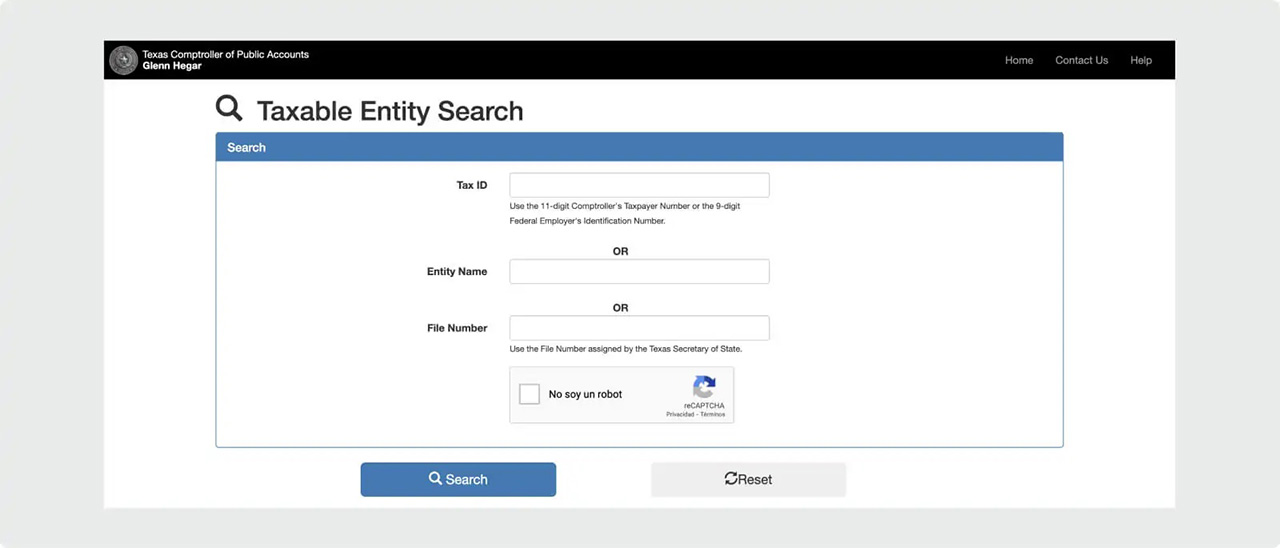

Next, check if the selected name is available. You can do so by running a name search with the Texas Comptroller:

If your business name is available, you can reserve it for up to 120 days while you finish the other steps to form your LLC. You’ll need to file an application and pay a $40 fee.

This is optional however.

Finally, check if the domain name is available. Be sure to verify that your business name is also available as a domain name. Even if you don’t plan to create a website right away, you may want to snatch it anyway to prevent others from buying it.

If you want to use an alternate name, file Texas Form 503, Assumed Name Certificate, with both the Secretary of State and the county clerk where your LLC is located.

Step 2: Appoint a registered agent

Texas requires you to have a registered agent for your LLC.

In Texas, a registered agent can be:

- A Texas resident, or

- A business licensed to transact business in Texas with a physical street address (P.O. box addresses aren’t allowed).

You can act as a registered agent yourself, appoint an employee, or someone else in your company.

If you don't want to be your own registered agent, you can hire one for about $89-$175/year in Texas.

Regardless of who you appoint as your agent, you must get written authorization to show they consent to the decision.

|

Registered agent: DIY vs. hire a registered agent service |

||

|

Pros |

Cons |

|

|

Self |

|

|

|

Hiring company |

|

|

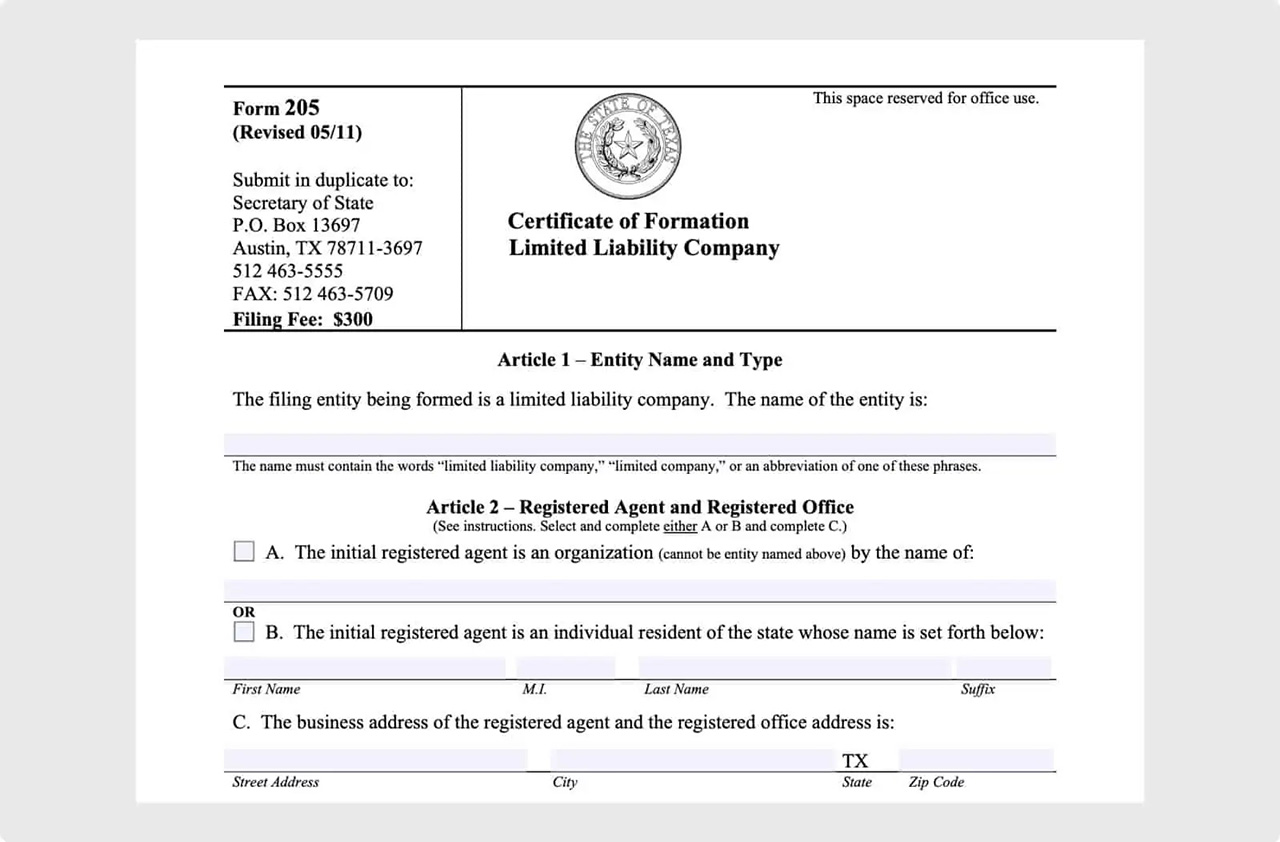

Step 3: File the Texas LLC Certificate of Formation

Filing the Certificate of Formation is what makes your LLC official.

This application tells the Texas Secretary of State the necessary details about your company, including entity name, physical address, registered agent, members/owners and addresses, and the company's general purpose.

To start the LLC filing process, download and fill in Form 205, Certificate of Formation Limited Liability Company.

Then mail it to the Secretary of State in Austin and pay a $300 state fee.

You also have the option to file the Certificate online via the SOSDirect website.

Once the Secretary of State receives your Certificate of Formation, it can take as little as three or four business days to process it if you file electronically. But if you send the documents by mail, the LLC registration process can take up to four to five weeks.

After your Certificate has been approved, you’ll receive a stamped copy, which means you’re officially allowed to do business in Texas. Congratulations!

Step 4: Get certified copies of your LLC formation documents

Although you'll receive a stamped approved copy of your Certification of Formation, you should also get a certified stamped copy for your business records. You may need to provide certified copies to open a business bank account or apply for business credit.

Certified document fees start at $15 per document.

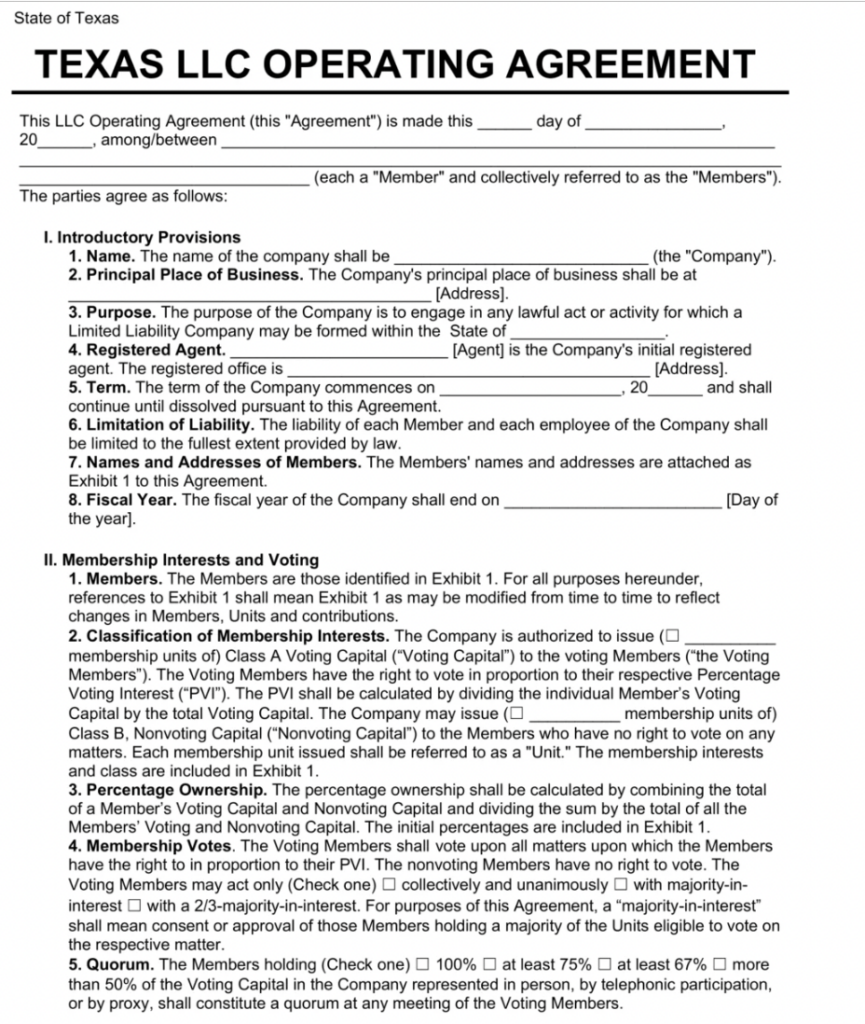

Step 5: Create an LLC operating agreement

Although Texas doesn’t require your LLC to have an operating agreement, it’s a best practice to put one in place to prevent any misunderstandings among the LLC members.

LLCs use an operating agreement to outline the rules, regulations, and procedures for how the business will operate and be managed. The agreement includes details on financial and operational decision-making. Think of it as a roadmap for preventing and resolving operational issues.

A standard operating agreement will address issues such as:

- Who has decision-making power? What happens if there’s a disagreement?

- What happens if one member wants to leave the business? What happens to his stake? How can the member leave?

- What if the LLC wants to bring on another member? How will the new member’s powers differ from the original members?

- What happens when the members want to end the LLC?

If you don’t create an operating agreement for your LLC, your business will be governed by the default Texas laws, which might produce unintended consequences.

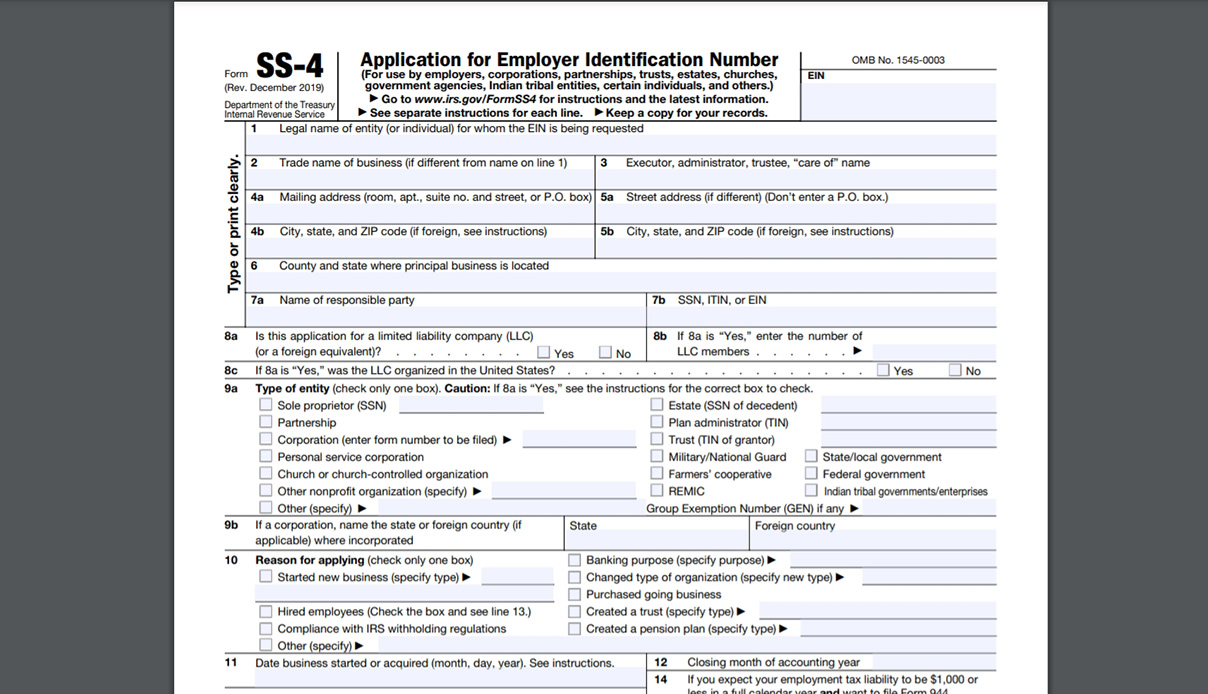

Step 6: Obtain an EIN (Employer Identification Number) from the IRS

An EIN is the identification number the IRS uses for your business. Think of it as your business’s Social Security number.

You need an EIN to report federal taxes. Also, it’s used on company tax returns and for paying employment taxes if you have employees. However, you will not need an EIN if you're the only member of your new Texas LLC. That’s because the IRS disregards the business and sees you and the business as the same taxpayer. Therefore, you’ll use your Social Security number on your LLC’s federal tax documents.

Still, getting an EIN for your single-member LLC is a good idea. You’ll need it to open a business bank account, and it can help prevent identity theft by keeping your Social Security number off your business documents.

You can apply for your number online using the IRS’s Online EIN application, and it’s free. You’ll answer a few questions about your business and instantly receive your EIN.

If you’d rather do things old school, you can use Form SS-4, Application for Employer Identification Number, and mail or fax it to the Internal Revenue Service. It’s still free, but it can take up to four weeks to get your EIN.

Costs to set up an LLC in Texas

Below is a detailed overview of all costs (mandatory and optional) you’ll face when starting a company in Texas.

- $300 for a Certificate of Formation (Form 205) for a domestic LLC.

- $750 for registration of a foreign LLC (Form 304).

- $100 – 150 /annually for professional registered agent fees (optional)

- $40 for LLC name reservation (optional)

- $15+ for certified document copies (optional)

LLCs are excluded from filing an annual report with the Secretary of State if there are no changes in structure. Instead, LLCs need to file an annual public information report to the Texas Comptroller of Public Accounts.

Further steps

Don't forget these last few steps when setting up your Texas LLC.

Once you have your EIN, you can open a business bank account. Keeping your business finances separate from your personal is critical for an LLC. Here’s why a business bank account is essential:

- Simplifies business record keeping

- Eases tax preparation

- Prevents commingling of funds (that’s a big no-no in the eyes of the IRS)

- Preserves personal liability protection

Since banks have different requirements for opening and maintaining accounts, it’s wise to call around to see who has the best options.

Tip: Consider getting a corporate credit card in your company’s name. You’ll be able to accrue rewards or cashback while keeping your business and personal finances separate.

Texas doesn’t require a general business license or permit. However, certain businesses may need a license to operate. For example, breweries will need a permit from the Texas Alcohol and Beverage Commission.

Lastly, your local city or jurisdiction may require a general or a specific permit or license. So check with your local authorities to determine if your business needs any type of license to operate.