Looking for a straightforward guide on how to start a limited liability company (LLC) in Nebraska? You’re in the right spot.

By forming a Nebraska LLC, you’ll have a legal structure to conquer your dreams. LLCs provide excellent personal liability protection while keeping your taxes down.

You’re in good company starting a business in Nebraska. Billionaires Warren Buffet and Henry Davis operate in the state. The favorable business laws and new business support provide a unique blend of opportunity and affordability.

Let’s shift into drive and start down the road to forming an LLC in Nebraska.

Steps Needed to Get an LLC in Nebraska:

- Step 1: Choose a name for your new LLC

- Step 2: Appoint a registered agent

- Step 3: Draft and File the Nebraska Certificate of Organization

- Step 4: Create an LLC operating agreement

- Step 5: Get an EIN (Employer Identification Number) from the IRS

- Costs to set up an LLC in Nebraska

- Further steps

LLC Formation Service

- Formed 1,000,000+ LLCs

- $39 formation includes registered agent service

- Fast formation & same day filing

- Exceptional customer reviews

Last updated:

Jan 2025

Last updated:

Jan 2025

Step 1: Choose a name for your new LLC

Naming is a big decision for new businesses. You want a brandable company name that reflects what you do.

Your Nebraska LLC name must also be different from other businesses. Nebraska naming requirements also say the name must end with Limited Liability Company or one of its abbreviations — L.L.C, LLC, or LC.

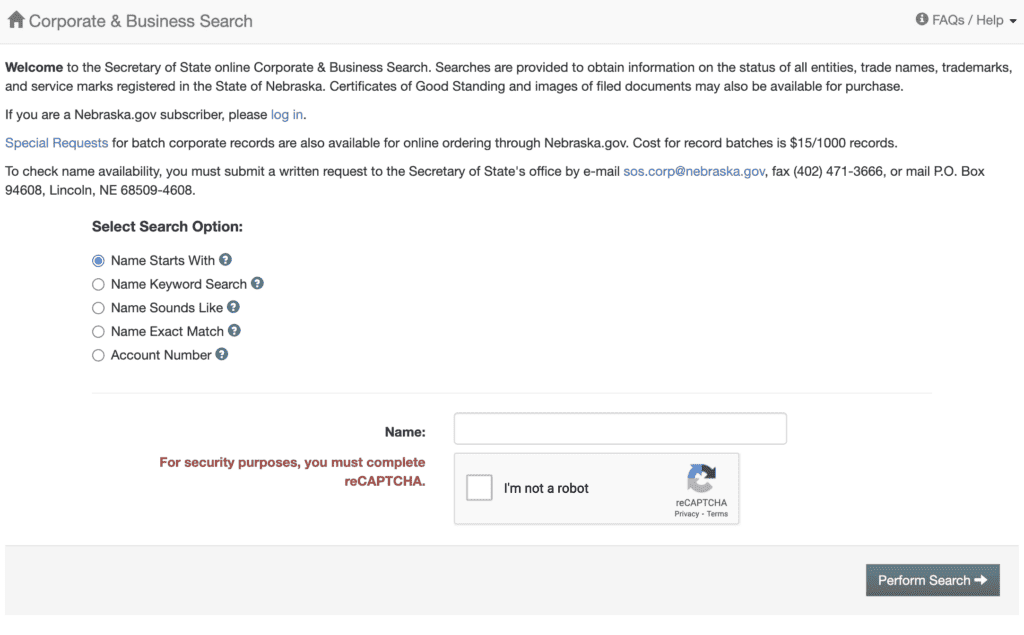

Use Nebraska’s Online Corporate & Business Search to see what’s available:

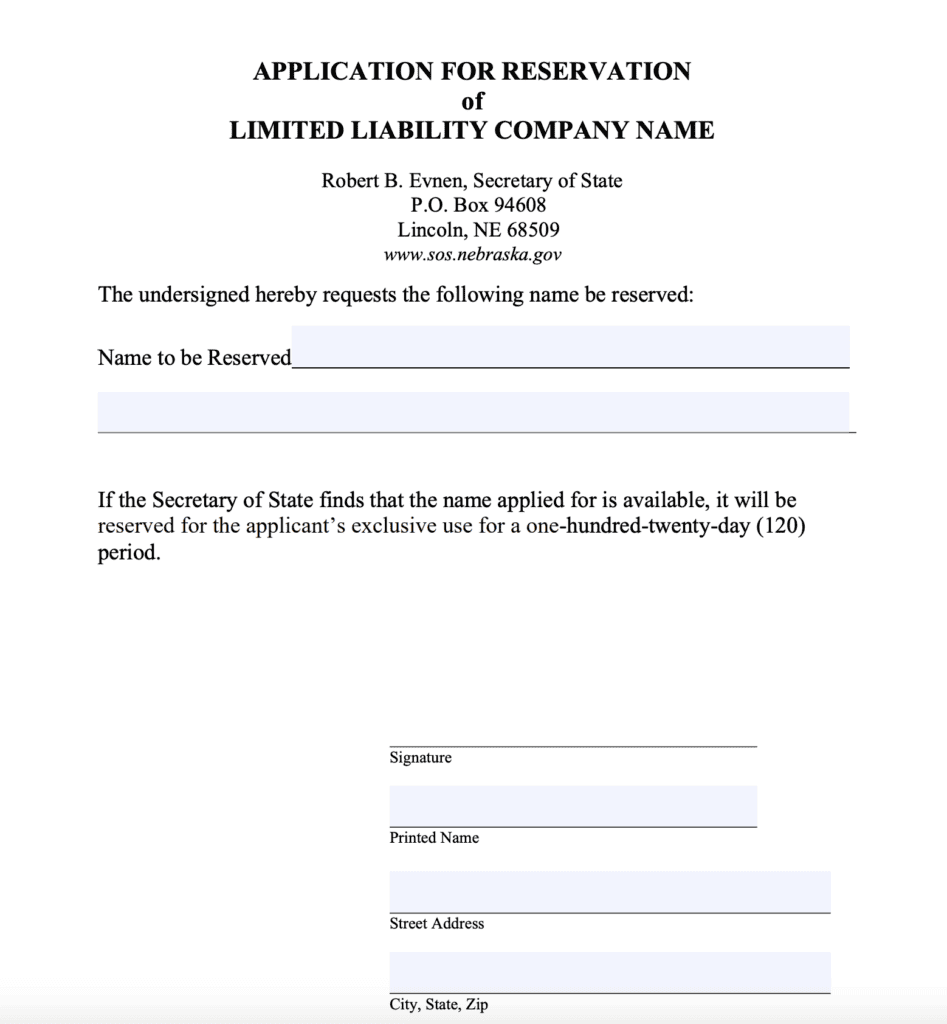

Name reservation (optional)

You can reserve a business name for 120 days. This optional step allows you to secure a name while preparing other formation documents.

To place a reservation, complete the “Application for Reservation of LLC Name” and mail it with the $15 fee to the Nebraska Secretary of State's office (Secretary of State P.O. Box 94608 Lincoln, NE 68509). Online submissions are not available.

Trade name (optional)

Similar to sole proprietorships, LLCs can do business under a trade name. This is also known as a doing-business-as (DBA) or fictitious name.

File a registration of trade name with the Secretary of State in Nebraska. There’s a $100 fee for online filings and $110 to file in person.

You’ll also need to publish a notice of the trade name in a local newspaper. And you’ll need to do this quickly. You only have 45 days to fulfill this required publication.

Step 2: Appoint a registered agent

Nebraska requires every LLC to designate a registered agent. This role serves as the main contact for your LLC. It accepts legal notices, service of process, and other official correspondence.

You can appoint an individual or an entity as your registered agent in Nebraska. Every Nebraska registered agent must:

- Be at least 18 years of age

- Have a physical address in the state (not a P.O. Box)

- Be present during regular business hours year-round

You can be your company’s registered agent. This is common with cash-strapped single-member LLCs as it reduces costs. But it comes with some negative consequences:

- Registered agents must be around to receive legal documents

- Your name and address will be in the public record

- Being served with a lawsuit in front of clients

- You’re on your own to catch all vital notices

If you don't want to be your own registered agent, you can hire one for about $99-$199/year in Nebraska. If you form an LLC with Northwest, they'll give you a free registered agent for the first year. After that, it's $125 per year.

Step 3: Draft and File the Nebraska Certificate of Organization

This is the most important step to starting an LLC. Filing the Certificate of Organization forms an LLC in Nebraska. Once processed, your new LLC entity exists.

And there is a convenient eDelivery service for online filings. To complete LLC formation, you’ll need to provide:

- Your LLC name and mailing address

- Registered agent’s name and address

- The preferred effective date for your LLC

Create and upload your Certificate of Organization as a PDF file.

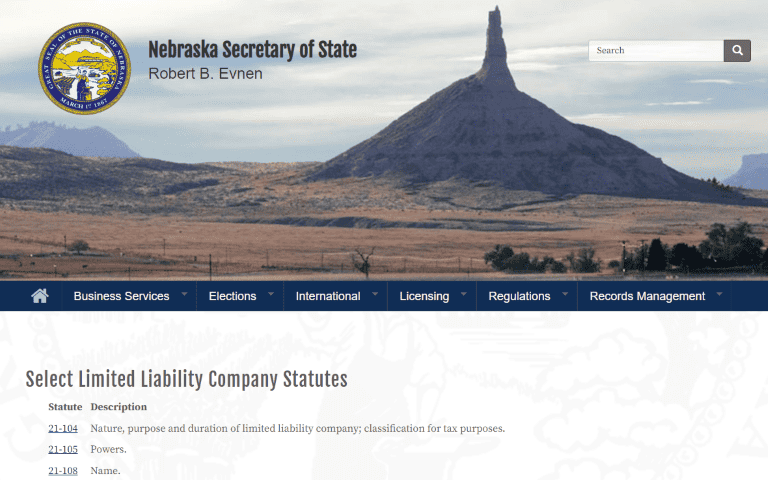

Your Certificate of Organization should comply with Nebraska statutes. Outline the nature of your business and company management structure. You may need to consult with an attorney to create one.

There is a $100 fee to file online and $110 by mail: Robert B. Evnen, Secretary of State P.O. Box 94608 Lincoln, NE 68509.

Notice of publication

Nebraska law requires a Notice of Publication for all new businesses, including LLCs. The notice must run for three straight weeks in a generally circulated newspaper in the same county.

The Notice of Publication must include:

- LLC’s name and address

- Date of establishment

- The nature of your business

Publication prices vary with costs ranging from $50 to $250. After publishing the notice, a local newspaper must provide an affidavit of publication.

You can use the Nebraska eDelivery site to upload the affidavit. Or you can mail it to the SOS with a money order or check. The filing fee is $25 online and $30 by mail.

Certificate of LLC Registration

Once your LLC is approved, request a Certificate of LLC Registration from Nebraska. Use the Corporate & Business Name Search to request it. The cost is $10.

Keep the Certificate with your company records. You may need it to open a bank account or get loans.

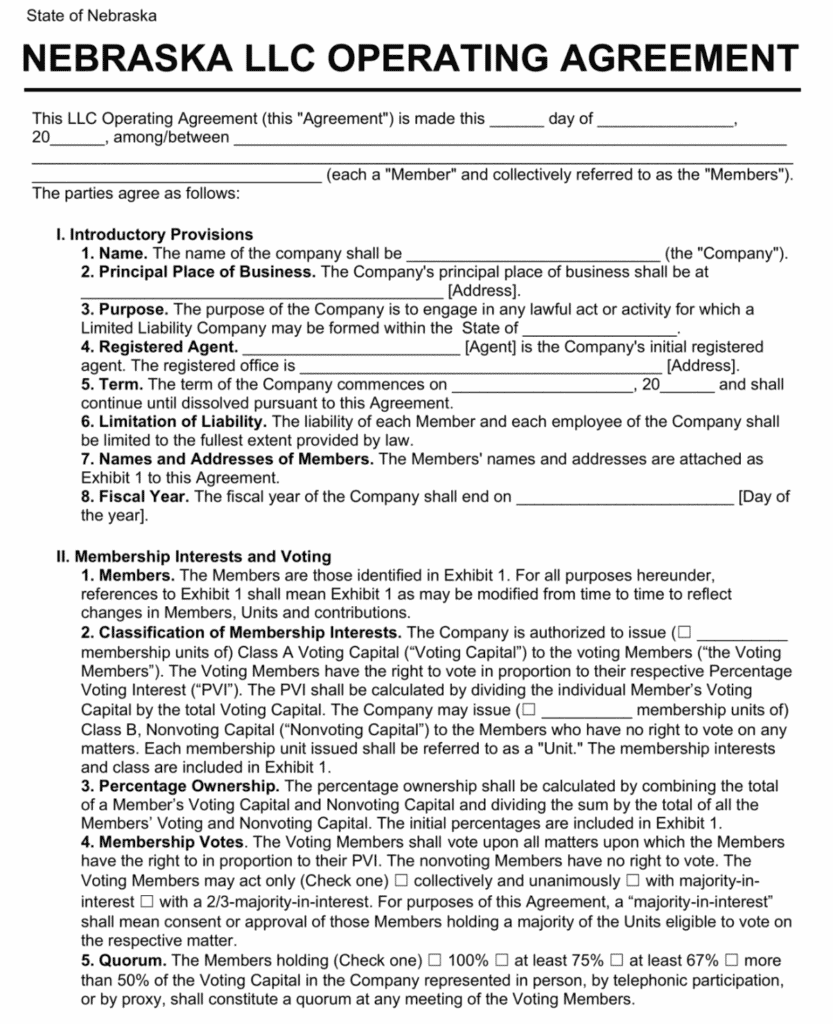

Step 4: Create an LLC operating agreement

Next, you’ll want to create an LLC operating agreement.

An operating agreement is not a legally required document for Nebraska LLCs. But it can help you:

- Define operating procedures

- Plan for adding or removing a member (owner)

- Build a reputational advantage for your new company

- Resolve legal disputes without invoking Nebraska law

- Secure funding from lenders and investors

If you don’t have an operating agreement, any disputes will fall back to Nebraska law. Rather than deal with this uncertainty, you can form a clear set of rules.

You can create your operating agreement or use an online template. Or you can hire a corporate attorney to draft one for you.

Step 5: Get an EIN (Employer Identification Number) from the IRS

Your LLC may need a federal Employer Identification Number (EIN). This nine-digit number acts like a Social Security number. It helps the IRS get you set up to pay federal taxes and hire employees.

EIN registration is mandatory for multi-member LLCs. But it’s optional for some single-member LLCs without employees.

Many LLC owners opt to get one anyway since it may be needed to open a bank account or attract investors.

Use the Internal Revenue Service (IRS) website to apply for an EIN online. It’s the quickest way. And it’s free.

Costs to set up an LLC in Nebraska

Filing for LLC registration in Nebraska costs $100 online or $110 by mail. And you must pay for the newspaper publication in Nebraska. This usually costs around $50 to $250 for the publication plus a $25/$30 state fee.

This brings the estimated total to $165 to $375.

Other potential/optional expenses that a business owner may encounter include:

- Business name reservation ($30)

- Filing for a trade name ($100 online and $110 for in-person filing)

- Hiring a registered agent (approximately $99-$199 per year)

- Hiring an attorney to help draft your Certificate of Organization or operating agreement ($1,000 or more)

LLC owners are also obligated to file a biennial report with the state of Nebraska every two years. This has a $13 fee.

Further steps

Open a business bank account

You’ll want to open a business bank account right after forming your LLC. It’s useful for accounting and tax needs. But it’s also crucial to maintaining the LLC’s legal protections

If you combine personal and business finances, courts view that as a sign that the LLC isn’t a separate entity. This means that you can be found personally liable if someone sues your LLC.

Local taxes, licenses, and permits

Federal taxes aren’t your only concern. If your Nebraska LLC needs to collect sales tax or hire employees, there are two agencies you must register with:

- Nebraska Department of Revenue: Provides a state tax ID for paying sales tax, employee tax withholding, and other state business taxes

- Department of Labor: LLCs with employees need to register for unemployment insurance tax

Every business also must get any needed licenses or permits. Check with state, city, and county agencies.

For example, the City of Omaha does not offer a general business license. But it does offer liquor licenses, building permits, and occupational licenses. The City of Lincoln has a long list of forms and permits that may apply if your LLC operates there.

Local resources

Starting a business is full of new hurdles. Nebraska has a wide range of organizations ready to ease the burden.

The Nebraska Small Business Assistance Act offers grants. And the Nebraska SBDC can connect you with knowledgeable consultants at no cost. The Nebraska Department of Economic Development is another great resource. They can help with site selection, administrative needs, and business planning.

LLC Formation Service

- Formed 1,000,000+ LLCs

- $39 formation includes registered agent service

- Fast formation & same day filing

- Exceptional customer reviews

Last updated:

Jan 2025

Last updated:

Jan 2025