Starting a Limited Liability Company (LLC) in New York State is a straightforward process that involves preparing a few key documents, meeting state requirements, and paying the necessary filing fees.

With the right information and steps, you can quickly establish your business and take advantage of the benefits an LLC provides. Since the filing process varies by state, it’s crucial to understand the specific requirements for forming an LLC in New York. By following the outlined steps, you can avoid unnecessary delays and get your business up and running smoothly.

This guide will walk you through the six essential steps to successfully form an LLC in New York.

Ready? Let's get started!

Steps to Create an LLC in New York:

- Step 1: Choose a Name for Your LLC

- Step 2: Appoint a Registered Agent (optional)

- Step 3: File and Submit the Articles of Organization

- Step 4: Complete the New York LLC Publication Process

- Step 5: Create an Operating Agreement

- Step 6: Obtain an Employer Identification Number (EIN)

- Costs to Set Up an LLC in NY

- Further Steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Choose a Name for Your LLC

The first step in forming your business is choosing a name. Ideally, it should represent your brand, and customers should recognize it easily. It can be anything you like. But whatever name you choose, ensure it conforms to New York's LLC state guidelines, including:

- It says LLC (Limited Liability Company, LLC or L.L.C. etc)

- The name must be distinguishable from other businesses registered in New York

- It doesn't imply government affiliation

- It can't be confused with any government agency or department

New York also restricts several words and phrases for specific business names, and you might need approval from other state agencies.

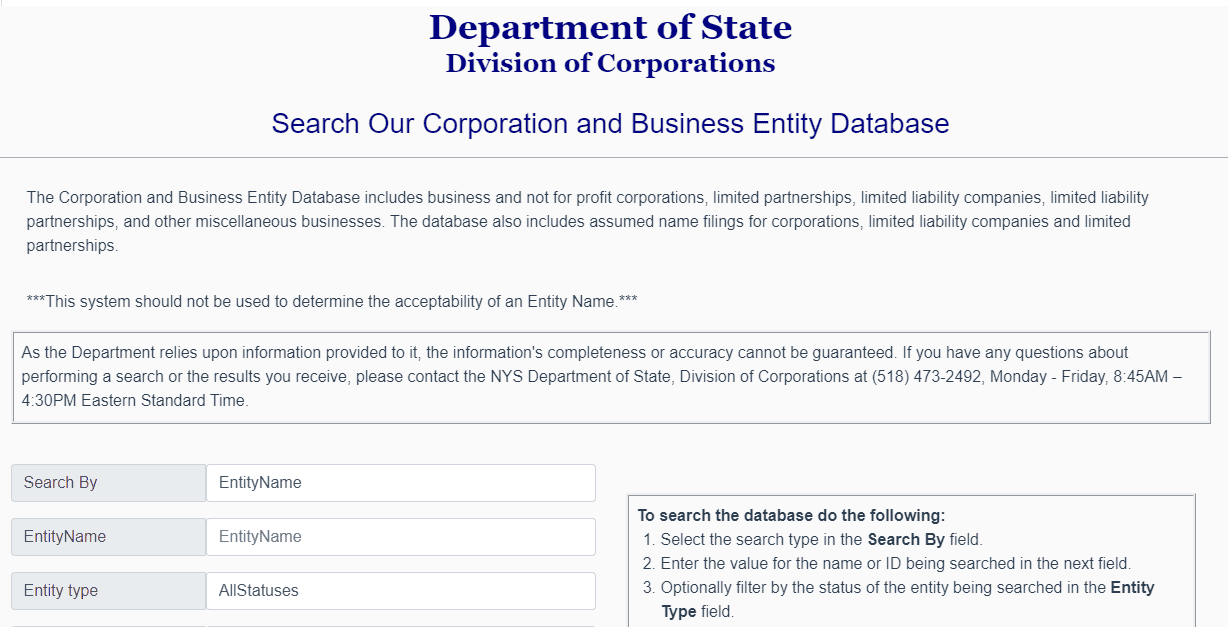

Search the New York Corporation and Business Entity Database to see if your preferred LLC name is available:

Alternatively, you can contact the New York Department of State’s Division of Corporations for more assistance. There is no fee for conducting a basic search in the database.

Choosing a business name goes beyond state guidelines; consider selecting an LLC name that aligns with your business identity. Customer ease and brand consistency depend on it.

If you've found an ideal business name but aren't ready to form an LLC, you can reserve it promptly to avoid losing it to others (optional). You can consider using a DBA (assumed name) as well.

Step 2. Appoint a Registered Agent (optional)

Your LLC requires a registered agent to serve as the primary contact for the company.

They receive legal notices, tax notices and compliance reminders on your behalf. Generally, for LLCs in New York, the Secretary of State serves as the default agent for the service of process (also called a registered agent).

But you can assign yourself as an individual or a commercial provider if you prefer.

The Secretary of State is the default agent for service of process for all LLCs in New York.

If you appoint someone, make sure they meet the following criteria:

- Must be a New York resident with a physical address

- Must be 18 or older when assigned

- Licensed to do business in New York (for registered agent services).

- Is available in person to receive documents

If you don't want to be your own registered agent, you can hire one for about $99-$249/year in New York.

Note: New York LLCs do not need a separate registered agent unless they choose to appoint one.

Step 3: File and Submit the Articles of Organization

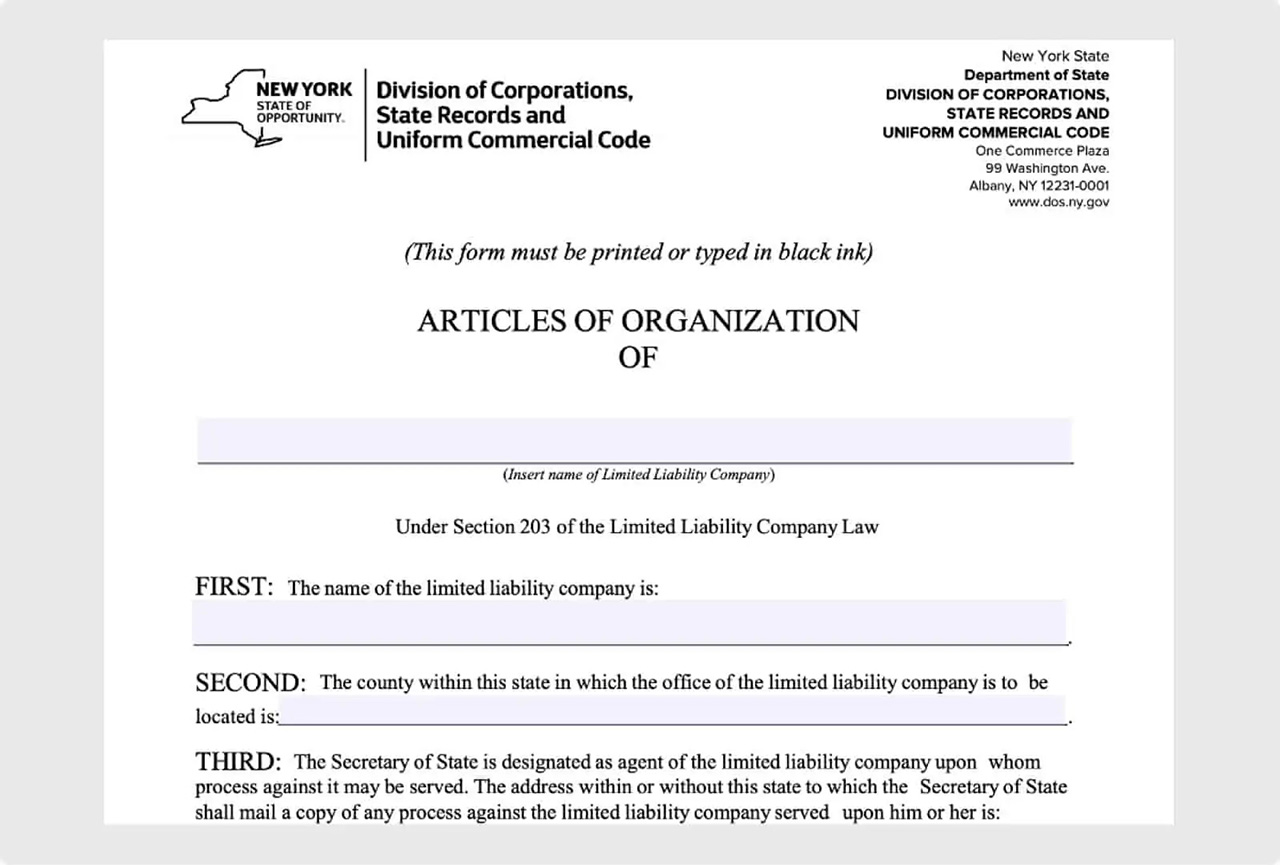

In New York, a limited liability company must file an Articles of Organization.

An Articles of Organization defines the LLC's purpose, location, and members.

You can file the Articles of Organization with the Department of State under Section 203 of the New York Limited Liability Company Law.

To file, send the Articles of Organization and $200 filing fee to the:

New York Department of State, Division of Corporations, 99 Washington Avenue, Albany, NY 12231.

You can also file online at the Department of State's website, and your filing receipt will be emailed to you within minutes of filing.

After approval, the state will issue a Filing Receipt, which serves as proof of LLC formation.

Step 4: Complete the New York LLC Publication Process

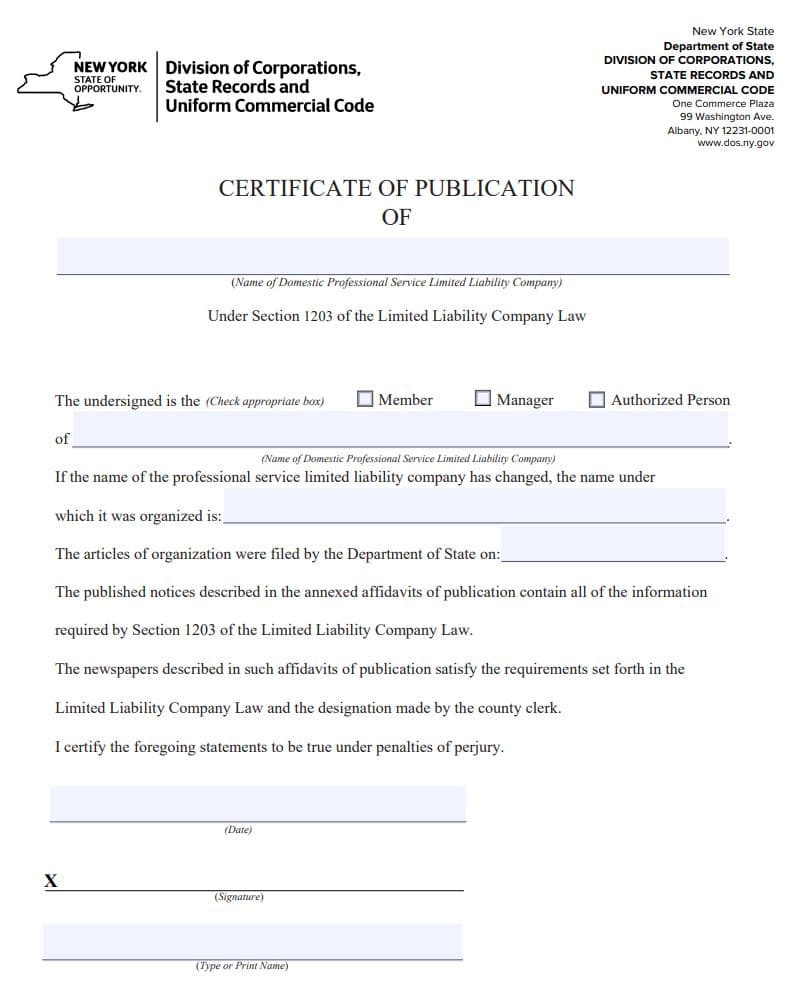

For six consecutive weeks, you must advertise your LLC formation notice in a daily and weekly newspaper in New York. It has to be done within 120 days of formation.

The average cost for newspaper publication varies widely ($150–$2,000+ depending on county).

Failure to submit the Certificate of Publication within 120 days will revoke your LLC's business license.

Note: Publication must be in a paper approved by your county. To find out which newspapers are accepted check this page or contact your county clerk. You must ensure that your LLC name on the notice corresponds to the name on the Department of State's records. Each newspaper company will send you an affidavit of publication and charge you for publication.

To complete the publication process, you must submit your LLC's Certificate of Publication to the New York State Department with a $50 filing fee.

Step 5. Create an Operating Agreement

The next step is to draft an operating agreement detailing your new LLC's rules, regulations, and procedures. New York LLC operating agreements (OA) are legally binding documents all LLC members sign.

Members of an LLC can enter into an operating agreement before, during, or within 90 days after filing their articles of organization under New York LLC law. Operating agreements offer many benefits:

- You avoid legal trouble under Section 417 of the state's LLC law.

- An operating agreement specifies how your New York limited liability company will function, which can reduce business disputes between members.

- The Small Business Association (SBA) says it can help maintain your LLC's limited liability status.

- It makes your company more credible, making loans easier. Business owners often have to submit an OA when they apply for a loan or open an account with a financial institution.

- It may sometimes replace default LLC laws in New York.

- New York LLC operating agreements: what to include

Step 6. Obtain an Employer Identification Number (EIN)

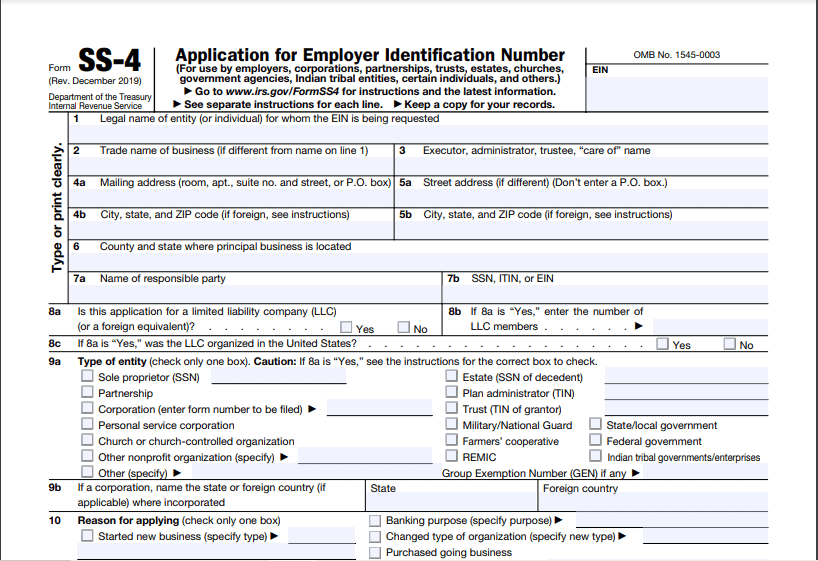

The Internal Revenue Service (IRS), a federal government division, assigns your LLC an Employer Identification Number (EIN). Like a Social Security Number, the EIN identifies your business to the IRS.

Before applying for an EIN, determine how many LLC members you have. The IRS and state require paperwork for changing from a single-member LLC to a multi-member LLC (or vice versa). Also, you'll need to transfer LLC ownership and amend your Operating Agreement.

Before applying for an EIN, determine how many LLC members you have. The IRS and state require paperwork for changing from a single-member LLC to a multi-member LLC (or vice versa). Also, you'll need to transfer LLC ownership and amend your Operating Agreement.

Applying for an EIN online if you have an SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number is the simplest and fastest filing method. It takes about 15 minutes to complete the online application, which generates your EIN.

Costs to Set Up an LLC in New York

Depending on your LLC, the cost of starting an LLC in New York will vary, but forming an LLC in New York requires fees for:

- Corporation Articles – $200

- A Certificate of publication – $50

- Newspapers publishing notices- $150 – $2,000

To get things done faster, you can pay:

- $25 per document for a 24-hour turnaround

- $75 per document for same-day processing

- $150 per document Processing within 2 hours

Further Steps

Open a Bank Account

It may seem intuitive for new business owners, especially those with single-member LLCs, to use their accounts for business transactions. However, if you use your account for business transactions, you may report your taxes incorrectly, which does not work well for long-term accounting purposes.

By contrast, a business bank account keeps your finances separate from your company's, making bookkeeping easier.

Get Permits and Licenses

Depending on your industry, you can search for licenses after forming a New York LLC online. Permits and licenses in the state fall into the following categories:

- Local licenses and permits – These are issued by the city or county where you start your business. For example, you must check with the Suffolk County Department of Labor, Licensing, & Consumer Affairs about licensing requirements to form an LLC in Suffolk County, NY.

- Professional licenses – For example, starting a cosmetology clinic requires a State Department of State Cosmetologist license.

New York State License Center, Division of Licensing Services, and NY Office of the Professions are all reliable sources of valuable license information.

Don't Forget Federal and State Income Taxes

New York LLCs must file a Biennial Statement every two years with a $9 fee.

New York LLCs with over $250,000 in annual income must pay an additional state filing fee.

Your LLC must be tax-compliant and in good standing by paying the appropriate taxes.

LLCs are treated as disregarded entities in New York and taxed as sole proprietorships or partnerships by default. However, federal income tax reporting differs. Multi-member LLCs report federal income taxes using Form 1065, while single-member LLCs use Form 1040 Schedule C.