Whether you're a New Jersey resident or coming from out of state, starting an LLC in New Jersey is a smart move.

New Jersey's close proximity to New York provides access to big-city opportunities without the sky-high cost of living. Plus, the state is attracting more residents, boosting the local talent pool and customer base. Forming an LLC in New Jersey positions your business to serve this growing market while giving you personal liability protection and simplifying your taxes.

Ready to take the first step? Let’s dive into how you can start your LLC in New Jersey!

Steps to Create an LLC in New Jersey:

- Step 1. Pick a Name for Your LLC

- Step 2. Appoint a Registered Agent

- Step 3. Draft and Submit the Certificate of Formation

- Step 4. Get a Certificate of Formation Copy from the State

- Step 5. Create an LLC Operating Agreement

- Step 6. Get an Employer Identification Number (EIN)

- Costs to Set Up an LLC in New Jersey

- Further Steps

Need to save time? Hire Northwest to form your LLC.

Step 1. Pick a Name for Your LLC

LLC formation in NJ begins with name selection.

Business naming is full of creative thoughts and marketing concerns. But you must also mind the legal requirements. Generally, the name of your New Jersey LLC must be different from other businesses. You want to avoid anything too similar to existing companies.

Your LLC name must also include Limited Liability Company or a similar abbreviation. People need to know they are doing business with an LLC.

All New Jersey LLC names must avoid:

- Terms related to government agencies, like the FBI, IRS, or Treasury

- Restricted words such as bank, trust, or insurance, unless you have the permission

- Other prohibited names with obscenities or criminal activities

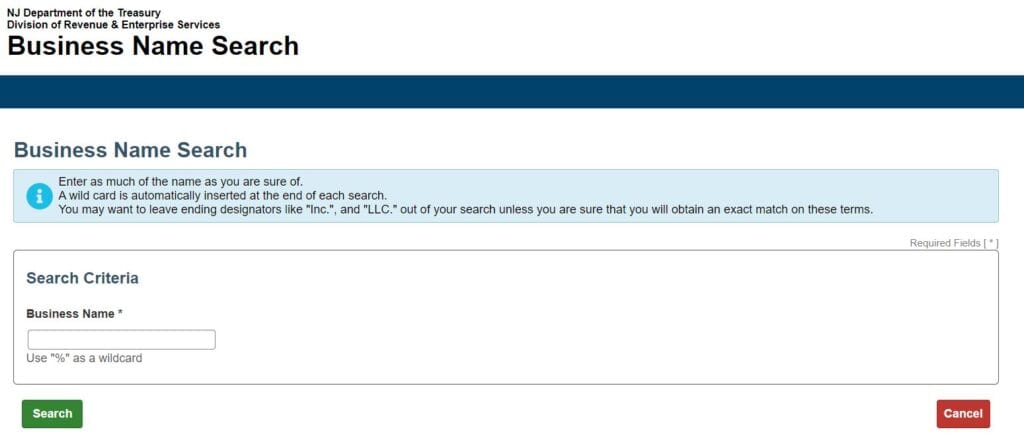

New Jersey has two tools to help you pick a name. The Business Name Search on the NJ Secretary of State's website that lists existing business names. The Business Name Availability helps determine if a specific name is available for your use.

Use both to make sure your name doesn’t infringe on an existing business.

Name Reservation (optional)

You can choose to reserve your LLC name for up to 120 days. This can give you time to tackle other New Jersey LLC formation needs without worrying about someone taking your desired name.

To do so, file an Application For Reservation of Name. The state fee is $50 for 120 days. Note: Name reservations can be renewed for additional 120-day periods.

Trade Name (optional)

It’s also possible to do business using a different name than the LLC’s legal name.

Some business owners like to use this tool to use a name that’s more closely related to the product or service. You may need to use one if you bring an LLC from another state into New Jersey, but the name is already in use here.

New Jersey calls this a doing-business-as (DBA) name. Other states call it a trade name or fictitious name. You can register a DBA in New Jersey by filing a Registration of Alternate Name. The fee is $50. You can file the form online, by mail, or in person.

Step 2. Appoint a Registered Agent

In New Jersey, an LLC is required to have a registered agent. Here are the requirements:

- Must be either an individual resident of New Jersey or a business entity authorized to do business in the state.

- Must have a physical street address in New Jersey. P.O. Box addresses are not acceptable.

- Must be available during normal business hours to receive legal documents, service of process, and official state communications on behalf of the LLC.

- Must consent to their appointment. This means they must agree to serve as the registered agent for the LLC.

These requirements ensure that there is a reliable point of contact within the state for legal and official communications.

If you don't want to be your own registered agent, you can hire one for about $89-$175/year in New Jersey.

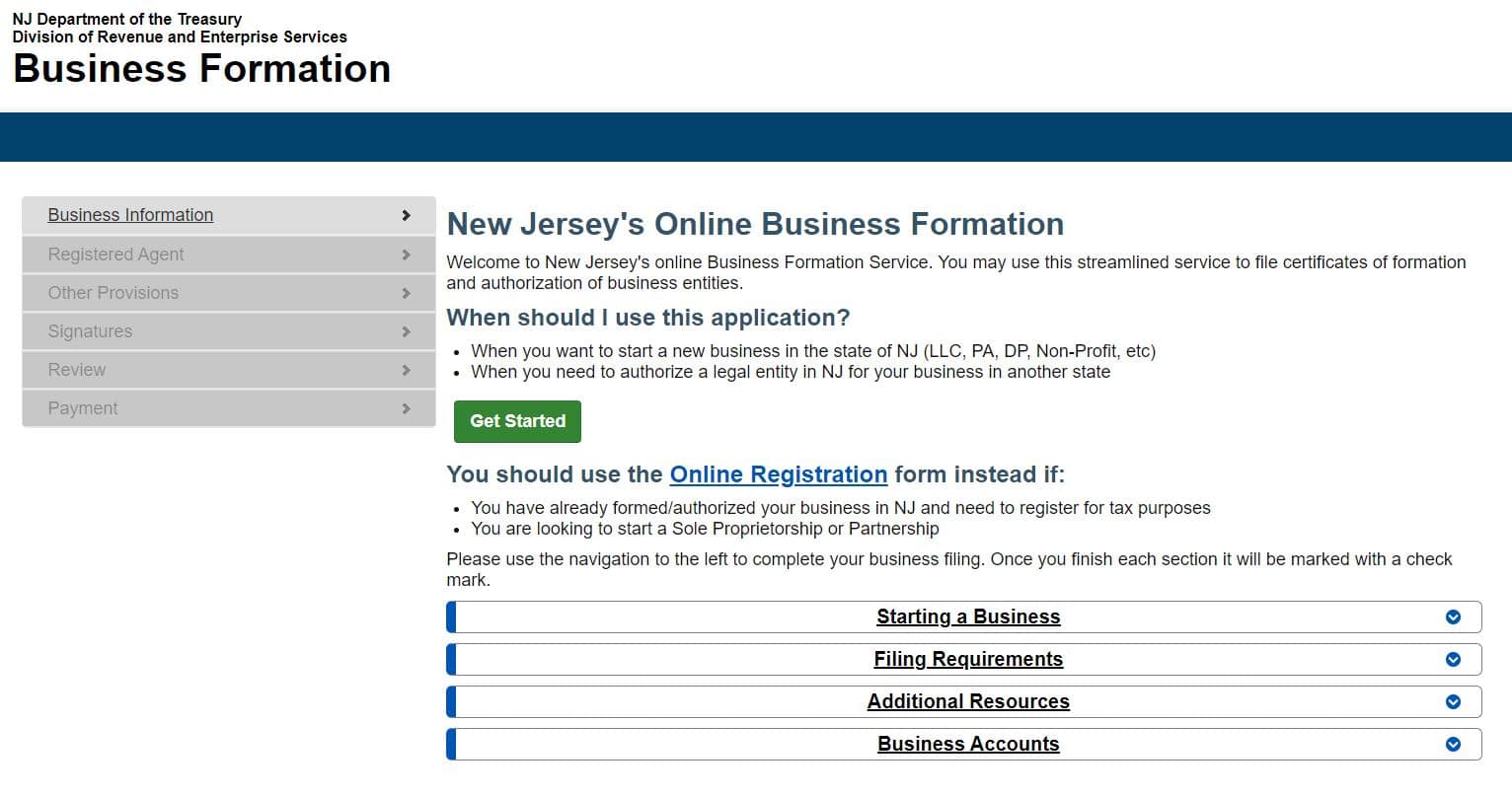

Step 3: Draft and Submit the Certificate of Formation

When you’re ready to get down to business, it’s time to file your Certificate of Formation. This exciting step is what legally forms your LLC. Other states call it the articles of organization.

To tackle this monumental task, submit a Public Records Filing for New Business Entity to the New Jersey Division of Revenue. Corporations and limited partnerships use this form too. So to form an LLC, you will skip over some fields.

You can complete and submit this form online, by mail, or by fax. Online filing is done through New Jersey’s Online Business Formation portal:

You will need to provide the following information:

- LLC’s name (must be unique)

- Name and address of each LLC organizer

- Street address of the New Jersey registered office

- Street address of the principal place of business

- Name and address of the registered agent

- LLC duration (perpetual unless you provide a different period)

The filing fee is $125. The processing time if you file online is 1-3 days. If you file by mail or fax, the processing time can be 3-4 weeks.

If you file by fax or in person, the processing time can be expedited by paying additional fees. For same-day processing, the cost is $50. Filing online is highly recommended to expedite the formation process and get your LLC registered more quickly.

Step 4: Get a Certificate of Formation Copy from the State

After New Jersey approves your LLC formation, you’ll get a Certificate of Formation. This is also called a Certificate of Authority for foreign (out-of-state) businesses.

This is an important document that you want to keep with your business records.

It also provides your Entity ID, a 10-digit number used in New Jersey to identify your business records. These records are public information. They are separate from your confidential tax records.

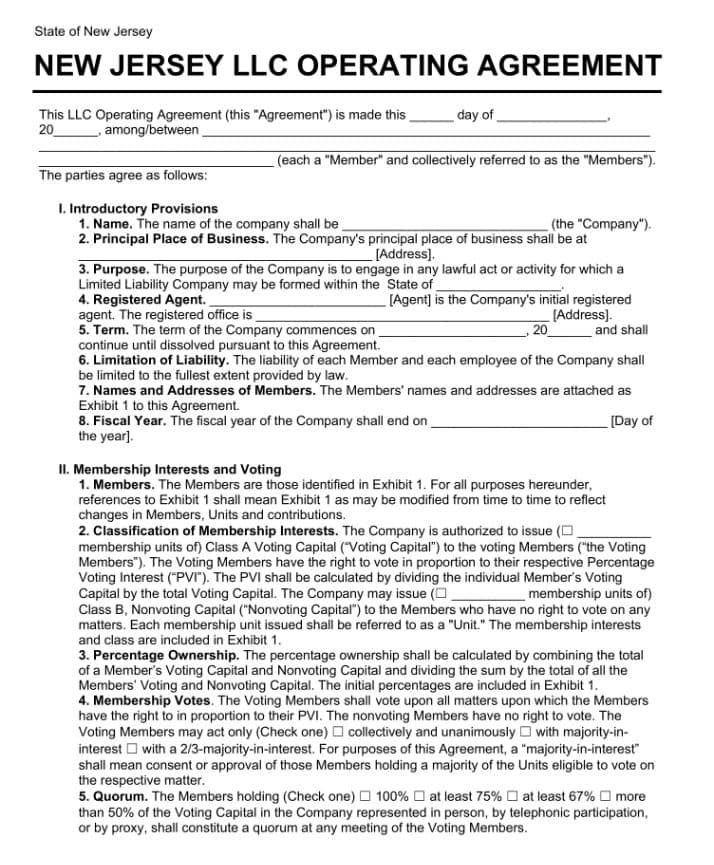

Step 5: Create an LLC Operating Agreement

An operating agreement governs the LLC. It’s an internal contract between members that lays out a lot of details about how the LLC functions and handles situations. It should be signed and dated upon forming the LLC.

An operating agreement also establishes:

- The rights and duties of members and managers

- Ownership percentages and contributions

- Activities of the LLC, including distribution of profits or losses

- Ways to add or remove members

- Method for dissolving the LLC

- Procedure for handling various disputes

Your LLC will use New Jersey law when the operating agreement doesn’t address an issue. It’s also possible New Jersey law will override the operating agreement in certain circumstances. But a well-drafted agreement serves as the primary set of rules for your LLC.

You are not required to file it with New Jersey authorities. Give a copy of the operating agreement to all members and keep at least one with the LLC records.

Multi-member LLCs should strongly consider making one. A written operating agreement can provide greater liability protection for the LLC and its members than New Jersey law.

It also helps investors understand the business and prevents internal conflict.

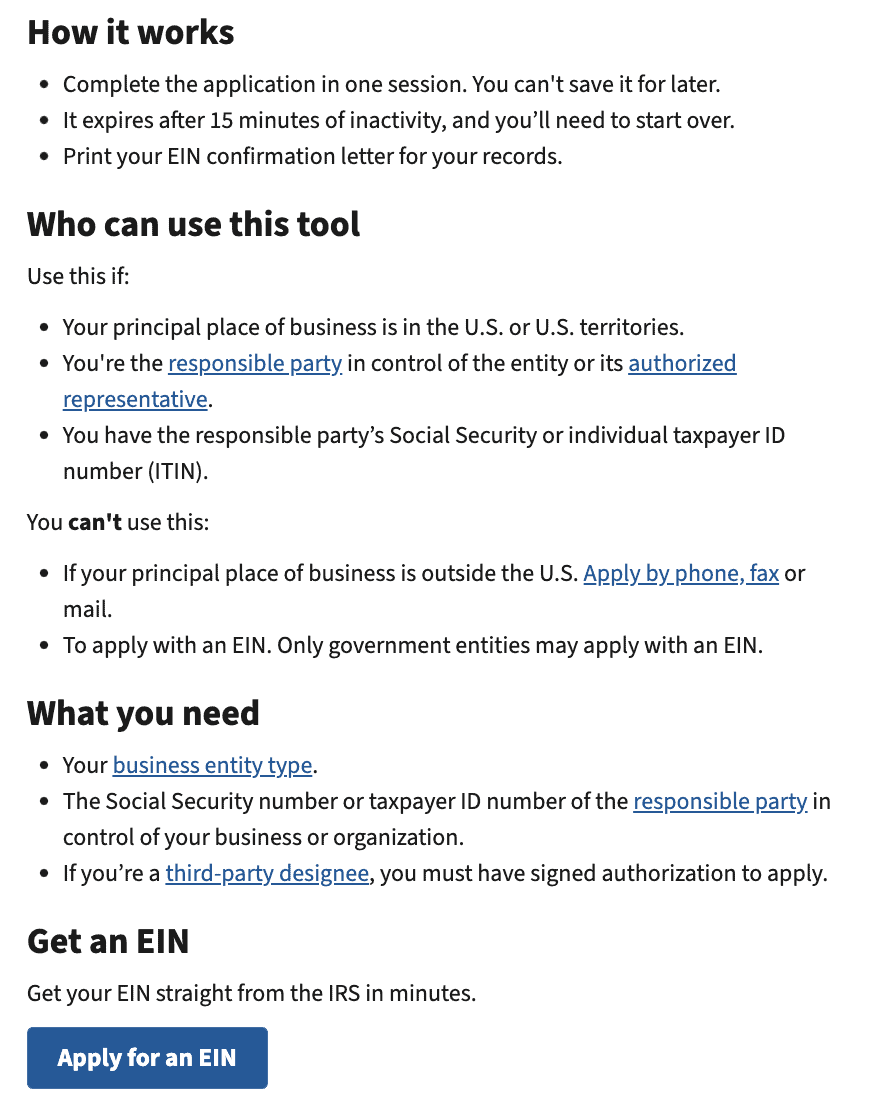

Step 6: Get an Employer Identification Number (EIN)

While obtaining an EIN from the IRS is free and straightforward, it is not mandatory for single-member LLCs without employees. However, having an EIN can be beneficial for banking and other business purposes.

You can get an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). New Jersey requires you to provide this detail when forming your LLC.

An EIN is the business equivalent of a Social Security number. It is necessary to hire employees and handle certain taxes.

The application process is free and straightforward. You can get an EIN online in minutes.

Costs to Set Up an LLC in New Jersey

Business owners can plan on spending $125 to start an LLC in New Jersey. This is the cost of filing the Certificate of Formation.

The costs of forming an LLC in New Jersey could also include (optional):

- Reserving a name ($50)

- Registering a DBA name ($50)

- Using expedited services (cost varies).

- Hiring a registered agent ($89 – $175/year)

- Using attorney to draft an operating agreement ($0 – $1,000)

Further Steps

Open a Bank Bccount

To operate your new business successfully, you need a business bank account. It not only helps with record-keeping, but it’s also crucial to your LLC’s legal benefits. If you mix your personal finances and your LLC gets sued, courts could determine the LLC isn’t a separate entity. You could be personally on the hook.

Business bank account fees vary depending on the amount of activity in your account and the deposit cash. Plan to pay $10 to $50 monthly.

Obtain Permits and Licenses

New Jersey does not require a general state business license. However, depending on your LLC's location and industry, some businesses will need additional permits or licenses.

The specific permits required vary based on factors such as the industry and location of your business. To determine the permits and licenses relevant to your LLC, you can use the New Jersey Business Action Center's Permitting Wizard tool. You’ll also want to review the city and county needs. For example, you can find a long list of business licenses and permits from the City of Newark.

Annual Reports and Tax Filing

All LLCs in New Jersey must file an annual report with the New Jersey Division of Revenue and Enterprise Services. This report confirms or updates the company's business information on record with the state and costs $75. Annual reports can be filed online through the New Jersey Division of Revenue and Enterprise Services website

This material is provided for informational purposes only. The provision of this material does not create an attorney-client relationship between Paul Donovan and/or Donovan Legal PLLC and the reader, and does not constitute legal advice. Legal advice must be tailored to the specific circumstances of each case, and the contents of this article are not a substitute for legal counsel. Do not take action in reliance on the contents of this material without seeking the advice of counsel.