Starting an LLC in Nevada is a smart move for entrepreneurs looking for strong liability protection, tax advantages, and business-friendly regulations—all with minimal red tape.

With Nevada’s pro-business policies and growth-friendly environment, now is a great time to establish your company.

This step-by-step guide simplifies the process, breaking it down into clear, actionable steps so you can confidently set up your LLC without confusion.

Ready? Let’s get started!

Steps to Create an LLC in Nevada:

- Step 1: Choose Name for Your LLC

- Step 2: Appoint a Registered Agent

- Step 3: File Articles of Organization

- Step 4: Obtain a “Certificate of Organization” from the State

- Step 5: Create an LLC Operating Agreement

- Step 6: Get an Employer Identification Number (EIN)

- Costs to Set Up an LLC in Nevada

- Further Steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Choose a Name for Your LLC

The first task to form an LLC in Nevada is choosing a name.

You want a memorable name that reflects your business's nature and resonates with your audience.

All LLC names in Nevada must include Limited Liability Company, Limited Company, or a similar abbreviation. Some words like realtor, master association, licensed engineer, and certified public accountant are restricted from use.

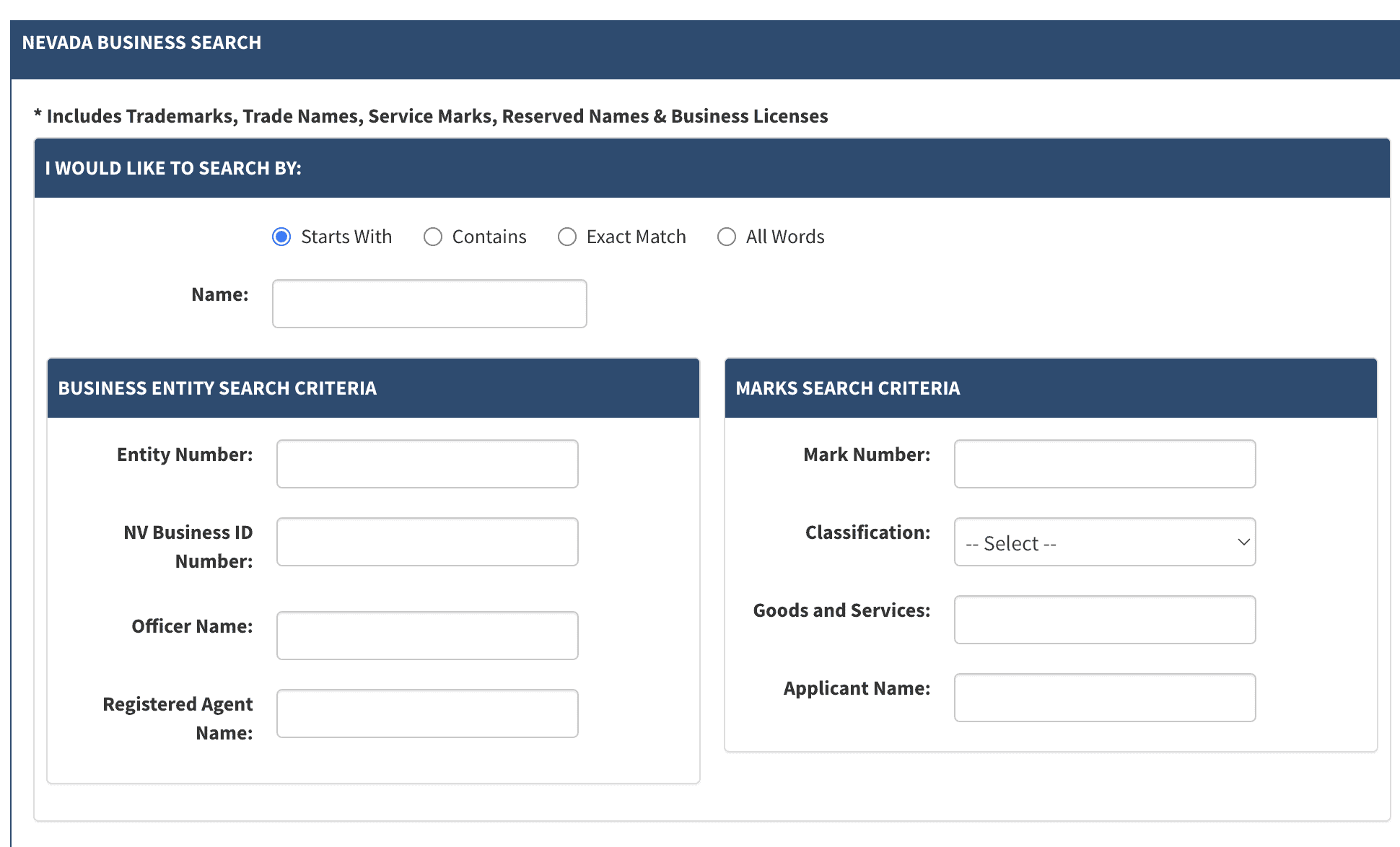

Your Nevada LLC name must be unique. You don’t want to create confusion with any existing companies. Search the Secretary of State database to ensure your preferred name is available:

Name Reservation (optional)

Once you find a name for your Nevada LLC, you can use the name reservation form to secure it.

This takes off the pressure while you complete the LLC formation process. It’s optional. Nevada allows you to reserve a name for 90 days for $25.

Fictitious Name (optional)

You may want to register a fictitious name. This allows you to conduct business under a brand name different from the business entity. It’s also known as a doing-business-as (DBA) name. Some places call it a trade name. For example, a company named Electrics General LLC can operate as Jason's Electro Repairs.

In Nevada, a fictitious firm name (DBA) must be registered with the County Clerk's office in the county where the business is located, not with the Secretary of State.

Costs vary from one city to another. But overall, expect to pay $20–$25 per name.

Step 2: Appoint a Registered Agent

A registered agent is a central role for any LLC. This contact accepts legal documents and service of process for your LLC.

Appointing the registered agent is a crucial part of starting your Nevada LLC.

A registered agent for a Nevada LLC must meet several requirements: The agent must be at least 18 years old and have a physical street address in Nevada, as P.O. boxes are not acceptable.

They must also be available during regular business hours to receive legal documents and official notices on behalf of the LLC. The agent can be either an individual resident of Nevada or a business entity authorized to conduct business in the state.

You can be your own LLC registered agent or appoint someone who works for you or is a member of your LLC.

If you don't want to be your own registered agent, you can hire one for about $125-$175/year in Nevada.

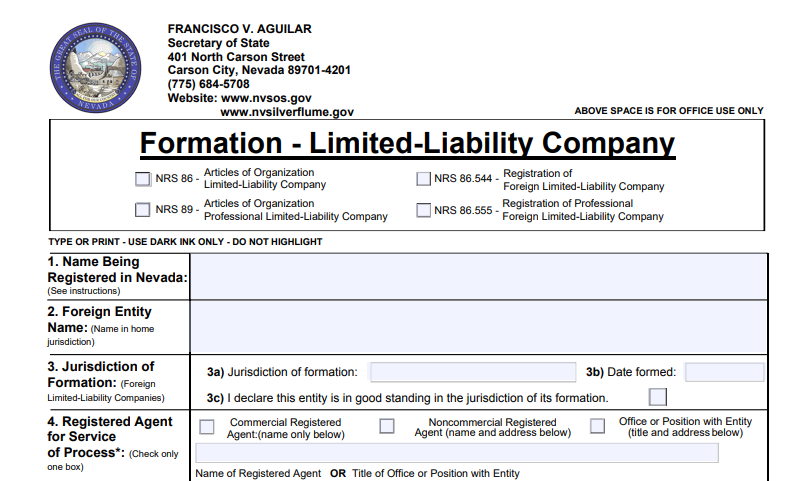

Step 3: File Articles of Organization

Hold on tight for this exciting step.

Filing your Articles of Organization establishes your Nevada LLC. Once you pass this, you are at a point of no return and own an LLC. The Articles of Organization form requires:

- LLC name

- The list of managers

- Whether it is member-managed or manager-managed

- Each organizer's name, address, and signature

- A list of any other members that will govern internal affairs

- Your LLC's registered agent's name, address, and signature

You can also outline the specific operating agreements to clarify the internal structure and management procedures.

Nevada provides a simple LLC registration form (Articles of Organization) to use. Complete all sections with accurate information to avoid delays or registration problems:

And then mail it to the following address:

Nevada Secretary of State

Commercial Recordings Division

202 North Carson Street

Carson City, NV 89701-4201

Alternatively (faster way) to set up your LLC is to use Nevada's First Stop for Business Registration.

For the fastest processing and to avoid potential delays, online filing is generally recommended.

If you file your Nevada LLC online, it typically takes 1-2 business days for processing. If you choose to file by mail, it can take about 3-4 weeks, plus the additional mail time.

There are no differences in the filing fees for online and mail submissions. Nevada offers expedited processing options for an additional fee: 24-hour service for $125, 2-hour service for $500, and 1-hour service for $1,000.

Once your application is processed, your Nevada LLC is officially established.

Step 4: Obtain a “Certificate of Organization” from the State

In Nevada, after filing your LLC formation documents, you will receive a Certificate of Organization from the Secretary of State, which serves as official proof of your LLC's registration.

If you need additional certified copies of this certificate, you can request them through the Nevada Secretary of State's office. The cost for a certified copy is $30, plus $2 per page.

To request a certified copy, visit the Nevada Secretary of State's Forms & Fees page, where you can find the necessary forms and instructions. Ensure you include the appropriate payment with your request.

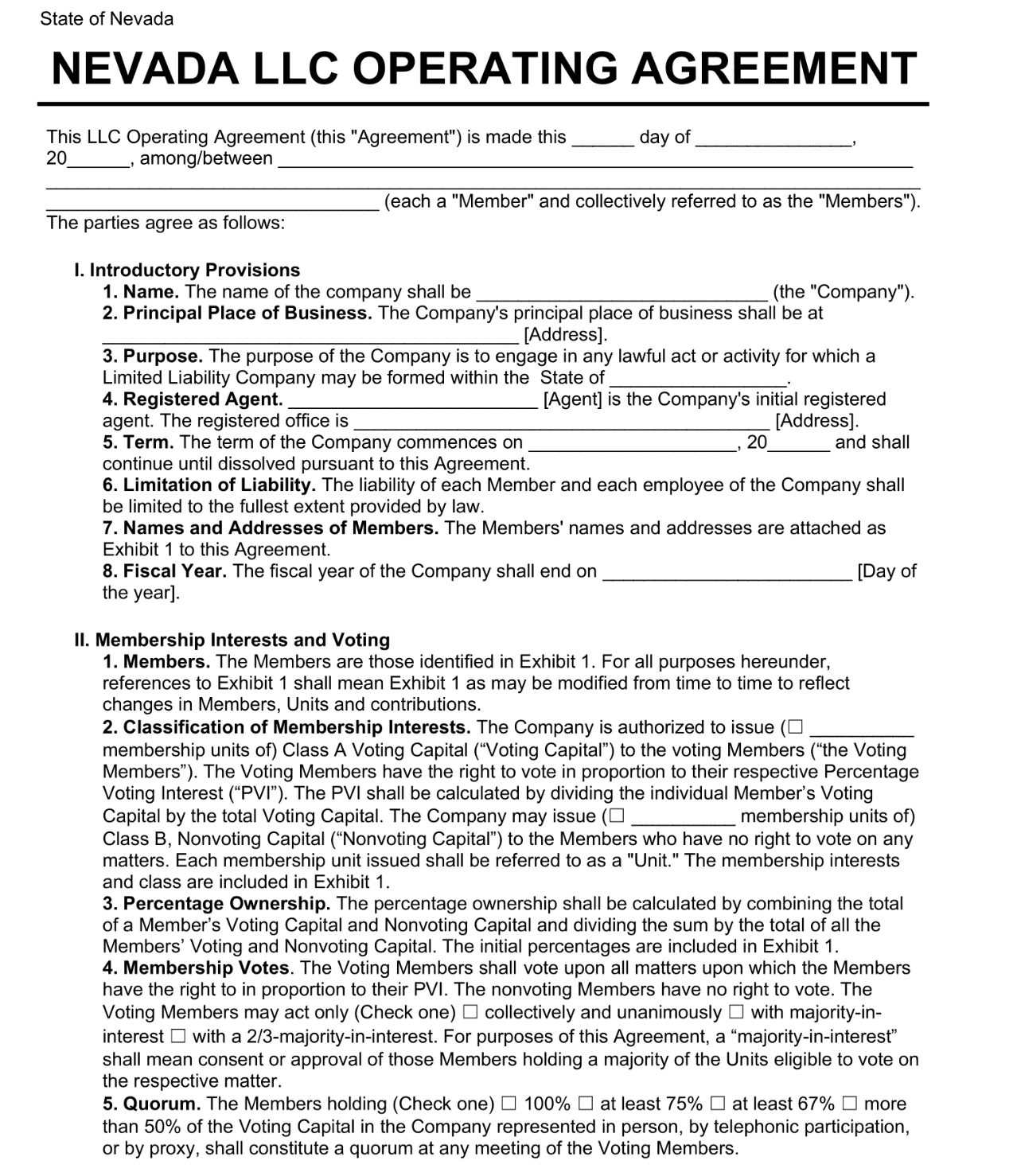

Step 5: Create an LLC Operating Agreement

Having an operating agreement in Nevada acts as a roadmap for how your LLC will run. This document outlines the following functions:

- Ownership structure and contributions

- Member rights and responsibilities

- Distribution of profit and losses

- How to handle certain disputes

- Methods for adding or removing members

- Procedure to close the business

Nevada doesn’t require an operating agreement. But it is highly recommended or else your LLC will use the default Nevada laws. These may fail to capture all your business's specific needs. You can customize the rules for your LLC with a well-drafted operating agreement.

Luckily, the Nevada Secretary of State offers a free online operating agreement tool.

Step 6: Get an Employer Identification Number (EIN)

An Employer Identification Number (EIN) is like a Social Security number for a business. The IRS uses them for tax purposes.

Single-member LLCs without employees and not electing corporate tax treatment are not required to obtain an EIN. However, obtaining one is advisable for banking and other business purposes.

All multi-member LLCs must get an EIN. It’s also essential if you plan to hire employees. And it may be necessary for banking and tax filing purposes.

Some single-member LLCs without employees and certain retirement plans can use the owner’s Social Security number instead. But it can be beneficial to get an EIN anyway for certain transactions or business needs.

The EIN application is free and easy. Go to the IRS website to get yours in minutes. You’ll need your LLC name, address, and tax filing status.

Costs to Set Up an LLC in Nevada

Starting an LLC in Nevada involves initial one-time fees of at least $425. These costs may increase if you choose to hire professional assistance during the formation process. In addition to the startup fees, there are recurring expenses, such as the annual listing fee and the Nevada business license, which together cost at least $350.

If you use a professional registered agent, you’ll also have ongoing expenses for their services. The table below outlines the costs associated with setting up an LLC in Nevada.

| Nevada LLC Set Up Requirement | Fee |

| Filing fee | $75 |

| Initial listing fee | $150 |

| Business license fee | $200 |

| Registered agent (optional) | $125–$175 |

| Legal and professional consultation (optional) | $0–$1,000 |

These costs are higher than in other states. But many owners find them manageable once they get up and running.

You also might need to pay for permits or licenses, insurance, and income and payroll taxes.

Further Steps

Once you have established your LLC in Nevada, there are a few extra steps to complete before you operate.

Open a Bank Account

Establishing a business bank account helps maintain clear financial records. It’s also crucial to protect your personal liability.

If you mix personal and business funds, you may lose some of the LLC’s legal benefits. This could result in your personal assets being at risk during a lawsuit.

When searching for a bank in Nevada, you choose one with favorable terms for your LLC. Consider factors such as transaction limits, account fees, customer support, and online banking capabilities. You also want a bank with an excellent reputation for fraud protection.

Obtain Permits and Licenses

Depending on the nature and location of your business, identify the permits and licenses needed. Besides the mandatory Nevada business license, your LLC might have other hoops to jump through. Examples include local business licenses, industry-specific licenses, health permits, and zoning permits. This list of municipalities and permits can point you in the right direction.

Getting these permits and licenses prevents legal complications.

Submit Annual Report and Tax Filing

You will need to file an annual report with the Nevada Secretary of State. It gives you a chance to report any major changes and maintains your Nevada LLC’s good standing. Registering with the Nevada Department of Taxation is also vital for many LLCs. It is how you meet tax obligations such as sales, employment, and income taxes.

You can use the Nevada Tax Center to help manage your business filings.

Other Resources

Learning from others can help you discover the shortcut to success. Experienced entrepreneurs can share techniques and tools that you can leverage. The Nevada SBDC is a great place to start. You can connect with a mentor to get no-cost advice. The Nevada Department of Business and Industry also keeps a calendar of small business training and events.