Starting an LLC in Mississippi might seem overwhelming, but don’t worry—this guide is here to simplify the process and get you up and running quickly.

We’ve broken everything down into easy-to-follow steps, so you can focus on building your business while enjoying the peace of mind that comes with personal liability protection.

By forming an LLC, you’re creating a legal entity that shows you’re serious about your business while safeguarding your personal assets. Mississippi is a fantastic place to launch your venture, with its low costs, strong infrastructure, and a variety of local incentive programs designed to help new businesses thrive.

Ready to build a solid foundation for your LLC? Let’s dive in and get started!

Steps to Create an LLC in Mississippi:

- Step 1: Choose a name for your LLC

- Step 2: Choose a registered agent

- Step 3: File the Mississippi LLC Certificate of Organization

- Step 4: Create an LLC Operating Agreement

- Step 5: Get an Employer Identification Number (EIN) from the IRS

- Costs to set up an LLC in Mississippi

- Further steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Choose a name for your LLC

Selecting a name for your business is the first step in forming an LLC.

The name you choose for your Mississippi LLC must:

- Differ from the name of any other business in the state

- Include Limited Liability Company or an abbreviation such as LLC or Ltd

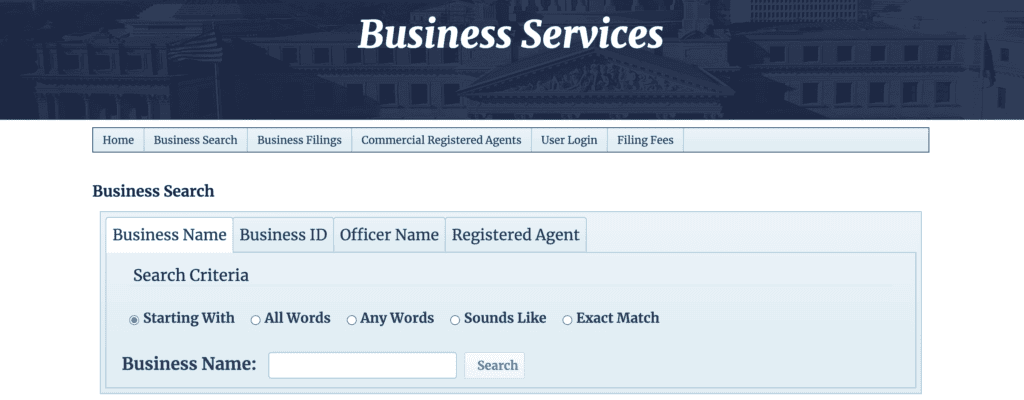

Head over to the business name search tool on the Secretary of State (SOS) website. Check to see if your prospective business name is available:

Name Reservation (optional)

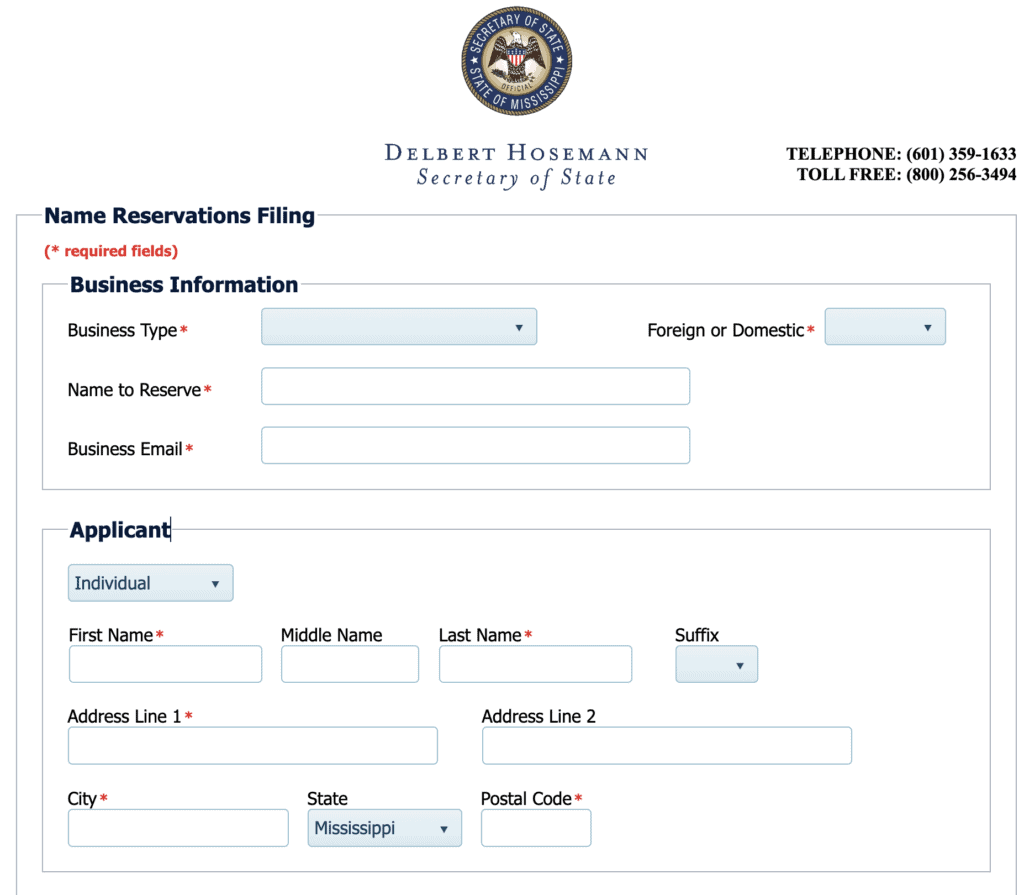

If you found the name you want but aren’t quite ready to form your LLC, you can file to reserve the LLC name. This will stop others from taking it while you prepare the rest of your LLC formation documents.

Complete the Name Reservations Filing form online. Be prepared to pay a $25 reservation fee to hold the name for 180 days.

Trade Name (optional)

LLCs can do business under a name that is different from your LLC’s legal name. Some places call this a trade name or doing-business-as (DBA) name. Mississippi uses fictitious names. This can be a great way to sell products or services under unique brands, yet keep everything owned by one LLC.

To use a trade name for your Mississippi LLC, you must register it. Use the Fictitious Name Registration form and pay a $25 fee. This registration is valid until December 31 of the fifth year following its registration, after which it must be renewed.

Step 2: Choose a registered agent

Like every other state, Mississippi requires all LLCs to designate a registered agent.

The appointee will be in charge of handling official correspondence. In the event of a lawsuit, the registered agent receives the legal papers. It’s an important role.

All Mississippi LLC registered agents must:

- Be a Mississippi resident at least 18 years of age or a registered agent service provider within the state

- Have a physical Mississippi address (not a P.O. Box)

- Be available during standard business hours

You can be your own registered agent. But business owners can’t use the formed LLC (as a business entity) to serve as a registered agent. The registered agent must be an individual, not an entity.

Serving as your own registered agent means that your address will be in the public record. This reduces privacy and increases your junk mail. It also means you need to be around and sort through the mail without missing any critical notices.

If you don't want to be your own registered agent, you can hire one for about $100-$200/year in Mississippi. If you form an LLC with Northwest, they'll give you a free registered agent for the first year. After that, it's $125 per year.

Step 3: File the Mississippi LLC Certificate Of Organization

The previous steps were the groundwork. Now comes the heavy lifting. This step establishes the Mississippi LLC legal entity.

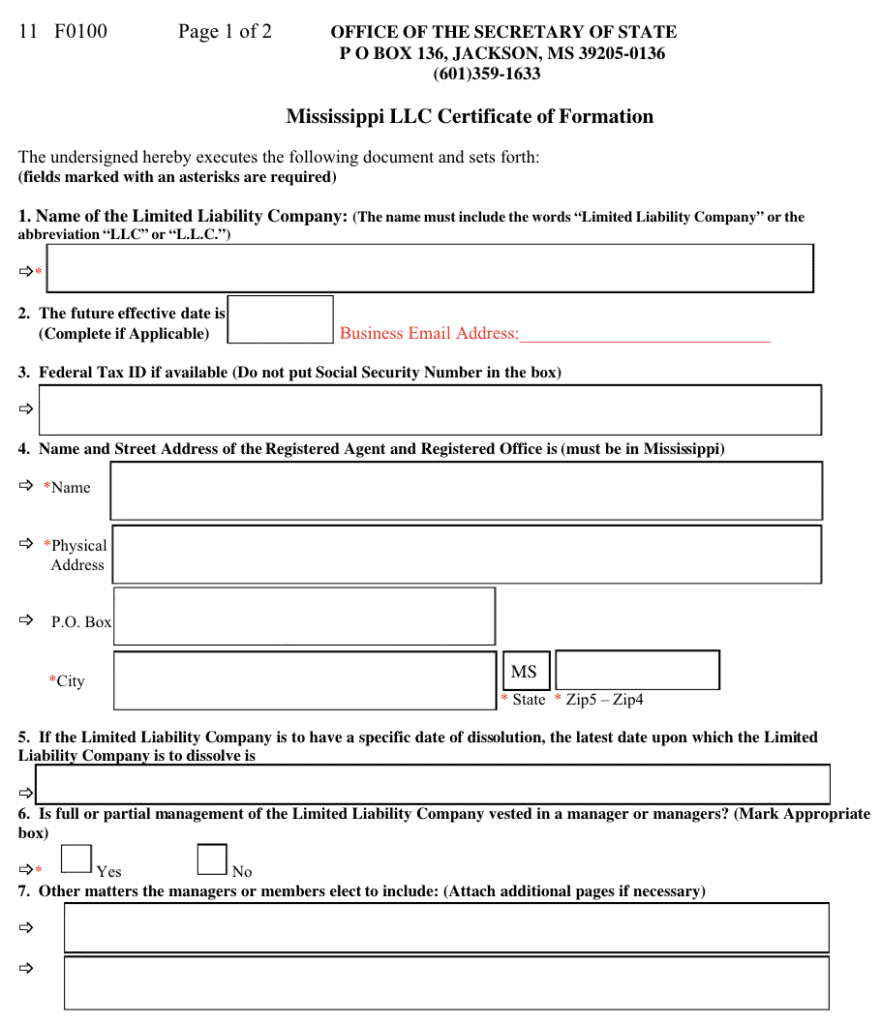

You’ll need to file the LLC Certificate of Formation with the Mississippi Secretary of State. While some people think an attorney must complete this step, it’s likely easier than you think.

To complete the filing, you must provide:

- The name and address of your LLC

- The name and address of the registered agent

- The LLC’s effective date (immediate if left blank or any date up to 90 days from filing)

- The NAICS code for your LLC’s business type

- Authorized signature

In Mississippi, all business filings, including the Certificate of Formation, must be submitted online using the Secretary of State’s online filing system. The filing fee for the Certificate of Formation is $50. Filing online may include a small credit card processing fee (e.g., $4 for the Certificate of Formation, bringing the total to $54).

Registering a foreign LLC in Mississippi costs $250, which is relevant for businesses expanding into the state.

The approval process takes around 1-2 business days for online submissions. Mississippi doesn’t provide expedited services.

Once approved, it’s a good idea to request a “Certificate of Formation” (also known as a Certificate of Existence) from Mississippi.

This document proves that your business exists and can help with banking needs. Get one by creating an account and paying $25.

Step 4: Create an LLC Operating Agreement

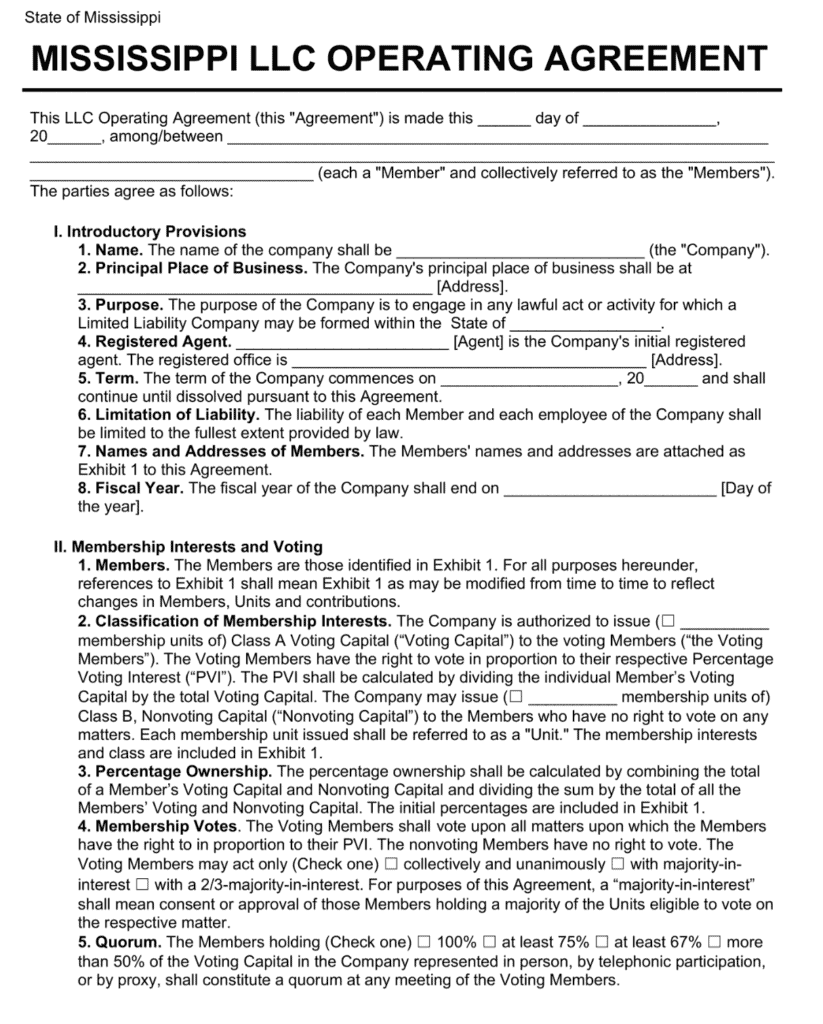

Creating an operating agreement is not required. But it’s an essential step for any multi-member LLC. And it’s good practice for single-member LLCs too.

You don’t need to file it with the SOS. It’s an internal contract between LLC members.

The operating agreement provides key aspects of your LLC’s operation, such as:

- The rights, obligations, and responsibilities of the LLC members

- The business structure of your LLC

- The rules and management processes

If a solid operating agreement is not in place, your LLC will use Mississippi state law. This can be an issue should there be any legal disputes between members or third parties. It’s hard to predict the outcome.

Instead, you can make sure everyone is on the same page by having an operating agreement. It lays out the rules and helps avoid conflict. It can also protect your interests.

You can draft an operating agreement by consulting with a business lawyer. Or use an online template to save on costs.

Step 5: Get an Employer Identification Number (EIN) from the IRS

An Employer Identification Number (EIN) is like a Social Security number for a business. The Internal Revenue Service (IRS) uses EINs for federal tax purposes.

Visiting the EIN Application page of the IRS website is quick and free. Or you can get an EIN by phone, fax, or mailing the proper form.

Costs to set up an LLC in Mississippi

Setting up a Mississippi LLC has low costs. The only mandatory fee is $50 (+$4 for credit card processing online) to file the LLC Certificate of Formation. Foreign LLC filing fee is $250.

Optional costs to start an LLC in Mississippi include:

- Reserve an LLC name: $25

- Register a trade name: $25

- Hire a registered agent service: $100 to $200

- Request copy of Certificate of Formation: $25

- Operating agreement: $0 – $1,000

You’ll also need to file an annual report for your Mississippi LLC. But there’s no fee for domestic LLCs, making it very attractive compared to other states which can charge up to $500.

Further steps

Once you’ve completed the above key steps, there are a few other things you want to take care of right away.

Open a business bank account

You need to open a separate bank account for your Mississippi LLC.

This helps to maintain LLC protections, such as limited liability and asset protection. If you mix business and personal finances, you put your personal assets at risk during lawsuits.

Local taxes and approval

Your LLC may need to register with certain agencies for taxes, licenses, and permits. The specific needs depend on the business activities involved.

Many businesses need to consider business tax needs. You should review the Mississippi Department of Revenue website. And if you hire employees, you must register with the Department of Employment Security. Don’t overlook license and permit needs too. These can come from state, city, and county authorities.

For example, the City of Jackson and the City of Biloxi have a variety of business licenses and permits. Hinds County handles some business approval needs for LLCs in unincorporated areas.

Additional community resources

Rather than learn from the school of hard knocks, take a note from experienced business owners. They can save you from stumbling through challenges by providing key insights. You can get no-cost counseling from organizations such as:

- Mississippi Small Business Development Center: Provider of small business assistance and resources

- Mississippi Development Authority: Great resource for finding local incentives and financing opportunities

- Mississippi Gulf Coast Chamber of Commerce: Fostering leadership and advocating for businesses