Thinking about starting an LLC in Maine? You’ve come to the right place.

Maine is not only famous for its picturesque pine forests and stunning coastline, but it’s also a welcoming state for entrepreneurs. Whether you're launching a new venture or transitioning an existing business, forming a limited liability company (LLC) in Maine is a smart move. An LLC provides personal liability protection, streamlines your tax structure, and sends a clear message that your business is professional and credible.

This detailed, step-by-step guide will walk you through the process of forming an LLC in Maine, covering everything you need to know to get started.

Steps to Create an LLC in Maine:

- Step 1: Name Your New LLC

- Step 2: Appoint a Registered Agent

- Step 3: File the Certificate of Formation

- Step 4: Create an LLC Operating Agreement

- Step 5: Get an EIN (Employer Identification Number) from the IRS

- Costs to Set Up an LLC in Maine

- Further Steps

Need to save time? Hire Northwest to form your LLC.

Step 1. Name Your New LLC

Choosing a business name for your Maine LLC is a great place to focus on first.

You may have some ideas floating around. Before selecting one, you need to make sure it meets Maine’s naming guidelines.

Every Maine LLC name must:

- Be unique and different from other registered businesses

- Contain Limited Liability Company, Limited Company, or a similar abbreviation

- Not contain words for other business types, such as Limited Partnership or Corporation

- Exclude obscene language and unlawful activities

- Avoid references to government agencies

You can only use terms related to regulated industries if authorized to do so. This includes industries like banking, law, or medicine.

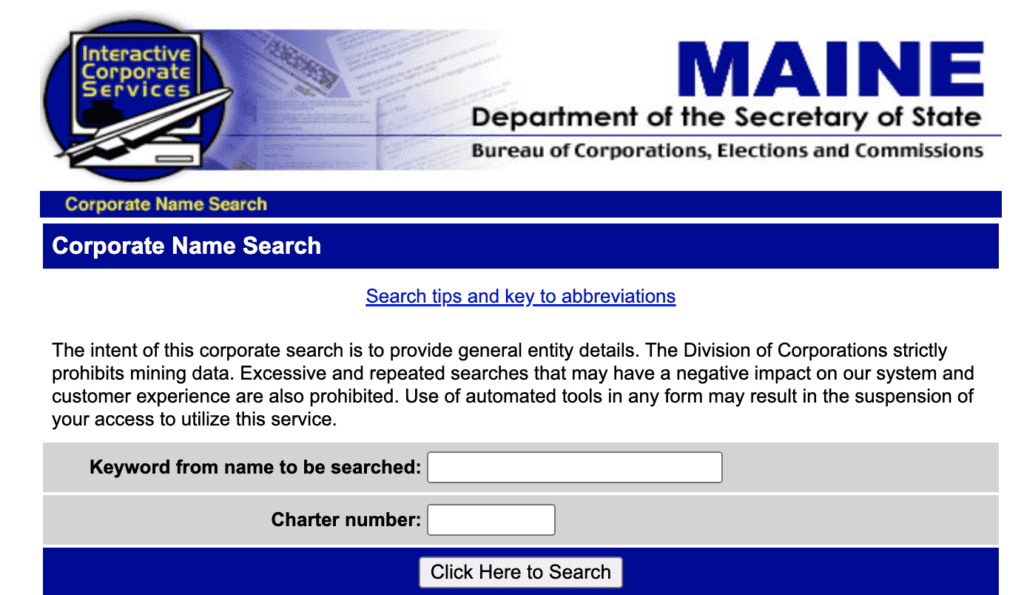

Once you have some ideas, check the Maine business name database to see if it’s available:

You want to use a name that won’t cause confusion with existing businesses.

Making a name reservation (optional)

Once you verify the selected name availability, you can reserve it for up to 120 days. You’ll file an Application for Reservation of Name by mail. A $20 filing fee applies.

This gives you time to prepare formation documents without rushing. Maine name reservations can’t be renewed after the initial 120 days.

Trade name (optional)

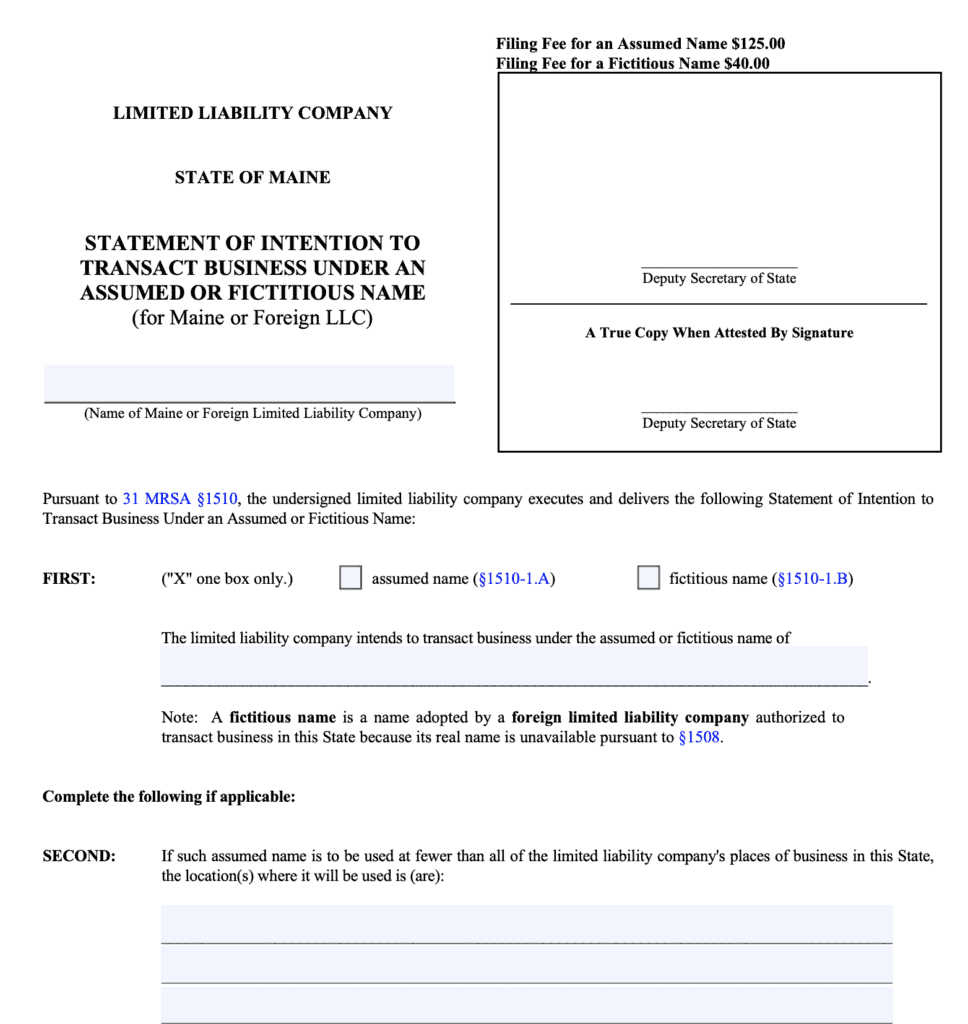

If you want, you can do business under a name different from the LLC’s legal name. This is often known as a trade name or doing-business-as (DBA) name. Maine calls it an assumed or fictitious name.

For example, the company “Kate’s Wedding Gowns LLC” could operate under “Best Wedding Gowns in Maine.”

To use one, register the name with the Maine Secretary of State as one of these two options:

- Assumed name: Maine LLCs using another name to operate. The filing fee is $125.

- Fictitious name: Foreign LLCs that need to use a different name to operate in Maine because another Maine entity uses its legal name. The filing fee is $40.

To register a fictitious or assumed name, file a Statement of Intention to Transact Business Under an Assumed or Fictitious Name (MLLC-5) form.

Step 2. Appoint a Registered Agent

One essential role for every LLC is deciding who will serve as the registered agent.

This is the main point of contact that receives things like tax documents and legal notices. The registered agent can be an individual or business entity. The requirements generally include:

- At least 18 years old

- Maine resident or a business entity authorized to operate in Maine

- Have a Maine address (not a virtual office or P.O. Box)

- Keep regular business hours

You can be your own registered agent to keep costs down. This comes with some downsides, such as your contact information becoming public, having to sort through junk mail without missing critical notices, needing to keep regular business hours to receive legal documents, and if you make a mistake or miss a notice, no one will be there to help.

If you don't want to be your own registered agent, you can hire one for about $99-$199/year in Maine. If you form an LLC with Northwest, they'll give you a free registered agent for the first year. After that, it's $125 per year.

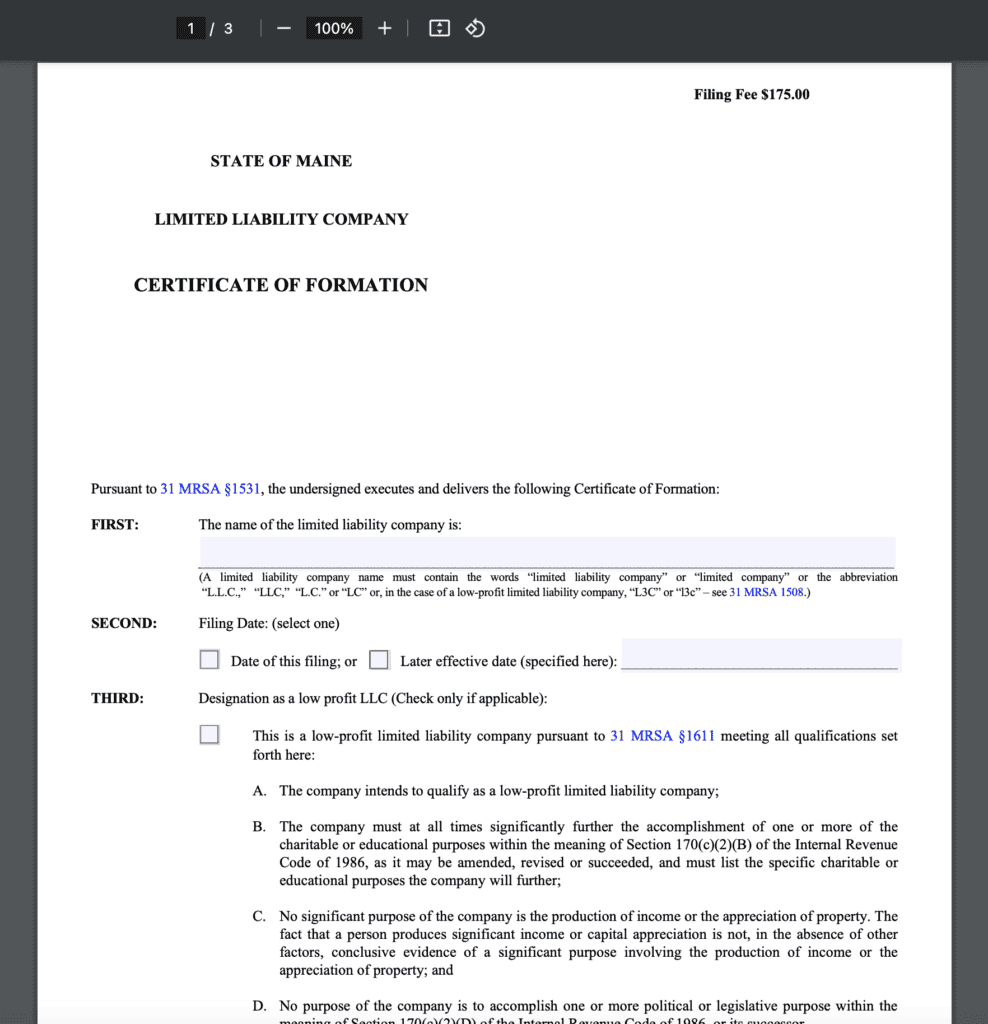

Step 3. File the Certificate of Formation

If you’re looking for the step that turns your idea into a real business, this is it.

Submitting the “Certificate of Formation” is what forms your Maine LLC.

Here is how to file your Certificate of Formation:

- Download a Maine Certificate of Formation (MLLC-6) form

- Fill out the form with the entity name, entity type, registered agent’s name and office address, and the filing date

- File the completed form with the Maine SOS by mail

- Pay a filing cost of $175

To form an LLC in Maine, you must submit the form through the mail. There’s no online option. To file the Certificate of Formation for an LLC in Maine, you should send it to the following address:

Maine Secretary of State, Division of Corporations UCC and Commissions

101 State House Station

Augusta, ME 04333-0101

The SOS will process your filing. It typically takes around 5-10 business days. But it can be up to 15 business days in the event of delays and holidays. If you need your LLC formed faster, expedited processing is available at an additional fee. Once received, the SOS will complete:

- 24-hour processing: $50

- Immediate same-day processing: $100

After the SOS approves your LLC, request a Certificate of LLC registration. Keep this with your LLC’s records. It may be needed for things like banking or finance purposes. The cost is $30.

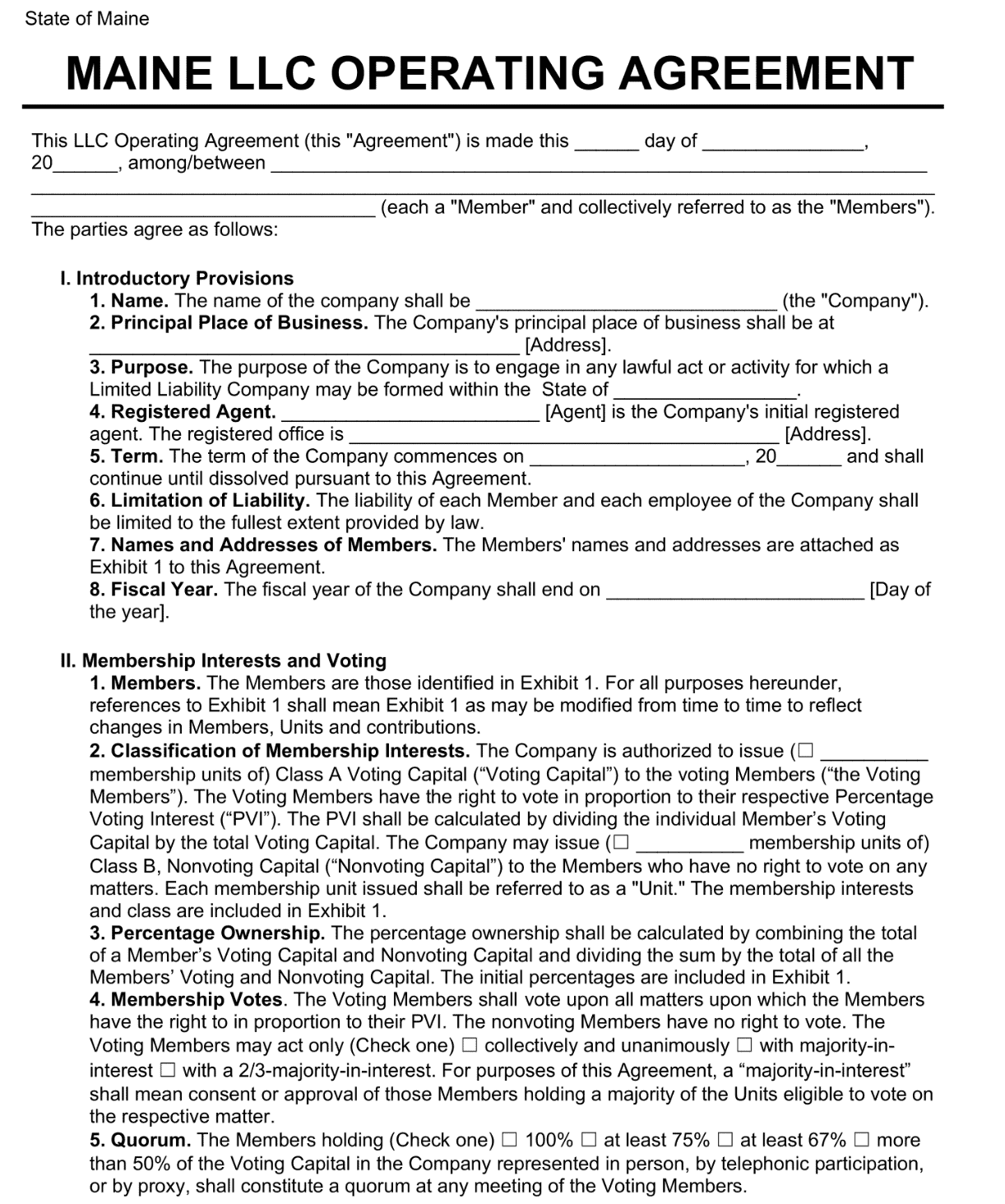

Step 4. Create an LLC Operating Agreement

An operating agreement is a legal document that establishes your LLC's rules. It ensures all members are on the same page, providing predictable outcomes and preventing disputes.

Operating agreements can help to protect your interests and make sure that your business operates as you intend. Rather than be blindsided by business partners, the agreement lays out how to handle many situations.

Maine legally requires single-member and multi-member LLCs to have an operating agreement. Although it can be oral, a written agreement is much better. It holds more value in court and avoids conflicting beliefs.

An operating agreement includes things like:

- Member investments and contributions

- Profit, loss, and distribution allocations

- Decision-making powers, voting rights, and management duties

- How to transfer membership interest

- Dissolution of the LLC

You don’t need to file your LLC’s operating agreement with Maine. It’s an internal contract between members. Make sure it’s filed safely with other important company documents.

You can create an operating agreement using a template. Or have a corporate attorney draw one up for your business.

Step 5. Get an EIN (Employer Identification Number) from the IRS

Congratulations! You’ve formed your LLC. Now it’s time to think about taxes.

Get an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). It’s like a Social Security number for businesses. The IRS uses them to track tax information.

Any LLC with multiple members or any employees must get an EIN.

Some single-member LLCs without employees don’t need to get an EIN. They can use a personal Social Security number. But it’s best practice to get one anyway as some banks require them to open a business account. Plus, it’s easy and free.

To obtain an EIN for your Maine LLC, complete and submit your application on the IRS website. The IRS will issue your EIN in minutes.

Costs to Set Up an LLC in Maine

The minimum cost to form an LLC in Maine is $175. This is the filing fee for the Certificate of Formation and cannot be avoided.

Other optional costs to form a Maine LLC include:

- Name reservation: $20

- Assumed name registration: $125

- Fictitious name for a foreign LLC: $40

- Registered agent service: $99 to $199 per year

- Expedited processing: $50 to $100

- Operating agreement: $0 to $1,000 or more

Further Steps

After creating your Maine LLC, there are a few more items worth knocking out right away. These help to set your business up for success.

Business bank account

The most critical is to open a separate bank account for your company. Mixing personal and business funds can lead to legal problems. If your LLC gets sued, it could lose its ability to protect your personal assets.

A business bank account also helps with tax and accounting purposes. Some banks offer business accounts with no monthly fees, as long as you meet certain minimums. Others usually charge $25 or less per month.

Maine tax registration

If you have employees, you’ll need to register for Maine State Income Tax Withholding by completing and filing an Application for Tax Registration.

You also may need to register if you sell taxable goods or services. The issued state ID lets you report all applicable state taxes.

Licenses and permits

Depending on your business activities, you may need to register with other state bodies. There’s an entire list of professions, as well as separate licenses for alcohol sales and gaming.

Local authorities may have other licenses and permits for your LLC. For example, the City of Portland Maine offers licenses for street vendors, taxi services, and massage therapists. The City of Lewiston has a similar list of business licenses.