Forming a Limited Liability Company (LLC) in Delaware is a popular choice for its business-friendly laws and favorable legal environment.

Delaware is often considered one of the best states to form an LLC because it has limited fees, tax obligations and better privacy.

These factors make Delaware an attractive state for forming an LLC, as they help reduce operational costs and provide a favorable legal framework for businesses.

So if you too would like to open an LLC in Delaware, this guide will explain how to get your company registered and running in the steps outlined below.

Steps to Create an LLC in Delaware:

- Step 1: Choose a Name for Your LLC

- Step 2: Appoint a Registered Agent

- Step 3: Draft and File a Certificate of Formation

- Step 4: Create an LLC Operating Agreement

- Step 5: Obtain an EIN (Employer Identification Number) from the IRS

- Total Cost to Set Up Your LLC in Delaware

- Further Steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Choose a Name for Your LLC

A good starting point is deciding on a name for your LLC.

While you might already have an idea in mind, it must also meet Delaware requirements. Every Delaware LLC name needs to:

- Include Limited Liability Company, L.L.C., or LLC

- Be unique from other businesses in Delaware

- Avoid terms related to regulated fields like banking or medicine, unless authorized

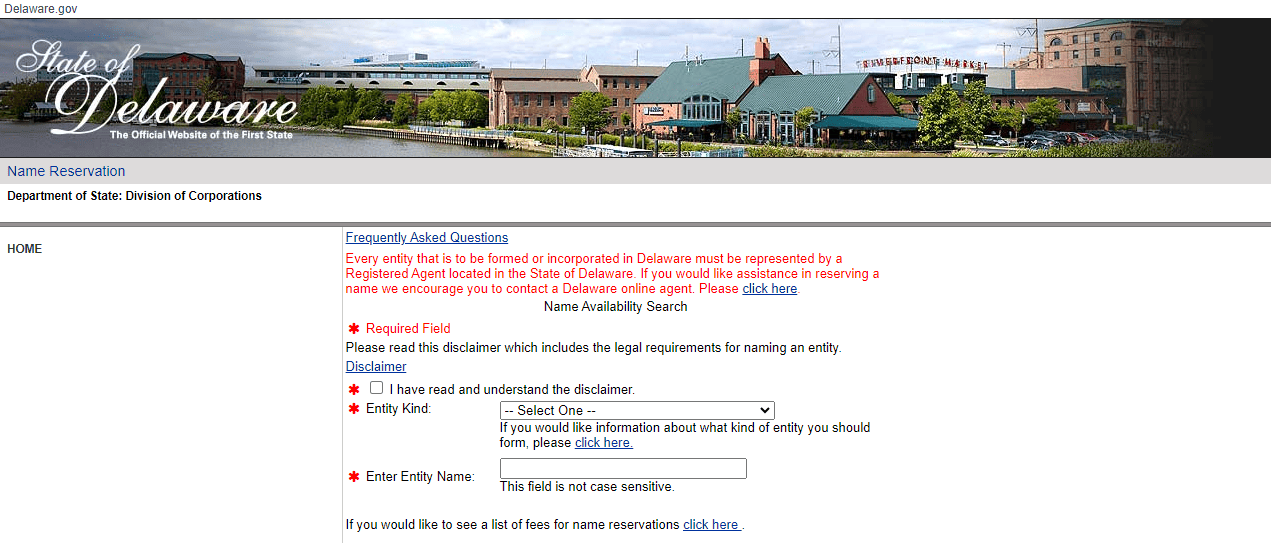

Once you have chosen a name, check to see if it’s available on the Delaware Division of Corporation’s website:

Avoid names that may cause confusion with existing businesses.

You can pay $75 to reserve the name for 120 days (optional). This gives you time to prepare other documents without worrying someone will take the name. But it does not mean Delaware approves the name.

Your LLC may also request a “doing business as” (DBA) name. Many business owners use these to operate under a name different from the legal name.

Step 2: Appoint a Registered Agent

Delaware requires all new businesses to appoint a registered agent.

The purpose of a registered agent is to receive important mail and legal notices. This includes state notices and legal documents. If someone files a lawsuit against your business, the registered agent accepts the service of process.

A Delaware registered agent can be either a person at least 18 years old or a business entity. Either one must have a physical address in Delaware. P.O. Boxes are not accepted.

You or your business can be your own registered agent.

If you don't want to be your own registered agent, you can hire one for about $75-$125/year in Delaware.

Step 3: Draft and File a Certificate of Formation

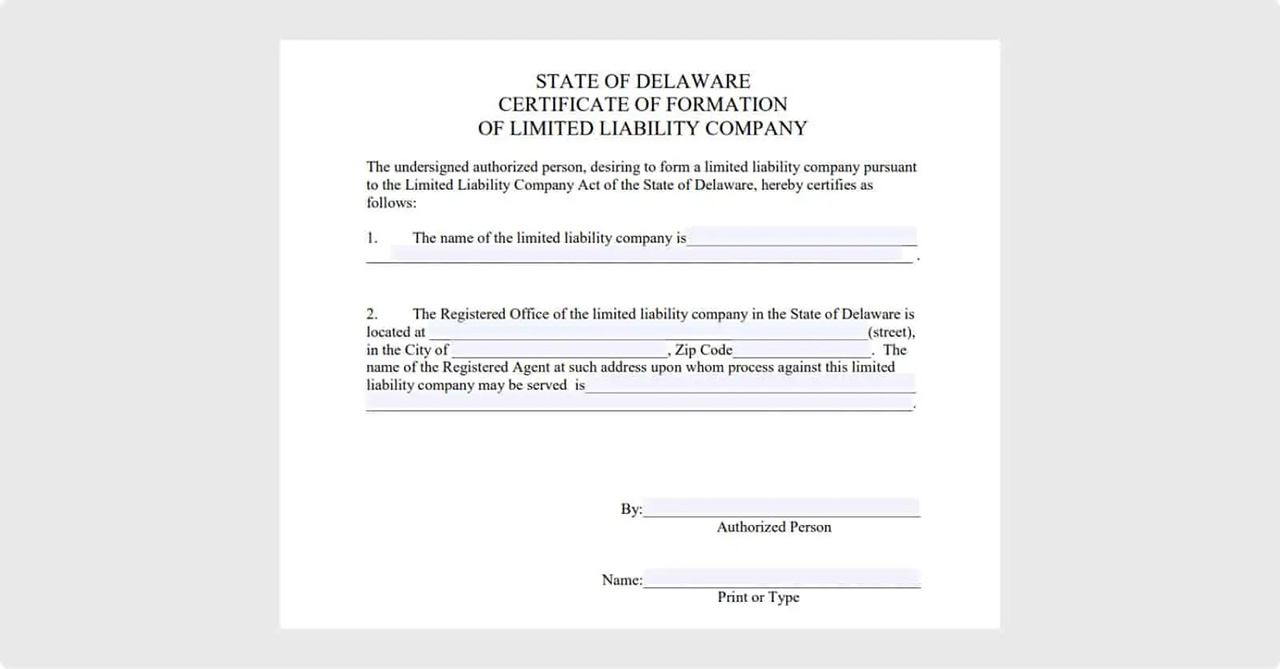

The Certificate of Formation is a legal document that creates your new LLC. Other states call this the Articles of Organization.

The state application is straightforward as it only requires two things:

- LLC’s name

- Registered agent’s name and address

An authorized person, called an LLC organizer, must sign and submit it to the Delaware Division of Corporations.

Remember: Before filing the Certificate of Formation, you must obtain permission from the registered agent to list their details on the state-submitted document.

There is no official state document that Delaware requires you to use. But Delaware provides an example of Certificate of Formation you can copy and submit.

The filing fee for the Certificate of Formation is:

- $90 for domestic LLCs

- $200 for foreign LLCs registration/conversion, plus the $90 for the certification formation

Note: A foreign LLC doesn’t file a Certificate of Formation. It files a Certificate of Registration of a Foreign Limited Liability Company. Once filed, Delaware will return a copy stamped “filed” to you. You should request a certified copy to keep with your records. There is a $50 fee.

You can file the Certificate of Formation online. Or send it by mail with a cover letter and check to:

Division of Corporations

John G. Townsend Building

401 Federal Street

Suite 4

Dover, DE 19901

Delaware generally takes 7 to 10 days to process the document after receipt. If that is too long, you can buy expedited services.

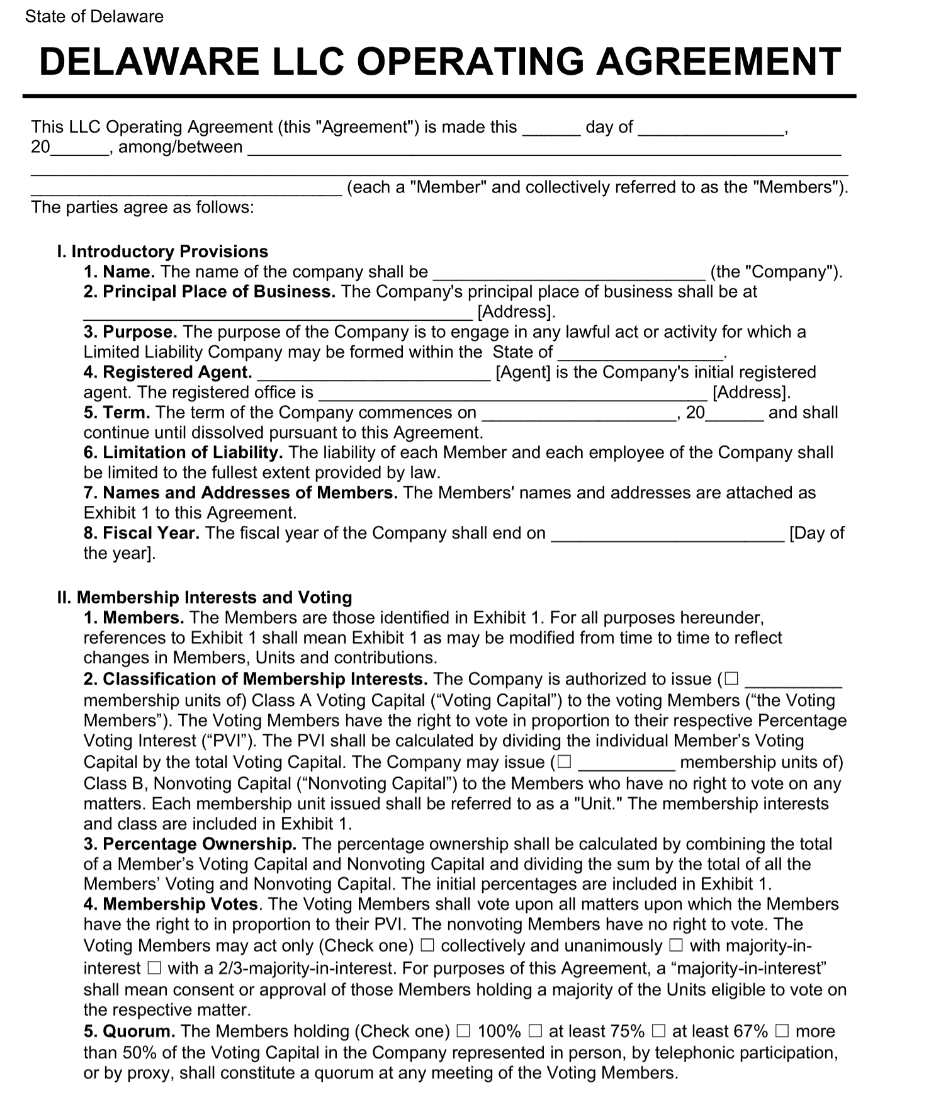

Step 4: Create an LLC Operating Agreement

An operating agreement is an internal agreement between LLC members. It lays out the rights and obligations, plus other important aspects of how the LLC functions.

Although an operating agreement is not necessary at formation, Delaware law requires all LLCs to adopt an operating agreement at some point. You do not have to file a copy of a written operating agreement with the state.

If you form an LLC without a written or oral agreement, the Delaware Limited Liability Company Act serves as the implied operating agreement.

Operating agreements are essential for multi-member LLCs. A properly drafted one includes:

- Member voting rights, contributions, and ownership percentages

- Allocation of profit and losses

- Amount and timing of distributions

- Rights and responsibilities of management

- Procedures for changing the LLC ownership structure

- Financial reporting responsibilities

- LLC dissolution procedures

You can create an operating agreement using free or low-cost online templates. Or you can hire an attorney to customize one for you.

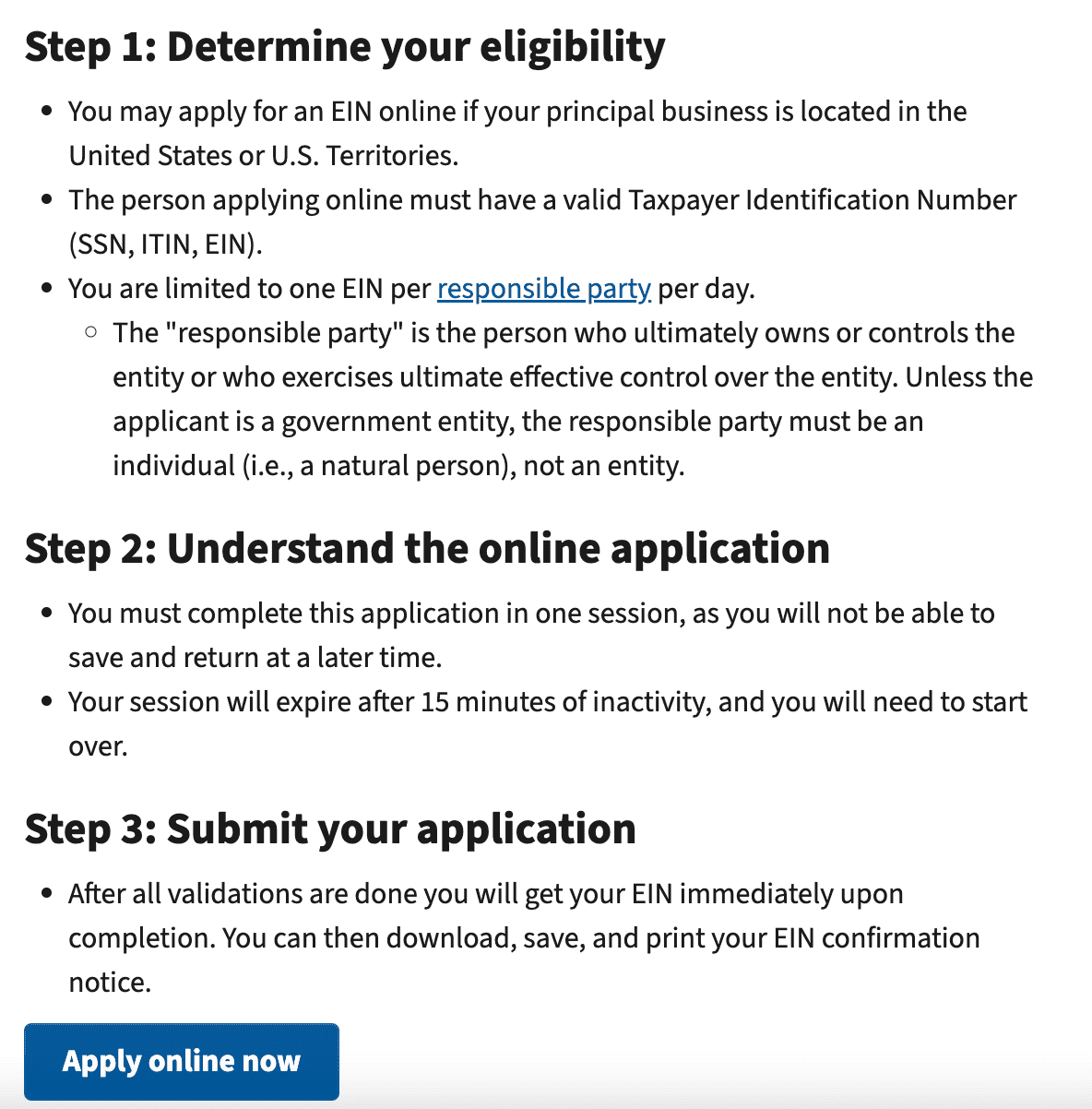

Step 5: Obtain an EIN (Employer Identification Number) from the IRS

Now that you have formed your new entity, it’s time to think about taxes. That starts with getting an employer identification number (EIN) from the Internal Revenue Service (IRS).

An EIN is like a Social Security number for a business. The IRS uses them to track tax information.

All multi-member LLCs must get an EIN. Some banks also require one to open a business bank account.

Some sole proprietorships don’t need to get an EIN. They can use their personal Social Security number instead. But if the LLC hires employees or falls under other IRS requirements, it must get one.

The process to get an EIN online is free and easy. The IRS immediately provides the number.

Total Cost to Set Up Your LLC in Delaware

The minimum cost to set up your LLC in Delaware is $90. This is the fee to file the Certificate of Formation for domestic LLCs.

Other optional Delaware LLC formation costs include:

- $75 to reserve an LLC name

- $25 to register a DBA name

- $50-$200 to hire a registered agent

- $290 for foreign LLC formation

- Up to $1,000 for expedited processing

The total cost to form an LLC in Delaware is anywhere from $90+.

Further Steps

Open a Business Bank Account

Opening a business bank account is essential for your new business. It helps to maintain the legal protections provided by the LLC.

If you combine your business and personal finances, it can cause serious problems. Your personal assets may be at risk if your business gets sued. You’ll usually need to provide your Certificate of Formation and EIN to open an account. Fees vary depending on the bank, deposit amount, and account services. Plan to pay $0 to $35 monthly.

Delaware Taxes, Permits, and Licenses

Business owners must be aware of the need to register with certain authorities.

For Delaware LLCs, the starting point is with the Division of Revenue. You must get a Delaware Business License, which starts at $75. Each LLC must also pay an annual tax of $300 for the privilege to conduct business in Delaware. LLCs in Delaware may be subject to other business taxes. These include ones like gross receipts and employment taxes.

Use the Delaware One-Stop portal to figure out and apply for the tax licenses your LLC needs.

Local city and county authorities may have extra requirements. For example, LLCs in Wilmington and Dover need city business licenses too.

Other Considerations

Savvy business owners understand the value of insurance coverage. A general liability policy can save the day when things turn south.

You can catapult your business forward by learning from local leaders. Get no-cost consultations from the SBDC or join the Chamber of Commerce. Delaware has an extensive list of business resources so you can expand your knowledge and circle.

This material is provided for informational purposes only. The provision of this material does not create an attorney-client relationship between Paul Donovan and/or Donovan Legal PLLC and the reader, and does not constitute legal advice. Legal advice must be tailored to the specific circumstances of each case, and the contents of this article are not a substitute for legal counsel. Do not take action in reliance on the contents of this material without seeking the advice of counsel.