Starting a business in North Carolina offers exciting opportunities in a state known for its innovation, cultural richness, and business-friendly environment.

A key step in launching your venture is choosing the right legal structure. For many entrepreneurs, forming a Limited Liability Company (LLC) is a smart choice. An LLC provides personal liability protection while offering the simplicity and flexibility many small businesses need. It’s an excellent option for protecting your assets and ensuring efficient operations.

This guide breaks down the process of starting an LLC in North Carolina into clear, manageable steps. By following these instructions, you’ll comply with state requirements and set the foundation for your business’s success.

Steps to Create an LLC in North Carolina:

- Step 1: Choose a Name for Your LLC

- Step 2: Appoint a Registered Agent

- Step 3: File the North Carolina LLC Articles of Organization

- Step 4: Order Certified Copies of Your LLC Formation Documents

- Step 5: Create an LLC Operating Agreement

- Step 6: Get an Employer Identification Number (EIN) from the IRS

- Costs to Set Up an LLC in NC

- Further Steps

Need to save time? Hire Northwest to form your LLC.

Step 1. Choose a Name for Your LLC

The first step to forming your LLC in North Carolina is picking an operating name.

The legal business name is present on all your company documents, invoices, website, and other touchpoints with the customers. Choosing a name for your LLC means you’ll need to develop a unique combination. If you pick a name that’s similar or the same as another business, you can be sued under trade name laws.

There are three ways to check if the business name you want to use is available:

- The North Carolina Trademark Registration site is an excellent source to check if the LLC name is already registered as a trademark under state law.

- And you can use the North Carolina Secretary of State business search tool:

Also, keep in mind that North Carolina has several unique naming requirements for LLCs. Unless you obtain special permission from the licensing boards or state agencies, you can't include the following terms in your LLC name:

- Realtor

- CPA

- Bank

- Insurance

- Pharmacy

- Architect

- Trust

Other than that, the name of your Limited Liability Company must include only words that are legal and non-offensive. The name must also contain the words:

- Limited Liability Company

- Ltd. Liability Co.

- Limited Liability Co.

- Ltd. Liability Company

- LLC

- L.L.C.

Step 2. Appoint a Registered Agent

Once you’ve chosen a name for your LLC, you must select a North Carolina registered agent.

Your registered agent is a person or professional services business who agrees to be your point of contact with the state. This person or business will receive government notices on behalf of your business.

There are some tradeoffs to serving as your own registered agent, including:

- Your street address becomes public if it’s your principal place of business.

- You may receive more marketing or junk mail from companies that purchase public mailing lists from the Secretary of State.

- If you’re served legal papers, your family, friends, and neighbours may witness this.

- Anytime you move, you’ll have to update your mailing address with the Secretary of State and pay applicable fees.

ote that P.O. boxes are not accepted. The registered agent must have a physical address in North Carolina.

If you don't want to be your own registered agent, you can hire one for about $125-$299/year in NC.

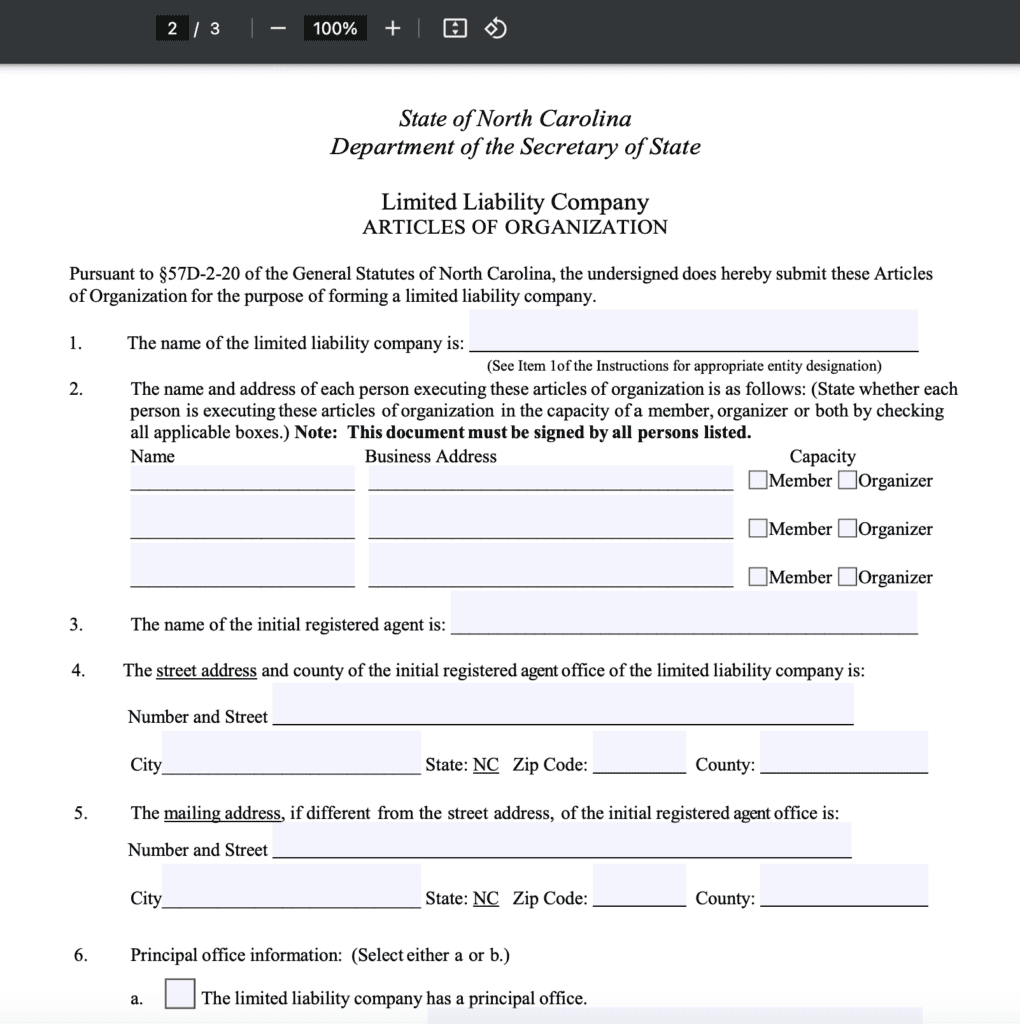

Step 3. File the North Carolina LLC Articles of Organization

The Articles of Organization filing are required to form an LLC in North Carolina. This business document details the basic information about your company, such as:

- Your business name

- All LLC members (owners)

- Principal office address and mailing address of the business

- Registered agent address and contact details

You can complete Form L-01 on paper or online. The filing fee is $125 paid to the North Carolina Secretary of State.

Standard processing takes 7–10 business days (not specified in your guide).

Expedited processing is available too. For an extra $100, you can form an LLC in 24 hours. And for an additional $200, you get same-day service. Same-day service guarantees that the documents will be reviewed and filed (or rejected) by the end of the business day.

Step 4. Order Certified Copies of Your LLC Formation Documents

Your approved Articles of Organization are your stamp of approval that your LLC is legally allowed to operate in North Carolina.

Be sure to get a certified copy of all your formation documents. You'll want them for your business records, and banks may ask to see them when you open a business bank account or apply for a loan.

You submit your request online, and the cost for each certification starts at $13.

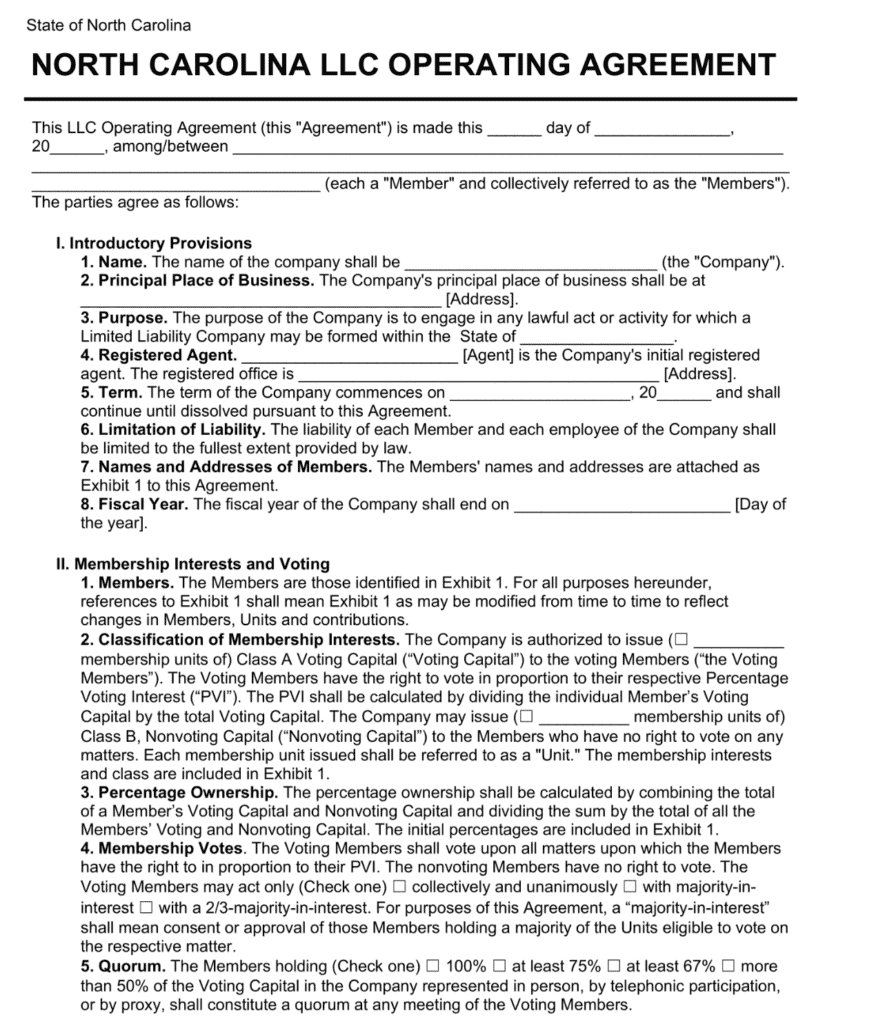

Step 5. Create an LLC Operating Agreement

An LLC operating agreement outlines how you’ll operate the business, how profits and losses are shared amongst LLC members, and which rights and duties each member has.

There are several templates online for members to use as a starting point. Operating agreements are internal to the LLC and are not required to be submitted or filed with the North Carolina Secretary of State.

However, it’s vital to draft one if you have one or more business partners.

Step 6. Get an Employer Identification Number (EIN) from the IRS

An Employer Identification Number (EIN) is like the Social Security number for your business. When you open a bank account or apply for business credit, banks will likely ask for your EIN.

If you plan to hire employees, your EIN is required to track your small business hiring activity and ensure you comply with payroll regulations. Multi-member LLCs are required to have an EIN. You'll also need one if you plan to hire employees, need to pay excise taxes, or operate in a federally regulated industry (like hazardous transportation or agriculture).

Obtaining an EIN is free by following the instructions on the IRS website. Once you complete the application, your EIN is available immediately for use.

LLC Tax Classifications

The sole proprietorship is the default tax classification for LLCs with one owner (also called a member). In this case, you don’t need to file extra federal tax forms since profits and losses from the business are included in your personal tax return.

LLCs with more than one member are taxed as a partnership. This requires a separate business tax return, and it's best to use a tax professional when tax season rolls around.

Costs to Set Up an LLC in NC

The costs to form your LLC in North Carolina will vary depending on its complexity and whether outside professional service providers are used. But here's a list of expenses you may have to pay to set up your LLC:

- Name reservation: $30 (optional)

- Professional registered agent: $100 – $200 / annually (optional)

- Filing Articles of Organization: $125 (mandatory)

- Expediting fees: $100 – $200 (optional)

- Certified document copies: $13+

Further Steps

You're nearly finished with the administrative work on setting up your North Carolina LLC.

But here are a few items you don't want to overlook. They are critical for your company's success.

North Carolina has no state requirements around opening a business bank account upon LLC formation. Yet, since you must keep your business and personal finances separate, it’s a sound next step to make.

For example, you should not pay for business items out of your personal checking account or vice versa. This implies that your LLC isn’t truly a separate business entity. If you’re commingling funds and you get sued, you could lose the asset protection that an LLC provides, and your personal assets could be in jeopardy.

North Carolina doesn't require a general business license to operate an LLC in the state. But if you're operating in certain industries or professions, specialty licenses may be needed. For example, a hair salon will need a cosmetology license and a retail coffee shop will need a sales tax license and health and safety permits from the county.

Sales & Use Tax Number is required if selling goods in NC (filed with the NC Department of Revenue).

Begin by checking your local county clerk's office to learn which permits or licenses you may need, or you can start a search using the North Carolina Department of Commerce occupational license database.

Lastly, North Carolina has a $200 annual report fee, which is due by April 15 each year.