Thinking about starting an LLC in Kentucky?

Known for its world-class horse racing and legendary bourbon, Kentucky also offers a welcoming environment for entrepreneurs to kickstart their small businesses. With its central location in the U.S., the state provides convenient access to shipping and transportation networks.

Add to that a low cost of living and state-backed initiatives supporting industries like construction, technology, energy, healthcare, and aerospace, and Kentucky becomes an appealing choice for new businesses.

If you're considering forming a limited liability company (LLC) in Kentucky, here's a step-by-step guide to get you started.

Steps to Create an LLC in Kentucky

- Step 1: Pick a name for your LLC

- Step 2: Choose a registered agent

- Step 3: File the Kentucky LLC Articles of Organization

- Step 4: Obtain a copy of the Certificate of LLC Registration

- Step 5: Create an LLC operating agreement

- Step 6: Get an (EIN) Employer Identification Number from the IRS

- Costs to set up an LLC in Kentucky

- Further steps

Step 1: Pick a name for your LLC

The first step of LLC formation is choosing a name. Bringing creativity to the table is wise. But there are also some legal requirements to be aware of.

Under Kentucky law, the LLC name must:

- Contain Limited Liability Company, Limited Company, or an abbreviation

- Be unique and different from existing Kentucky businesses

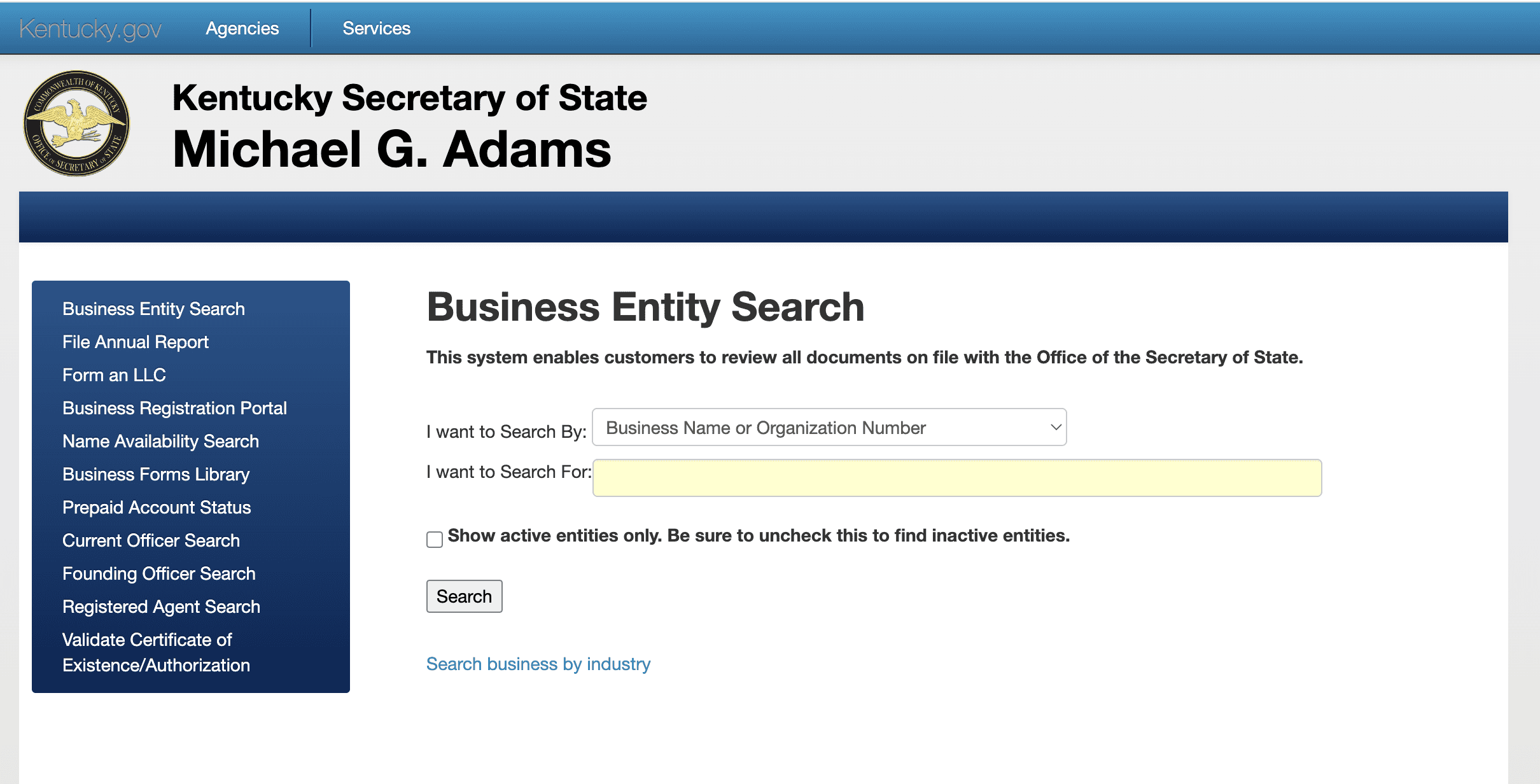

Use the state's name search tool to determine whether the LLC name is available:

Name reservation (optional)

If you’re not ready to form your LLC just yet, you can place a name reservation for 120 days. To do so, file form RES with the Kentucky Secretary of State. The fee is $15.

If you have an LLC from another state and want to do business in Kentucky, you may register the name of your LLC in advance. File an Application of Registered Name. The fee is $36.

Trade name (optional)

There may be times when you want to use a name other than your LLC's legal name. Many business owners use these to provide a lot of flexibility with branding.

For example, you may need to use this if you have a business from another state but the name is taken in Kentucky. Or you can use it to operate different product lines under descriptive names. In Kentucky, this is known as an assumed name. Some places call this a fictitious name, trade name, or doing-business-as (DBA) name.

To use an assumed name, file a Certificate of Assumed Name. The fee is $20. This can be done by mail, in person, or online.

Step 2: Choose a registered agent

A registered agent is a key point of contact for your business. Their task is to receive important mail or papers. This includes things like tax documents and legal notices.

Kentucky requires every LLC to appoint a registered agent. It must have a physical address in Kentucky (no P.O. Boxes).

You may serve as your own designated agent. It avoids an expense and lets you handle everything directly. But many experienced business owners choose to hire a registered agent service instead. Doing so helps to:

- Increase privacy since the registered agent’s address is public information

- Avoid the possibility of being served with a lawsuit in front of customers

- Provide schedule flexibility since registered agents must be available during normal business hours

In case you don't want to be your own registered agent, you can hire one for about $99-$199/year in Kentucky. If you form an LLC with Northwest, they'll give you a free registered agent for the first year. After that, it's $125 per year.

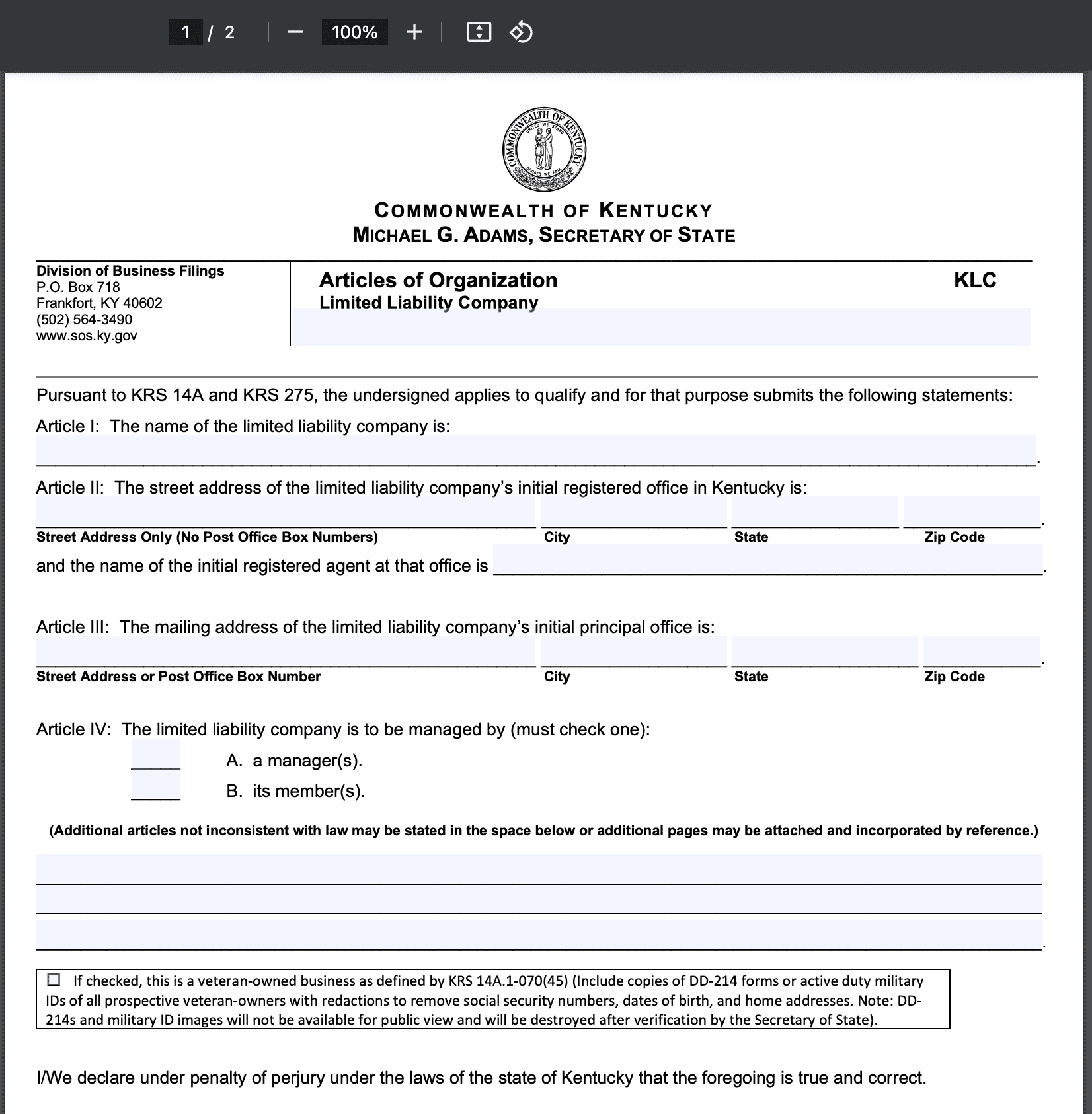

Step 3: File the Kentucky LLC Articles of Organization

Now is a great time to pay close attention. This is an exciting step that turns your idea into a legal entity. The Articles of Organization forms your Kentucky LLC.

While this step can be intimidating, it only contains basic information about your business entity. This includes:

- LLC Name

- Registered agent name and address

- Operating address and mailing address

- County of operation

- Management structure (member-managed or manager-managed)

- Industry and size

- LLC organizer signature(s)

The fee for registering a domestic LLC is $40. If you ever need to amend your Articles of Organization, a $40 fee is due each time.

Filing online through the Kentucky One Stop Business Portal is the easiest and fastest method. These are usually processed within 24 hours.

You can also file the Articles of Organization by mail to the Kentucky Secretary of State. The processing time can be longer. Kentucky does not offer expedited filing services.

Other LLC registrations

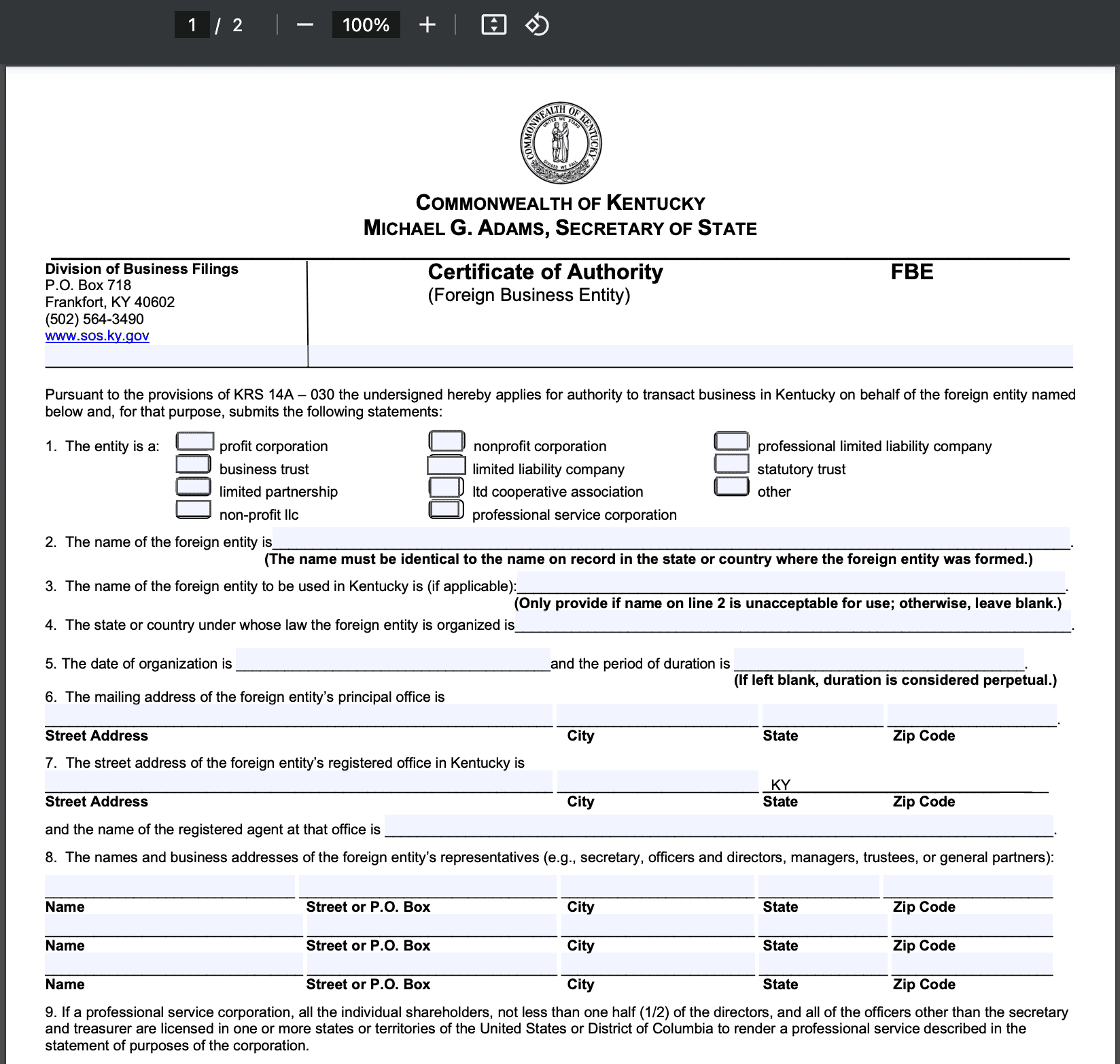

If you have an LLC from another state and would like to do business in Kentucky, you’ll need to register as a foreign business entity.

File an application for a Certificate of Authority with the Kentucky Secretary of State. The foreign LLC registration fee is $90.

There are also different forms for registering a non-profit LLC or a professional service LLC (PLLC).

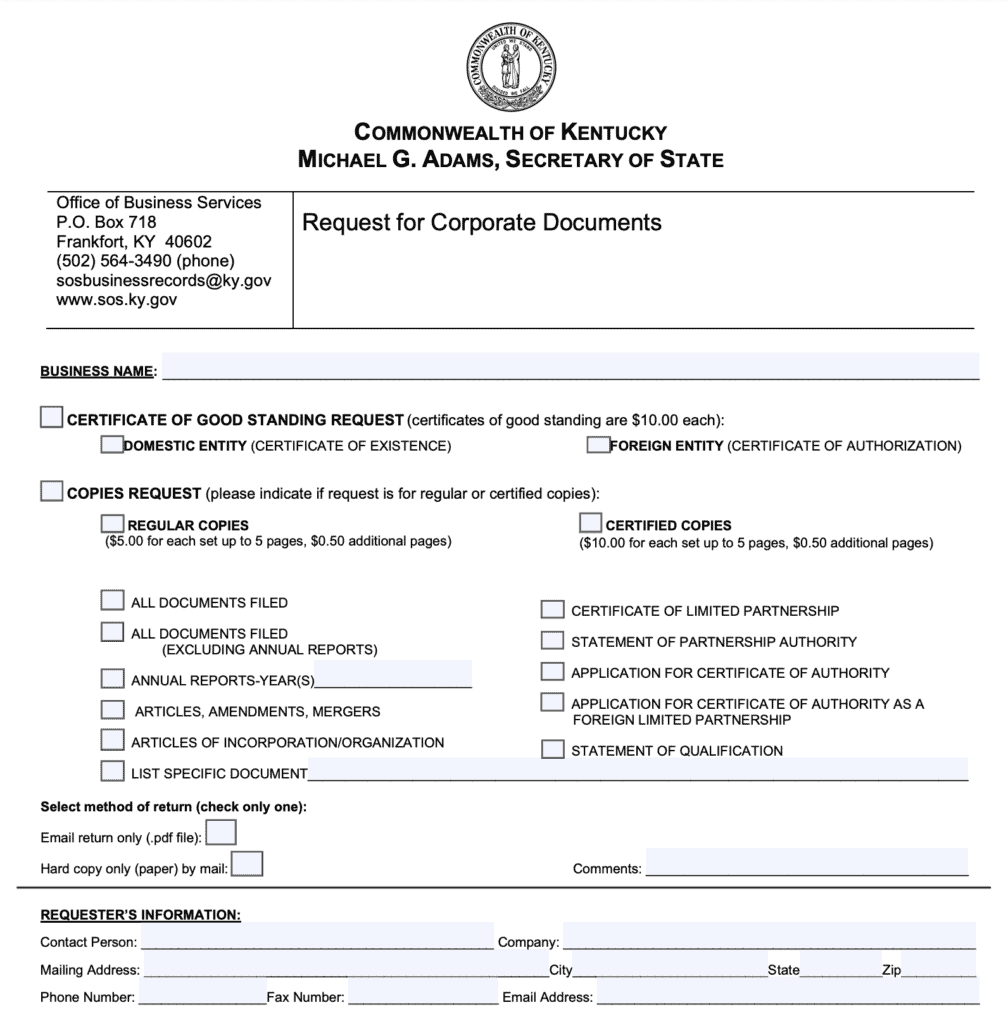

Step 4: Request a copy of the Certificate of LLC Registration

After the Secretary of State approves your LLC formation documents, you want to get a certified copy to keep with your records. You may also need it to open a business bank account or get a loan.

In Kentucky, use the Request for Corporate Documents form. There is a $10 fee for the first five pages, and if needed, $0.50 for each additional page.

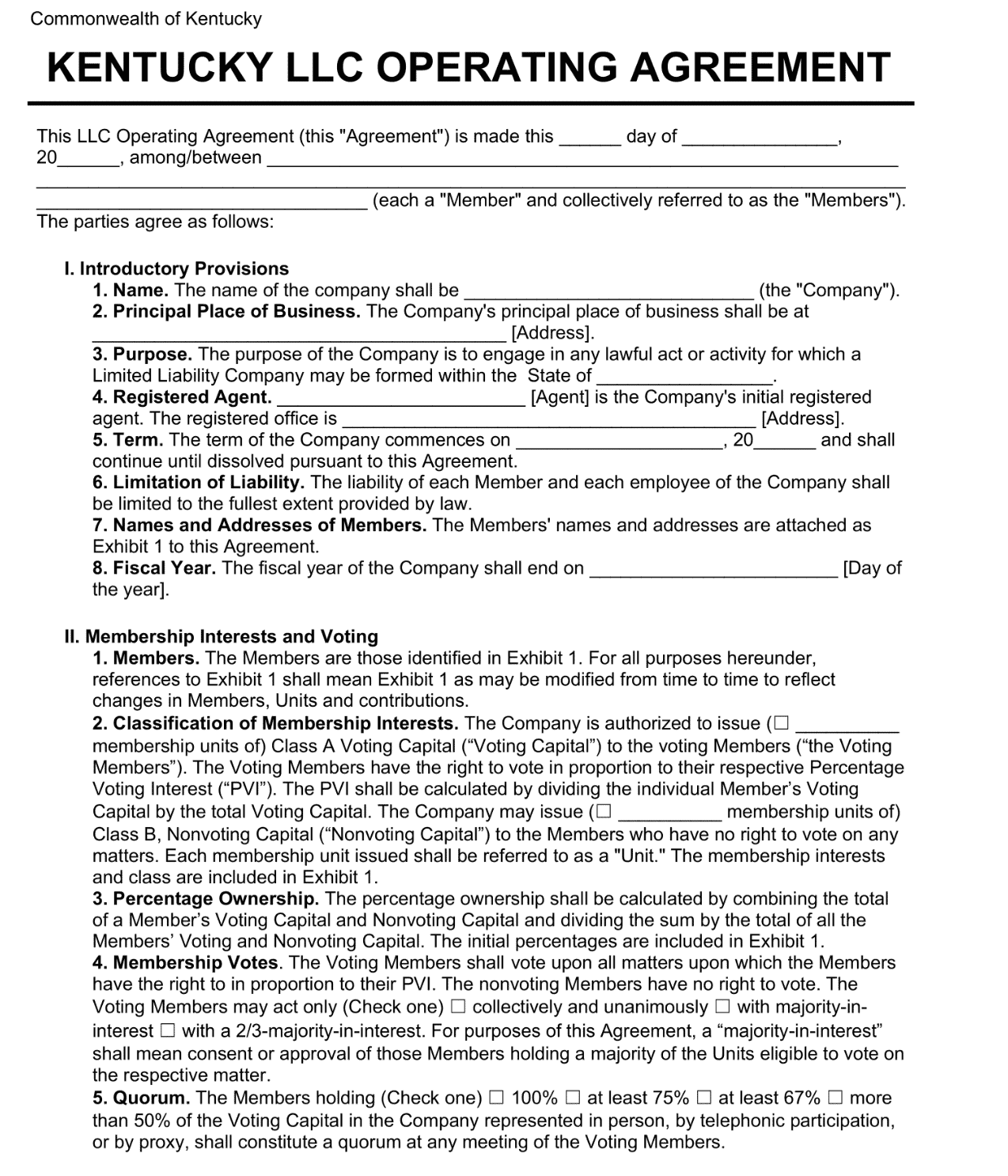

Step 5: Create an LLC operating agreement

Next up is drafting an operating agreement. This document is a contract between business members that helps lay out how the business functions.

Although Kentucky doesn’t require one, it is best to have an operating agreement in place. Kentucky law will step in to resolve disputes when an operating agreement is absent or insufficient.

Savvy business owners use them to ensure the business functions as they intend. It also provides predictability and prevents conflicts.

A well-drafted operating agreement covers things like:

- Rights and duties of LLC members and managers

- Ownership percentages and contributions

- Allocation of profits and losses

- Distribution timing and amount

- How to add or remove a member

- LLC dissolution procedure

You can draft an agreement using a free or low-cost online template. Or you can hire an attorney to customize one for you, which can cost $1,000 or more. The price can be worth it for complicated multi-member LLCs.

Step 6: Get an EIN (Employer Identification Number) from the IRS

Once your new legal entity is formed, you should obtain an employer identification number (EIN) from the Internal Revenue Service.

An EIN is the business equivalent of a Social Security number.

It is necessary to file federal tax returns for LLC members and employees. Also, some places may require an EIN to open a business bank account. Having EIN may help build the LLC's business credit rating and protect against identity theft.

The application process is straightforward, and you may obtain an EIN online. There is no fee.

Costs to set up an LLC in Kentucky

The minimum cost to start your Kentucky LLC is $40 to file your Articles of Organization and another $10 to get a certified copy.

Here's a summary of the costs of starting an LLC in Kentucky:

- Reserving a business name – $15 – $36 (optional)

- Registering a DBA – $20 (optional)

- Using a professional registered agent – $50 – $150/year (optional)

- Filing your LLC Articles of Organization – $40

- Obtaining copies of approved Articles of Organization – $10+

- Drafting an Operating Agreement – $0 – $1,000 (optional)

Further steps

Even after you registered your LLC, your work isn't quite finished. You may need to complete a few more tasks before operating.

Open a business bank account

Opening a business bank account is another key step in business formation.

Combining personal and business finances can cause disaster. If your LLC gets sued, your personal assets may be at risk. Using a business bank account helps prove that it is a separate entity. Business bank accounts usually have little to no monthly fees, usually $30 or less.

Register with the Kentucky Department of Revenue

Certain Kentucky LLCs need to register with the Department of Revenue (DOR). There are a variety of business taxes that may apply to your business, depending on the activities involved. For example, if the LLC sells goods or has employees, it must register with the state for employer withholding tax, sales tax, and use tax.

Head over to the DOR’s Business Registration page to see what your business needs.

Get licenses and permits

Before you start conducting business, check to see if your business needs any licenses or permits. Many state, city, and county organizations can require approval. Kentucky has a variety of state licenses and permits. These apply to certain occupations like financial services and gaming. But also can be needed for alcohol sales and construction.

You may also need local permission. For example, the City of Louisville and the City of Lexington offer certain licenses and permits.

Other resources

To blast through challenges, learn from the experience of others. You can get no-cost counseling from the Kentucky SBDC. Or join the Chamber of Commerce to be part of a large community of business owners. Furthermore, shopping for insurance policies is another wise step. General liability coverage can step in during many difficult situations.

This material is provided for informational purposes only. The provision of this material does not create an attorney-client relationship between Paul Donovan and/or Donovan Legal PLLC and the reader, and does not constitute legal advice. Legal advice must be tailored to the specific circumstances of each case, and the contents of this article are not a substitute for legal counsel. Do not take action in reliance on the contents of this material without seeking the advice of counsel.

LLC Formation Service

- Formed 1,000,000+ LLCs

- $39 formation includes registered agent service

- Fast formation & same day filing

- Exceptional customer reviews

Last updated:

Jan 2025

Last updated:

Jan 2025