When it comes to completely changing the name of your LLC, the process is similar to filing for a DBA.

You can do this independently or with an attorney or rely on web-based legal services to assist you.

If you plan to handle this process alone, just make sure you understand your state's requirements. Laws can vary significantly, and mistakes can require costly corrections later.

Here's how to change your LLC name:

- Verify Business Name Availability

- Approve a Resolution for the LLC Name Change

- File an Amendment Form for Your Articles of Organization

- Notify Tax and Business Licensing Agencies about Name Change

- Change Your Business Name on Other Documents and Assets

1. Verify business name availability

Just as you did during LLC formation, conduct a name search on your Secretary of State's online business database to see if your desired name has already been used or not.

Also, double-check with the United States Patent and Trademark Office (USPTO) for any trademark conflicts.

If you receive confirmation the entity name you want to use is available, you may consider paying for a name reservation to hold it. This prevents other businesses from claiming it and establishes your intentions for its use.

2. Approve a resolution for the LLC name change

If you’re part of a multi-member LLC, check your LLC’s operating agreement for any instructions to amend its name. A vote among the LLC owners may be necessary if there aren't any procedures for this process. If it passes, write up a resolution that summarizes the new amendment.

Typically, a resolution is a single-page document with the following information:

- Company name

- Date of passage

- Descriptive title of the approved action

- Details of action

- Signatures of those agreeing to the resolution

3. File an amendment form for your articles of organization

You will need to file articles of amendment with the state of authorities in your company formation state and pay applicable fees. Depending on the state, this form is called Certificate of Change, Certificate of Amendment, or Articles of Amendment.

For example, in New York, you would submit a Certificate of Amendment to the Department of State. This form and several others related to amending an LLC are available online. But must be printed out, completed, and returned in the mail.

While New York only requires your company to amend its Articles of Organization to reflect changes to its name, other states may need more. Be sure to check with your Secretary of State or business attorney about these requirements.

4. Notify tax and business licensing agencies about the name change

Once you have successfully changed the name of your LLC, you have to update numerous government and business licensing agencies about it.

Failure to take this vital step can have tax consequences later down the road because your EIN (Employer Identification Number) and other state business licenses will not be able to attribute your liabilities or refunds accurately.

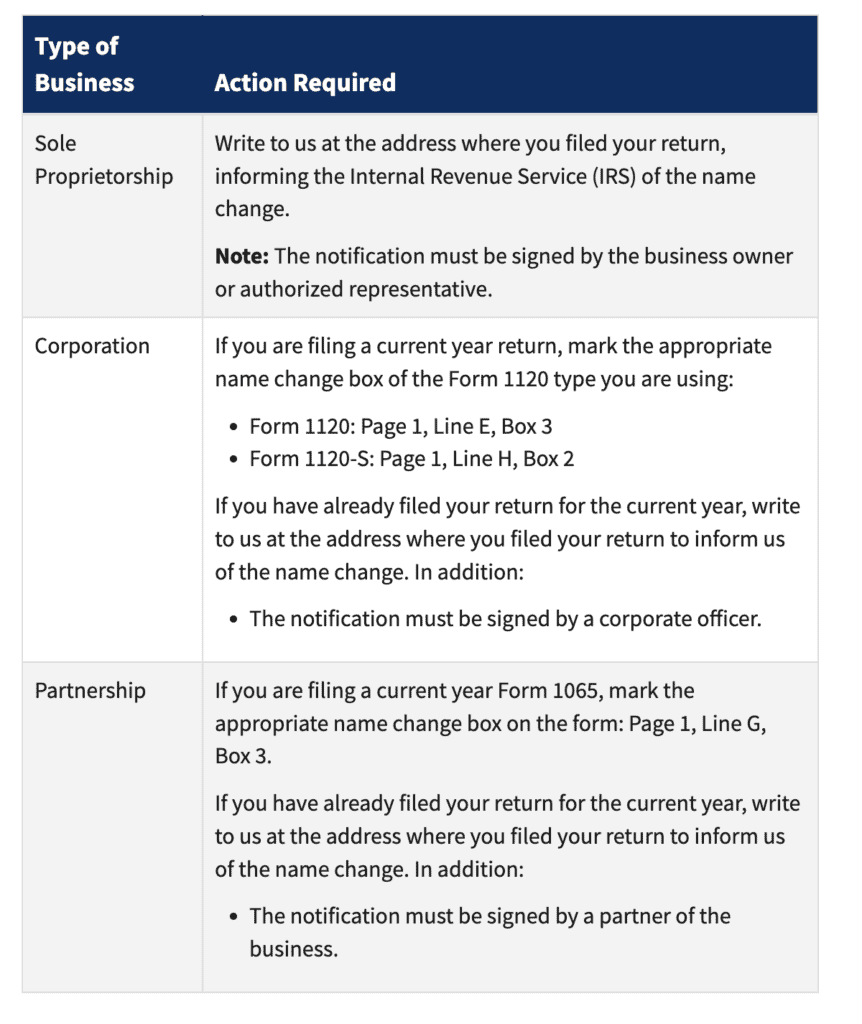

You can easily update this information with the IRS by checking the name change box on your filing. If you need to do this sooner, you can also send a copy of the amendment certificate and a letter explaining the name update request.

Similarly, you’ll have to inform all state agencies. Procedures for updating this information can vary depending on the licensing body involved, so don't hesitate to call ahead to get instructions on how to do so.

5. Change your business name on other documents and assets

After your LLC name change gets approved, you will need to create a quick checklist of all the other contacts, forms, and assets that need updating.

This includes vendors you do business with, as well as your customers and insurers. Everything that bears your old name will need to reflect your new one.

Here’s a checklist to go through:

- Documents including brochures, stationery, invoices, and other related forms

- You registered agent

- Website domain name, logo, and content

- Physical signage

- Business bank accounts, including credit cards, checking accounts, and tax returns

- Business cards

- Social media profiles

- Online review sites

- Contracts, including lease or service agreements

Also, ensure that your marketing material and overall strategy reflect your new identity.

FAQs about LLC name change

Here are some of the most common questions about changing the name of the LLC.