Small businesses power the U.S. economy, making up a whopping 99.9% of American companies – and paying billions of dollars per year in federal and state taxes.

As inflation and operating expenses have risen, small firms have become increasingly worried about the impact taxes have on their business. In fact, 16% now say taxes are their top problem in operating their businesses, up from 11% one year ago, according to the National Federation of Independent Business.

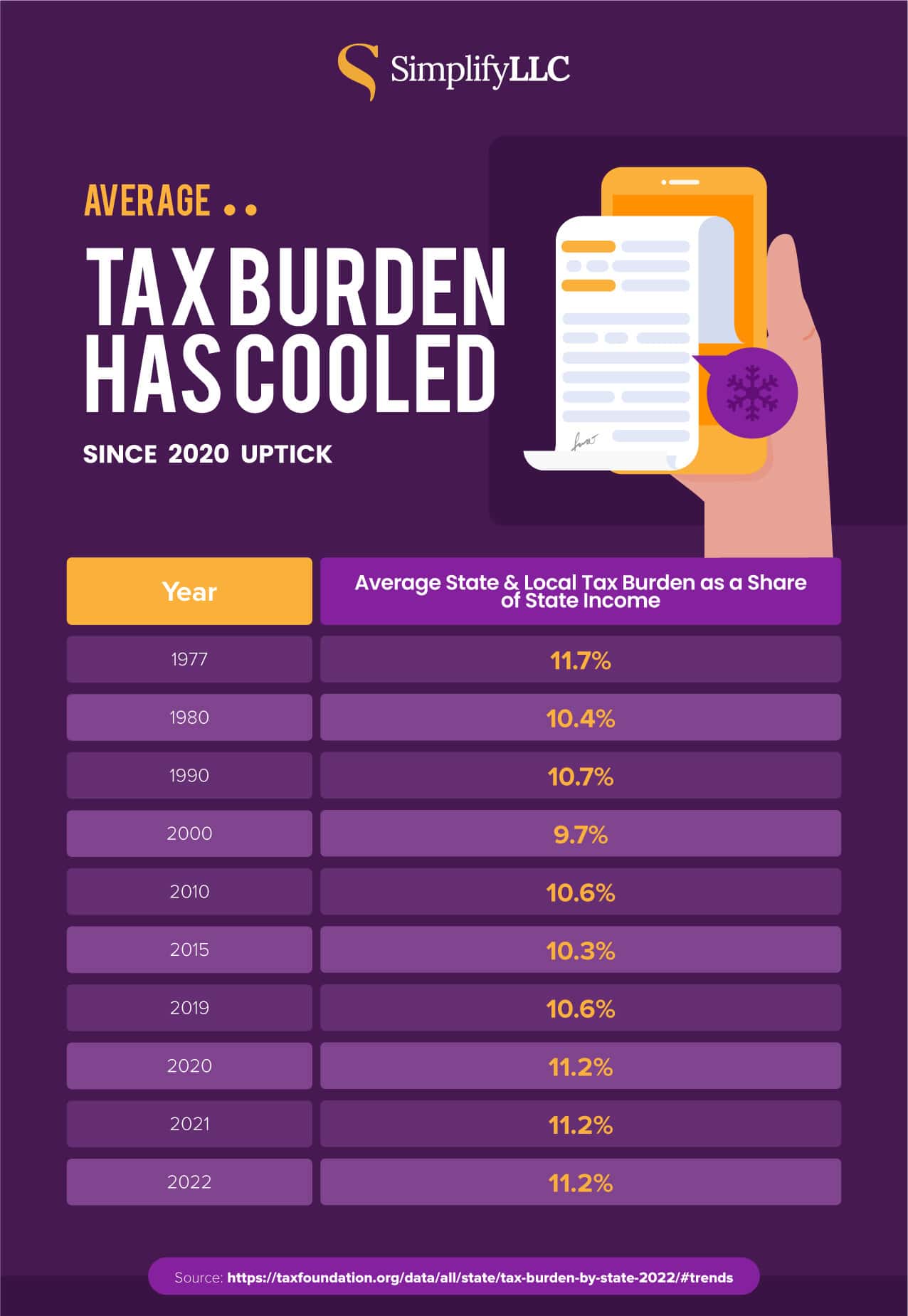

On average across the states, 11.2% of state income came from state and local taxes in 2022, the highest tax burden in decades. In addition, the federal tax rate can range from 10% to 37%.

Higher taxes not only hinders the ability of fledgling startups to succeed, but it can hurt the state’s economy by stifling innovation – measured by patents filed and inventors living in the state – according to the National Bureau of Economic Research. This is why many companies have fled states like California and New York for greener and tax-friendlier pastures such as Texas and Florida.

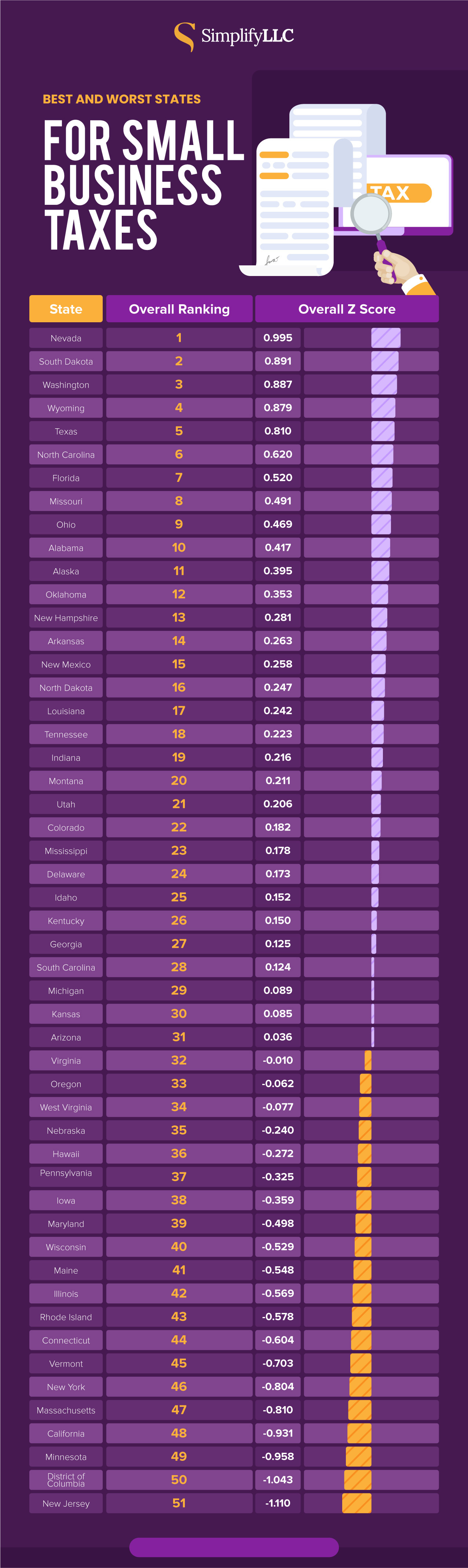

To find out which states are the most tax-friendly to small businesses in 2023, SimplifyLLC analyzed federal data across five key factors that impact small enterprises: corporate taxes, personal income taxes, sales taxes, property taxes and unemployment taxes.

Our analysis found that states with no or low personal and corporate income taxes are the most tax-friendly for small businesses, even when they have higher taxes for property, sales and unemployment compared with other states. Yet every state has pros and cons, meaning it’s important to keep your specific situation in mind when choosing where to launch or grow your business.

Key Findings

- Nevada No. 1 Best State: Fueled by no corporate or personal income taxes and, along with a handful of other states, has the lowest maximum unemployment tax rate at 5.4%.

- New Jersey No. 1 Worst State: Driven by the second-highest per capita property tax in the U.S. ($3,538) and high taxes on sales as well as corporate and personal income.

- None of the top five states – Nevada, South Dakota, Washington, Wyoming and Texas – have personal or corporate taxes.

Best States

None of the top five states – Nevada, South Dakota, Washington, Wyoming and Texas – have personal or corporate taxes, so what sets them apart from one another are their tax burdens across property, unemployment and sales. For example, No. 2 South Dakota’s average per capita property tax is $1,661, compared with $2,160 in No. 4 Wyoming.

There are some caveats, underscoring the importance of choosing the best state for your individual business needs. For example, instead of a corporate income tax, No. 5 Texas and No. 9 Ohio have other charges, while No. 1 Nevada imposes gross receipts taxes. No. 13 New Hampshire, meanwhile, doesn’t have a standard personal income tax, but it levies a tax of 5% on dividends and interest income.

Worst States

The worst places for small business taxes are New Jersey, the District of Columbia, Minnesota, California and Massachusetts. No. 48 California has the highest personal income tax rate in the U.S., at 12.3%, while No. 49 Minnesota has the highest corporate rate at 9.8%. Per capita property taxes are higher in the District of Columbia than anywhere else, followed by last-ranked New Jersey ($4,497 and $3,538, respectively).

While the poorest-scoring states tend to have high taxes across the board, there are a few notable exceptions. In New York, ranked 46th overall, the sales tax rate is 4% – one of the lowest rates in the country. Further, Connecticut and Vermont, which also rank in the bottom 10, both have an unemployment tax rate of 5.4%, tying with a handful of other states for the lowest rate in the U.S.

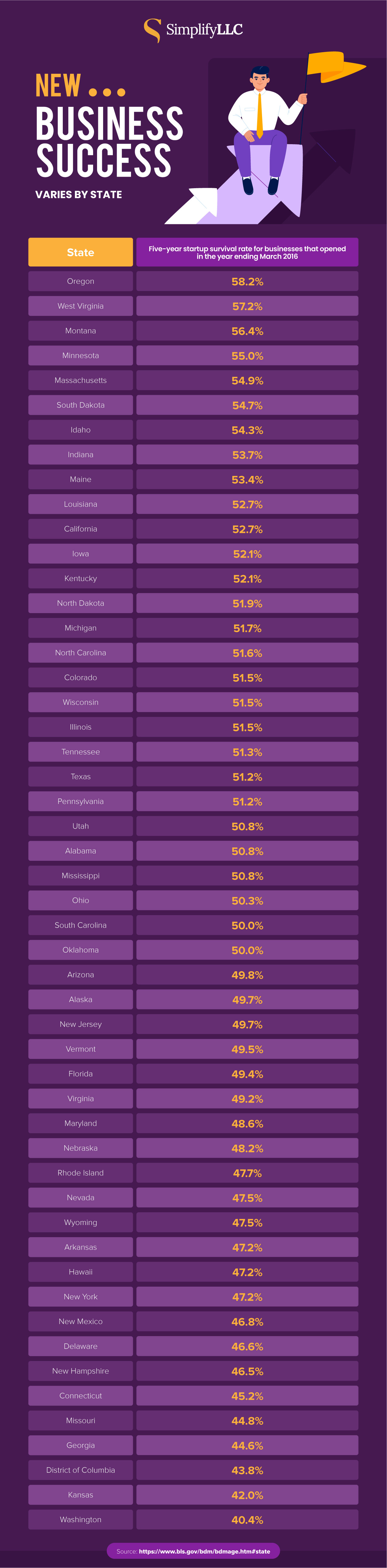

Small Businesses Survival Rates by State

While tax liability plays a huge role in operating a business, it is just one of many factors that contribute to success. Other factors include the overall state of the economy, creating a product or service that fills a need, and having a holistic solid business plan and executing on it. Below we rank in which states entrepreneurs have had the best and worst five-year survival rate.

5 Tips to Lower Your Business Taxes

Remember that tax laws are subject to change and can vary greatly between states. It's crucial to stay informed about the latest updates and consult with professionals who are well-versed in local tax regulations to ensure you're making the right decisions for your business.

- Structure Your Business Wisely: The legal structure of your business can impact your tax liability. Different structures, such as sole proprietorship, partnership, LLC, and corporation, have varying tax implications. Choose the structure that aligns with your business goals and provides the most favorable tax treatment.

- Take Advantage of Deductions and Credits: Common deductions include expenses related to business operations, such as supplies, travel, equipment, and office space.

- Invest in Tax-Advantaged Accounts: Contribute to tax-advantaged retirement accounts, like a 401(k) or an IRA (Individual Retirement Account). These contributions can be deducted from your taxable income, reducing your overall tax liability.

- Consider Depreciation and Amortization: Depreciation and amortization allow you to deduct the cost of certain assets over time. This can include things like equipment, machinery, and real estate. Different tax rules apply for different assets, so consult a tax professional to determine the best way to take advantage of these deductions.

- Hire a Qualified Tax Professional: A good accountant can help you identify opportunities for deductions, credits, and tax-saving strategies that you might not be aware of. A professional can also ensure that you're in compliance with tax laws and regulations.

Conclusion

The rise of remote work, shifting consumer attitudes and economic unpredictability means that every state offers something different for entrepreneurs. Whether you’re a fledgling startup looking for favorable conditions or an established company eyeing expansion opportunities, it’s important to understand the tax environment where you’re setting up shop.

Business structure, economic trends and regional tax policies all play a crucial role in determining the financial outlook for America’s 33.2 million small business owners, and well-informed entrepreneurs are better able to minimize their tax burden while leveraging strong business conditions.

Methodology

We used the most recent data for five metrics to determine the best and worst states for small business taxes. We used a Z-score distribution to scale each metric relative to the mean across all 50 states and Washington, D.C., and capped outliers at 2. We used weighted averages of the Z-scores to determine states’ overall rankings. Corporate and income tax rates were each weighted at 25%, while metrics spanning property, sales and unemployment taxes were weighted at 16.6% each. For the sales tax metric, we used 1.76% as Alaska’s rate because even though there is no statewide sales tax, local taxes on average equal 1.76%. Here’s a closer look at the metrics we used:

- Maximum corporate tax rate, 2023 (Federation of Tax Administrators)

- Maximum personal income tax rate, 2023 (Federation of Tax Administrators)

- Per capita property taxes, 2021 (Urban Institute)

- Sales tax rate, 2022 (Tax Foundation)

- Maximum unemployment tax rate, 2023 (U.S. Department of Labor)