Thinking about starting a limited liability company (LLC) in Kansas? Excellent choice!

Kansas offers a favorable cost of living and competitive tax rates. If you're considering hiring employees, you'll find a skilled workforce ready to contribute. The Kansas business center provides abundant startup resources to support your venture.

To establish your business in the Sunflower State, you'll need to handle a few administrative tasks. This includes preparing incorporation documents, applying for business licenses, and registering for taxes.

Excited to begin? Let's dive in!

Steps to Create an LLC in Kansas:

- Step 1: Choose a Name for Your Kansas LLC

- Step 2: Appoint a Registered Agent

- Step 3: File the Kansas LLC Articles of Organization

- Step 4: Get Certified Copies of LLC Registration Documents

- Step 5: Draft an LLC Operating Agreement

- Step 6: Acquire an Employer Identification Number (EIN) from the IRS

- Costs to Step Up an LLC in Kansas

- Further Steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Choose a Name for Your Kansas LLC

Get started by selecting a name for your Kansas LLC.

You might already have some ideas floating around. You’ll need to first verify they meet Kansas naming requirements as well.

To sum up, every Kansas LLC name must:

- Be different or distinguishable from existing businesses

- Include Limited Liability Company, Limited Company, or a similar abbreviation

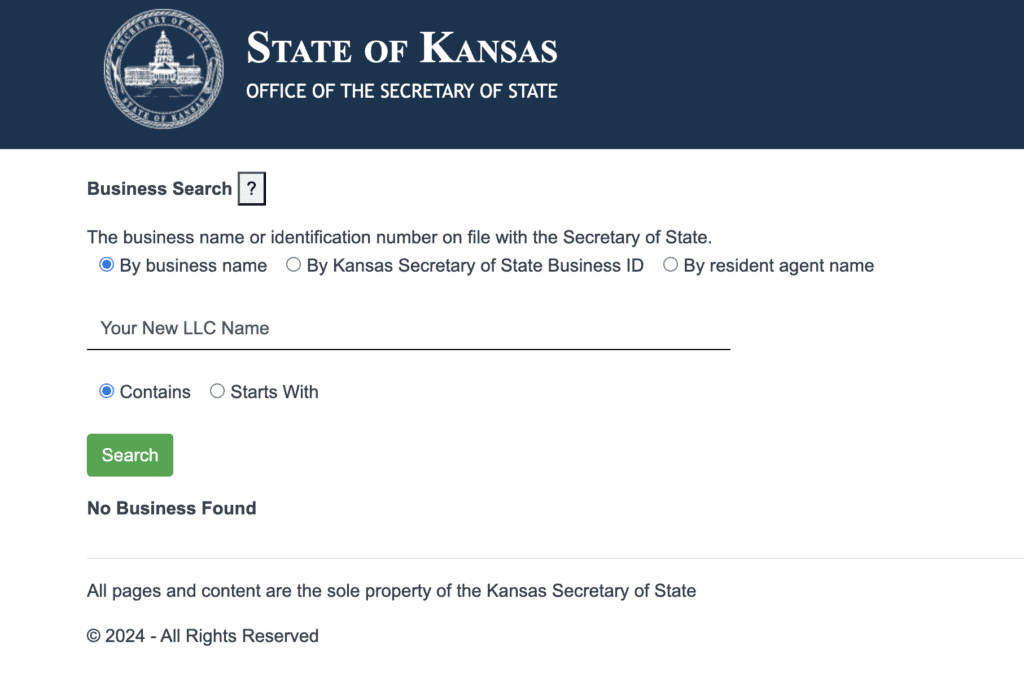

Once you have some ideas, head over to the Kansas Secretary of State name search tool. You can check to see if the name you want is available.

Name Reservation (optional)

Kansas allows you to reserve a business name for up to 120 days. This gives you time to prepare other formation documents without the concern that someone else might take the name.

To reserve a name in Kansas, file a name reservation form. The filing fee is $35 if mailed or $30 if filed online.

Trade Name (optional)

You can operate your business under a name that differs from your LLC’s legal name.

This is known as using a trade name or doing-business-as (DBA) name. It’s a popular tool used by many business owners. Unlike other states, you do not have to register your trade name with Kansas authorities.

You can register a state trademark in Kansas to add some protection and legitimacy to the trade name. Apply for a trademark/service mark registration with the Kansas Secretary of State. The filing fee is $40.

Step 2: Appoint a Registered Agent

You’ll have to choose a registered agent before filing your formation documents. A registered agent is a person or entity you appoint to receive legal documents on behalf of your LLC.

If your business gets sued, the notices go to the registered agent. It may also receive other official correspondence, like tax documents.

A registered agent must:

- Be at least 18 years old

- Have a physical business address in Kansas (not a P.O. Box)

- Be available during normal business hours

As the business owner, you can serve as your own registered agent. Some LLC owners choose to outsource registered agent responsibilities to free up their time during the day. Many find the cost to be worth it because:

- You won’t have to be available every day at the registered office address

- You can keep your address out of the public record, protecting your privacy

- You’ll avoid potentially embarrassing situations, like being served with a lawsuit in front of customers

In case you don't want to be your own registered agent, you can hire one for about $90-$249/year in Kansas.

Step 3: File the Kansas LLC Articles of Organization

Now we’re getting to the heart of your business formation. Filing the Articles of Organization is what transforms your idea into a legal entity.

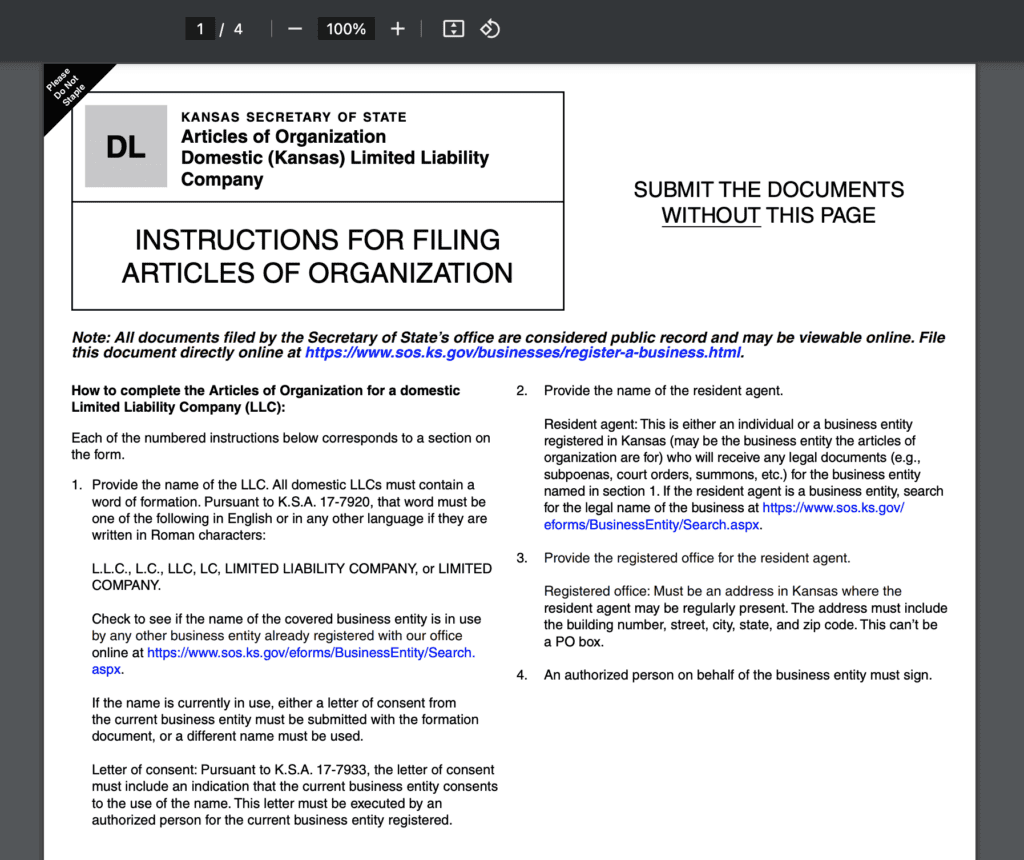

In Kansas, use Form DL to file the Articles of Organization for a domestic LLC with the Secretary of State.

If you have an LLC from another state and want to operate in Kansas, file Form FA to register a foreign LLC instead.

To file your LLC formation documents online in Kansas, please visit the Kansas Secretary of State's Business Filing Center.

On the Articles of Organization form, you must provide the following details:

- Your LLC‘s name and address

- Your registered agent details

- Tax closing month

Kansas does not require listing the names of all LLC members. You can include one LLC organizer.

The standard state filing fee is $165 for both domestic and foreign LLCs. Domestic LLCs can file online for $5 ($160) less and get quicker processing.

To file your Kansas LLC Articles of Organization by mail, send the completed form along with the $165 filing fee to:

Kansas Secretary of State Memorial Hall

1st Floor 120 SW

10th Avenue Topeka

KS 66612

Step 4: Get Certified Copies of LLC Registration Documents

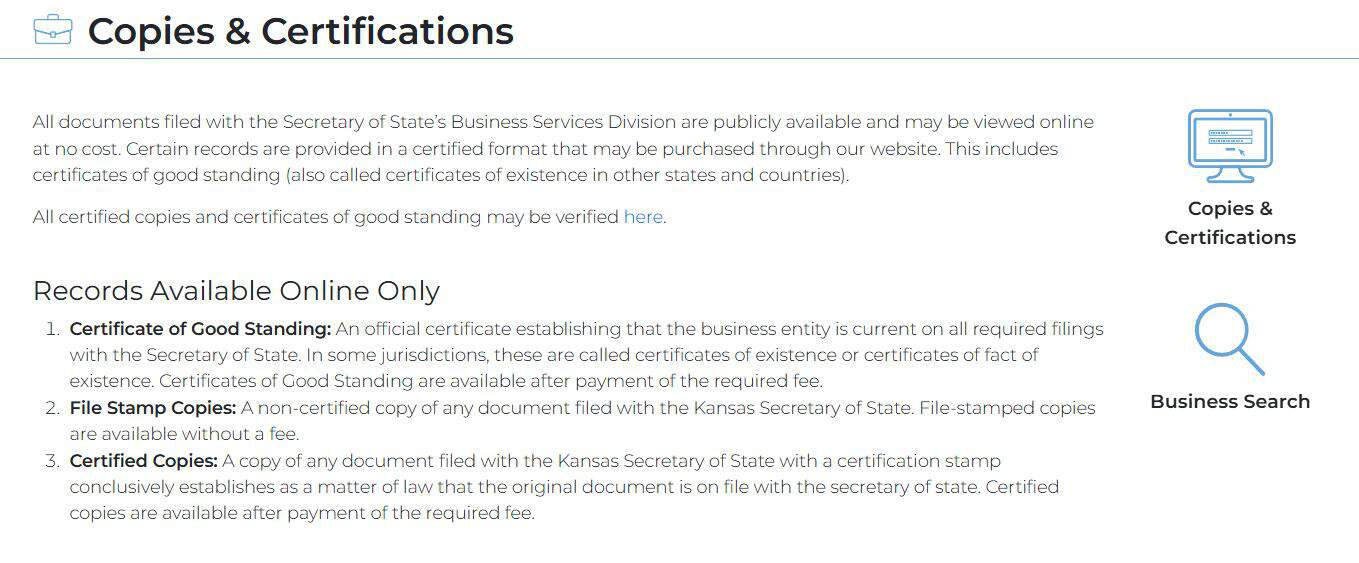

After the Kansas Secretary of State approves your Articles of Organization, you've officially started your Kansas LLC.

Before you get too far along, obtain certified copies of your approved LLC formation documents.

This is optional, but highly recommended. In Kansas, certified document copies are $35 plus $1 per page.

Keep these with your company's records. You may need to provide them to open a business bank account or receive business loans.

Step 5: Draft an LLC Operating Agreement

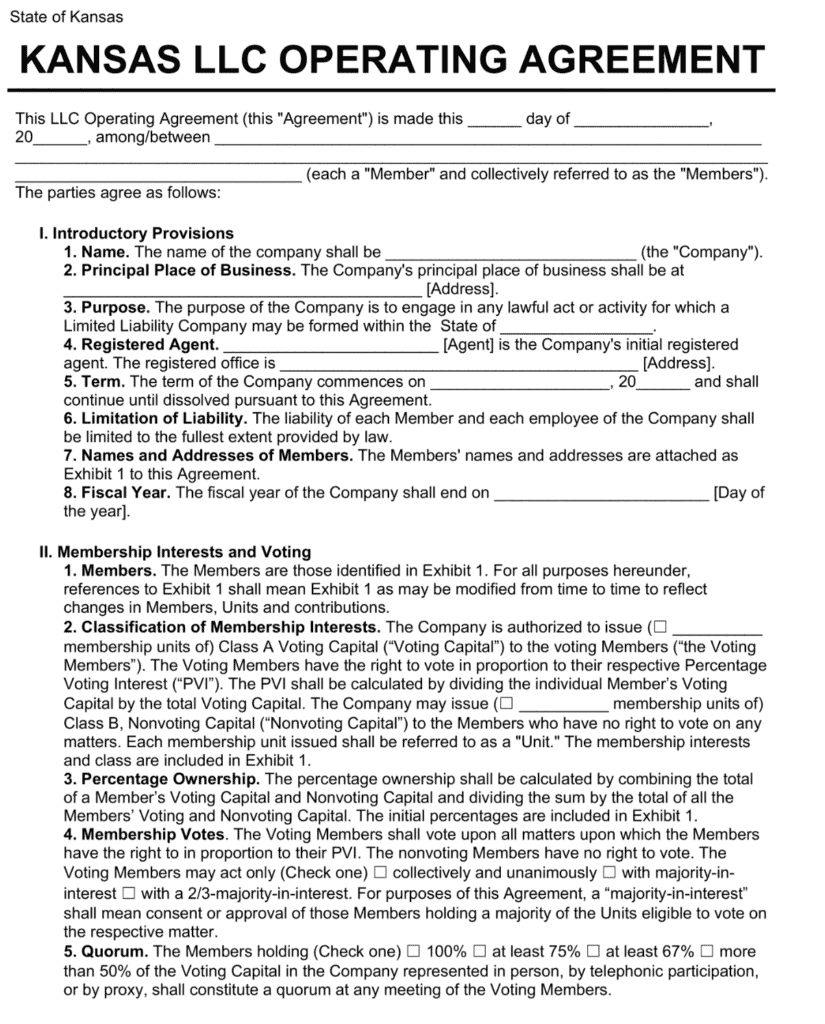

The next part of starting a business is creating an operating agreement.

This is an internal contract between owners and managers that outlines how the business functions and handles many situations.

While not mandatory, it is advisable to have an operating agreement to outline the management and operational structure of your LLC.

If you don’t have one, Kansas law will step in to resolve disputes. The results can be surprising and may not be what you have in mind. Experienced business owners use operating agreements to ensure that everything works out as they intend.

Well-drafted operated agreements include things like:

- Duties and rights of members and managers

- Ownership percentages and contribution amounts

- Distribution of profits or losses

- How to add or remove members

- Procedure for winding down the LLC

An operating agreement is essential if your LLC has more than one member. But it’s best practice to have one in all cases. Your LLC's operating agreement doesn’t have to be filed with the Kansas Secretary of State.

You can draft your own LLC operating agreement using an online template. Or hire a corporate attorney to handle it for a fee.

Step 6: Acquire an EIN (Employer Identification Number) from the IRS

An EIN is a unique nine-digit number issued by the Internal Revenue Service (IRS). It’s similar to a Social Security number. The IRS uses them to track tax information and employment activities.

Having an EIN is mandatory for multi-member LLCs. Single-member LLCs classified as sole proprietorships must get an EIN if they choose to hire employees or meet other requirements.

EINs can also be necessary to establish business credit and open business bank accounts.

Apply for an EIN on the IRS website. It’s quick and free. You’ll get the EIN issued in minutes.

Costs to Set Up an LLC in Kansas

Kansas is a relatively inexpensive place to start your LLC.

The minimum cost to form an LLC in Kansas is $160 to file your Articles of Organization online for a domestic LLC (foreign is $165). Add $35 for a certified copy of the filing.

Other optional costs of starting an LLC in Kansas include:

- Name reservation: $35

- Trademark registration: $40

- Professional registered agent: $90+ / annually

- Articles of Organization: $160 – $165

- Certified document copies: $35+

- Operating agreement: $0 – $1,000

Further steps

At this point, you’ve reached a major milestone. Your Kansas LLC is established and you've almost finished setting it up. Don't forget about the last few things.

Open a Business Bank Account

LLC owners should open a business bank account separate from their personal accounts. Combining personal and company finances can cause disaster. If your business gets sued, your personal assets may be at risk. A business bank account is also helpful for recordkeeping and tax information.

Kansas City Credit Union, Bank Midwest, and the Central Bank of Kansas City offer banking services for small businesses. There are many national providers as well. Monthly fees range from free to about $30.

Register with the Kansas Department of Revenue

Many businesses need to register with the Kansas Department of Revenue (DOR). The exact needs depend on the activities of your operation.

You may need a sales tax permit in Kansas if your LLC provides taxable services or sells taxable products. The DOR also handles liquor taxes and employee withholding.

As part of the DOR’s business registration process, you’ll answer a questionnaire to help determine your needs.

Obtain Licenses and Permits

Kansas has compiled a large list of business activities that may need approval from state agencies. Then turn to the city and county authorities to get what your LLC needs.

For example, the City of Wichita and Overland Park have lists of available licenses and permits. You can find similar information for Johnson County and Sedgwick County.