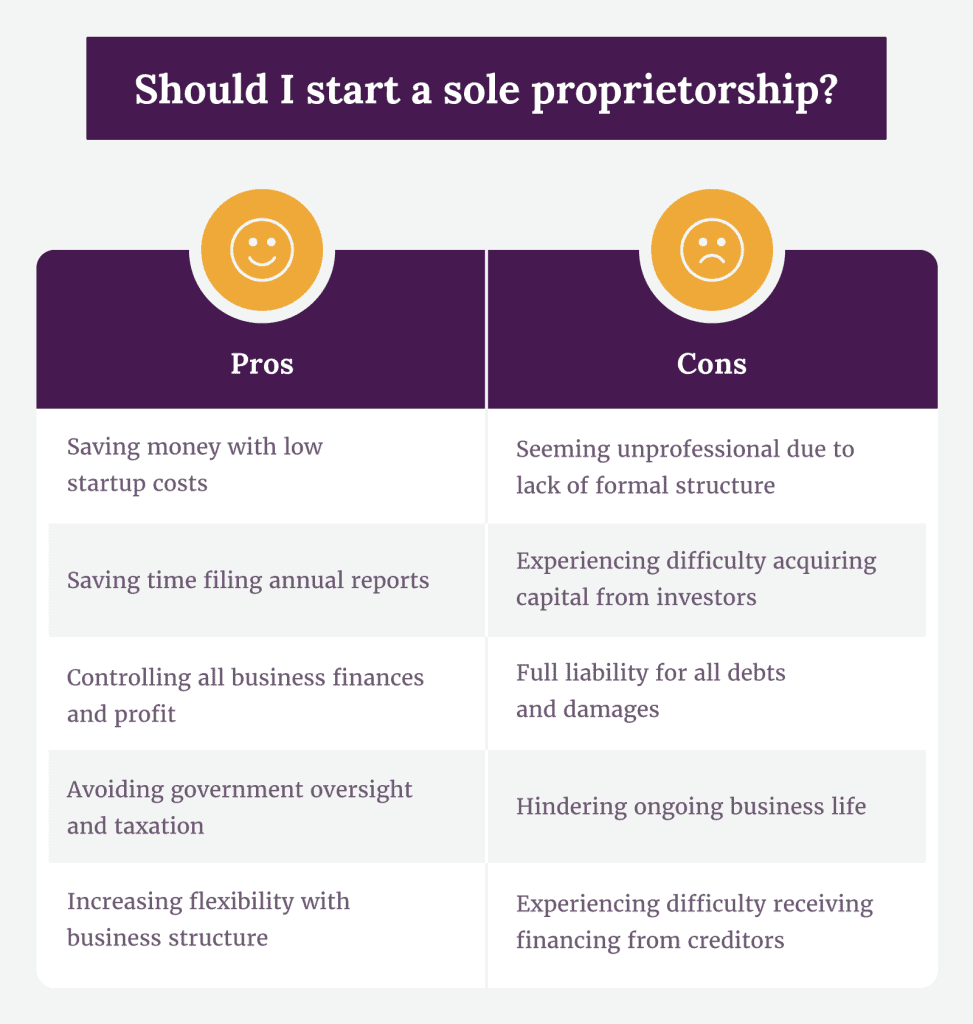

Starting a sole proprietorship is advantageous for aspiring small business owners looking to streamline the startup process and save money on filing fees. However, you should carefully consider some disadvantages.

This guide will cover the sole proprietorship pros and cons and answer some frequently asked questions.

What is a sole proprietorship?

A sole proprietorship is an unincorporated business operated by one individual where there's no legal separation between the company and the owner. It's one of the most common business structures since it's so easy to get started.

In this type of business structure, you don't have to take any action to create a formal business structure. You're technically already operating under this structure as long as you're the only owner.

Pros of a sole proprietorship

Since there's no formal process for getting started, the advantages of the sole proprietorship are mainly the simple startup, cost-effectiveness, and less paperwork.

1. Saving money with low startup costs

Formally registering a business entity involves many different fees and startup costs to get up and running. Filing fees will vary depending on your state of incorporation. Fees range from as little as $40 to as much as $500.

In a sole proprietorship, you won't have to register your business with the Secretary of State's office, so these fees won't apply to your business.

2. Saving time filing annual reports

Under other legal business entities, filing an annual report is required. There's also an associated filing fee and potential late fee if you fail to send your report in on time. Sole proprietorships don't require any annual reports.

3. Controlling all business finances and profit

As a sole proprietor, you won't have to split any profit with other participating members. You also won't have to separate business and personal incomes. Any business income is also your personal income.

Likewise, when you don't have a business partner, you have complete control over business finances.

Let's say you'd like to find an office space to rent for business purposes; as a sole proprietor, you'll have the final say as to how much you'd like to spend on rent and any relevant office essentials.

4. Avoiding government oversight and taxation

Since you won't need to register a legal structure with the state as a sole proprietor, there are fewer forms to fill out. You won't have to submit Articles of Organization, prepare business minutes, or file a recurring annual report to the Secretary of State's office.

In the same vein, since there's no separation between your personal and business income, you won't need to pay taxes except for your personal tax return.

5. Increasing flexibility with business structure

In a sole proprietorship, you have complete control over day-to-day operations. You can decide when meetings are held if any processes should be updated, and the active hours of operation during the day.

Cons of a sole proprietorship

While many financial and logistical benefits are mentioned above, the lack of formal structure and increased liability are considerable cons of a sole proprietorship. Be sure to consider the disadvantages of a sole proprietorship when selecting a business structure.

1. Seeming unprofessional due to lack of formal structure

Even if you run a tight ship, lack of a formal business structure can be perceived as unprofessional by financial institutions and potential colleagues. Legally registering comes with significant monetary and time commitments but can provide your business with increased credibility and liability protection.

2. Experiencing difficulty acquiring capital from investors

Lack of formal structure and perceived lack of professionalism can make it difficult to raise capital from investors. Investors want to feel like their money is going to a business in secure standing. When you forgo the protections of a formal business structure, this can make your sole proprietorship feel like a risky investment.

3. Being liable for all debts and damages

Being the sole proprietor means your business isn't a separate legal entity. If your business has any outstanding debt or any incident involving the business, you're 100% responsible and can be sued for damages incurred.

4. Hindering ongoing business life

Legally, you and your sole proprietorship are the same entity. If you were to pass away unexpectedly, the business would end. That makes it challenging to plan for ownership succession and subsequent business survival.

5. Experiencing difficulty receiving financing from creditors

Sole proprietorship implies any company debt will be your personal debt as well. Creditors see that as a risk, which affects your ability to receive funding for your business from a lender.

Running a sole proprietorship can hinder your ability to borrow funds you may not have readily available. Capital is necessary to keep business operations moving. Losing the ability to receive a business loan can particularly affect beginner entrepreneurs running their own businesses for the first time.

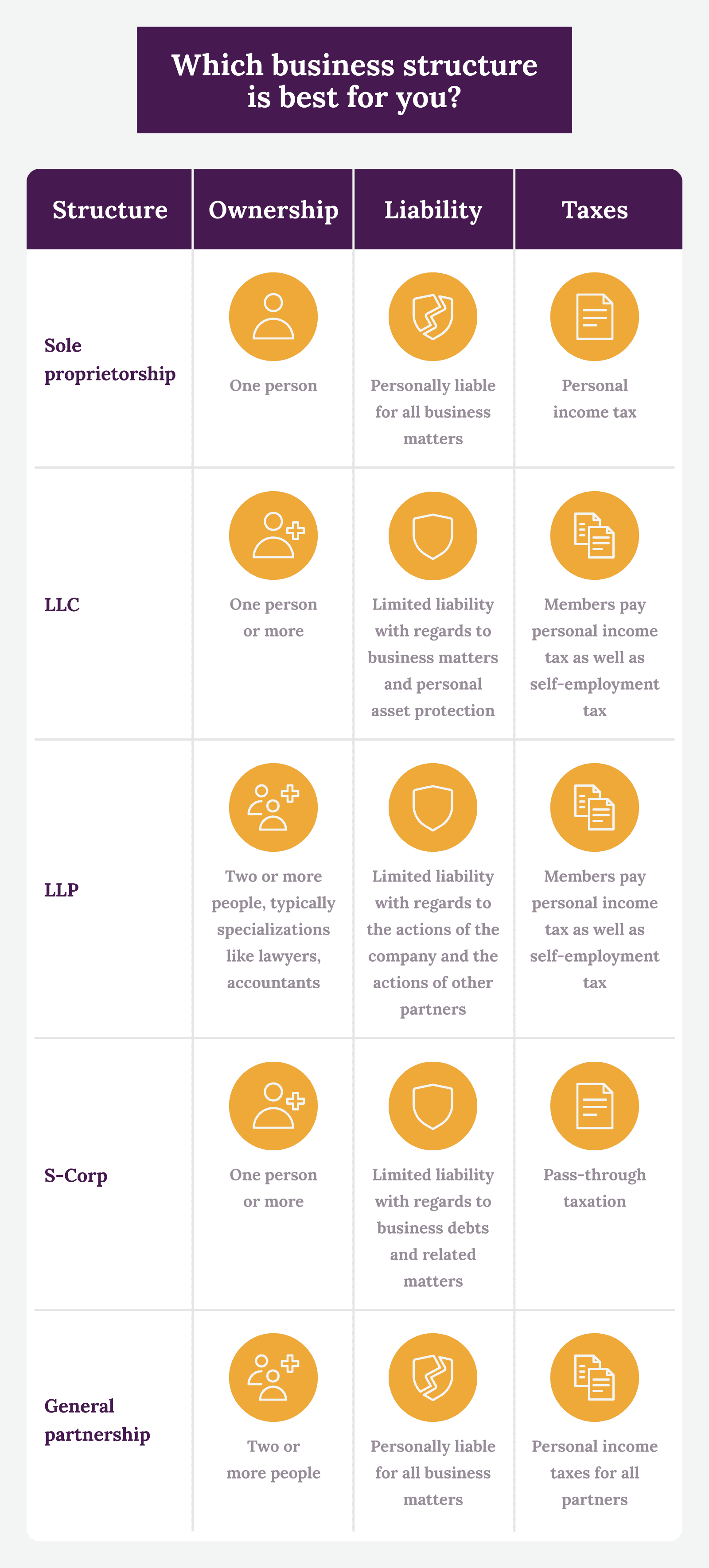

Alternatives to sole proprietorship

If you're looking to start a specialized firm or start a business with a partner, a sole proprietorship may not be the best fit. If you'd also like to take advantage of certain tax benefits granted to formal business structures, you may consider opting out of sole proprietorship.

LLC

A limited liability company (LLC) is a formal business entity where the owner receives limited liability and personal asset protection without corporate taxation. An LLC can be owned and operated by one person like a sole proprietorship.

Given the similarities, you're likely wondering, “Is an LLC a sole proprietorship?”

In short, an LLC is not a sole proprietorship. The largest difference is the increased legal protection against any company wrongdoing. Members are not personally liable for business debts or incidents, unlike a sole proprietorship.

LLP

A limited liability partnership (LLP) is a formal business entity run by multiple members, increasing owners' legal protection. Owners receive limited liability with regards to the business's actions and limited liability against the actions of other owners.

An LLP is unlike a sole proprietorship because there need to be multiple people owning and operating the business. Likewise, this structure is only available in certain states. LLPs are typically only used by specialized companies like accounting and law firms.

S Corporation

An S corporation (S-corp) is a tax status of an LLC that provides additional tax advantages. If your LLC has 100 shareholders or less, you will be taxed as a partnership and not as a corporation.

A sole proprietorship will not be able to have any shareholders. Therefore, unless you decide to register as an LLC first, you won't be able to take advantage of the S-corp status.

General partnership

A general partnership (GP), much like a sole proprietorship, is an unincorporated business where the owners take full responsibility and liability for all business assets, debts, and potential incidents. Unlike a sole proprietorship, a general partnership requires two or more people at a minimum.

General partnerships also benefit from a cost-effective and convenient startup process. Partners will need to create a written partnership agreement, but they typically won't need to file formal paperwork with the state.