As the name implies, a real estate LLC is a business entity formed solely to make real estate investments.

Regular limited liability companies provide a range of services or sell goods.

On the other hand, Real estate LLCs often have no activities other than owning and managing properties.

If you plan to invest in several real estate projects, forming an LLC is a smart decision.

First of all, an LLC gives you more tax flexibility. Secondly, you can use it to pool capital from several investors without exposing your personal assets.

However, company formation is a decision every real estate professional has to take independently after weighing all the pros and cons.

Advantages of LLC for real estate investing

The reasons for using an LLC vary for each investor. But there are many universally practical benefits of using an LLC to purchase real estate:

- Personal liability protection

- Tax benefits over a corporation

- Easy ownership transfer

- Flexible management structure

- Fast access to good credit history

- Ability to add foreign investors

1. Personal liability protection

The most common reason investors use LLCs to invest in real estate is to reduce personal liability.

By investing through an LLC, your liability is limited to the assets held by your LLC, such as cash in the bank account or property investments.

Should anything wrong happen on or to the property, your personal assets will remain off-limits to creditors or legal persecutors.

Here are several scenarios where an LLC creates an added layer of security:

- Protection against tenant lawsuits when operating rental properties

- Extra personal asset protection in cases when your homeowner's insurance policy doesn’t cover accident

2. Tax benefits over a corporation

Real Estate LLCs can elect a federal tax classification.

By default, single-member LLCs are taxed as a sole proprietorship. Multi-member LLCs report taxes as a partnership.

In both cases, the business income and expenses of the LLC flow through to the individual investor. Meaning you’ll report company profits on a personal income tax return and pay personal income taxes.

LLCs can also deduct business expenses incurred with owning real estate. It reduces your overall tax burden. Depreciation is a large deduction when owning and investing in real estate, and LLC members can claim this deduction to lower personal tax liability.

Alternatively, you can elect to get taxed as an S-corp or C-corporation.

In this case, you can better separate business and personal taxes. And, for example, choose to draw a small salary or receive dividends as a means to getting paid from your LLC. But mind that double taxation will apply to LLCs, reporting taxes as a corporation. That means you’ll have to pay state corporate income taxes on business profits and then personal income taxes on the money you’ve received from your LLC. Corporate tax rates alone are relatively high in many states.

3. Easy ownership transfer

An incorporated status lends some attractive benefits to ownership transfer. You can quickly sell interest in your LLC to transfer a property (or some fraction of it) to another investor. The process is simple and governed by applicable state laws. You can also transfer a company ownership percentage to family members.

To do so, you’ll have to add them as a new LLC member and document their rights and allocations in the LLC operating agreement.

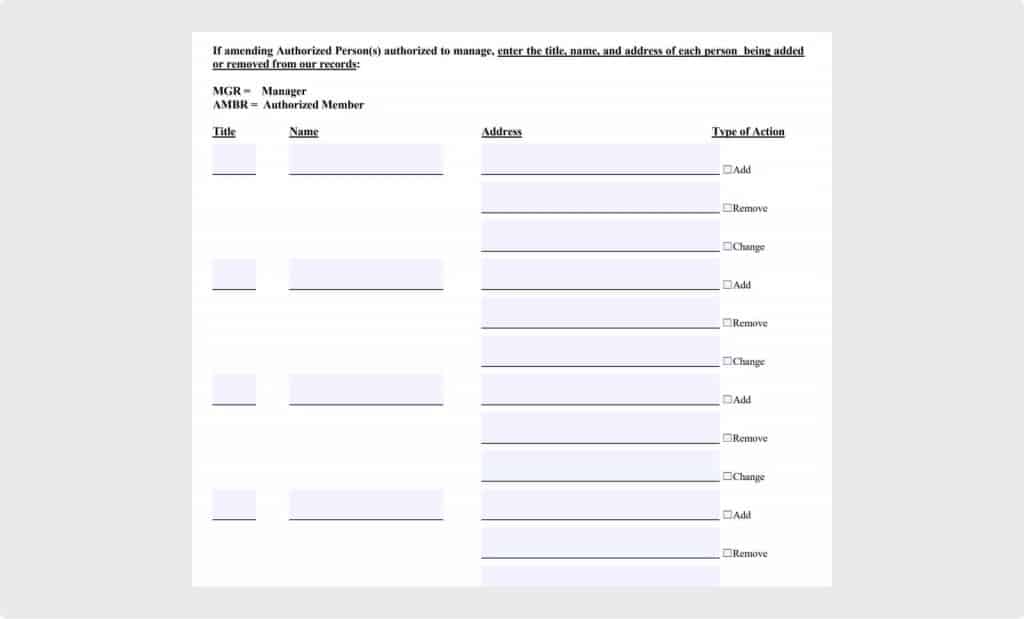

For example, in Florida, you’ll have to file an LLC amendment application to list new members being added or removed. Once approved, the change will come into effect.

Flipping investment properties through an LLC is also easy and cost-friendly.

Because you can transfer ownership and sell the interest rather than selling the property itself. That alone can save a ton of money in realtor fees.

4. Flexible management structure

Many investors outsource property management to professional companies. Doing so frees up your time for more exciting stuff like starting another type of business or renovating more investment properties.

LLC allows you to quickly appoint a third-party (non-owner) as a manager of your company. Another common option is to divide managerial duties between different LLC members. These duties should be outlined in the operating agreement.

5. Fast access to good credit history

LLCs can take out loans like an individual investor. Depending on the down payment, property performance, and creditworthiness of the LLC, banks will determine the amount of credit they can extend.

Banks can offer non-recourse loans for companies with a good credit history. A non-recourse loan is not personally guaranteed by LLC members. That limits your personal exposure to liabilities. LLCs can also use one property to secure a loan for a second property.

Another investment strategy is to purchase an existing real estate holding with good credit history to secure more competitive offers.

6. Ability to add foreign investors

Investing through a real estate LLC allows you to pool money from multiple members to purchase assets.

Even better — you can add foreign national(s) (non-US citizens and residents) as LLC members. Doing so is an easy way to help your foreign family or clients purchase property in the US.

However, if that’s the route you take, ensure that you’re compliant with the rules and regulations provided by the Securities and Exchange Commission (SEC) for real estate securities and exemptions.

Disadvantages of LLC for real estate investing

Investing in real estate through an LLC is beneficial in many ways. However, there are also some downsides to using an LLC.

Here are the disadvantages of using an LLC for a real estate investing business:

- Extra maintenance costs

- Limitation to one state

- State business property taxes

- Automatic LLC dissolution clauses

- Obtaining a loan can be challenging

1. Extra maintenance costs

Setting up an LLC comes with a range of operational and maintenance costs such as:

- Filing articles of organization

- Registered agent services

- Annual report fees

- Minimal annual franchise taxes (in some states)

Annual report filing fees and requirements vary by state. Some states require annual report submissions. Others have bi-annual renewals. Then there are some places with no annual fees or reports for an LLC. Similarly, only certain states collect minimal annual franchise taxes — a flat or progressive tax applied towards all incorporated business entities despite their income.

Business owners should comply with the filing rules and requirements, plus pay all the state fees.

2. Limitation to one state

LLCs can only buy property in the state they are registered. Meaning, if you want to purchase property through a Georgia LLC, your company needs to be incorporated in the said state.

If you're going to build a portfolio of assets across the country, you’ll have to set up a separate LLC in every state you intend to buy. It increases the operating costs due to state registration fees, annual filing requirements, and minimum franchise taxes previously discussed.

3. State business property taxes

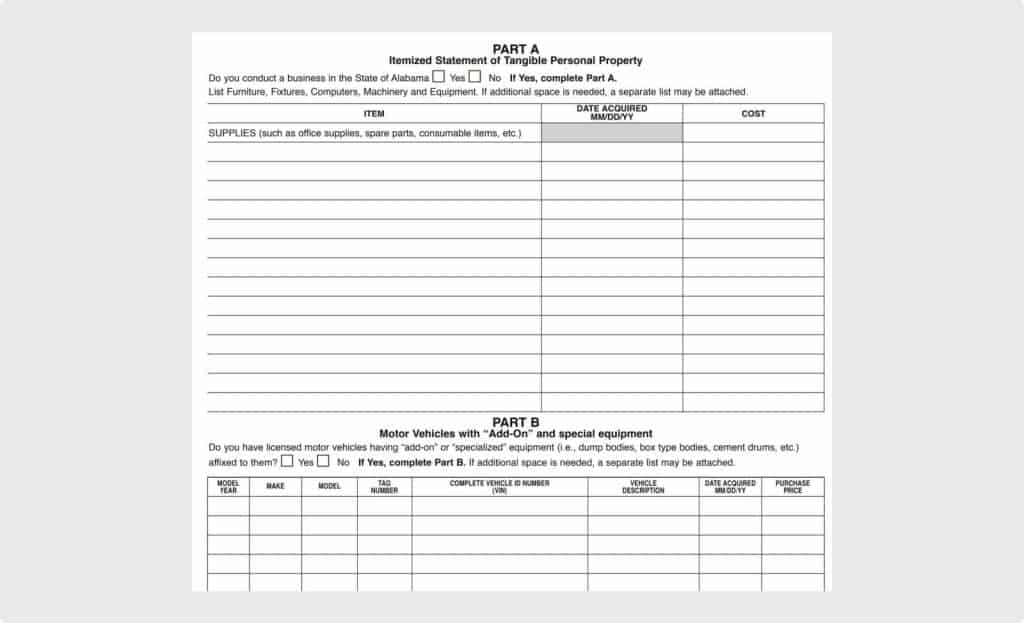

Some LLCs in states such as Maryland, Indiana, and Kentucky collect taxes on business personal properties (BPP) of a specific value. These taxes are different from real estate property taxes.

Business property taxes are levied on assets (intangible or tangible) owned or leased by a company.

The business property owned by the LLC can be subject to tax at the state level and property taxes on the real estate at the local level.

Above is an excerpt from the Alabama Personal Property Tax Form, which requires LLC owners to report and pay tax on items owned, personal property leased or rented, and other assets held by the LLC.

4. Automatic LLC dissolution clauses

An LLC can be dissolved automatically under certain conditions:

- Upon the death of the owner — this complicates estate planning, can make inheritance/estate planning difficult, and creates challenges in dealing with other members of the LLC.

- After declaring bankruptcy — again, this can be inconvenient.

You should address the above issues in your operating agreement. Consult with a corporate attorney to ensure that your legal entity will be protected against involuntary dissolution.

5. Obtaining a loan can be challenging

Obtaining a loan through an LLC can be a hit or miss.

Banks are unlikely to offer you competitive interest rates as a brand new company with no credit history.

If a loan is issued, they may ask that the loan be recourse and also that each member personally guarantee the loan. In that case, the lender can impose joint or personal liability on each member of the LLC defaults.

Obtaining a mortgage for an LLC-owned property can be difficult depending upon the investment and type of property.

LLCs are also not eligible for typical residential loans, such as FHA loans accessible to first-time homeowners.

So unless you purchase or join a company with an attractive credit record, securing a loan may be challenging.

Can an LLC get a residential mortgage?

Typically, yes. It’s possible to get a residential mortgage through an LLC.

However, if your company doesn’t have assets to back that loan, a financial institution may ask LLC members to guarantee the loan personally and pledge their personal assets as collateral.

Conclusion

Each investor must decide whether to invest in real estate through a real estate LLC is for them.

In most cases, people who realize the most benefits from an LLC are serial real estate investors who hold multiple properties.

Specifically, they enjoy:

- Better asset protection in the case of lawsuits or default

- Tax flexibility and legal ways to a lower personal income tax rate

- Ease of pooling money from multiple members

- Flexible transfer of interests when selling properties

FAQs about real estate LLCs

Here are some frequently asked questions regarding real estate LLCs.