You can elect an S-corporation status for your limited liability company (LLC) so long as it meets the Internal Revenue Service’s (IRS) requirements.

Making this change is for federal tax purposes and can provide significant savings. It doesn’t create a new business entity or change the legal structure of your LLC. You’re still an LLC for statutory purposes but are an S-corporation for tax purposes.

Changing your tax classification can impact other areas of your business beyond finances. So it’s best to seek out legal advice before making any changes.

But the key to remember is: You’re not changing your company’s legal structure. You’re changing how it’s taxed.

Why convert an LLC to S-corporation?

The short answer is for tax savings. Reducing your tax bill is the primary reason entrepreneurs elect to have their LLC taxed as an S-corporation.

For this to make sense, you need to understand how LLCs are taxed by default.

An LLC is a business structure created under state laws. But federal tax laws treat LLCs as a “pass-through” entity — meaning they don’t recognize an LLC as a tax class.

Some of the types of entities under the U.S. federal tax code include:

- Sole proprietorships

- Partnerships

- Corporations

- Trusts

- Estates

You’ll notice that LLC isn’t included on this list. So how then does The IRS tax LLCs?

The default tax classifications for all LLCs are:

- Single-member LLCs are taxed as sole proprietorships

- Multi-member LLCs are taxed as partnerships

Owners of both sole proprietorships and partnerships are considered self-employed by the IRS. And that means they’ll pay:

- Self-employment tax of 15.3% on all company profits

- Income tax ranging from 10% to 37% on all business income

These default designations mean LLC owners can’t take advantage of the tax benefits corporations get to enjoy, like no self-employment tax or higher expense deductibility.

For these and other reasons, US Congress created Subchapter S of Chapter 1 of the tax code that created the S-corporation tax classification.

Any eligible business can elect to be taxed as an S-corporation. (We’ll talk about the requirements in a bit). While choosing to have your LLC taxed as an S-corporation instead of the default sole proprietorship or partnership has extra tax advantages, the decision comes with a catch called reasonable compensation.

Reasonable compensation rule

An LLC, taxed as an S-corp, must pay its owners a reasonable salary. That’s because the business owners are also considered employees in this situation.

There’s no clear definition of what makes compensation “reasonable.” But generally, you must factor in the members’:

- Time and effort devoted to the business

- Training, education, or experience

- Duties and responsibilities

- Comparable salaries at comparable companies for similar services

- Payments to non-shareholders

The compensation paid to owners will be taxed just as if paid to any other employee. So that means the company will pay:

- 7.65% for FICA tax (e.g., Social Security and Medicare taxes)

- State and federal unemployment tax rates

But the real advantage of an S-corporation is that any payments made to the owner over the reasonable salary amount are considered a distribution of profit and not subject to any self-employment tax. That can lead to significant tax savings.

Let’s look at a basic example to help illustrate the differences between the various tax scenarios.

|

Sole proprietorship & partnership |

S-Corporation |

|||

|

Gross revenue |

$ 500,000 | Gross revenue | $ 500,000 | |

|

Expenses |

$(375,000) | Salary |

$(50,000) |

|

|

Net income |

$125,000 | Other expenses |

$(325,000) |

|

| Net income |

$125,000 |

|||

| Personal income tax rate | 20% | |||

|

Self-employment tax rate |

15.3% | Personal income tax rate | 20% | |

|

Employment tax (FICA) Rate |

7.65% |

|||

|

Income tax |

$25,000 | Income tax |

$25,000 |

|

|

Self-employment |

$19,125 | Employment tax (FICA) |

$3,825 |

|

|

Total tax |

$44,125 | Total tax |

$28,825 |

|

|

Potential tax savings: $15,300 |

||||

Although this example is elementary, it helps to show that there’s potential for significant tax savings by electing to be taxed as an S-corporation.

Steps to change LLC’s tax status from default to S-corporation

Switching your LLC to an S-corp for income tax purposes isn’t difficult. But you’ll want to make sure you meet the requirements and deadlines to qualify.

1. Verify your eligibility for S-corporation election

Most LLCs will meet the basic IRS requirements to be taxed as an S-corp:

- Be an eligible domestic (US-based) company

- Have 100 or fewer shareholders, which can only be:

- Individuals (US residents and nonresident aliens)

- Certains trusts

- Certain estates

- Have only one class of stock

If you tick all the above, you are good to apply.

2. Mind the tax election due dates

Tax entity classification elections must be made within a specific timeframe. You’ll need to notify the IRS about your decision to switch no later than two months and 15 days after the start of the tax year when you want the election to take effect.

If you decide that starting January 1, 2022, you would like to be taxed as an S-corporation, you must inform the IRS by March 15, 2022.

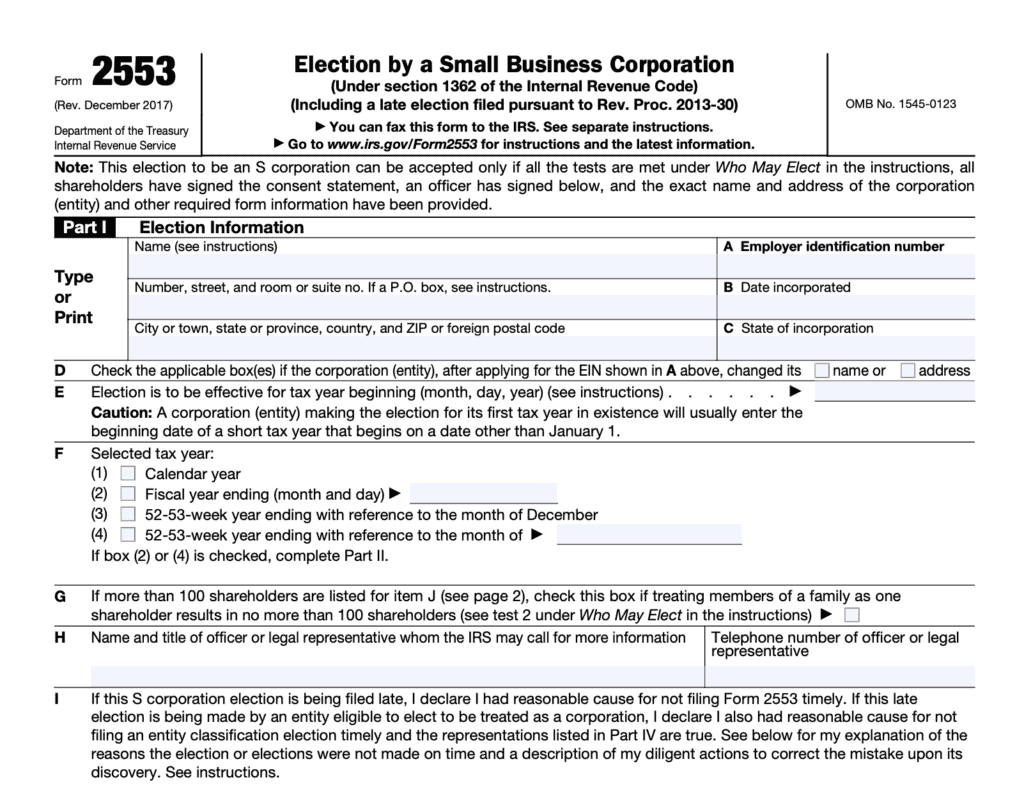

You inform the IRS of the above by filing Form 2553, Election by a Small Business Corporation.

3. Complete and file Form 2553 with the IRS

When you submit your completed IRS Form 2553, you’re officially letting them know you want your LLC to be taxed as an S-corporation.

The form is only four pages long. You’ll need to provide company contact information, tax year, and ownership information. But it gets tricky in two places.

- All owners must sign the form to consent to the S election. It’s fine if you’re a single-member LLC. But if your business has multiple members, getting everyone’s signature on one form will take coordination.

- Page 3 asks some technical tax questions to which you may not know the answer. So you may want to get your CPA or tax professional involved when completing Form 2553.

You can expect it to take the IRS at least six to eight weeks to process your election request. But while you wait, continue to operate your company as if it were already an S-corp.

Once approved, your S-corp election will remain in effect until the IRS revokes it or you withdraw it.

Choosing S-corp tax status for your LLC is a complex decision that can have impacts beyond taxation. So be sure to consult with your tax and legal advisors.

Conclusion: Which is better for taxes, LLC or S-corp?

Generally, most LLCs will benefit from being taxed as an S-corporation.

LLCs, by default, are taxed based upon the number of owners. Single-member LLCs get taxed as sole proprietors, and multi-members are taxed as partnerships. And both subject the owners to self-employment tax, in addition to income tax.

S-corporation tax status eliminates the self-employment tax because members will be employees and owners. As employees, you’ll need to be paid a reasonable salary, and the remaining company profits will be taxed as income on the member’s personal tax return.

FAQs about LLC to S-corporation conversion process

Here are some frequently asked questions regarding the S-corporation tax class election for LLC.