You have launched a new small business, but things didn’t go as planned. That’s alright because failure is an inevitable part of every entrepreneurial journey.

Now, as part of the “wrap up,” you need to figure out how to close your limited liability company (LLC) to avoid any adverse legal consequences.

Closing an LLC is typically referred to as an LLC dissolution — a legal process every state has in place for terminating the existence of a business structure either voluntary by members or forcefully by the state.

But if you’re looking up this topic, your company probably has a good standing with the local authorities. Thus, you’d have to complete the closing process yourself.

There are multiple causes for the dissolution of an LLC, including the failure to pay the annual reports with the LLC’s Secretary of State, bankruptcy, or the voluntary dissolution by the LLC’s members.

Steps Needed to Close an LLC:

- Step 1: Hold an LLC dissolution meeting with other stakeholders

- Step 2: Fulfill any outstanding business, financial, and tax obligations

- Step 3: File articles of dissolution with the secretary of state

- Step 4: Close your business bank account and cancel insurance

- Step 5: Divide the remaining assets between LLC members

1. Hold an LLC dissolution meeting with other stakeholders

This primarily applies to multi-member LLCs since single-member companies probably have the majority vote.

According to state laws around LLC statutes, you must secure the majority vote from LLC members to dissolve a company. The exact requirements may vary from one state to another.

For example, in Florida, per Fla. Stat. 605.0701, dissolution is only effective if consent is provided unanimously by all LLC members. Delaware LLCs are bound to secure the consent of members who hold ⅔ of the company ownership, interest, or profits as per the Limited Liability Act.

So before dissolving your LLC, you must check with your state for the requirements on how many member votes you need to close your LLC.

If there are no state-specific requirements, follow along with the provisions in your operating agreement. For example, 75% or 5 out of 6 “in favor” member votes are required to dissolve a company.

2. Fulfil any outstanding business, financial, and tax obligations

Your next step is to ensure that you’re leaving no loose ends. Precisely, you have fulfilled all the business, financial, and tax obligations.

Business obligations

Here are some of the business obligations that need to be wound up before dissolving your LLC:

- Inform all your clients about closing down your business

- Close the office location and cancel your lease

- Cancel your Doing Business As (DBA) name with the state

- Start to selling equipment to recoup some costs

- Cancel registered agent service and any other business subscriptions

- Cancel general business license and sales tax permit (if applicable)

Financial obligations

Next, tackle all the outstanding bookkeeping and accounting tasks to get your finances in order. Some must-do steps include:

- Pay all employee salaries and contractor fees.

- Fulfill all account payables to vendors/supplies

- Close your financial books for the year

- Give creditors a notice

The last step is hugely important. Once you decide to close your LLC, you’ll inform all creditors that your business will soon be dissolved.

Having this information will allow the creditors to know when they can file a lawsuit against the company. Usually, the time frame is three to five years within the dissolution of the business.

Different states have different requirements when it comes to an official notice. You should check your Secretary of State rules to determine how much information you need to give and whether you need to publish the official announcement in a newspaper.

Tax obligations

LLC dissolution doesn’t remove any outstanding state and federal tax obligations your business may have.

Specifically, you may have to report and pay:

- State franchise taxes

- Sales and use tax

- State employment taxes

- Federal personal income taxes

- Federal corporate income taxes

Many states will not permit the LLC to file the “Articles of Dissolution” with the State’s Secretary of State (SOS) without first paying outstanding franchise tax for the current year.

For example, if you would like to dissolve your LLC in November of 2024, you must first pay the franchise tax to the state where your LLC is organized (e.g., California).

On a federal level, you may also have certain taxes due to the Internal Revenue Service (IRS). Conveniently, the IRS has a checklist of the actions you need to take when closing a business.

- File a final tax return and related forms (for every LLC member)

- Take care of your employer taxes

- Pay the taxes you owe

- Report payments to contract workers

- Cancel Your EIN (Employer Identification Number)

- Close your IRS Business Account

- Keep all records

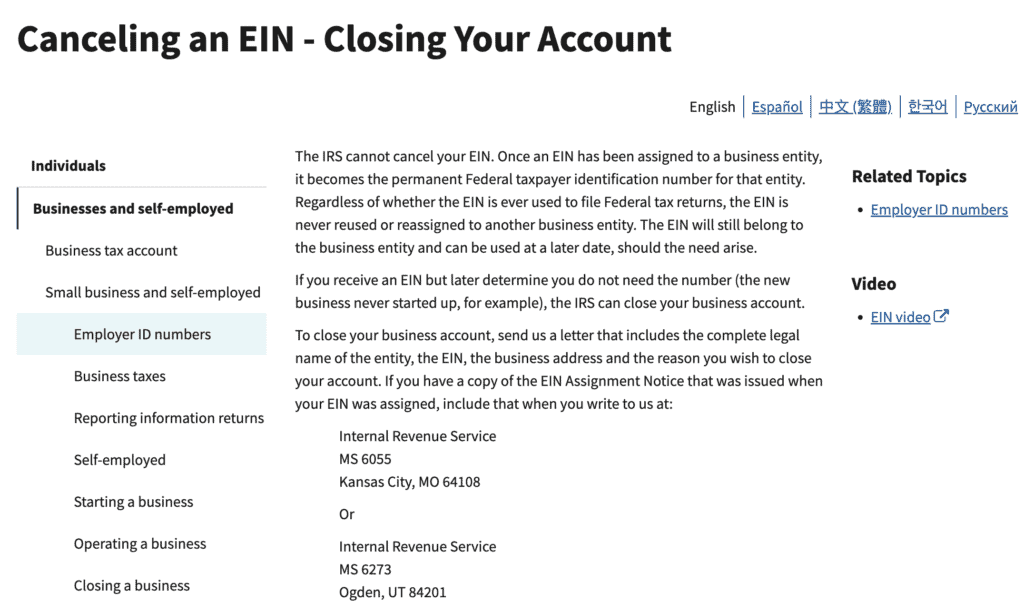

All of the above steps are probably familiar to you. So let’s dwell on the new one — canceling an EIN and closing a Business Account.

Your EIN is a permanent federal taxpayer identification number, and technically you can’t cancel it. Instead, you should inform the IRS about seizing your corporate activity. Then an IRS will close your Business Account (and stop tracking your EIN).

To close a Business Account, you must send IRS a letter that includes:

- The complete legal name of the business

- The business EIN and EIN Assignment Notice (if you have a copy)

- The business address

- The reason you wish to close the account

The feds will then process your request and close your account. However, you’re still required to keep all business-related financial records.

It’s crucial to do this if the IRS decides to audit your tax returns during the period the LLC operated.

Failure to maintain records could result in the unnecessary taxation of either previously reported income or qualified business expense deductions.

Can my LLC affect my personal credit?

No. Legally, an LLC is viewed as a business structure, separate from its members (owners).

It means that creditors can’t go after its individual members for outstanding debts. Since LLC members have personal liability protection, your company’s debt or even bankruptcy will not affect your personal credit score.

3. File articles of dissolution with the secretary of state

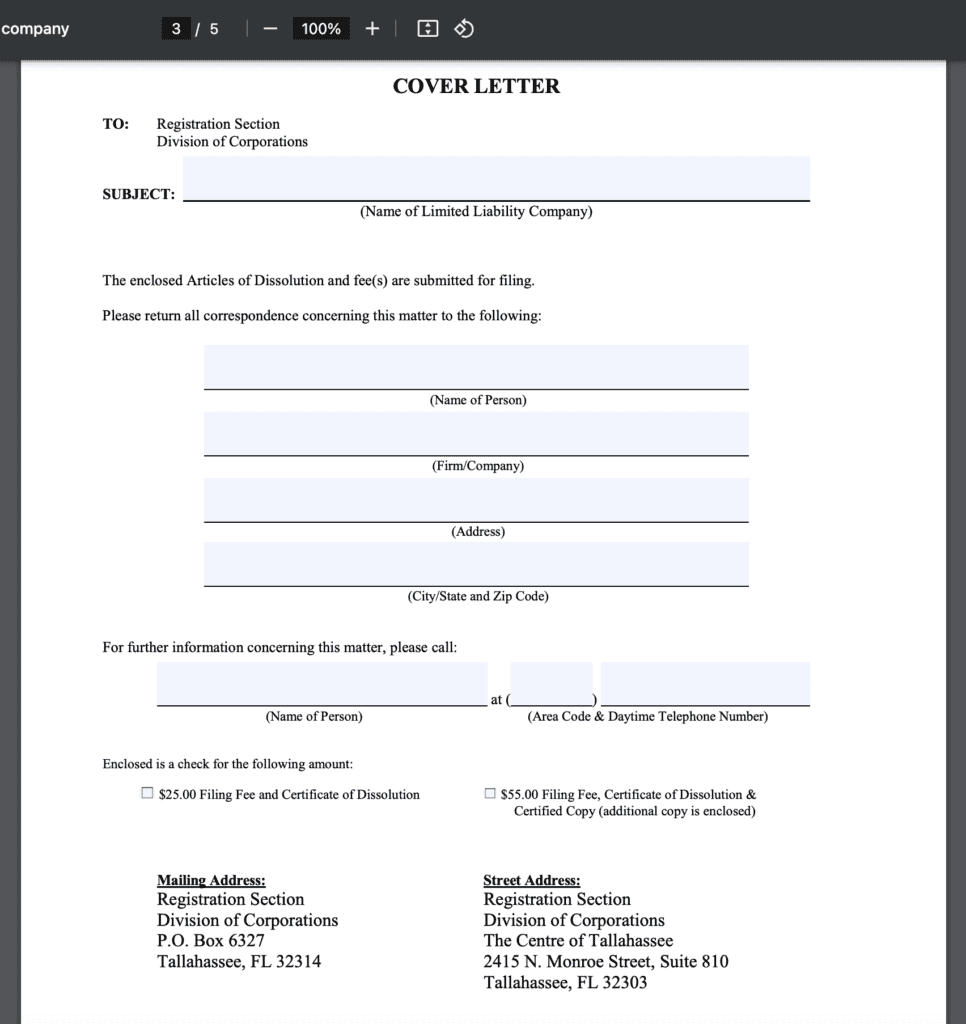

To dissolve your LLC, you’re required to file Articles of Dissolution with your Secretary of State where your LLC is formed.

The Articles of Dissolution are usually a one-page form requiring you to provide the following details:

- LLC name

- Date of formation

- Brief description of the reason for your dissolution

Some states additionally require that you publish a notice of dissolution in a local newspaper to notify any creditors. For the same reason, they impose a waiting period of approximately 3 to 4 months for the dissolution to take effect.

Florida’s Articles of Dissolution is one example of what the form looks like.

How much does it cost to dissolve an LLC?

Filing the Articles of Dissolution with the Secretary of State typically costs $25 to $100 in most states.

It can be a little more if you would like a certified copy of the Articles of Dissolution. For example, in Florida, the fee is $25, Delaware is $200, and New York is $60.

4. Close your business bank account and cancel insurance

Once you’re done with all financial payments, you should close your bank account and cancel any remaining services and charges, such as insurance.

The bank account held by the LLC upon dissolution is simply for winding up the LLC’s affairs before closing for good. Once the LLC is closed, there’s no reason to maintain a bank account as there’s no longer an operating business.

Similarly, regarding the insurance, once the LLC is dissolved, there’s no longer a reason to continue paying the insurance premiums for a non-functioning business.

5. Divide the remaining assets between LLC members

Your operating agreement may specify the percentage each member is to receive post-company dissolution. Ensure that these obligations are met and that all business assets are either sold off or equitably distributed between members.

Once the business is closed, and the LLC is done for good with all its liabilities paid and assets sold, there’s no longer an entity with which to hold the assets. As such, whatever is left remaining in the LLC belongs to the LLC’s members.

As previously mentioned, the LLC’s operating agreement should dictate how those assets should be distributed among its members.

What happens when an LLC dissolves?

Once all creditors have been paid, all assets distributed, and Articles of Dissolution granted by the state, your LLC is considered fully dissolved.

As mentioned above, if your state requires notice of dissolution, there may be a short period that creditors can come back and make a claim.

If that doesn’t happen, you’re free to move on to another chapter of your life.

FAQs about closing an LLC

Here are several commonly asked questions and answers about closing an LLC.