Wisconsin’s rich entrepreneurial history and supportive business environment make it an excellent place to start an LLC.

From iconic companies like Harley-Davidson and Trek Bicycles to a thriving local economy, the state offers plenty of opportunities for new ventures.

Forming an LLC in Wisconsin provides personal liability protection, management flexibility, and access to state-backed resources like tax incentives and top-tier talent from public universities.

While the process might seem complex, it’s straightforward with the right guidance.

Ready to form your new LLC? Let’s get started!

Steps to Create an LLC in Wisconsin:

- Step 1: Name Your LLC

- Step 2: Appoint a Registered Agent

- Step 3: File the LLC Articles of Organization

- Step 4: Create an LLC Operating Agreement

- Step 5: Obtain an EIN (Employer Identification Number) from the IRS

- Costs to Set Up an LLC in Wisconsin

- Final Steps

Need to save time? Hire Northwest to form your LLC.

Step 1: Name Your LLC

The first aspect of forming your Wisconsin LLC is coming up with a name that complies with Wisconsin’s LLC naming rules.

Generally, there are two requirements in Wisconsin for naming an LLC:

- The name must be distinguishable from other LLCs.

- The name must contain the words “limited liability company” or “limited liability co” or end with the abbreviation “LLC” or “L.L.C.”

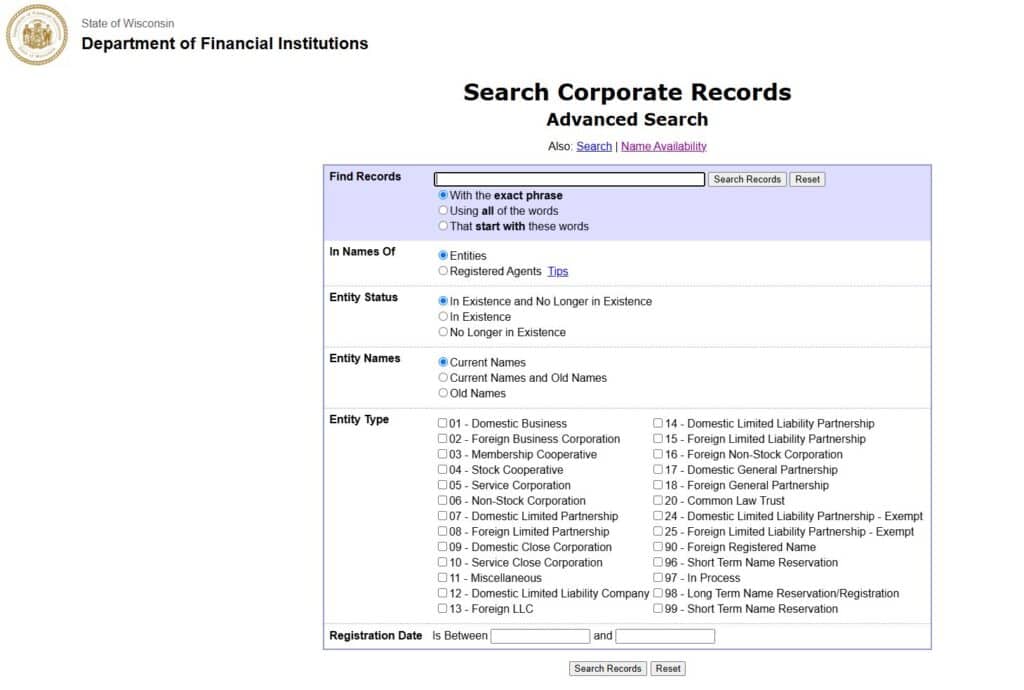

Once you’ve come up with a name, you can complete a name search using the Wisconsin Department of Financial Institutions’ LLC name availability tool to see if it’s already registered.

Wisconsin doesn’t allow multiple companies to use the same legal name. So before you register your LLC, you need to make sure your desired name is available:

Name Reservation (optional)

If you’ve settled on a name that’s still available in Wisconsin, but you’re not quite ready to submit your LLC formation documents, you can reserve the name for 120 days by submitting a Name Reservation Application and paying a $15 fee. Reserving a name ensures it’s available when you’re ready to file with the state and prevents other business entities from registering under it.

Trade Name (optional)

If you plan to use a moniker/trade name for your business, Wisconsin encourages you to register this alternate brand name as a “doing business as” (DBA) name. Also known as a fictitious or assumed name, the state of Wisconsin refers to DBA as a “trademark name.”

Using a trademark name makes sense for some companies.

For example, if your LLC’s legal name is generic and you want to use a more descriptive name, a trademark name might be the right choice. An LLC named “Midwest Ventures” operating as a photographer may wish to register the trade name “Madison Wedding Photography.”

Registering a trademark name makes it public knowledge and allows consumers to identify the owner of a business. And like you did when you searched for your business name, you’ll want to confirm that your desired trade name hasn’t been registered yet. You’ll need to create an account to search the trademark database and also to register your name. Registrations expire after 10 years, and the application fee is $15.

Step 2: Appoint a Registered Agent

In short, a registered agent is a person (18 years or older) or company that’s appointed to accept official and legal documents on behalf of your business entity. The registered agent can be you, a trusted employee, or someone not directly involved in the business, like an attorney or a registered agent service company.

Generally, the agent must be:

- A Wisconsin resident with a physical street address in the state. No P.O. boxes allowed

- Available during regular business hours

You may want to consider using a professional registered agent service. If you operate a business out of your home, you can keep your personal address out of the public records by using a professional service.

If you don't want to be your own registered agent, you can hire one for about $50-$150/year in Wisconsin.

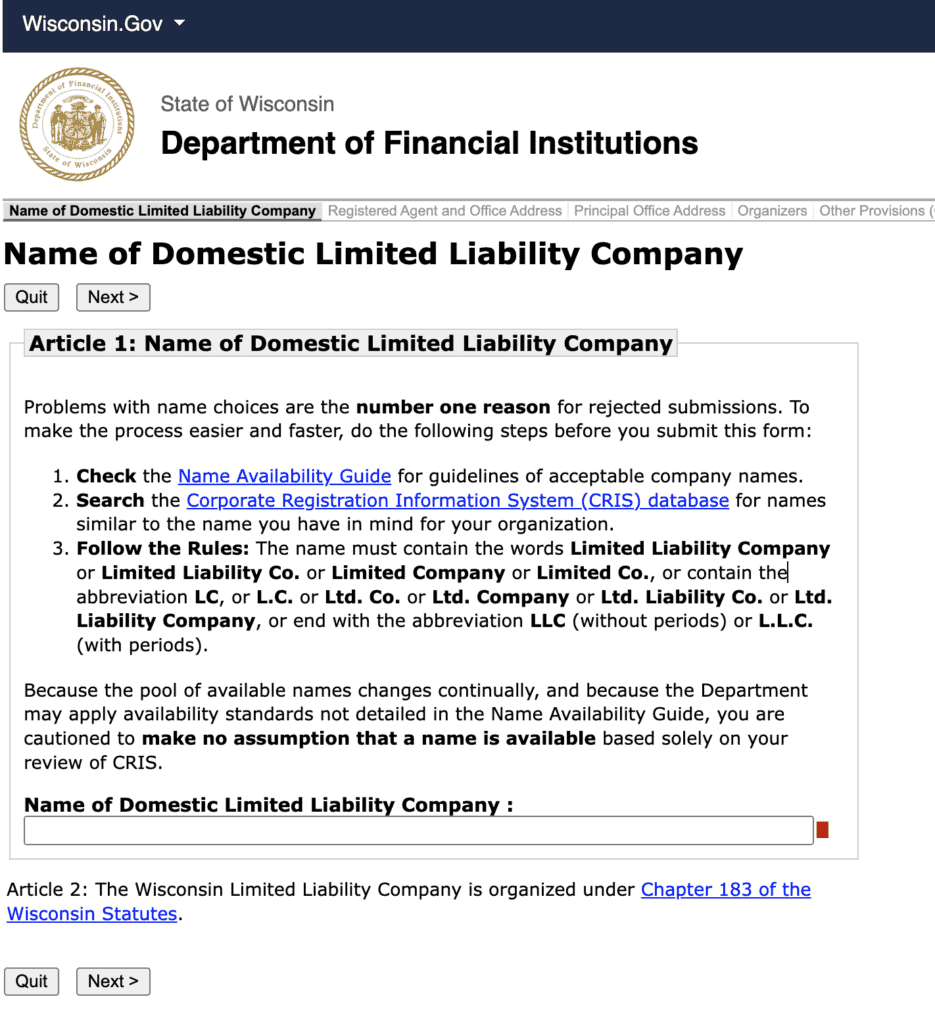

Step 3: File the Wisconsin LLC Articles of Organization

After selecting your business name and registered agent, you can file your Wisconsin Articles of Organization with the Department of Financial Institutions (not the Secretary of State). It’s the official document that creates your business and allows you to operate in Wisconsin.

Wisconsin moved to electronic applications a few years ago, so you’ll need to submit your application online:

Information you’ll need to submit your Articles of Organization includes:

- LLC name

- Registered agent details, including office address

- Management type (manager or member-managed)

- LLC member (owner) names and addresses

- Name of the person completing the application

- Signature of one of the members

Note: The filing fee is $130 for online submissions and $170 for paper submissions. You can send paper submissions (Form 502) to the following address.

Wisconsin Department of Financial Institutions

Division of Corporate & Consumer Services

P.O. Box 93348

Milwaukee, WI 53293-0348

Wisconsin provides an expedited processing service for an additional $25 fee if you’re in a rush. Expedited requests are completed by the close of business on the first business day following receipt of your application.

Upon the approval of your LLC registration, a best practice is to obtain a Certificate of Status from Wisconsin. This document costs $10 and shows that your business has been created and is in good standing with the state. It will assist you as you open a business bank account (more on that later), and obtain business financing, among others.

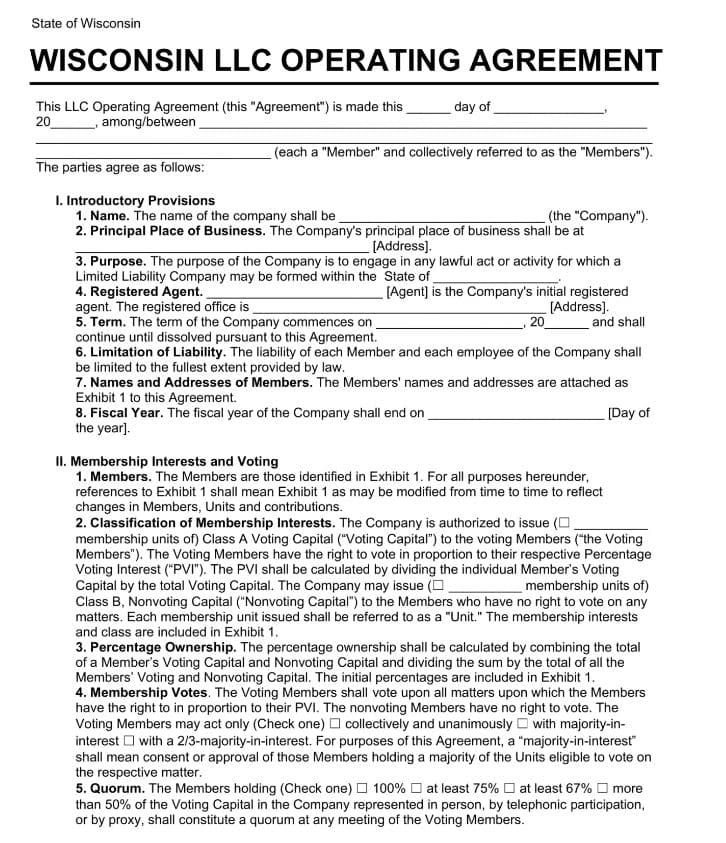

Step 4: Create an LLC Operating Agreement

You’re almost finished!

One of the last critical steps you’ll want to complete is to prepare an LLC operating agreement. Even though Wisconsin doesn’t require you to have this document, it’s a good idea to have one drafted.

An operating agreement is a legal agreement that governs how your LLC will be managed. It covers things such as:

- Percentage ownership

- Voting rights and responsibilities

- Powers and responsibilities of members

- Distribution of profits and losses

- Admitting new members or removing members

Without an operating agreement in place, your LLC will resemble a sole proprietorship, and you may lose some of the benefits that come with forming an LLC.

And when you don’t have an agreement in place, your business structure will be governed by the default Wisconsin laws that can produce unintended consequences.

Since the agreement creates the basis for operating your business, invest time and money to write it correctly. You can buy customizable templates online for a few hundred dollars, or you could hire a local attorney for $1,000 or more.

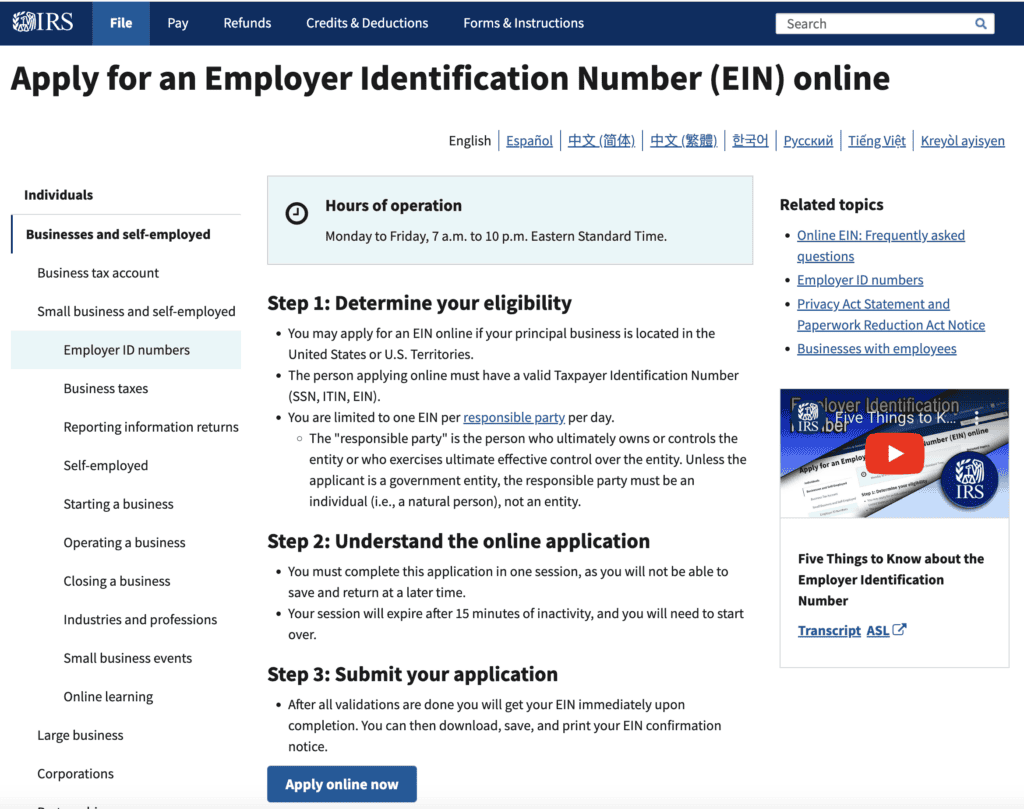

Step 5: Obtain an EIN (Employer Identification Number) from the IRS

After you’ve filed our Articles of Organization, you’ll want to apply for a federal EIN from the Internal Revenue Service (IRS). A federal employer identification number acts as a social security number for your business and helps the tax authorities identify your tax filings.

While LLCs with one member, called single-member LLCs, can generally get by using the member’s social security number as its federal tax identification number, multiple-member LLCs will need an EIN. And although the single-member LLC may not need one, you should consider getting one if you prefer to keep your personal information off company documents.

Information you’ll need to apply for an EIN includes:

- Business name and contact information

- Number of members

- Reason for applying

- Date business started

- Number of employees expected in the next 12 months

- The principal activity of your business

The good news is that getting an EIN is free, and you can apply online to get your number issued immediately.

Costs to Set Up an LLC in Wisconsin

When establishing an LLC in Wisconsin, there are obligatory and discretionary fees.

You will be required to pay the $130 (or $170 for paper submissions) LLC formation fee upon commencing your business.

Optional charges that could be relevant encompass reserving a business name ($15), utilizing a trade name ($15), and engaging a third-party commercial registered agent service (approximately $100 per year).

Additionally, if you opt to enlist an attorney or an online platform to draft your operating agreement, you will also be accountable for those expenses.

Final Steps

The good news is you have now completed the primary steps to creating your new Wisconsin LLC.

Congratulations!

The bad news is there are still a few more tasks you need to complete:

The first is to open a business bank account. This will help keep your business finances organized and separated from your personal bank activity. Don’t be fooled into thinking you can use your personal bank account for your business at the beginning. That’s a big no-no.

You will also be required to complete an annual report and pay a $25 fee each year. This process confirms all of your information is up to date with the state and that your business is still active. There is a $15 surcharge for paper filings, making the total $40 for paper submissions.

Business owners with employees will need to register with the Wisconsin Department of Revenue in order to withhold payroll taxes and file reports. Depending on your type of business, you might need an occupational license to start your LLC.