This step-by-step guide to starting an LLC in West Virginia has all you need to turn your business idea into reality.

Forming an LLC in West Virginia helps to establish a reputation while also providing valuable legal protections. As a separate entity, LLCs are a great tool for starting a business without putting personal liability on the table. And they keep your tax situation simplified.

Best of all, the state’s fees are remarkably low. And you can complete West Virginia LLC formation through a modern online system.

Let’s go over how to start an LLC in West Virginia.

- Step 1: Pick a business name for your LLC

- Step 2: Choose a registered agent

- Step 3: File the West Virginia LLC Articles of Organization

- Step 4: Prepare an LLC operating agreement

- Step 5: Obtain an EIN (Employer Identification Number) from the IRS

- Costs to set up an LLC in West Virginia

- Further steps

Step 1: Pick a business name for your LLC

A great starting point is figuring out the name you want to use for your new West Virginia LLC. It’s a good idea to keep advertising considerations in mind. But your LLC name needs to also meet West Virginia’s law.

Every West Virginia LLC name must:

- Include Limited Liability Company, Limited Company, or an abbreviation like LLC or LC

- Be unique and distinguishable from business names already reserved or in use

- Avoid using terms related to government agencies, illegal activities, or regulated industries like medicine or law, unless authorized

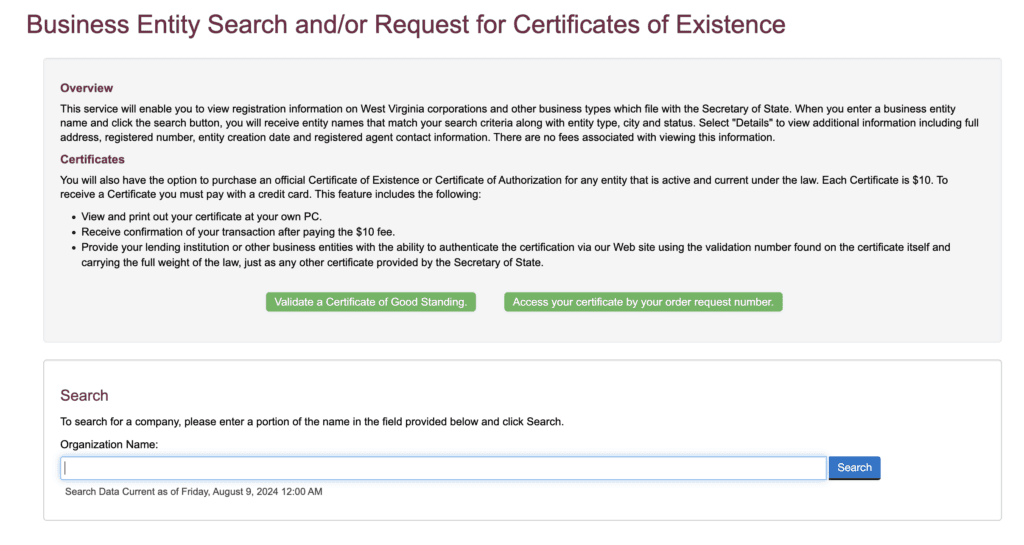

Once you have an idea in mind, head over to the West Virginia Business Entity Search to see if it is available.

Name reservations (optional)

Once you have decided on a name, you can reserve it for 120 days. This gives you time to prepare other LLC documents without worrying that someone will take your LLC name.

To reserve your name, file an Application for Name Reservation with the West Virginia Secretary of State (SOS). A $15 fee applies.

Trade name registration (optional)

If you want to operate under a name other than the LLC’s legal name, you can do so with a trade name. Also known as a doing-business-as (DBA) name, this provides a lot of flexibility with branding and advertising.

If you want to run multiple product lines, you can use trade names to sell the products under descriptive names. But all lines can still be owned by one LLC.

To use a trade name for your West Virginia LLC, you need to file an Application for Trade Name. You do so online using the One Stop portal. Or you can also file in person, via mail, email, or fax. A $25 fee applies.

Step 2: Choose a registered agent

A crucial part of all LLCs is the designation of a registered agent. This contact is responsible for receiving important notices, such as legal documents.

In West Virginia, the SOS asks you to appoint a person or company for whom notice of process may be sent. While this state doesn’t call it a registered agent, this is the same role.

The designated person or company must:

- Be a resident or company authorized to do business in West Virginia

- Maintain a physical address in West Virginia (a P.O. Box doesn’t work)

- Be available during regular business hours

You or your company can be your own registered agent. Doing so means that your address becomes part of the public record. You’ll have to sort through junk mail without missing critical notices. And you might be served with a lawsuit in front of customers.

If you don't want to be your own registered agent, you can hire one for about $99-$199/year in West Virginia.

If you form an LLC with Northwest, they'll give you a free registered agent for the first year. After that, it's $125 per year.

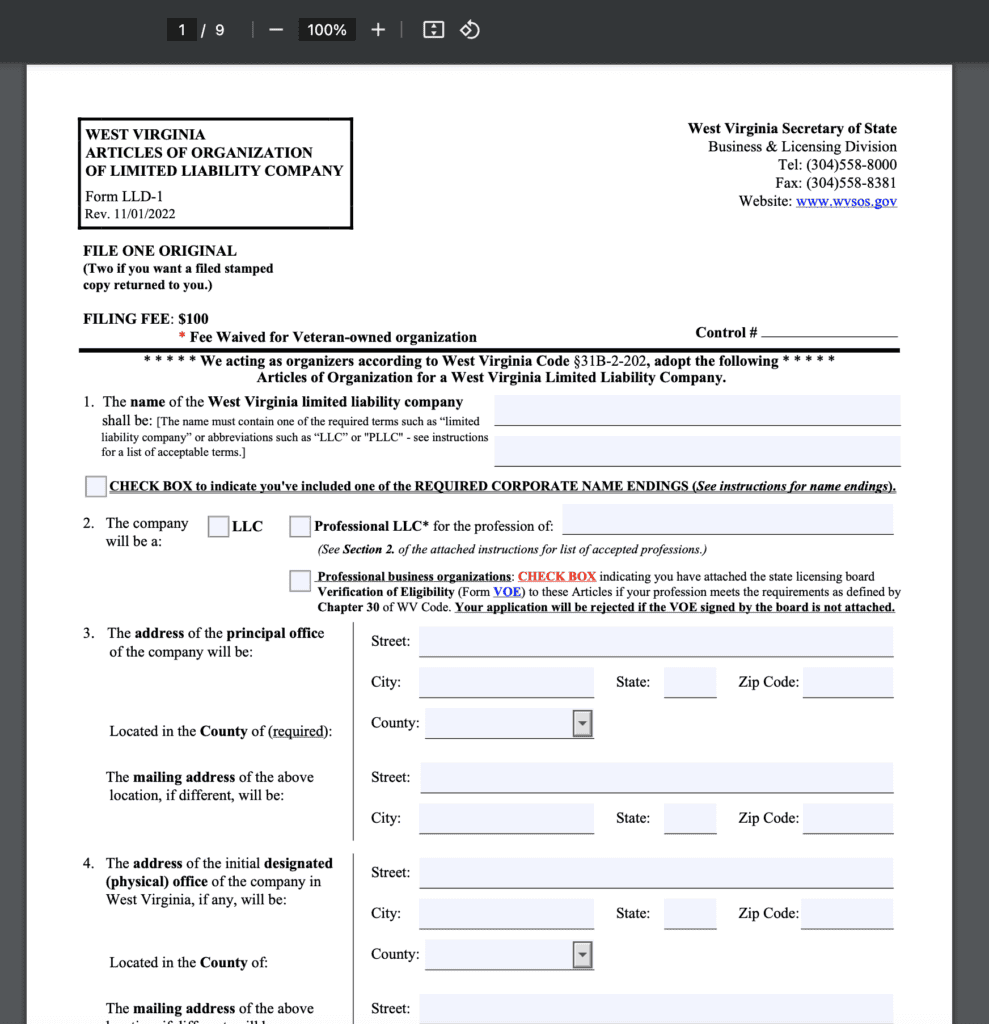

Step 3: File the West Virginia LLC Articles of Organization

Get ready for one of the most exciting parts of LLC formation. Filing the articles of organization with the West Virginia SOS is what transforms your business idea into a legal entity. This step creates your LLC.

West Virginia has an LLC application to help streamline the process. It requires:

- LLC’s name, purpose, and office address

- Name and address of the person or company for notice of process (registered agent)

- Name and address of the person(s) organizing the LLC

- Whether the LLC is member-managed or manager-managed

- Answers to a few other questions, if specific situations apply

Filing your articles of organization online is easy through the One Stop portal. Or you can file it in person, via email, fax, or mail.

The standard filing fee is $100 with a turnaround time of 5 to 10 business days for processing. If needed, you can speed things up with expedited processing for an extra fee:

- 24-hour processing for $25 extra

- 2-hour for $250 extra

- 1-hour for $500 extra

If you include an extra original copy, they’ll date-stamp it as filed and return it to you at no cost. You can order a certified copy for $15. Make sure to keep a copy of the file articles of organization for your records.

To register a business from another state in West Virginia, you need to follow the foreign LLC instructions. The fee jumps up to $150.

Step 4: Prepare an LLC Operating Agreement

An operating agreement is a contract between LLC members. West Virginia doesn’t require an operating agreement for an LLC. But they are essential for any multi-member LLCs and good practice to have one even for single-member LLCs.

An operating agreement includes things like:

- Member rights and duties

- Ownership percentages and contributions

- Distribution of profits and losses

- How to add or remove a member

- Method for dissolving the LLC

If you don’t have an operating agreement, West Virginia law will step in. The results may not align with your desires. Savvy business owners protect their interests by executing a well-drafted operating agreement.

You can find free or low-cost operating agreement templates online. Or you can hire an attorney to customize one for you but expect to pay around $1,000 or more.

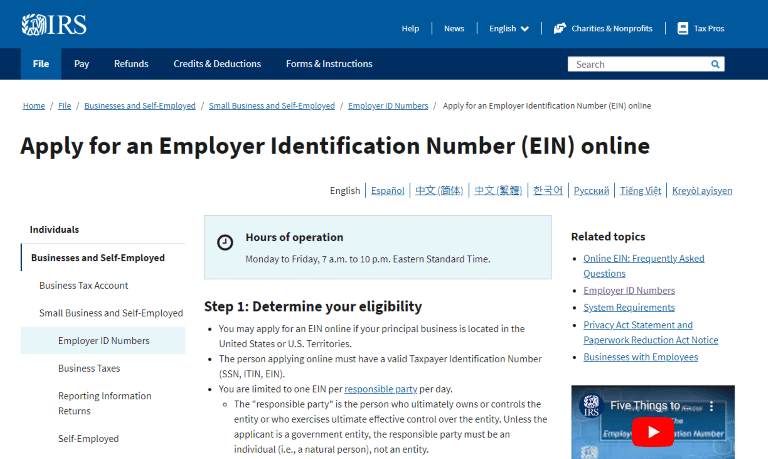

Step 5: Obtain an EIN (Employer Identification Number) from the IRS

While LLC taxes are fairly straightforward, the Internal Revenue Service (IRS) still needs to stay on top of them. To do so, the IRS uses an Employer Identification Number (EIN) to track business taxes.

An EIN is like a Social Security number for your business.

Any LLC with more than one member or that hires any employees must have one. The IRS also requires one for a handful of other specific situations. But some sole proprietorships can use their personal Social Security number instead.

Getting an EIN is fast and free. You can apply for one online in about 10 minutes. The IRS will provide your EIN right away.

Costs to set up an LLC in West Virginia

The minimum cost to set up an LLC in West Virginia is $100 to file the articles of organization. That is the only required cost.

Other fees that you can choose to add to your West Virginia LLC formation include:

- $15 to reserve a name

- $25 to register a trade name

- $50 to $200 to hire a registered agent

- $25 to $500 for expedited processing of the articles of organization

- $150 to register a foreign LLC

Including these optional fees, the total cost to start a West Virginia LLC is anywhere from $100 to $890 or more.

Further steps

At this point, pat yourself on the back and celebrate the formation of your new West Virginia LLC. But don’t let the momentum fade. There are a few last steps that you should knock out right away.

Business bank account

Opening a business bank account is likely more important than you imagine. Of course, it helps with bookkeeping and having accurate financial statements. But it also helps to maintain the legal protections that an LLC provides.

If you mix personal and business finances, that shows that the LLC isn’t a separate entity. This is a big problem if your business gets sued. It means that your personal assets could be at risk.

Business bank accounts can cost anywhere from free to around $25 per month, depending on the bank and the account services included.

Local taxes, licenses, and permits

Before you start operating, you must get the needed approval from state, city, and county authorities. This includes things like tax registrations, local licenses, and activity-based permits.

Start by going to the West Virginia Tax Division to get a business registration certificate, which is like a general business license. Your LLC may also be subject to sales and use, excise, or pass-through entity taxes.

Once done with tax registration, check out the West Virginia licenses and permits to see if anything applies to your business activities.

Some local authorities also require general business licenses. These include places like Charleston’s Business and Occupation Privilege Tax and the City of Weirton Business License Program.

Other considerations

Exploring insurance options is another task worth your attention. You’ll likely need a workers’ compensation policy if you hire employees. And all businesses can benefit from a general liability policy.

You can blast through roadblocks by learning from experienced business owners. Connect with your local community by joining the Chamber of Commerce. Find great mentors through programs like the West Virginia SBDC and SCORE.