This easy-to-follow guide has everything you need to start an LLC in Hawaii. After finishing these steps, you’ll be able to experience the thrill and rewards of owning your own business.

Forming an LLC in Hawaii is a great way to go. It keeps regulatory issues to a minimum while offering valuable legal protections. Establishing an LLC shields you from personal liability and boosts your reputation.

Thousands of small businesses thrive across the islands. Join them by completing these simple steps to starting an LLC in Hawaii.

- Step 1: Secure a name for your LLC

- Step 2: Appoint a registered agent

- Step 3: File the Hawaii LLC Articles of Organization

- Step 4: Prepare an LLC operating agreement

- Step 5: Obtain an EIN (Employer Identification Number) from the IRS

- Costs to set up an LLC in Hawaii

- Further steps

Step 1: Secure a name for your LLC

The first task to tackle is deciding on a name for your LLC. You may need to consider the advertising needs. But another critical aspect is making sure the LLC name meets Hawaii’s legal requirements.

Every Hawaii LLC name must:

- Include Limited Liability Company or abbreviations like L.L.C., LLC, Ltd, or Co.

- Not be substantially identical to any existing business’s name

Head over to the Hawaii Department of Commerce and Consumer Affairs (DCCA) for more details.

It is essential that your name is unique and doesn’t cause confusion with other entities. To see if your idea is available, use Hawaii DCCA’s Business Search.

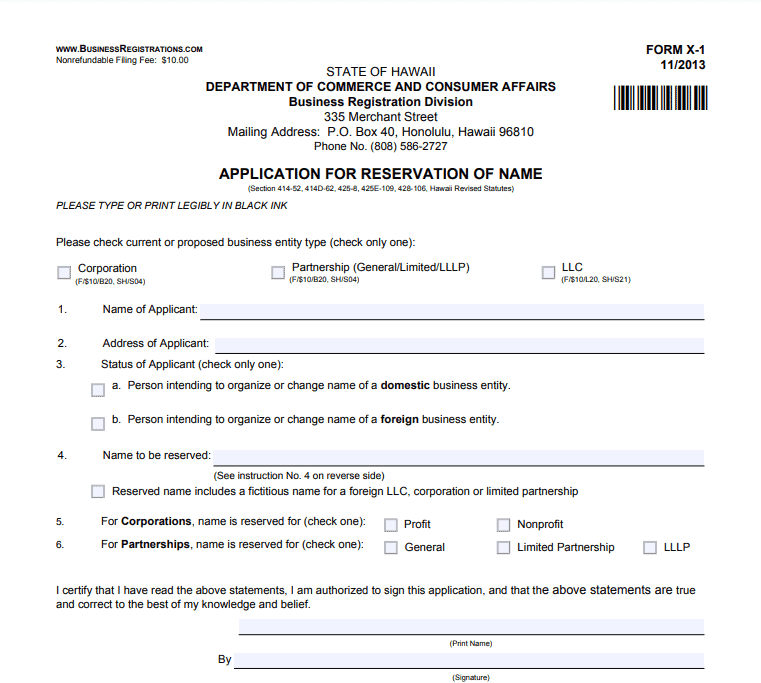

Reserving a name (optional)

You can reserve an LLC name for 120 days. This lets you have more time to prepare formation documents without worrying that someone will take it.

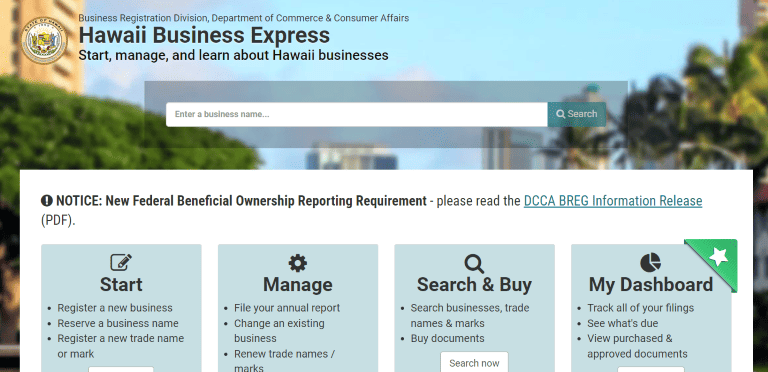

To do so, file an Application for Reservation of Name to the DCCA. The Hawaii Business Express online system makes things very easy. You can also file via mail, email ([email protected]), or fax (808-586-2733).

A $10 fee applies for all name reservations.

Trade name (optional)

Many business owners operate under a name different from the LLC’s legal name. This is known as using a trade name. It can help to:

- Separate the company’s legal name from the advertised one

- Run different products or service lines under descriptive names

To use a trade name in Hawaii, you must register it. You can use a paper form or file online through the Business Express portal.

A $50 fee applies and it is good for five years.

Step 2: Appoint a registered agent

Every LLC must appoint a registered agent. This is an official contact for the LLC. It is responsible for receiving important items such as tax documents and legal notices.

The registered agent must have a physical address in Hawaii. It can be an individual who resides in the state or an entity authorized to transact business there. They must be available during regular business hours.

You can serve as your own registered agent. But many experienced business owners prefer hiring a professional registered agent service. This lets you:

- Keep your address out of public record

- Avoid sorting junk mail without missing critical notices

- Take time off without concern of breaching your registered agent duties

- Focus on other business needs

If you don't want to be your own registered agent, you can hire one for about $99-$199/year in Hawaii.

If you form an LLC with Northwest, they'll give you a free registered agent for the first year. After that, it's $125 per year.

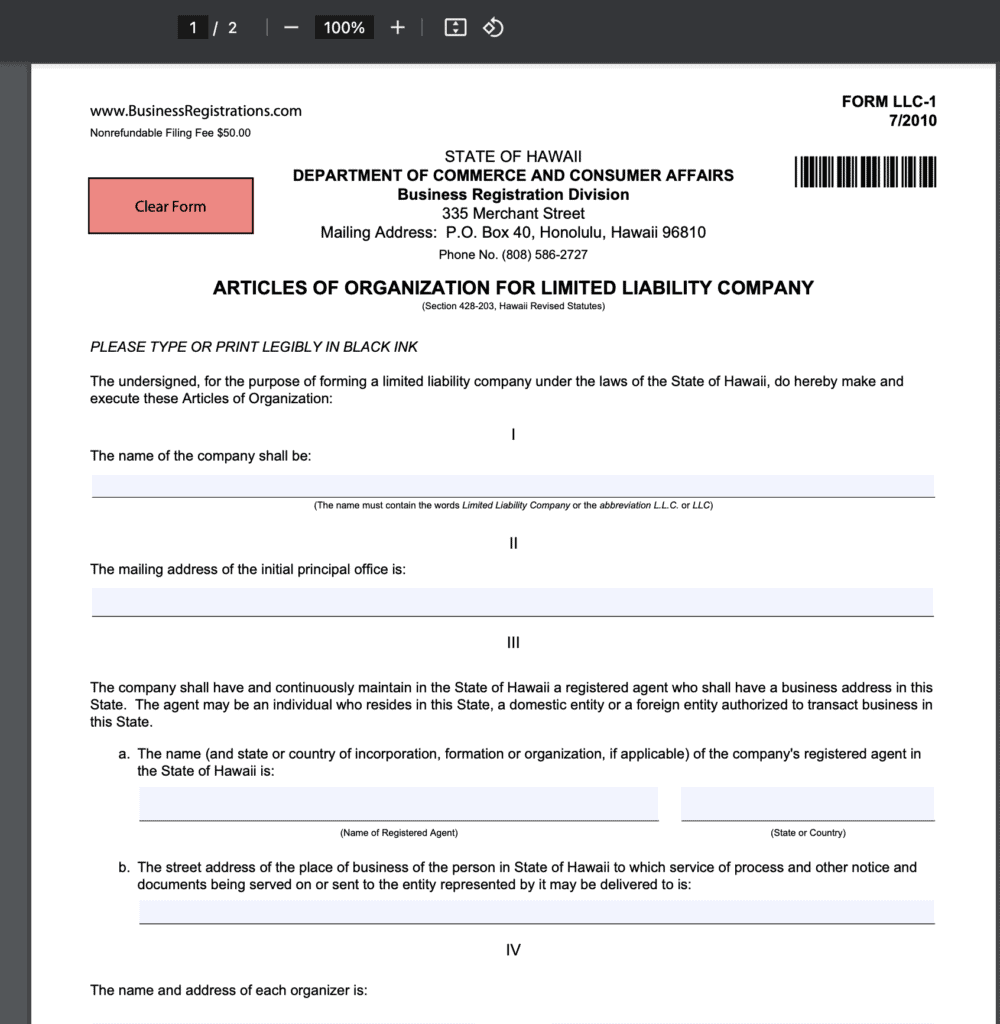

Step 3: File the Hawaii LLC Articles of Organization

Now it’s time for one of the most exciting parts of forming your Hawaii LLC. Filing your articles of organization is what transforms your business idea into a legal entity. It’s what starts your company.

This step can be intimidating. But the Articles of Organization form only requires basic information, including:

- LLC’s name and principal address

- Registered agent name and address

- Name and address of each person organizing the LLC

- An expiration date for LLC, if desired

- If the LLC will be member-managed or manager-managed

- Names and addresses of members or managers

- If members are liable for debts

You can file the paper form or use the Hawaii Business Express online service.

A $50 fee applies to file your Hawaii LLC’s articles of organization. Hawaii also has a $1 State Archives fee for certain documents that become part of permanent public records, including this document.

If you want to operate a business from another state in Hawaii, register it as a Foreign LLC. The fee remains $50, but make sure to use Form FLLC-1.

The usual processing time for Hawaii LLCs is from 3 to 5 days. You can buy expedited service for an extra $25 for 1-day processing.

Once processed, you should get a certified copy for your records. This costs $10 plus $0.25 per page.

Step 4: Prepare an LLC operating agreement

An operating agreement is an internal contract that lays out the rules for how the LLC functions. Although Hawaii doesn’t require one, it is best practice for all LLCs to have an operating agreement. And they are essential for any multi-member LLC.

Without one, your LLC will use state law if disputes arise. The results can be surprising and may not align with your interests. Creating an operating agreement ensures your company functions as you intend.

Operating agreements cover things like:

- Rights and duties of members and managers

- Contributions and ownership percentages

- How to add or remove a member

- How to distribute profits and losses

- The method to dissolve the LLC

They can also be needed to open bank accounts or accept certain financing offers.

You can use free or low-cost operating agreement templates available online. Or you can hire a business attorney to help customize one for your LLC, but you should expect to spend $1,000 or more.

Step 5: Obtain an EIN (Employer Identification Number) from the IRS

The Internal Revenue Service (IRS) tracks business tax information using an Employer Identification Number (EIN). It is like a Social Security number for businesses.

All multi-member LLCs must get an EIN. The IRS also requires single-member LLCs to have one if they hire employees or other specific items apply. Banks may require one as well.

Getting an EIN is quick and easy. You can apply online and the IRS will issue your EIN immediately. And it’s free.

Costs to set up an LLC in Hawaii

Forming an LLC in Hawaii is quite affordable. The only mandatory cost to start a Hawaii LLC is $51 for filing the articles of organization and paying the State Archives fee. Add $10 for a certified copy and $25 for expedited processing.

Hawaii LLCs also must file an annual report. It ensures your LLC’s information is kept up to date. It costs $12.50 to file online or $15 to file through the mail.

Other optional costs to form a Hawaii LLC include:

- $10 to reserve a name (+ $25 for expedited review)

- $50 to register a trade name (+ $20 for expedited review)

- $50-$300 per year to hire a registered agent service

- $1,000 or more for a customized operating agreement from an attorney

The total cost to form an LLC in Hawaii is anywhere from $51 to $1,480, plus at least $12.50 per year for the annual report.

Further steps

At this point, you’ve formed your Hawaii LLC and are almost ready to launch your new business. But there are a few more things to take care of right away.

State registrations

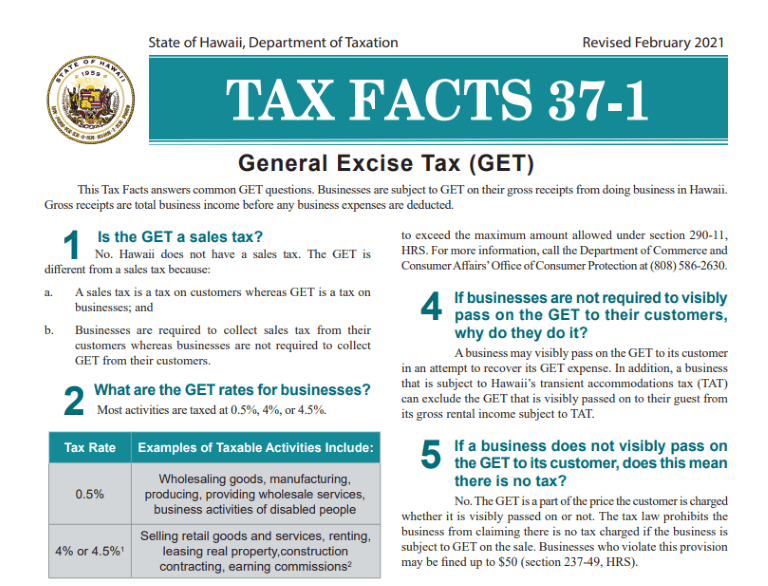

All Hawaii businesses need to get a General Excise Tax (GET) license. To do so, register with the Hawaii Department of Taxation (DOTAX).

You’ll need to complete Form BB-1 and pay a one-time $20 fee.

All businesses must pay the General Excise Tax. It is similar to a sales tax, but it is a tax on the business instead of a tax on the customers. For more information, see the Tax Facts sheet.

If your LLC will hire employees, you also need to register with the Department of Labor and Industrial Relations (DLIR). Your business may have to pay unemployment insurance as well.

Licenses and permits

Another crucial element to running a business is getting any needed approval. This can come from state, country, and city authorities.

In Hawaii, the Professional and Vocational Licensing (PVL) Division oversees many industries and professions. Activities like construction, massage therapy, and pest control need to get approval. Places like Honolulu and Hawaii County also have certain activities that require a license or permit.

Business bank account

Opening a business bank account is extremely useful for LLCs. It streamlines record keeping for accounting and taxes. But it also ensures the LLC’s legal protections are upheld.

If you combine your personal and business accounts, you may lose the LLC’s asset protection. Your personal assets and investments might be at risk if your business gets sued. Using a business bank account shows that your LLC is a separate entity.

Accounts range from free to about $25 per month, depending on your initial deposit and the account services.

Other considerations

Another excellent idea is to protect your business with appropriate insurance. All businesses can benefit from a general liability policy. If you are hiring employees, a workers’ compensation policy is a must.

A great way to uncover the path to success is by connecting with the local business community.

The Hawaii SBDC offers no-cost advising services to help you get off the ground. And the Chamber of Commerce is a large network of business owners working together to create prosperity for all.